The jig is up for Ramaphosa

News out today from Capital Economics in London suggests the Ramaphoria effect is dead in the water. Ramaphosa's accession to the presidency was supposed to lift our hearts and souls and produce an economic miracle on the basis that with Jacob Zuma gone, everything would sort itself out.

News out today from Capital Economics in London suggests the Ramaphoria effect is dead in the water. Ramaphosa's accession to the presidency was supposed to lift our hearts and souls and produce an economic miracle on the basis that with Jacob Zuma gone, everything would sort itself out.This, of course, was a ridiculous assumption. Cyril Ramaphosa is playing a double game, promising to clean up corruption (which is laudable) while keeping the radical and disaffected wing of the ANC in check with talk of expropriation without compensation (EWC). He sure is covering a lot of ground there.

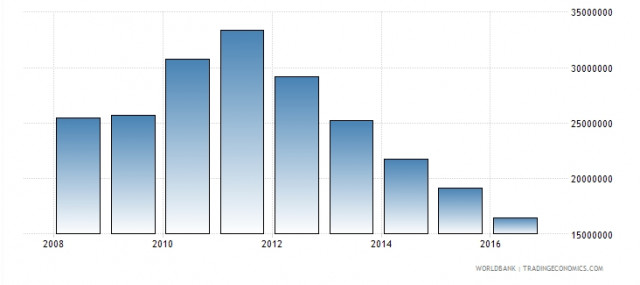

Let's make one thing clear: SA is dead as an investment destination if EWC sees the light of day. In fact we are already there. The country's capital account has been screaming towards zero since 2012 when the sheer criminality of the Zupta era came to light (see the graph below). Money is fleeing the country, and Ramaphosa has had little impact on this rather long-term trend.

On a recent visit to Germany, the Institute of Race Relations project manager Terry Corrigan got a sense of how the Germans see us.

On a recent visit to Germany, the Institute of Race Relations project manager Terry Corrigan got a sense of how the Germans see us.Says Corrigan: "Some of those with whom we discussed the issue noted the disjuncture between President Ramaphosa’s investment initiative and the negative effect of these policy choices on the actual investment environment. (It’s as well to point out that what is required is less soothing words and explanations than guarantees that South Africa is open and receptive to foreign capital.)

"For the moment, EWC is a self-inflicted hindrance to South Africa’s investment ambitions."

Capital Economics explains why it is so downbeat on SA:

There are three key reasons why it doubts that the economy will stage a sharp recovery in Q2.

First, while temporary factors contributed to the fall in output in Q1, they only explain a small share of the contraction. It’s true that the drop in mining production was exacerbated by temporary disruptions in the platinum sector. But these explained less than a fifth of the 2.5% q/q fall in mining production. And while the Western Cape’s drought may have weighed on the agricultural sector, recent survey data suggest that the sector will remain weak later this year.

Second, President Cyril Ramaphosa’s first few months in office have seen both a faster-than-expected move towards fiscal austerity and an unhelpful lack of policy clarity. VAT hikes will help to stabilise the public finances, but they are a painful drag on domestic consumption. And while Mr. Ramaphosa has moved rapidly in some areas (e.g. replacing the leadership at Eskom), his delays regarding the renegotiation of mining rights have probably deterred investment. The reopening of the land reform debate may also have spooked some investors.

Third (and not unrelated) the optimism surrounding Mr. Ramaphosa has proved fleeting. The president’s rise to power provided an immediate boost to business and consumer confidence. And survey respondents thought that things would only get better; the PMI survey measuring expectations of conditions in six months’ time jumped even farther than the headline index. Neither effect, however, has lasted. This gloomy reappraisal of the economy’s prospects has poured cold water on hopes that ‘Ramaphoria’ will translate into a tangible boost to demand later this year.

The jig is up. Ramaphosa is hostage to the electoral base, and the sumptuous system of patronage perfected by his predecessor, Jacob Zuma. He can't undo it without wrecking the ANC. In the process, the slow but relentless destruction of the economy seems the only certainty we can take to the bank.