30% of SA businesses cannot survive a one-month lockdown

We now have a better sense of the impact the lockdown is having on the economy, and it’s not pretty.

We now have a better sense of the impact the lockdown is having on the economy, and it’s not pretty. We now have a better sense of the impact the lockdown is having on the economy, and it’s not pretty.

We now have a better sense of the impact the lockdown is having on the economy, and it’s not pretty. President Cyril Ramaphosa on Tuesday announced a R500 billion coronavirus stimulus package and sweeping structural reforms to get the economy back on track.

President Cyril Ramaphosa on Tuesday announced a R500 billion coronavirus stimulus package and sweeping structural reforms to get the economy back on track. As South Africa enters the fourth weekend of the Covid-19 lockdown, the economic and social consequences are now becoming more apparent. And it doesn't look good.

As South Africa enters the fourth weekend of the Covid-19 lockdown, the economic and social consequences are now becoming more apparent. And it doesn't look good. President Cyril Ramaphosa this week announced that SA is to go into a 21-day lockdown from 26 March 2020 in an effort to combat the spread of the Covid-19 virus. Here are some of the key support measures for businesses, employees and the poor:

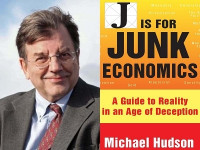

President Cyril Ramaphosa this week announced that SA is to go into a 21-day lockdown from 26 March 2020 in an effort to combat the spread of the Covid-19 virus. Here are some of the key support measures for businesses, employees and the poor: As we mark the 10th anniversary of the collapse of Lehman Brothers, economist Michael Hudson looks back over what we have learned in the last decade. Criminally, the major banks were bailed out but not the mortgage bond holders. Banks are bigger and more profitable than ever, but we have now entered an era of debt deflation - meaning more and more of our money is going to pay back bank debts. There is less disposable income available to purchase goods. Don't be fooled by the apparent calm of the financial system - the only way out of this is for banks to fail, or the grisly alternative - a Greece-style austerity programme, with depopulation, job losses and massive economic shrinkage.

As we mark the 10th anniversary of the collapse of Lehman Brothers, economist Michael Hudson looks back over what we have learned in the last decade. Criminally, the major banks were bailed out but not the mortgage bond holders. Banks are bigger and more profitable than ever, but we have now entered an era of debt deflation - meaning more and more of our money is going to pay back bank debts. There is less disposable income available to purchase goods. Don't be fooled by the apparent calm of the financial system - the only way out of this is for banks to fail, or the grisly alternative - a Greece-style austerity programme, with depopulation, job losses and massive economic shrinkage. People Against Petrol and Paraffin Price Increases (Papppi), headed by Visvin Reddy, is calling for a 35% drop in fuel prices. Did you know that 38% of what you pay at the pump goes to levies and taxes? And that nearly R2 goes to the bankrupt and corrupted Road Accident Fund? Reddy has had enough. He put out a video stating his case for a fuel price reduction and it got 500,000 hits. Just as Organisation Undoing Tax Abuse (OUTA) has thrown a crowbar into e-tolls, so may Papppi bring enough social pressure on government to rein in this runaway train.

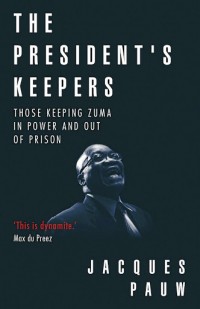

People Against Petrol and Paraffin Price Increases (Papppi), headed by Visvin Reddy, is calling for a 35% drop in fuel prices. Did you know that 38% of what you pay at the pump goes to levies and taxes? And that nearly R2 goes to the bankrupt and corrupted Road Accident Fund? Reddy has had enough. He put out a video stating his case for a fuel price reduction and it got 500,000 hits. Just as Organisation Undoing Tax Abuse (OUTA) has thrown a crowbar into e-tolls, so may Papppi bring enough social pressure on government to rein in this runaway train.  News out today from Capital Economics in London suggests the Ramaphoria effect is dead in the water. Ramaphosa's accession to the presidency was supposed to lift our hearts and souls and produce an economic miracle on the basis that with Jacob Zuma gone, everything would sort itself out.

News out today from Capital Economics in London suggests the Ramaphoria effect is dead in the water. Ramaphosa's accession to the presidency was supposed to lift our hearts and souls and produce an economic miracle on the basis that with Jacob Zuma gone, everything would sort itself out. Cyril Ramaphosa's accession to the presidential throne was supposed to have lifted our hearts and souls, but figures just out for the first quarter of 2018 show an economic contraction of 2,2%. The only sector showing growth is government services - no surprise there. The country is at the edge of a cliff, and it is doubtful if anyone in government is fully aware just how serious the mess is.

Cyril Ramaphosa's accession to the presidential throne was supposed to have lifted our hearts and souls, but figures just out for the first quarter of 2018 show an economic contraction of 2,2%. The only sector showing growth is government services - no surprise there. The country is at the edge of a cliff, and it is doubtful if anyone in government is fully aware just how serious the mess is. Michael Hudson is regarded by many as one of the world’s best economists because of his willingness to pierce the veil of deceit that passes for modern economic wisdom. His lastet book J is for Junk Economics exposes much of modern economic thought as pure propaganda, according to Moneyweb.

Michael Hudson is regarded by many as one of the world’s best economists because of his willingness to pierce the veil of deceit that passes for modern economic wisdom. His lastet book J is for Junk Economics exposes much of modern economic thought as pure propaganda, according to Moneyweb. President Ramaphosa plans an investment conference later this year with a target to attract, well, we're not quite sure - anywhere between R240bn and R1,2tr a year, or perhaps it is $100bn in foreign direct investment. His figures are murky, but the real problem is he has poisoned the well before he even started with talk of expropriating land without compensation. Following through on this will send a signal that any Constitutional guarantees on property are meaningless. Now Ramaphosa appears to be walking back on this threat, no doubt sensing his task of economic regeneration is dead in the water if expropriation is part of his agenda. John Kane-Berman of the Institute of Race Relations explains what's going on.

President Ramaphosa plans an investment conference later this year with a target to attract, well, we're not quite sure - anywhere between R240bn and R1,2tr a year, or perhaps it is $100bn in foreign direct investment. His figures are murky, but the real problem is he has poisoned the well before he even started with talk of expropriating land without compensation. Following through on this will send a signal that any Constitutional guarantees on property are meaningless. Now Ramaphosa appears to be walking back on this threat, no doubt sensing his task of economic regeneration is dead in the water if expropriation is part of his agenda. John Kane-Berman of the Institute of Race Relations explains what's going on. President Cyril Ramaphosa seems to have a lot going for him. His early new-broom sweeps have been incisive and the market indicators are responding well. A plethora of good news has come his way in the weeks since he was sworn in. Alan Hirsch, Professor and Director of the Graduate School of Development Policy, University of Cape Town, explains what he must do to correct SA's current trajectory.

President Cyril Ramaphosa seems to have a lot going for him. His early new-broom sweeps have been incisive and the market indicators are responding well. A plethora of good news has come his way in the weeks since he was sworn in. Alan Hirsch, Professor and Director of the Graduate School of Development Policy, University of Cape Town, explains what he must do to correct SA's current trajectory. Zim was once the freest economy in the world, says Zimbabwean parliamentarian Eddie Cross. It happenbed between 2009 and 2013 when an opposition MP took over the finance ministry and lifted exchange controls and scrapped price controls that had been implemented by the previous government. All manner of economic restrictions were lifted, resulting in an economic flowering the likes of which had not been seen before or since. This all came to an end in 2013 when Zanu-PF regained absolute control of the government. But there is a lesson here for all Africa countries. If we in SA follow the Zimbabwean model (indeed, should Zim follow its own example), a new era of economic prosperity would eventuate.

Zim was once the freest economy in the world, says Zimbabwean parliamentarian Eddie Cross. It happenbed between 2009 and 2013 when an opposition MP took over the finance ministry and lifted exchange controls and scrapped price controls that had been implemented by the previous government. All manner of economic restrictions were lifted, resulting in an economic flowering the likes of which had not been seen before or since. This all came to an end in 2013 when Zanu-PF regained absolute control of the government. But there is a lesson here for all Africa countries. If we in SA follow the Zimbabwean model (indeed, should Zim follow its own example), a new era of economic prosperity would eventuate. If SAA were a privately-owned company, it would be shipped to the knackers' yard. It is hopelessly insolvent. The airline's new CEO Vuyani Jurana outlined to parliament's standing committee on finance, and it was not a pretty picture. Even after getting another R10bn lifeline from Treasury in March, the airline will have outstanding debt of R13,8bn and expects to post another loss of R5,6bn for 2018. Perhaps it is time to wind it up and sell the brand to a more competent airline operator.

If SAA were a privately-owned company, it would be shipped to the knackers' yard. It is hopelessly insolvent. The airline's new CEO Vuyani Jurana outlined to parliament's standing committee on finance, and it was not a pretty picture. Even after getting another R10bn lifeline from Treasury in March, the airline will have outstanding debt of R13,8bn and expects to post another loss of R5,6bn for 2018. Perhaps it is time to wind it up and sell the brand to a more competent airline operator.  Eskom has become a totem pole for all that is wrong with SA. It is also provides a salutary lesson in what happens when deluded socialists get their hands on the economy. As Nicholas Woode-Smith argues in this article, Eskom has been mismanaged for decades. For a time we had the cheapest power in the world, based on electricity prices that were completely unrealistic. Then the government spoke half-heartedly about inviting private competition. It was so poorly implemented it was designed to fail. The train smash that Eskom has become explains, to a larger degree than many will admit, why the economy is flatlining.

Eskom has become a totem pole for all that is wrong with SA. It is also provides a salutary lesson in what happens when deluded socialists get their hands on the economy. As Nicholas Woode-Smith argues in this article, Eskom has been mismanaged for decades. For a time we had the cheapest power in the world, based on electricity prices that were completely unrealistic. Then the government spoke half-heartedly about inviting private competition. It was so poorly implemented it was designed to fail. The train smash that Eskom has become explains, to a larger degree than many will admit, why the economy is flatlining.  The ANC knows very well what needs to be done to avoid junk status. For many years, however – and especially in the past 11 months, when the threat of downgrades has been most acute – it has been doing the opposite. So much so, in fact, that it seems to have been inviting junk status, writes Anthea Jeffrey of the Institute of Race Relations in Biznews.

The ANC knows very well what needs to be done to avoid junk status. For many years, however – and especially in the past 11 months, when the threat of downgrades has been most acute – it has been doing the opposite. So much so, in fact, that it seems to have been inviting junk status, writes Anthea Jeffrey of the Institute of Race Relations in Biznews. Former SAA chairperson Dudu Myeni has been removed from her position at the airline but will not go quietly. She has now insinuated that Bidvest is one of several companies supposedly looting SAA, and had a dig at her old boss - former finance minister Pravin Gordhan - for holding shares in Bidvest. This is rather desperate stuff from the woman under whose watch SAA clocked up losses of more than R10bn. James Person of the Moorfield Storey Institute unpacks the problems at SAA and concludes the airline, far from being a national asset, is a national liability where the poor are subsidising the rich.

Former SAA chairperson Dudu Myeni has been removed from her position at the airline but will not go quietly. She has now insinuated that Bidvest is one of several companies supposedly looting SAA, and had a dig at her old boss - former finance minister Pravin Gordhan - for holding shares in Bidvest. This is rather desperate stuff from the woman under whose watch SAA clocked up losses of more than R10bn. James Person of the Moorfield Storey Institute unpacks the problems at SAA and concludes the airline, far from being a national asset, is a national liability where the poor are subsidising the rich. South Africa is at the tipping point: hopelessly in debt, with economic decline as far as the eye can see, and captive to a government clueless as to what do do next. Temba Nolutshungu takes us through the prognosis, and it isn't pretty.

South Africa is at the tipping point: hopelessly in debt, with economic decline as far as the eye can see, and captive to a government clueless as to what do do next. Temba Nolutshungu takes us through the prognosis, and it isn't pretty. Sooner or later the government is going to have to confront selling off SAA, the national airline, just as it is now considering selling its shares in Telkom to meet its groaning revenue targets. This would not mean the end of the national airline. It is something multiple airlines around the world have faced with stunning success, as James Peron points out.

Sooner or later the government is going to have to confront selling off SAA, the national airline, just as it is now considering selling its shares in Telkom to meet its groaning revenue targets. This would not mean the end of the national airline. It is something multiple airlines around the world have faced with stunning success, as James Peron points out. Eskom’s latest annual financial statements record irregular expenditure of almost R3bn. Irregular compensation funds, shady tender processes and the link between the company’s financial director, Anoj Singh, to the Gupta family are all part-and-parcel of the Eskom story. Eskom’s long-term debt is now R336.8bn – the South African taxpayer is going to have to foot this bill along with every other tax imposed on them. Nothing will change if we do not end Eskom’s iron grip on the energy industry, with its state backing and continued taxpayer-funded bailouts.

Eskom’s latest annual financial statements record irregular expenditure of almost R3bn. Irregular compensation funds, shady tender processes and the link between the company’s financial director, Anoj Singh, to the Gupta family are all part-and-parcel of the Eskom story. Eskom’s long-term debt is now R336.8bn – the South African taxpayer is going to have to foot this bill along with every other tax imposed on them. Nothing will change if we do not end Eskom’s iron grip on the energy industry, with its state backing and continued taxpayer-funded bailouts. Thirteen African countries now rank higher than SA in economic freedom. Two decades ago, SA stood head and shoulders above the rest of the continent, but it's been a backwards march since then.

Thirteen African countries now rank higher than SA in economic freedom. Two decades ago, SA stood head and shoulders above the rest of the continent, but it's been a backwards march since then. Former communist country Bulgaria and SA have swapped places on the economic freedom scales. SA has plunged down the rankings in the last 14 years, while Bulgaria has gone the other way. Bulgaria did it by scaling back the size of government, containing money supply growth and reducing taxes. SA did the exact opposite. Economic freedom is important not just to the general health of the economy, but to life expectancy and political rights.

Former communist country Bulgaria and SA have swapped places on the economic freedom scales. SA has plunged down the rankings in the last 14 years, while Bulgaria has gone the other way. Bulgaria did it by scaling back the size of government, containing money supply growth and reducing taxes. SA did the exact opposite. Economic freedom is important not just to the general health of the economy, but to life expectancy and political rights. In desperate times, it is the black marekt that saves countries from their incompetent and rapacious governments. Two examples are examined in this article from TheAntimedia.org: Venezuela and Greece. To which we might add Zimbabwe and, increasingly, South Africa, where the shadow economy is reported to account for 25% of GDP. Governments traduce black marketeers as tax cheats and call them other horrible names, when they should be celebrated for pursuing the purest form of free enterprise.

In desperate times, it is the black marekt that saves countries from their incompetent and rapacious governments. Two examples are examined in this article from TheAntimedia.org: Venezuela and Greece. To which we might add Zimbabwe and, increasingly, South Africa, where the shadow economy is reported to account for 25% of GDP. Governments traduce black marketeers as tax cheats and call them other horrible names, when they should be celebrated for pursuing the purest form of free enterprise.  SA's debt burden has now reached 50% of GDP, and government has expanded the public service to the point where it is unaffordable. This is one of the factors weighing on ratings agencies as they contemplate a sovereign downgrade for SA to junk. If this happens, about R600bn will flow out of the country.

SA's debt burden has now reached 50% of GDP, and government has expanded the public service to the point where it is unaffordable. This is one of the factors weighing on ratings agencies as they contemplate a sovereign downgrade for SA to junk. If this happens, about R600bn will flow out of the country.  Social justice is a good thing so long as it remain within the bounds of sanity. When #Feesmustfall jumps to #Science mustfall and #Datamustfall, something weird takes over. Independent economist Luke Muller points out that campaigners pressing for lower data prices ignore the evidence that data prices are competitive and there are multiple suppliers. No conspiracy to look at here. Evidence of this is the fact that the percentage of South Africans accessing the internet grew from 7,6% to 52% over the last decade.

Social justice is a good thing so long as it remain within the bounds of sanity. When #Feesmustfall jumps to #Science mustfall and #Datamustfall, something weird takes over. Independent economist Luke Muller points out that campaigners pressing for lower data prices ignore the evidence that data prices are competitive and there are multiple suppliers. No conspiracy to look at here. Evidence of this is the fact that the percentage of South Africans accessing the internet grew from 7,6% to 52% over the last decade. The government and its satrapies obsessess continuously about income equality. This is a convenient flogging horse for those who want more state power. Of course, we will never achieve income equality, which is exactly what government wants. It wants the power to tax and direct the affairs of others. The freeloaders in government will forever declare war on poverty, war on drugs, war on income inequality... So many wars to wage, none of them winnable. Instead of obsessing about income inequality, we should welcome it as a vital ladder of opportunity that everyone is free to climb.

The government and its satrapies obsessess continuously about income equality. This is a convenient flogging horse for those who want more state power. Of course, we will never achieve income equality, which is exactly what government wants. It wants the power to tax and direct the affairs of others. The freeloaders in government will forever declare war on poverty, war on drugs, war on income inequality... So many wars to wage, none of them winnable. Instead of obsessing about income inequality, we should welcome it as a vital ladder of opportunity that everyone is free to climb.The views expressed herein are those of the author and do not necessarily reflect those of Acts Online. Acts Online accepts no responsibility for the accuracy, completeness or fairness of the article, nor does the information contained herein constitute advice, legal or otherwise.