Securitisation is legal. Or is it?

There are numerous contentious topics regarding the manner in which securitisation schemes are established and operated. The general inner workings of the securitisation schemes contradict the rules and regulations set out by regulatory bodes but it appears as if the regulatory bodies, rather than undertake their mandate to regulate and prevent contravention of the laws, are actively ignoring “the elephants in the room”so to speak.

The list below is a summary list of the legally contentious issues with the entire industry and practice of securitisation in general:

1. The sale and cessions of credit agreements is legal but under the National credit Act, credit providers are required by law to notify the borrower of a cessions/sale of their loan agreement and obtain consent or there is potential ground for declaring the credit agreement null and void if they have not. The extract from a government gazetted document of 2004 shown below alludes to this fact (Regulation Gazette No. 7975, Vol. 468 Pretoria 4 June 2004 No. 26415, page 19, http://www.gov.za/sites/www.gov.za/files/26415_rg7975_gon681.pdf).

2. The banks are divested of all their claims under securitisation schemes and it can be argued they cannot make claims against securities in the loan agreement( refer to notes and evidence in preceding chapters)

3. Under section 69 (4) of the narrational credit act, credit providers are required to keep registers of the credit agreements as well as report any sold/ceded to NCR. This clause in the act has specifically been left unenforced and temporarily suspended from the act until further notice by the finance minister and registrar

4. If a person transfers to another person the rights of a credit provider under a credit agreement referred to in subsection (2):

(a) the person who transfers those rights must report the particulars of that transfer, in the prescribed manner and form, to the national register established in terms of this section; and

(b) the person to whom those rights are transferred must satisfy any subsequent obligations of the credit provider under this section.

5. In the case of home loan agreements, the bank should transfer deeds of properties which are effectively physical assets security for the securitisation schemes, to the SPV or guarantee SPV which has claim over the home loan. The banks do not undertake this and maintain all title deeds in their name. It would be worthy to take not here however that, as mentioned earlier, the bank is divested of all their rights to claim and that the claim should be in the name of the legal creditor (SPV or guarantee SPV). As such should the title deed to the property also not be transferred to the legal creditor? In the past, I suspect, this was the mechanism to validate the bank’s claims in court where they claim to be legal creditors and simply denied any securitisation of the loan in question.

6. Let us review the banks' roles in securitisation schemes. From previous schematics we have observed that the banks have a high degree of involvement in the schemes and it could be determined through investigation the effective control which the banks exercise of the securitisation schemes. It was previously stated that the banks may not have direct involvement and control over securitisation schemes. As such the advising legal firms and attorneys who set out the draft terms and structures of the schemes are knowingly setting out the structure in a manner which contravenes the banking act of 1990, the securitisation rules of the Reserve Bank and general securitisation regulations. The Reserve Bank approves the securitisation transactions and reviews the transaction supplements and details of each securitisation scheme. Thus, it can be deduced that the Reserve Bank is aware of the contraventions and illegalities of the schemes yet overlooks these matters and approves the schemes anyway.

7. The banks have and are still presenting themselves as legal creditors in applications for summary judgments, summons, and in sequestration applications in instances of default of repayment and are obtaining court decisions falsely and fraudulently. This can be deemed as fraudulent activity and perjury in our courts. It should be duly noted that under the rules of the FSB, any director of a financial institution convicted of fraud is barred form serving as a director of any financial institution after conviction. If it could be proven that a bank has fraudulently made applications in court as the legal creditor when they are not, it infers that there is a plausible grounds for the bank being found guilty of fraud and as such the boards of said bank will be liable and guilty of fraud.

8. The banks are not allowed to act as agents of the securitisation scheme as per the rules of securitisation. this is stipulated in section 78 of the Banks Act of 1990 as seen here. The banks blatantly claim they have inter alia master service agreements which allow them to act as the administrators as well as collection agents on behalf of the issuer SPV ’s (Legal creditors). This is another contentious issue overlooked by regulatory bodies as the definition of an agent is called into question here as well as the role of the agent. In the case of securitisation schemes the bank is effectively responsible for all management and administration of the scheme as well as collection of all payments/receivable and reporting thereof. If we consider all possible interpretations of the role of an “agent" then the banks can be considered as agents in all aspects of the scheme. As such the structures of the securitisation schemes as well as the inter alia master service agreements should be declared illegal.

9. Overlooking the preceding anecdote, the banks act as collections agents anyway. They are a separate legal entity to the SPV (which is the legal creditor) so should the bank not be a registered debt collector as per NCA in order collect monies owed under the master service agreement?

10. Let’s revisit the issue of the title deed for instances pertaining to securitisation of home loans. The big question is why do they keep the the deed to properties other than for the reason of misinforming the courts and judges? We should remember that the reason banks securitise is because under the Basel banking rules they are required to retain a certain percentage of liquid cash in relation to the value of loans they issue. The entire securitisation industry is based on debt, the interest payable on that date and the period over which the total debt is payable. In order to free up more capital to loan to borrowers they need to sell off some of the loans at profit. If someone defaults on a home loan they want to acquire judgement for payment of the debt owing to the securitisation and if this fails they want to be able to re-acquire the property and put it back into the market with a new home loan or sell off at below market price to recover funds owing. The title deeds are kept in the name of the bank because you cannot offer a home loan on a property which is technically owned by another legal entity. Are you starting to see the bigger picture yet?

11. The banks have been known to forge, recreate or refuse to provide original copies of credit agreements. (Remember Absa and all those fires where credit agreements were recreated?). The suspected reason is in the credit agreements: if they wish to cede or sell off a home loan, there needs to be a clause which grants them this right, and it must be signed by the borrower. In some instances where people have requested this agreement, this clause is frequently found to be absent from the agreement. Thus if it is proved that a credit agreement was securitised without prior consent from the customer, then it is grounds for having the credit agreement declared null and void. In addition the sale or cession of a credit agreement would be required to undertaken within the regulatory framework and construct of the governing law of South Africa which the banks are ignoring.

12. The banks implement a clause in most credit agreements which allows for the sale/cession of your home loan which typically goes unnoticed. There are instances where this clause was asked to be removed by the borrower and the banks indicated it could not provide the loan without inclusion of this clause. Thus banks are prejudicing borrowers and forcing them to allow securitisation.

Why has securitisation proceeded unchallenged for so long?

There are a multitude of factors regarding the unabated progression of the securitisation industry and their dubious activities. The following are some proposed theories based on general investigations:

• Their is a principal deficiency in knowledge of the inner workings of securitisation and the legalities thereof in the legal system and amongst the contingent of legal practitioners. It seems that fundamentally many advocates and attorneys are unfamiliar with the regulations of this industry and the basic principles of securitisation. It’s a case of the legal firms who undertake a great deal of work for banks and the financial industry are aware of the legalities but refuse to litigate for those who wish to use to use it as a defence (“protecting the golden goose” so to speak). Those who do not work for banks do not litigate using the securitisation defence because they do not have any expertise or sufficient knowledge about it

• The banks refused to provide evidence of securitisation in the past and thus it was impossible to prove by the borrower. Its quite remarkable when you think of how many home loans have been securitised yet the banks actively claim that your specific loan was not securitised if you inquire. Well the question to ask them is if they are securitising loans then what makes your loan so unique that they didn’t securitise it? The banks are actively utilising misinformation and dissuasion of pursuing the securitisation issue. If every one of their customers had to ask them whether their loan was sold off would they tell every single person that it wasn’t? This is statistically impossible. Would a conman tell you his plan of how he is going to con you?…..

• The general public is not familiar with the inner workings of securitisation schemes, the size of the markets, the propensity and probability of their loan being sold and what their rights are; as well as the rights of the banks.

• It appears the regulatory bodies tasked with governing this industry are complicit in the banking industry’s practices and to some degree even shield the industry from further scrutiny

• The courts and appointed judges do not consider the matter of securitisation with the gravitas and merit with which it should be considered. There is general disregard for the matter if evidence thereof cannot be presented and they have an attitude in favour of the banks. It becomes the onus of the borrower to prove that they do not owe the bank the money as opposed to bank proving conclusively that they are in fact the legal creditor. The judges have accepted bank’s legal representatives' applications and testimonies in court as fact without question and promote the idea of borrowers paying because they took the money. It could never be proved and will be actively denounced by the legal system but it appears that the courts and judges are aware of the legal issues facing the banks but are actively protecting their interest due to instruction from the powers that be. I cannot for one second believe that every single judge in this country is blissfully unaware of what securitisation is and the legally contentious issues attributed to the industry in general. The courts work off evidence and operate under the construct of the law. Quite simply if the courts allow further perjury and false claims to be submitted in court on behalf of the banks then the system is inherently corrupted.

• The banking ombudsman, Reserve Bank, registrar of Banks,the NCR, the FSB and other regulatory bodies are not effectively regulating the industry in accordance with the rules and regulations as has been pointed out in the proceeding chapter. There are directives in place with these various institutions which actively prohibit the dissemination of specific information in the public domain in order to prevent any destabilisation of the market due to legal grey areas and the public becoming wise to their rights in the matter.

Identifying a securItised loan

The banks in general have a clandestine approach to dealing with securitisation and their legal rights in claims. I have initially indicated before that the problem with the securitisation matter is that the banks typically refused to provide proof of securitisation in the past. Realising they are treading into troubled waters in the legal realm they have begun to start issuing claims in the names of the special purpose vehicle but use mis-information to state that borrowers are still obliged to pay them on behalf of the SPV as they have a master service agreement. All inquiries into securitisation of loans are dealt with by a blanket approach where all inquiries are diffused by public relations representatives who provide vague and ambiguous information regarding what borrower’s rights are under securitisation schemes.

The directive is to keep the public in the dark about the securitisation process so far as possible since the banks are aware the number of potentially illegal claims they have raised in court in the past as well as the potential for losses due to failure to pay if borrowers learn of their rights in the schemes.

Let us refer back to an earlier topic of conversation: the banks are required, by law, to notify the borrower of any sale of their loan as well as obtain consent form the borrower. The banks are aware of this and thus realise they are in a perilous situation and are desperate not to draw attention to the matter. Furthermore they do not want to set a precedent in court where successful securitisation defence can be used as case examples in the legal system.

So how would one determine the ownership of their loan if the bank is not willing to provide this information? The following analysis is an in depth overview of the potential access points for acquisition of the information. The fundamentally important factor for the public to take cognisance of is that your loan is sold off in the form of a note/paper/debt security which are effectively synonymous terms. The industry itself is awash with convoluted and fractured terms and concepts. If you are not from a financial background then this is a somewhat ambiguous term but effectively it means that the loan (which is any note or paper indicating indebtedness) is registered as a debt security on a stock exchange for the purposes of trading. A promise to pay is an asset which can be financially exploited and this promise to pay (with a possible underlying physical asset as collateral) is in the form of a promissory note. The promissory notes are bundled and sold off to the SPV and they issue the notes for registration on the JSE in a tranche of notes. These notes are also know as debt securities or bonds in some cases. Effectively any loan or promise to pay can be listed as a debt security.

Why is the above information significant? The significance lies in the fact that there are strict regulations set out by the Reserve Bank, JSE and Financial Markets Act which pertain specifically to the listing of debt instruments and reporting on the performance of these debt security assets.

Thus there is a conclusive and definitive paper trail pertaining to notes/debt securities and the actual existence of a borrowers security and loan agreement on the JSE or any other exchange is effectively tangible proof and prima facie evidence that the loan was securitised. The only manner in which a loan in the form of a note can be registered as a debt security is by issuance by the issuer and this is why SPV’s are referred to as issuers as they issue the notes for transfer and registration. The securitisation transactions are pre-approved by the Reserve Bank and are scrutinised for compliance by the JSE listing requirements. As such it is impossible for your loan to end up being traded on a stock exchange by accident or oversight by the banks. There has to have been a product offering, then transaction supplement or summary and the actual sale which must be approved prior to the event of transfer and registration as a debt security.

The debt securities are traded on the exchange but the securities themselves are transferred and held in a central depository.

The following is a list of potential access points to acquire the information:

1. Request your certificate of balance for your loan. This is the first most obvious exercise. The banks have been known to alter certificates and/or use the bank’s letterhead but if your loan has been securitised then they should be issuing the certificate on behalf of the SPV on the SPV letterhead. If you receive a C.O.B. on a letterhead other than the bank’s then it is an indication of securitisation. Furthermore take note that if the bank issues a C.O.B. in their name and you determine your loan was securitised then this constitutes as knowingly trying to deceive and defraud the borrower

2. By law, issuers of papers/notes are required to maintain a comprehensive register of notes (debt securities) they have issued.!! As per regulations and criteria set out by the Reserve Bank and the JSE these registers of notes/papers must contain all the detailed information of the debt security which includes the nature of the debt security and reference to the borrower identity. In securitisation schemes the SPV’s, known as issuers, are the legal entities required to keep these registers. Since the banks operate most of the securitisation schemes they maintain this register but the SPV is a separate legal entity on which application for access to information could be made. Through legal application you could request information on any papers/notes which reference the borrower in specificity (.ie, ID Number, business number, bond number, etc)

3. Notes/papers which are to be registered as debt securities are bundled to form a bundle with a specific class rating. These tranches of notes/papers are sometimes referred to as a box. Each bundle within a securitisation programme is a registered trade instrument on the exchange and as such there is an ISIN (international securities identification number) associated with each box. Similarly there are stock codes associated with each securitisation scheme. If you have an idea of when you entered into your loan agreement and which possible securitisation scheme was used you can view the investor reports as shown on the South African Securitisation forum. The banks have their own specific securitisation schemes. One can narrow down the suspected bundle to which your loan was sold by assuming your loan was in any box with a class ‘A_’ RATING at the time of granting of the loan as there is no default in performance at that point. (A1 or A2 or A3 etc.)The above is significant because there is a record of the transaction and securities on the JSE and as per the JSE listing requirements and financial markets act and you can legally request information from the JSE (or relevant stock exchange) on any securities which reference the borrower in any of the suspected trade bundles. Some of the ISIN numbers for the securitisation schemes can be confirmed on International ISIN databases (eg. www.isin.org)

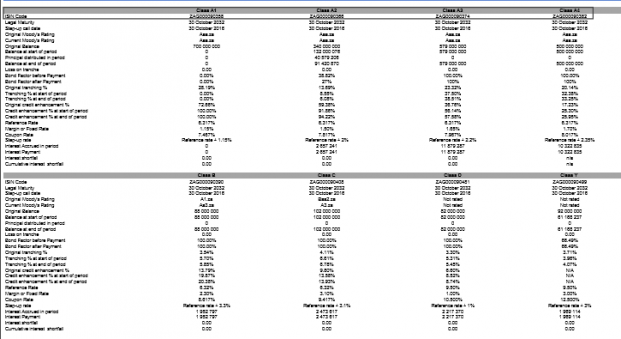

The followings schematic is copied from an investor report available at:

http://www.sasf.co.za/investorreports/RMBS/Blue%20Granite%203%20(RF)%20Ltd%20Quarterly%20Investor%20Report%201%20February%202016.pdf

It highlights the unique ISIN code for each class of notes (tranche). Each tranche is comprised of many loans bundled together.

The “ZAG….”reference indicates that the trade instrument is in the form of debt securities on the South african exchange (ZA= COUNTRY CODE, G= bond/debt instrument)

In some instances the loans making up the tranche are also attributed to a specific unlisted ISIN number which could be correlated with a master box number.

The JSE also maintains records and reports from issuers on the securities listed under each tranche.

4. Each note in a tranche has an individual certificate associated with it all details of the debt. Further insight into the certificates can be read in the example document at the link below:

za.ubs.com/filedb/deliver/xuuid/l001ce15a3e426ee4bbbb715a115f7137d2b/name/Additional%20South%20African%20Note%20Conditions_FINAL.pdf

5. Notes/papers are registered and listed and debt securities as we have learnt. Each tranche of notes is listed as a trade instrument but the actual debt securities are transferred and held in a central securities depository (CSDP). The local depository is STRATE a company registered in the republic of South Africa. They keep a concise digital record of securities transferred with access to information by investors and members. This is a potential access point to legally acquire information pertaining to any of your loans and collateral (debt securities)

visit: http://www.strate.co.za/

Image source: http://www.sasf.co.za/investorreports/RMBS/Blue%20Granite%203%20(RF)%20Ltd%20Quarterly%20Investor%20Report%201%20February%202016.pdf

In summary, the entities indicated preceding are involved in the securitisation industry and have concise records of the debt securities which are in the form of loans which were sold to the SPV.

They can all be approached with legal request for access to information. This is no easy feat but to deny you access to information through legal application they will have to provide sufficient legal argument as to why the borrower and the public in general should not have access.

The list below summarises the potential entities for acquisition of data pertaining to a borrower’s loan:

1. Johannesburg Stock Exchange

Trading and Market Services

+2711 5207154

+2711 5208581

[email protected]

2. Issuers (separate legal entity to bank) e.g.:

Issuer Blue Granite Investments No. 4 (Proprietary) Limited, registration number 2006/032191/07

Security SPV Blue Granite No. 4 Security SPV (Proprietary) Limited, registration number 2006/034129/07

3. Central securities depository- STRATE Central Securities Depository [CSD]

Strate limited (“Strate”), Registration no 1998/022242/06, registered as a Central Securities Depository in terms of the SSA.

4. Transfer agents ,eg: COMPUTERSHARE SERVICES (PTY) LTD

http://www.computershare.com/za/Pages/default.aspx

In summary of the presented information, it is advised that everyone adopts this research directive and commits to determining whether their loan agreement has been sold to a third party and affirms their rights and those of the banks and their subsidiaries. The information provided herein is not intended as legal advice and all legal inquiries and directives should be undertaken in consultation with legal practitioners. Only through mass action, which is poignantly demonstrated in other matters in this country, will more effective scrutiny of the industry be realised.