| (1) |

The Sick Leave and Family Responsibility Leave Benefit Fund for the Building Industry ("the Fund") is hereby continued and shall continue to be administered by the Council for the purposes of recompensing employees during periods of absence from work owing to incapacity, and paying gratuities to employees in the event of permanent disability, and the recompensing of employees during period of absence owing to family responsibility leave, in accordance with the rules of the Fund. |

| (2) |

The Fund shall be administered by the Council in accordance with the rules which it may make from time to time for this purpose ("the Rules") and all moneys of the Fund shall be administered, invested and paid out in accordance with the Rules, the Constitution of the Council and section 53(5) of the Act. Copies of the Rules should be submitted to the Director-General-Labour and shall be available for inspection at the offices of the Council. |

| (3) |

Contributions by the employer: |

| (a) |

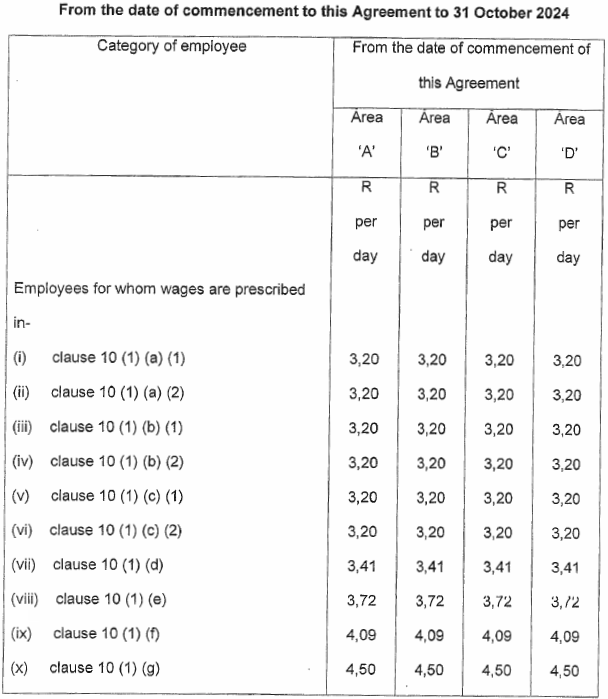

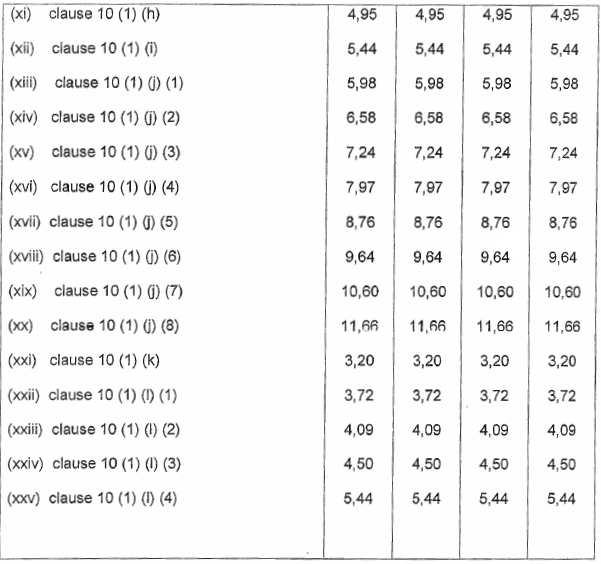

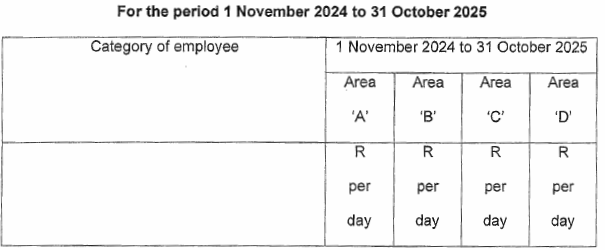

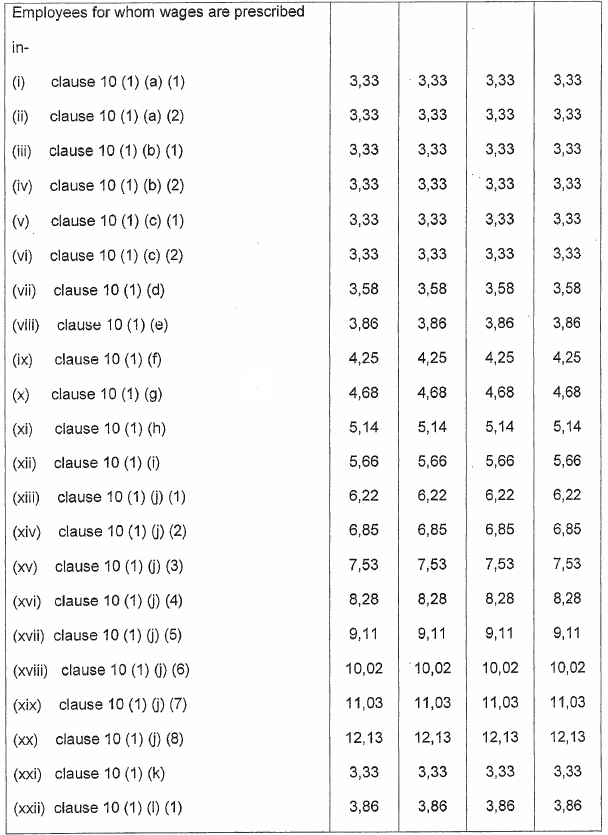

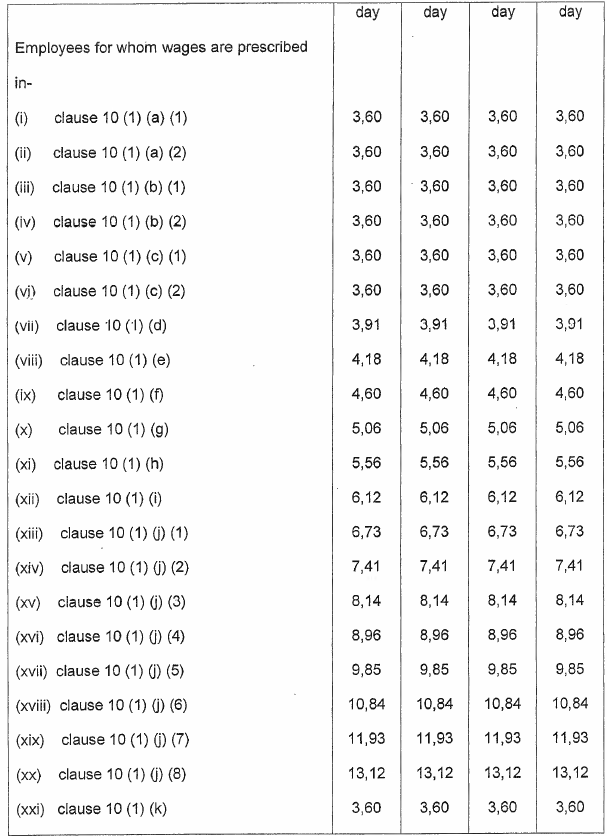

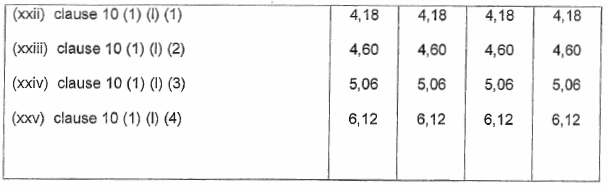

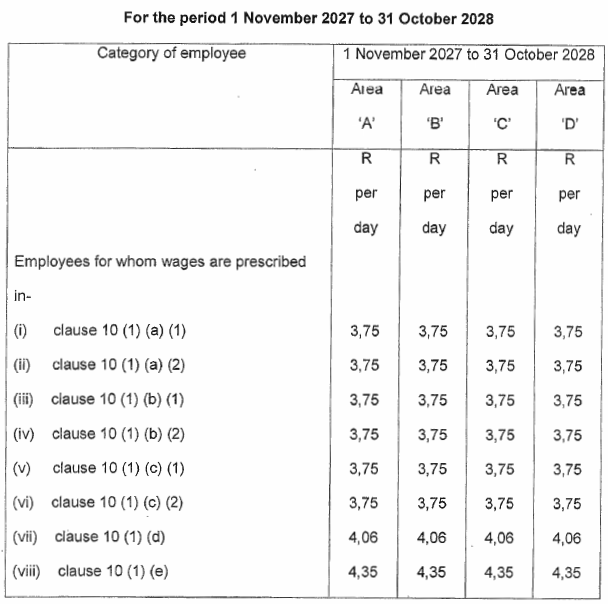

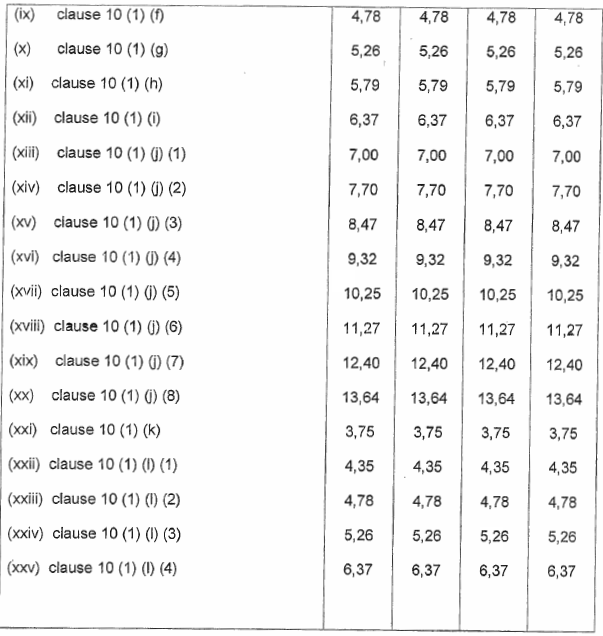

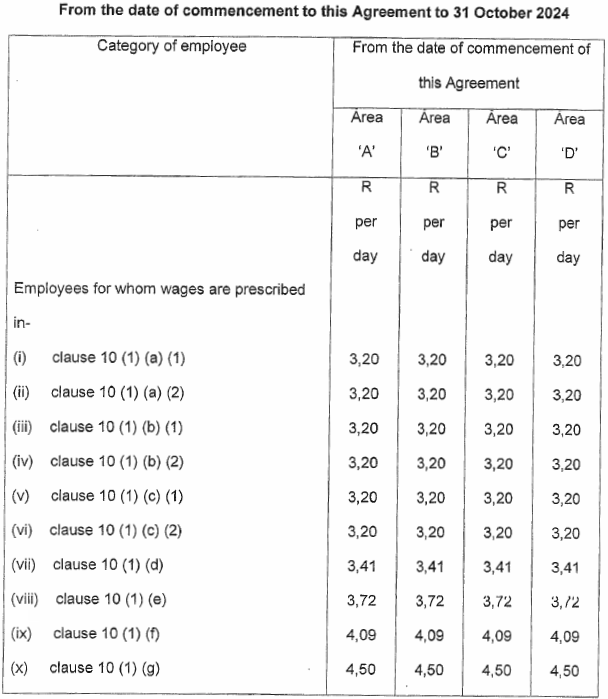

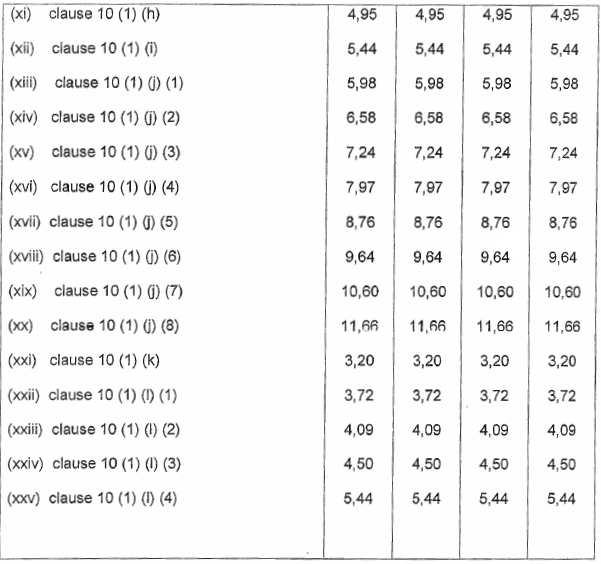

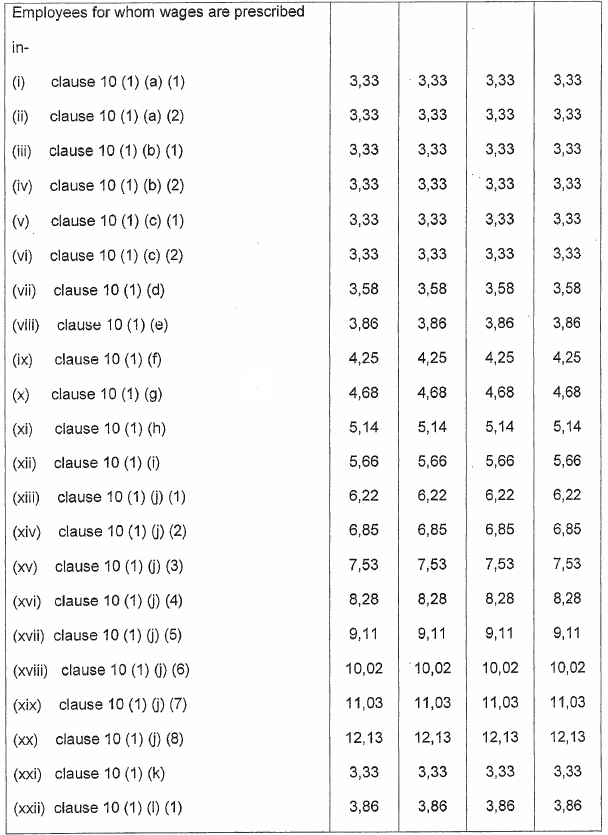

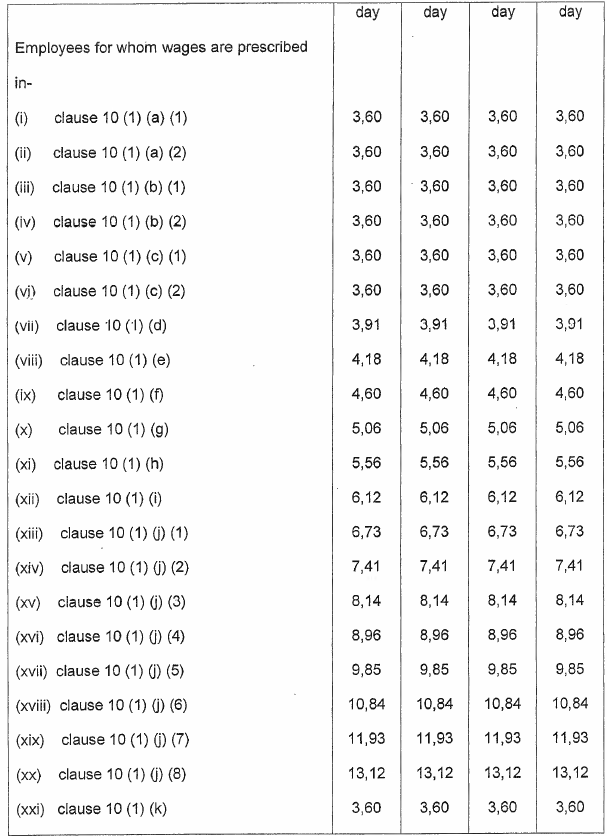

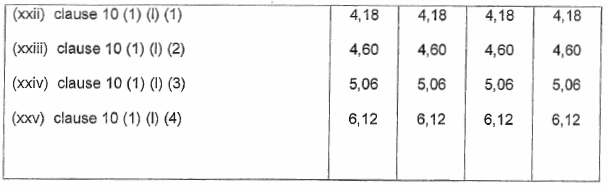

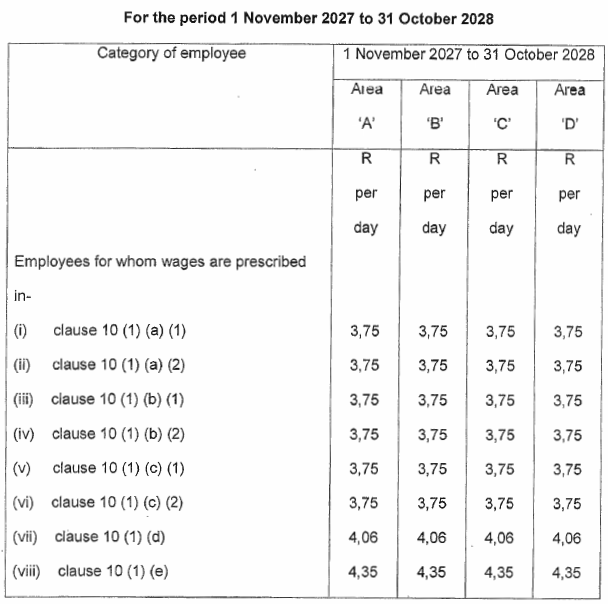

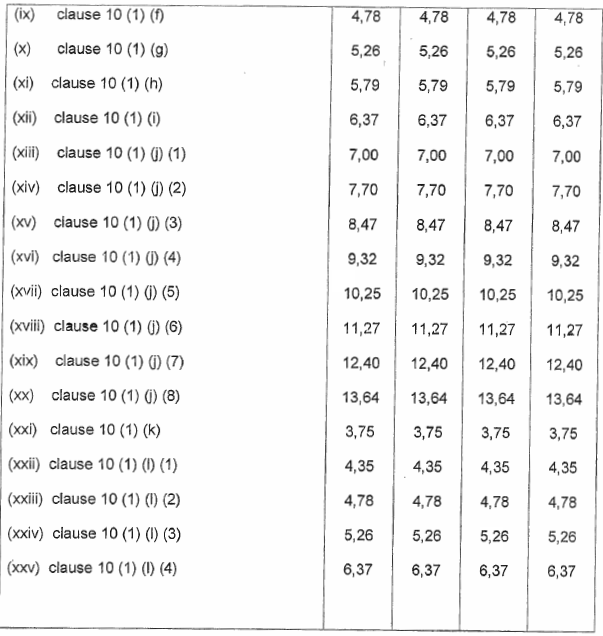

Every employer shall contribute an amount to the Fund on behalf of each eligible employee in respect of each contribution day for which the employee remains in his/her employ, which amount shall be calculated as follows: |

| (b) |

Every employer shall pay the specified contribution to the Council on the employee's normal pay day. |

[Clause 16(3)(a) and (b) substituted by section 7(7.1) of Notice No. R. 4190, GG49862, dated 14 December 2023]

| (a) |

During every sick leave cycle, an employee is entitled to an amount of paid sick leave equal to the number of days the employee would normally work during a period of six weeks as prescribed by the Basic Conditions of Employment Act, 1997. |

| (b) |

Despite paragraph (a), during the first six months of employment, an employee is entitled to one day's paid sick leave for every 26 days worked, as prescribed by the Basic Conditions Employment Act, 1997. |

| (c) |

During an employee's first sick-leave cycle, an employer may reduce the employee's entitlement to sick leave in terms of subclause (a) by the number of days sick leave taken in terms of subclause (b), as prescribed by the Basic Conditions of Employment Act, 1997. |

| (d) |

Subject to clause 23 of the Basic Conditions of Employment Act, 1997, an employer must pay an employee for a day's sick leave— |

| (i) |

the wage the employee would ordinarily have received for work on that day; and |

| (ii) |

on the employee's usual pay day. |

| (e) |

An agreement may reduce the pay to which an employee is entitled in respect of any day's absence in terms of this clause if— |

| (i) |

the number of days of paid sick leave is increased at least commensurately with any reduction in the daily amount of sick leave pay; and |

| (ii) |

the employee's entitlement to pay— |

| (aa) |

for any days sick leave is at least 75 percent of the wage payable to the employee for the ordinary hours the employee would have worked on that day; and |

| (ab) |

for sick leave over the sick leave cycle is at least equivalent to the employee's entitlement in terms of paragraph (b). |

| (f) |

Benefits shall be paid in respect of normal working days and in respect of the public holidays referred to in clause 9(5) of this Agreement, should the public holiday referred to fall on a normal working day. |

| (g) |

Notwithstanding the provisions of subclause (4)(a), (b), (c), (d), (e) and (f), a member shall be entitled to benefits from the Fund only if he has been certified by a medical practitioner as being unable to work owing to sickness of accident. |

Rules of the Sick fund:

An employee shall receive payment in respect of each working day on which he is absent during a cycle of 36 months, commencing on 1 November 2018 owing to illness or accident.

The maximum number days is payable in a cycle of 36 months shall be 30 days.

A member shall be entitled to benefits from the Fund only if a medical practitioner or any other person who is certified to diagnose and treat patients and who is registered with a professional council established by an Act of Parliament has certified him as being unable to work owing to sickness or accident.

The Fund must pay an employee for a days sick leave owing to sickness or injury the wage the employee ordinarily has receive for work on that day.

| (h) |

Subject to the Rules of the Fund, an employee shall not be entitled to sick pay— |

| (i) |

if he/she is absent form work owing to an accident which is compensable under the Compensation for Occupational Injuries and Diseases Act, 1993; |

| (ii) |

if his/her absence from work is related to the use of alcohol of illegal substances, or if he/she is incapacitated through sickness owing to his/her own negligence or misconduct; |

| (iii) |

if he/she fails to observe the instructions of a medical practitioner, or in the opinion of that practitioner, has aggravated his/her condition or retarded his/her recovery through his/her own actions; |

| (iv) |

if he/she suffers from injury in respect of which a third party is liable to or does pay compensation to him/hen |

| (v) |

while he/she undergoes treatment prescribed by any person other than a registered medical practitioner; |

| (vi) |

if he/she fails to provide the Council with any relevant information which it may require; |

| (vii) |

is he/she is found by the Council to be fit to resume his/her employment or to be permanently disabled, in which event he/she shall cease to be entitled to sick pay from a date fixed by the Council for this purpose. |

| (viii) |

If she takes maternity leave. |

| (ix) |

if he/she is unemployed or failed to contribute to the Fund. |

| (i) |

if at any time the amount to the credit of the Fund drops below R100 000,00 payment shall cease and shall not be resumed until the amount to the credit of the Fund exceeds the amount of R200 000,00. |

| (j) |

The Fund shall be entitled to recover any amount paid to an employee— |

| (i) |

in consequence of false information furnished to the Fund by or on behalf of that employee; |

| (ii) |

if the employee fails to notify the Fund timeously of any change of circumstances which could lead to the amount of benefits being reviewed or withdrawn, in which event the Fund may claim any money overpaid to the employee from him. |

| (k) |

An employee who is eligible for benefits in terms of this clause shall be entitled to receive from the Fund a full benefit specified for his employee category in terms of this Agreement, in respect of every five (5) consecutive working days which he is unable to work on account of sickness or injury. |

| (l) |

Family responsibility leave |

| (i) |

An employee shall receive payment in respect of three days' family responsibility leave at 100% of his prescribed rate of pay during a cycle of one year commencing on 1 January every year, and only in the following circumstances: |

| (aa) |

When the employee's child is born; |

| (bb) |

when the employee's child is sick; |

| (cc) |

in the event of the death of the employee's spouse, life partner, parent, adoptive parent, grandparent, child, adopted child, grandchild or sibling. |

| (ii) |

Application for these benefits must be made on the Council's official application form and shall be subject to the submission of the necessary documentary proof, as deemed appropriate by the Council to substantiate the benefit claim. |

| (m) |

In the event of expiration of this Agreement, the dissolution or winding up of the Council or a cessation of its operation, the provision of clause 14(8) and (9) relating to the Holiday Fund shall apply equally to this Fund. |

Debt Collectors Act, 1998

Debt Collectors Act, 1998