Debt Collectors Act, 1998

Debt Collectors Act, 1998

R 385

Labour Relations Act, 1995 (Act No. 66 of 1995)NoticesNational Bargaining Council for the Road Freight and Logistics Industry (NBCRFLI)Main Collective AgreementSchedulesSchedule 5 : Remuneration and other Monetary Benefits |

1.

| (a) | Minimum Wages |

| (1) | From the date of implementation for 2025 being 1 March 2025 for employers and employees of the industry or date to be determined by the Minister of Employment and Labour but not earlier than 1 March 2025 until 28 February 2027, the minimum rate at which wages in respect of ordinary hours of work shall be paid by an employer to each member of the under mentioned grades of his employees, shall be as follows: |

| (a) | Weekly Wages: |

General Freight, Courier, Furniture Removal and CIT:

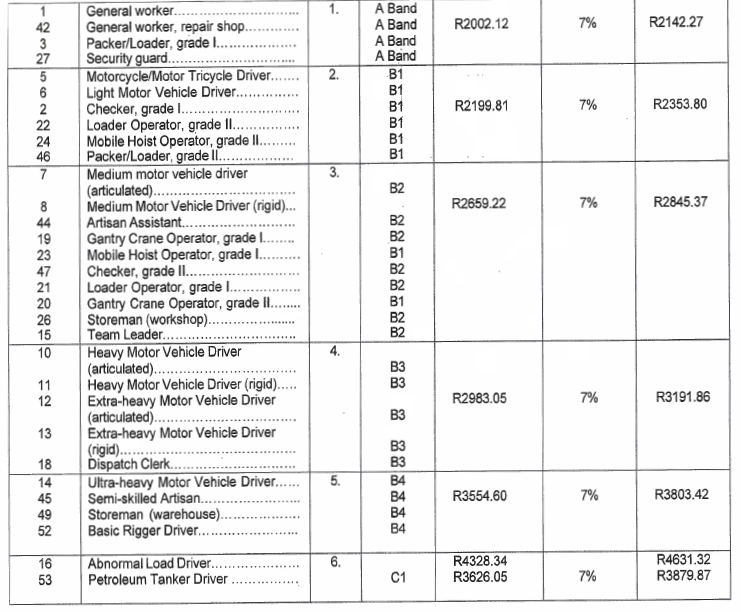

| (i) | TABLE ONE A (YEAR ONE): GENERAL FREIGHT AND FURNITURE REMOVAL SECTORS MINIMUM WAGES: GRADES 1TO 6 |

For the period 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026

APPLICATION OF WAGE INCREASES FOR THE PERIOD FROM 1 MARCH 2025 FOR EMPLOYERS AND EMPLOYEES OF THE INDUSTRY OR DATE TO BE DETERMINED BY THE MINISTER BUT NOT EARLIER THAN 1 MARCH 2025 ENDING 28 FEBRUARY 2026 FOR GRADES 1 - 6

| (a) | Across the board increases of 7% on actual wage shall be awarded to all employees, mentioned in grades 1 to 6 above, who were in the employ of an employer prior 1 March 2025. |

| (b) | The across-the-board increase must apply to the current wages before the adjustment of the minimums. |

COURIER SECTOR

(1)

| (b) | For the period 1 March 2025 or date to be determined by the Minister but not earlier than 1 March 2025 to 28 February 2026 the minimum weekly rate of which wages in respect of ordinary working hours shall be paid by an employer to his employees who are engaged in the undermentioned grades, shall be as follows: |

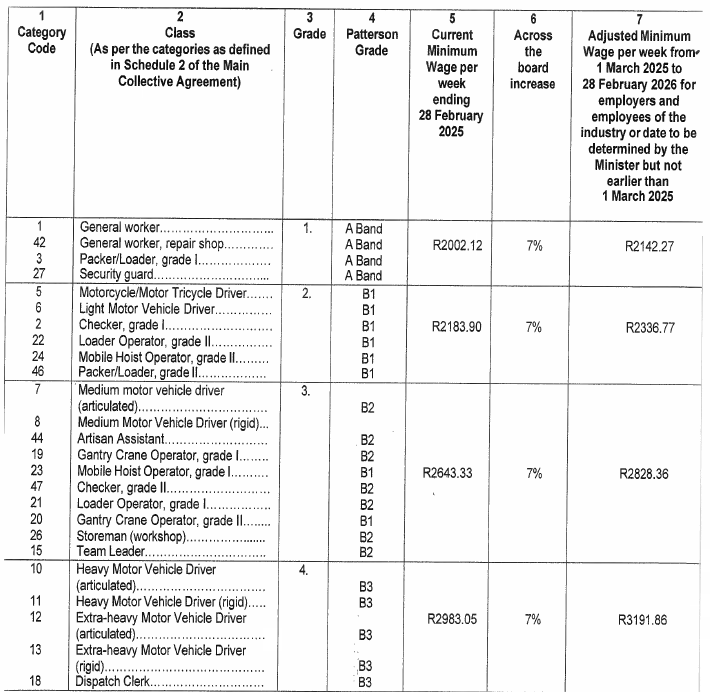

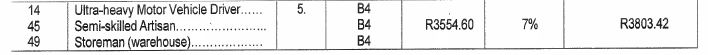

| (ii) | TABLE ONE B (YEAR ONE): COURIER SECTOR MINIMUM WAGES: GRADES 1 TO 5 |

APPLICATION OF WAGE INCREASES FOR THE PERIOD FROM 1 MARCH 2025 FOR EMPLOYERS AND EMPLOYEES OF THE INDUSTRY OR DATE TO BE DETERMINED BY THE MINISTER BUT NOT EARLIER THAN 1 MARCH 2025 ENDING 28 FEBRUARY 2026 FOR GRADES 1- 5

| (a) | Across the board increases of 7% on actual wage shall be awarded to all employees, mentioned in grades 1 to 5 above, who were in the employ of an employer prior to 1 March 2025. |

| (b) | The across-the-board increase must apply to the current wages before the adjustment of the minimums. |

(1)

| (c) | For the period 1 March 2024 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2024 until 28 February 2025 the minimum weekly rate of which wages in respect of ordinary working hours shall be paid by an employer to his employees who are engaged in the under mentioned grades, shall be as follows: |

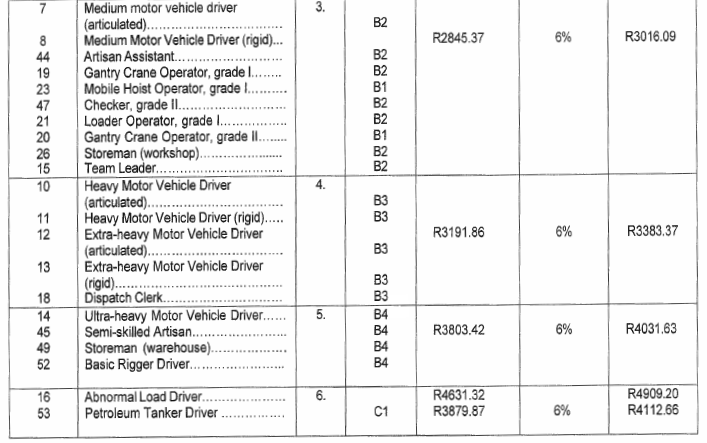

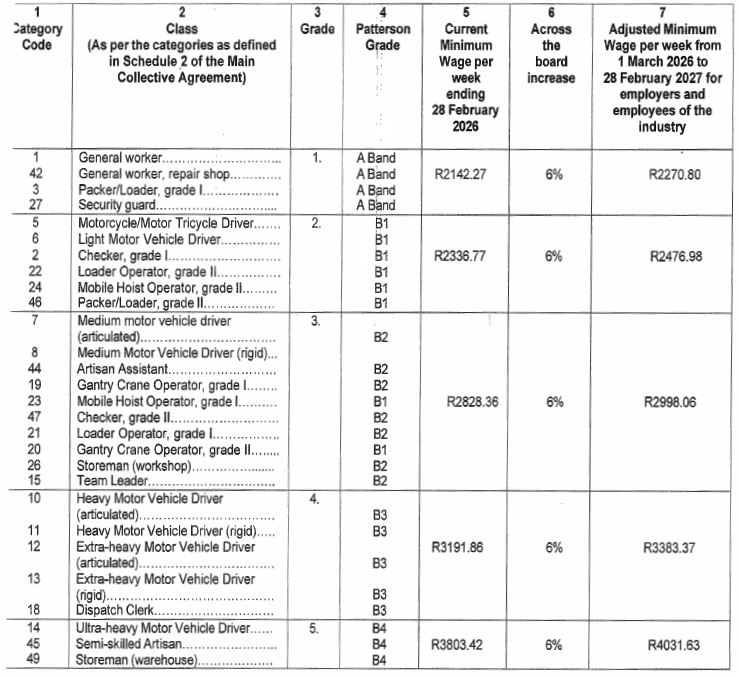

| (iii) | TABLE TWO A (YEAR TWO): GENERAL FREIGHT AND FURNITURE REMOVAL SECTORS MINIMUM WAGES: GRADES 1 TO 6 |

For the period 1 March 2026 until 28 February 2027 for employers and employees of the industry

APPLICATION OF WAGE INCREASES FOR THE PERIOD FROM 1 MARCH 2026 ENDING 28 FEBRUARY 2027 FOR GRADES 1 - 6

| (a) | Across the board increases of 6% on actual wage shall be awarded to all employees, mentioned in grades 1 to 6 above, who were in the employ of an employer prior 1 March 2026. |

| (b) | The across-the-board increase must apply to the current wages before the adjustment of the minimums. |

COURIER SECTOR

(1)

| (c) | For the period 1 March 2026 to 28 February 2027 the minimum weekly rate of which wages in respect of ordinary working hours shall be paid by an employer to his employees who are engaged in the undermentioned grades, shall be as follows: |

| (iv) | TABLE TWO B (YEAR TWO): COURIER SECTOR MINIMUM WAGES: GRADES 1 TO 5 |

APPLICATION OF WAGE INCREASES FOR THE PERIOD FROM 1 MARCH 2026 ENDING 28 FEBRUARY 2027 FOR GRADES 1- 5

| (a) | Across the board increases of 6% on actual wage shall be awarded to all employees, mentioned in grades 1 to 5 above, who were in the employ of an employer prior to 1 March 2026. |

| (b) | The across-the-board increase must apply to the current wages before the adjustment of the minimums. |

CASH IN TRANSIT SECTOR

(1)

| (d) | For the period 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2027 the minimum weekly rate of which wages in respect of ordinary working hours shall be paid by an employer to his employees who are engaged in the under mentioned grades, shall be as follows: |

| (v) | TABLE THREE: CASH IN TRANSIT CHAMBER MINIMUM WAGES: GRADES 3 TO 6: From 1 March 2025 or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2027 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Category Code |

Class (As per the categories as defined in Schedule 2 of the Main Collective Agreement |

Grade |

Pattersons Grade |

Current Minimum Wage per week ending 28 February 2025 |

Adjusted Minimum Wage per week on 01 March 2025 until 28 February 2026 |

Adjusted Minimum Wage per week on 01 March 2026 until 28 February 2027 |

|

50 |

Vehicle guard |

3. |

B2 |

R4169.24 |

R4461.09 |

R4728.76 |

|

51 |

Custodian |

5. |

B4 |

R4781.92 |

R5116.65 |

R5423.65 |

|

41 |

Security Officer, III |

6. |

B3 |

R3463.33 |

R3705.76 |

R3928.11 |

|

40 |

Security Officer, II |

|

B3 |

R4169.24 |

R4461.09 |

R4728.76 |

|

39 |

Security Officer, I |

|

B4 |

R4169.24 |

R4461.09 |

R4728.76 |

APPLICATION OF WAGE INCREASES FROM 1 MARCH 2025 OR DATE TO BE DETERMINED BY THE MINISTER BUT NOT EARLIER THAN 1 MARCH 2025 UNTIL 28 FEBRUARY 2026 FOR GRADES 3, 5 AND 6

| (vi) | TABLE ONE (YEAR ONE):. ACROSS THE BOARD INCREASES |

From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026.

|

Employees |

Across the Board Increase |

|

Current EBU up to Patterson Grading B4 |

7% |

|

Current EBU Patterson Grading C1 |

6% |

The across the board increases in table one shall be calculated on actual wage and shall be awarded to all employees mentioned in the said table, who were in the employ of an employer prior to 1 March 2025.

| (vii) | TABLE TWO (YEAR TWO): ACROSS THE BOARD INCREASES |

From 1 March 2026 until 28 February 2027.

|

Employees |

Across the Board Increase |

|

Current EBU up to Patterson Grading B4 |

6% |

|

Current EBU Patterson Grading C1 |

5% |

The across the board increases in table one shall be calculated on actual wage and shall be awarded to all employees mentioned in the said table, who were in the employ of an employer prior to 1 March 2026.

(1)

| (e) | Extended Bargaining Unit Employees engaged in the Cash-in-Transit Sector |

| (1) | Across the board increases |

| (a) | Year one: From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026: |

| (i) | 7 % in respect of all E8U employees up to Paterson Grade 84. |

| (ii) | 6 % in respect of all EBU employees in Paterson Grade C1. |

| (b) | Year two: From 1 March 2026 until 28 February 2027: |

| (i) | 6 % in respect of all EBU employees up to Paterson Grade 84. |

| (ii) | 5 % in respect of all EBU employees in Paterson Grade C1. |

(1)

| (h) | The only provisions of this Agreement that shall apply to extended bargaining unit employees shall be the increases referred to above, the provisions of clause 77 only as from December 2018, clause 54, clause 69, and schedule 4 item 8 (Wellness Fund). |

| 2. | Night-shift allowance |

| (1) | The following night-shift allowances shall be payable to employees for whom minimum wages are prescribed: |

(a)

|

Category of Employee |

Period: From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026 |

|

Employees who perform more than one hour of night work |

An allowance of R17.67 beyond one hour and R3.18 for every hour in excess thereof; or by a reduction of ordinary hours of work |

(b)

|

Category of Employee |

Period: From 1 March 2026 until 28 February 2027 |

|

Employees who perform more than one hour of night work |

An allowance of R18.73 beyond one hour and R3.37 for every hour in excess thereof; or by a reduction of ordinary hours of work |

| 3. | Consolidated allowance |

The consolidated allowance is payable in terms of clause 63 (7).

|

Period: 1 March 2025 until 28 February 2026 |

Period: 1 March 2026 until 28 February 2027 |

|

R127.48 per month |

R135.13 |

| 4. | Subsistence and Cross Border allowance |

| (a) | Subsistence Allowance |

The Subsistence allowance payable in terms of clause 36A of the Main Agreement, must be paid as per the schedule hereunder:

|

Subsistence Allowance: Period: From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026 |

||||

|

||||

|

||||

|

Total (absence plus 3 meals) R229.83 |

||||

|

Subsistence Allowance: From 1 March 2026 until 28 February 2027 |

||||

Total (absence plus 3 meals) R243.63 |

| (b) | Cross Border Allowance |

The Cross Border allowance payable in terms of clause 36B of the Main Agreement, must be paid as per the schedule hereunder:

|

Cross Border Allowance: Period: From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026 |

||||

|

||||

|

||||

|

Total (absence plus 3 meals) R459.48 |

||||

|

Cross Border Allowance: 1 March 2026 until 28 February 2027 |

||||

Total (absence plus 3 meals) R487.05 |

| 5. | Dangerous Goods Driver Limitation of Hours Allowance |

The allowance that must be paid to Dangerous Goods Drivers in terms of clause 60 of the Main Collective Agreement is:

| (a) | If the client restricts the driver's hours of work to 12 hours or less, the following must apply: |

| (i) | Year 1: (From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026) R156.46 |

| (ii) | Year 2: (From 1 March 2026 until 28 February 2027) R165.85 |

| (b) | If the client restricts the driver's hours of work to 13 hours or less, but not less than 12, the following must apply: |

| (i) | Year 1: (From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026) R100.58 |

| (ii) | Year 2: (From 1 March 2026 until 28 February 2027) R106.61 |

| (c) | If the client restricts the driver's hours of work to 14 hours or less, but not less than 13, the following must apply: |

| (i) | Year 1: (From 1 March 2025 for employers and employees of the industry or date to be determined by the Minister but not earlier than 1 March 2025 until 28 February 2026) R55.88 |

| (ii) | Year 2: (From 1 March 2026 until 28 February 2027) R59.23 |

[Schedule 5 substituted in its entirety by Notice No. R. 4988 of GG50841, dated 21 June 2024]