Exemptions

Where a small employer or his employee can satisfy the Council that any provisions of the Agreement are restricting entrepreneurial initiative and/or employment opportunities, such an employer or employee may apply to the Council for exemption from the specific provisions and the Council may grant such an exemption.

An employee on probation earns ten percent (10%) less than the prescribed hourly wages for a period not exceeding 3 (three) months which should not be less than the hourly wage prescribed by the National Minimum Wage Act. The hourly wages prescribed pertain to the payment of ordinary hours of work as prescribed in clause 9. Should statutory legislation reduce these ordinary hours of work the wages will automatically be reduced proportionately, bearing in mind the overtime aspect.

| (1) |

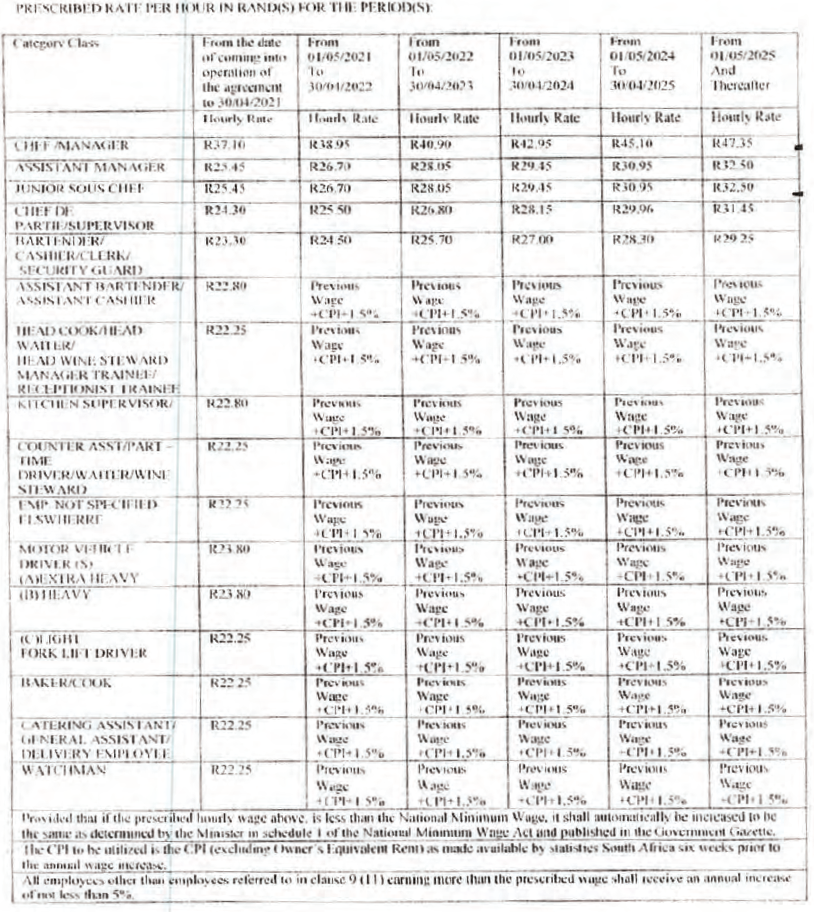

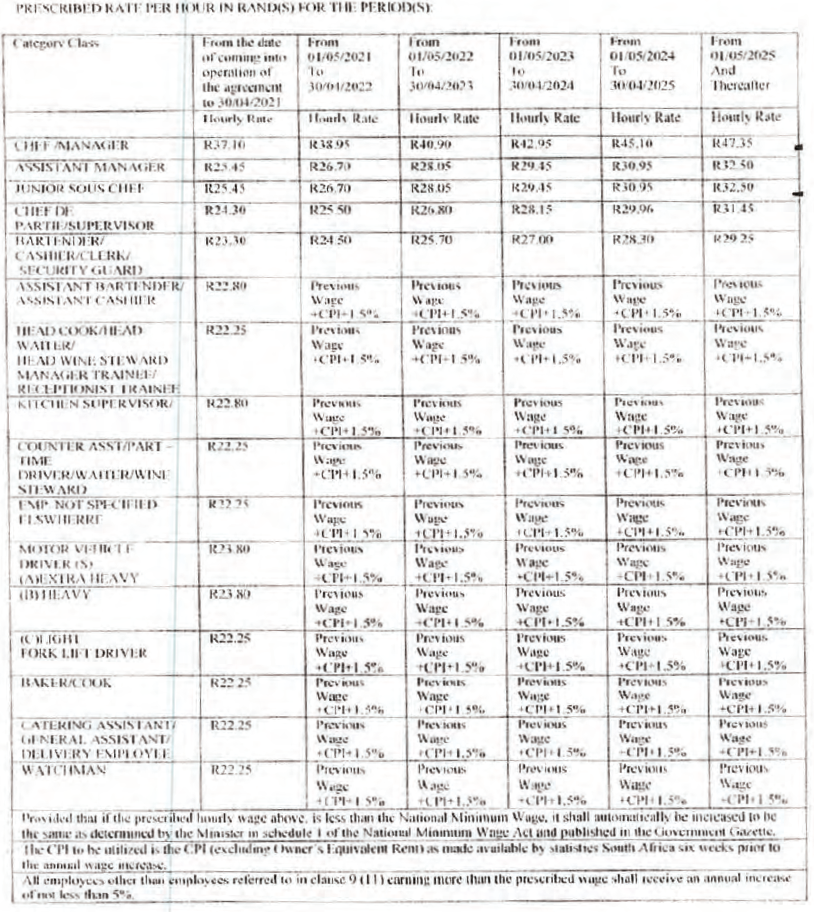

The hourly wage, excluding any gratuity or tips which shall be paid to each employee for the ordinary hours that the employee works in the area prescribed in sub-clause (5)(2) is set out hereunder of this clause and no employer shall pay, and no employee shall accept wages lower than the hourly wage prescribed in this clause. Provided that, if the prescribed hourly wage paid to an employee for ordinary hours worked is less than the national minimum wage it shall be adjusted to be the same as determined by the Minister in schedule 1 of the National Minimum Wage Act and published in the Government Gazette. Provided further that the wages so prescribed may be reduced by not more than 10 percent by a small employer as defined in clause 4. |

| (2) |

Employees employed in the following areas: |

| (a) |

The Province of Western Cape; |

| (b) |

The Province of Eastern Cape; |

| (c) |

The Province of Northern Cape; |

| (d) |

The Province of Free State; |

| (e) |

The Province of Kwa Zulu Natal; |

| (f) |

The Province of North West, excluding the Magisterial Districts of Brits and Rustenburg; |

| (g) |

The Province of Mpumalanga, excluding the Magisterial District of Witbank; |

| (h) |

The Limpopo Province, excluding the Magisterial District of Warmbaths; and |

| (i) |

The Magisterial Districts of Heidelberg, Nigel, Vereeniging, Vanderbijlpark, Oberholzer, Meyerton and Carletonville: |

Part time employees shall be paid in respect of ordinary hours of work as prescribed in clause 9, not less than the hourly wage prescribed in sub clause 5(2) above for an employee of the same class as the one in which he is employed.

| (1) |

All employees other than part time, commission workers and employees earning in excess of the threshold (Clause 9(11), who are employed by the same employer for a minimum of: |

| (a) |

12 consecutive months, shall receive one week's wages as an annual bonus payable during December. |

| (b) |

24 consecutive months or more, shall receive 2 week's wages as an annual bonus payable during December. |

| (1) |

The owner/management of an establishment and a commission worker may agree in writing that the commission worker will perform the duties of a waiter if and when so required by the owner on which commission will he paid at the end of each shift/week/month. |

| (2) |

The owner/management shall pay a commission worker the rates applicable for commission work as agreed: Provided that if during any calculation period, the commission worker does not earn an amount equivalent to at least the prescribed minimum wage for waiters, excluding any gratuity or tips, the owner shall pay the commission worker not less than the applicable minimum wage as prescribed for waiters for the hours that the commission worker worked. |

| (3) |

Commission workers to receive a funeral benefit, with both parties contributing in equal portions to the monthly contribution in the amount of R12-50 each. |

| (4) |

Commission workers working a minimum of 130 hours per month and for a minimum period of 2 years and longer with the same employer, shall be eligible to join the Momentum "Funds At Work Umbrella Provident Fund". |

| (5) |

An agreement to perform commission work in terms of this clause shall be concluded before the work commences and shall include— |

| (a) |

the commission worker's rate of commission; |

| (b) |

the basis for calculating commission; |

| (c) |

the period over which the payment is calculated, which period may not be longer than one month; |

| (d) |

when the employer shall pay the commission to the employee, which commission may not be paid more than seven days after the end of the period in which the commission was earned; and |

| (e) |

the type, description, number, quantity, margin, profit or orders (individual, weekly, monthly or otherwise) for which the employer is entitled to earn commission. |

| (6) |

The employer shall supply the employee with a copy of the agreement to perform commission work. |

| (7) |

The commission worker may apply for full time employment as a waiter, if a vacancy exists within the establishment for a waiter and the commission worker qualities for the position of waiter. |

| (8) |

An employer who intends to cancel or amend the agreement in operation relating to commission work, or the rates applicable thereunder, shall give the effected employee not less than four weeks' notice of such intention. |

| (1) |

The wage of an employee is calculated by reference to the employee's ordinary hours of work. |

| (2) |

For the purposes of any calculation in terms of this agreement— |

| (a) |

the hourly wage of a worker is obtained by— |

| (i) |

dividing the weekly wage by the ordinary number of hours worked in a week; |

| (b) |

the daily wage of an employee is obtained by— |

| (i) |

multiplying the hourly wage by the number of ordinary hours worked in a day; or |

| (ii) |

dividing the weekly wage by the number of days worked in a week. |

| (c) |

the weekly wage of an employee is obtained by— |

| (i) |

multiplying the hourly wage by the number of ordinary hours worked in a day multiplied by the number of days worked in a week; or |

| (ii) |

multiplying the daily wage by the number or days worked in a week; or |

| (iii) |

dividing the monthly wage by four and one-third. |

| (d) |

the monthly wage of an employee is obtained by multiplying the weekly wage by four and a third. |

An employer shall not reduce the wages of an employee who at the time this Agreement comes into operation or at any time thereafter, is paid a wage at a rate higher than the hourly rate prescribed for his grade in this Agreement, as long as he continues to work for the same employer. Provided that where a weekly-paid employee has been given one week's notice, or a monthly paid employee two weeks' notice, of a change of conditions of employment and such employee agrees in writing to accept a transfer to a grade of work which a lower hourly wage is prescribed, this provision shall not apply.

Stamp Duties Act, 1968 (Act 77 of 1968)

Stamp Duties Act, 1968 (Act 77 of 1968)