Civil Aviation Act, 2009

Civil Aviation Act, 2009

R 385

Labour Relations Act, 1995 (Act No. 66 of 1995)NoticesNational Bargaining Council for the Private Security SectorMain Collective Agreement4. Remuneration |

| (1) | Minimum salary: |

| (a) | The ordinary salary which an employer shall pay employees shall be as specified in the tables listed below. |

| (i) | The hourly equivalents reflected in the table hereunder shall be used solely for the calculation of time worked in excess of the ordinary hours or for the deduction of monies from the ordinary salary for short time as defined or for any unauthorized absenteeism or any reduced ordinary hours of work as may be agreed between the employer and the employee in terms of sub clause 3(50). |

| (b) | Subject to sub clause (a)(i) above, an employer shall pay to each member of the undermentioned classes of employees, other than casual employees, the minimum monthly salaries specified hereunder in Table 1, 2, and 3— |

Table 1 - Monthly salary rate for year 1 as gazetted in Notice R. 193 of 20 February 2020

|

|

AREAS 1 AND 2 |

AREA 3 |

Maximum permissible working hours per week for each respective category of employee, subject to clause 6(2), with regard to averaging of working hours. |

||

|

In the Magisterial Districts of |

Alberton, Bellville, Benoni, Bloemfontein, Boksburg, Brakpan, Camperdown, Chatsworth, Durban, East London, Germiston, Goodwood, Inanda, Johannesburg, Kempton Park, Kimberley, Klerksdorp, Krugersdorp, Kuils River, Mitchell's Plain, Nigel, Oberholzer, Paarl, Pietermaritzburg, Pinetown, Port Elizabeth, Pretoria, Randburg, Randfonteln, Roodepoort, Sasolburg, Simon's Town, Somerset West, Springs, Stellenbosch, Strand, The Cape, Ultenhage, Vanderbijlpark, Vereeniging, Westonaria, Wonderboom and Wynberg. |

|

All other areas |

|

|

|

|

Monthly salary |

|

Monthly salary |

|

|

|

Artisan |

R7 840.00 |

|

R6 845.00 |

|

45 |

|

Clerical Assistant |

R4 085.00 |

|

R4 085.00 |

|

45 |

|

Clerk |

|

|

|

|

|

|

During the first year of experience |

R4 261.00 |

|

R4 085.00 |

|

45 |

|

During the second year of experience |

R4 531.00 |

|

R4 085.00 |

|

|

|

During the third year of experience |

R4 765.00 |

|

R4 085.00 |

|

|

|

Thereafter |

R5 022.00 |

|

R4 269.00 |

|

|

|

Control or Communication Centre Operator |

As for relevant security officer grading |

48 |

|||

|

Controller |

As for a clerical assistant |

45 |

|||

|

Driver of a— |

|

|

|

|

45 |

|

Light motor vehicle |

R4 112.00 |

|

R4 085.00 |

|

|

|

Medium motor vehicle |

R4 407.00 |

|

R4 085.00 |

|

|

|

Heavy motor vehicle |

R4 601.00 |

|

R4 085.00 |

|

|

|

General Worker |

R4 085.00 |

|

R4 085.00 |

|

45 |

|

Handyman |

R4 549.00 |

|

R4 085.00 |

|

45 |

|

Security Officer |

|

|

|

|

48 |

|

Grade A |

R5 766.00 |

|

R4 811.00 |

|

|

|

Grade B |

R5 189.00 |

|

R4 396.00 |

|

|

|

Grade C, D & E |

R4 585.00 |

|

R4 358.00 |

|

|

|

Employees not elsewhere specified |

R4 095.00 |

|

R4 095.00 |

|

45 |

[Table 1 substituted by section 3(1) of Notice No. 334, GG44764, dated 4 June 2021]

Table 2 - Monthly salary rate for year 2 from date of operation of this agreement until 1 March 2022

|

MONTHLY SALARY RATES FOR YEAR 2 of operation of this agreement |

|||

|

|

AREAS 1 AND 2 |

AREA 3 |

Maximum permissible working hours per week for each respective category of employee, subject to clause 6(2), with regard to averaging of working hours. |

|

In the Magisterial Districts of |

Alberton, Bellville, Benoni, Bloemfontein, Boksburg, Brakpan, Camperdown, Chatsworth, Durban, East London, Germiston, Goodwood, Inanda, Johannesburg, Kempton Park, Kimberley, Klerksdorp, Krugersdorp, Kuils River, Mitchell's Plain, Nigel, Oberholzer, Paarl, Pietermaritzburg, Pinetown, Port Elizabeth, Pretoria, Randburg, Randfonteln, Roodepoort, Sasolburg, Simon's Town, Somerset West, Springs, Stellenbosch, Strand, The Cape, Ultenhage, Vanderbijlpark, Vereeniging, Westonaria, Wonderboom and Wynberg. |

All other areas |

|

|

|

Monthly salary |

Monthly salary |

|

|

Artisan |

R8 216.00 |

R7 174.00 |

45 |

|

Clerical Assistant |

R4 281.00 |

R4 281.00 |

45 |

|

Clerk |

|

|

|

|

During the first year of experience |

R4 466.00 |

R4 281.00 |

45 |

|

During the second year of experience |

R4 748.00 |

R4 281.00 |

|

|

During the third year of experience |

R4 994.00 |

R4 281.00 |

|

|

Thereafter |

R5 263.00 |

R4 474.00 |

|

|

Control or Communication Centre Operator |

As for relevant security officer grading |

48 |

|

|

Controller |

As for a clerical assistant |

45 |

|

|

Driver of a— |

|

|

45 |

|

Light motor vehicle |

R4 309.00 |

R4 281.00 |

|

|

Medium motor vehicle |

R4 619.00 |

R4 281.00 |

|

|

Heavy motor vehicle |

R4 822.00 |

R4 281.00 |

|

|

General Worker |

R4 281.00 |

R4 281.00 |

45 |

|

Handyman |

R4 767.00 |

R4 281.00 |

45 |

|

Security Officer |

|

|

48 |

|

Grade A |

R5 986.00 |

R5 020.00 |

|

|

Grade B |

R5 409.00 |

R4 605.00 |

|

|

Grade C, D & E |

R4 805.00 |

R4 567.00 |

|

|

Employees not elsewhere specified |

R4 292.00 |

R4 292.00 |

45 |

[Table 2 substituted by section 3(1) of Notice No. 334, GG44764, dated 4 June 2021]

Table 3 - Monthly salary rate for year 3 from 2 March 2022 until 1 March 2023

|

MONTHLY SALARY RATES FOR YEAR 3 of operation of this agreement |

|||

|

|

AREAS 1 AND 2 |

AREA 3 |

Maximum permissible working hours per week for each respective category of employee, subject to clause 6(2), with regard to averaging of working hours. |

|

In the Magisterial Districts of |

Alberton, Bellville, Benoni, Bloemfontein, Boksburg, Brakpan, Camperdown, Chatsworth, Durban, East London, Germiston, Goodwood, Inanda, Johannesburg, Kempton Park, Kimberley, Klerksdorp, Krugersdorp, Kuils River, Mitchell's Plain, Nigel, Oberholzer, Paarl, Pietermaritzburg, Pinetown, Port Elizabeth, Pretoria, Randburg, Randfonteln, Roodepoort, Sasolburg, Simon's Town, Somerset West, Springs, Stellenbosch, Strand, The Cape, Ultenhage, Vanderbijlpark, Vereeniging, Westonaria, Wonderboom and Wynberg. |

All other areas |

|

|

|

Monthly salary |

Monthly salary |

|

|

Artisan |

R8 611.00 |

R7 518.00 |

45 |

|

Clerical Assistant |

R4 487.00 |

R4 486.00 |

45 |

|

Clerk |

|

|

|

|

During the first year of experience |

R4 681.00 |

R4 486.00 |

45 |

|

During the second year of experience |

R4 976.00 |

R4 486.00 |

|

|

During the third year of experience |

R5 234.00 |

R4 486.00 |

|

|

Thereafter |

R5 516.00 |

R4 689.00 |

|

|

Control or Communication Centre Operator |

As for relevant security officer grading |

48 |

|

|

Controller |

As for a clerical assistant |

45 |

|

|

Driver of a— |

|

|

45 |

|

Light motor vehicle |

R4 516.00 |

R4 486.00 |

|

|

Medium motor vehicle |

R4 841.00 |

R4 486.00 |

|

|

Heavy motor vehicle |

R5 054.00 |

R4 486.00 |

|

|

General Worker |

|

|

45 |

|

During the first six months service with the same employer |

R4 487.00 |

R4 486.00 |

|

|

Thereafter |

R4 487.00 |

R4 486.00 |

|

|

Handyman |

R4 996.00 |

R4 486.00 |

45 |

|

Security Officer |

|

|

48 |

|

Grade A |

R6 217.00 |

R5 239.00 |

|

|

Grade B |

R5 640.00 |

R4 824.00 |

|

|

Grade C, D & E |

R5 036.00 |

R4 786.00 |

|

|

Employees not elsewhere specified |

R4 498.00 |

R4 498.00 |

45 |

[Table 3 substituted by section 3(1) of Notice No. 334, GG44764, dated 4 June 2021]

| (2) | Casual employees |

An employer shall pay a casual employee in respect of each hour or part of an hour (excluding overtime) worked by the employee on any day other than a paid Public holiday or a Sunday not less than the hourly wage as calculated in terms of clause 4(7)(b) for an ordinary employee who in the same area performs the same class of work as the casual employee is required to do, plus 15 percent, or not less than the hourly wage or hourly equivalent of the salary actually being paid to the ordinary employee, whichever is the greater amount—

Provided that

| (i) | for the purposes of this paragraph the expression "the ordinary employee" means the employee who performs the particular class of work in the employer's full-time employ and who is being paid the lowest salary for that class of work; and |

| (ii) | where the employer requires the casual employee— |

| (aa) | to perform the work of a class of employee for whom salaries on a rising scale are prescribed, the expression "hourly wage" shall mean the hourly equivalent wage prescribed for a qualified employee of that class; and |

| (ab) | to work for a period of less than four hours on any day, the employee shall be deemed to have worked four hours and remunerated accordingly. |

| (3) | Basis of contract: |

For the purposes of this clause, the contract of employment of an employee, other than a casual employee, shall be on a weekly basis.

| (4) | Security Officer Premium Allowance: |

A security officer premium allowance shall be applicable to all areas as defined in Tables 1, 2 and 3 and shall be payable on a monthly basis. The security officer premium allowance shall however not be payable to the security officer during periods of unauthorised absence from work, to be calculated on a pro-rated basis. Permission for authorised absent shall not be unreasonably denied.

Year 1 of operation of this Agreement as gazetted in Notice R.193 of 20 February 2020: R175.00 per month

Year 2 of operation of this agreement: R270.00 per month until 1 March 2022.

Year 3 of operation of this agreement: R439.00 per month until 1 March 2023.

The rand value of the security officer premium allowance referred to in clause 4, shall be added to the basic salary at the end of year 3 of the agreement calculated from the effective date as envisaged in 2.2 supra.

[Clause 4(4) substituted by section 3(2) of Notice No. 334, GG44764, dated 4 June 2021]

| (5) | Hospital Cover |

| (i) | In the second year of the operation of this agreement from the period of operation of the agreement until 1 March 2022, the employer shall contribute R100.00 for each security officer in its employ and the employee will contribute the balance of the total cost of the scheme, which allowance shall however not be payable during period of unauthorised absence from work to be calculated on a pro-rated basis. |

| (ii) | In the third year of the operation of this agreement from 02 March 2022 until 1 March 2023, the employer shall contribute R150 for each security officer in its employ and the employee will contribute the balance of the total cost of the scheme, which allowance shall however not be payable during periods of unauthorised absence from work to be calculated on a pro-rated basis. |

| (iii) | Appointment of an appropriate service provider will be subject to the NBCPSS process prior to the implementation of the Hospital Cover in year 2, calculated from the period of operation of this Agreement. |

| (iv) | The hospital cover shall be applicable to all areas as defined in Tables 1, 2 and 3 and payable each month, which premium allowance shall however not be payable during periods of unauthorised absence from work to be calculated on a pro-rated basis. Permission for authorised absence shall not be unreasonably denied. |

[Clause 4(5) substituted by section 3(3) of Notice No. 334, GG44764, dated 4 June 2021]

| (6) | Differential salary: |

An employer who requires or permits a member of one class of employee to perform for longer than one hour on any day, either in addition to the employee's own work or in substitution therefore, work of another class for which—

| (a) | Salary is higher than that of the employee's own class is prescribed in clause 4(1), shall pay to such employee in respect of that day not less than the daily equivalent calculated at the higher rate; or |

| (b) | a rising scale of remuneration resulting in a salary higher than that of the employee's own class, as prescribed in sub clause 4(1), shall pay to such employee in respect of that day not less than the daily salary calculated on the notch in the rising scale immediately above the salary which the employee was receiving for the employee's ordinary work: provided that— |

| (aa) | this sub clause shall not apply where the difference between the classes in terms of sub clause 4(1) is based on experience; and |

| (ab) | unless expressly otherwise provided in a written contract between the employer and employee, nothing in this agreement shall be so construed as to preclude an employer from requiring an employee to perform work of another class for which class the same or a lower salary is prescribed for such an employee. |

| (7) | Calculation of salary |

The ordinary salary, overtime and Sunday time of an employee, other than a casual employee, shall be calculated on a monthly basis and an employee shall be paid accordingly.

| (a) | The monthly salary of an employee shall be as stipulated in the relevant column of the tables 1, 2 and 3; and |

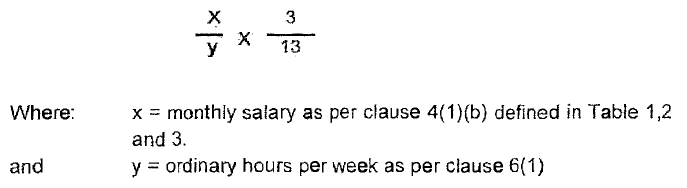

| (b) | Any hours in excess of the maximum daily or weekly ordinary hours or, if applicable, average weekly ordinary hours, as well as any hours in respect of work performed on a Sunday or public holiday, shall be calculated by using the formula below to determine the "hourly equivalent" figure and applying the relevant premium: |

| (c) | The "hourly equivalent" figure shall not be used to calculate the employee's ordinary salary in respect of ordinary hours worked, i.e., the employee's basic salary. |

| (8) | Night shift allowance |

If at least half of the shift ordinarily falls between the hours of 18:00 on one day and 06:00 the next day that employee will be entitled to and shall receive an allowance in respect of each night shift worked of R6.00 per shift.

| (9) | Special allowances |

The following allowances shall be paid, per shift, to each employee performing the following duties, on condition that no employee shall be entitled to accumulate more than any two of these special allowances in respect of any shift worked—

|

(a) |

Mobile supervisors: |

R8.50 |

|

(b) |

Armed security officer: |

R8.50 |

|

(c) |

Armed response officer: |

R8.50 |

|

(d) |

National key point officer: |

R8.50 |

|

(e) |

Control centre operator: |

R8.50 |