Protection of Businesses Act, 1978

Protection of Businesses Act, 1978

R 385

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to Banks' Financial Instrument TradingChapter 4 : Position Risk15. Method 2: Calculation of position risk: building-block method |

| (1) | In the case of interest-rate products, a bank shall classify the net positions according to the currency in which these positions are denominated and shall calculate the capital requirement in each individual currency separately and with regard to— |

| (a) | specific risk: a bank shall assign its net positions, as calculated in accordance with the definition of the long or short position, to the appropriate categories set out in Table 4, hereunder, on the basis of the net positions' residual maturities and shall then multiply these positions by the weightings shown. The aggregate of the weighted positions (regardless of whether they are long or short) shall be used to calculate the capital requirement for specific risk. |

Table 4

|

Central Government |

Qualifying items |

Banks in RSA and OECD countries |

Other items |

||

|

(All loan stock issued by the central Government or instruments guaranteed by the central Government) |

(All loan stock listed on Bond Market Exchange, or any other financial exchange listed loan stock approved by the Financial Services Board) |

|

|

||

|

Up to 6 months |

Over 6 and up to 24 months |

Over 24 months |

|

|

|

|

0,00% |

0,25% |

1,00% |

1,60% |

2,00% |

10,00% |

[Regulation 15(1)(a) and Table 4 substituted by regulation 2 of Notice No. R. 1006, GG 22737, dated 5 October 2001]

| (b) | general risk: a bank shall use, at its discretion, either the maturity-based calculation method, as set out in subparagraph (i) hereunder, or the duration-based calculation method, as set out in subparagraph (i) hereunder, in order to calculate the general risk of its exposures in loan stock. |

| (ii) | In terms of the maturity-based method: |

| (A) | The procedure for the calculation of capital requirements relating to general risk involves two basic steps. Firstly, all positions shall be weighted according to maturity (as explained in item (B) below) in order to calculate the capital requirement. Secondly, allowance shall be made for this capital requirement to be reduced when a weighted position is held alongside an opposite weighted position within the same maturity band. A reduction in the capital requirement shall also be allowed when the opposite weighted positions fall into different maturity bands, with the size of this reduction depending on whether the two positions fall into the same time zone, and in accordance with the particular time zones into which they fall. There are three time zones (groups of maturity bands), as set out in Table 5. |

| (B) | A bank shall assign its net positions to the appropriate maturity bands set out in column 2 of Table 5 below. It shall do so on the basis of residual maturity in the case of fixed-rate instruments and on the basis of the period until the interest rate is next set in the case of instruments in respect of which the interest rate is variable before final maturity. The bank shall then multiply each of these net positions by the weighting for the maturity band in question as set out in column 4 of Table 5 below. |

| (C) | The aggregate of the weighted long positions, and the aggregate of the weighted short positions, in each maturity band shall be calculated. The aggregate of the former that are matched by the latter in a given maturity band shall be the matched weighted position in that time band, whereas the residual, long or short position shall be the unmatched weighted position for the same time band. The total of the matched weighted positions in all time bands shall then be calculated. |

| (D) | The bank shall calculate the aggregate of the unmatched weighted long positions for the time bands included in each of the time zones set out in Table 5, below, in order to determine the unmatched weighted long position for each time zone. Similarly, the aggregate of the unmatched weighted short positions for each time band in a particular time zone shall be aggregated to determine the unmatched weighted short position for that time zone. That part of the unmatched weighted long position for a given time zone that is matched by the unmatched weighted short position for the same time zone shall be the matched weighted position for that time zone. That part of the unmatched weighted long position or unmatched weighted short position for a time zone that cannot be matched shall be the unmatched weighted position for that time zone. |

| (E) | The amount of the unmatched weighted long or short position in time zone one that is matched by the unmatched weighted short or long position in time zone two shall then be calculated. This is referred to in item (1) below as the matched weighted position between time zones one and two. The same calculation shall then be undertaken with regard to that part of the unmatched weighted residual position in time zone two and the unmatched weighted position in time zone three in order to calculate the matched weighted position between time zones two and three. |

| (F) | A bank may reverse the order contemplated in item (E) above so as to calculate the matched weighted position between time zones two and three before calculating the matched weighted position between time zones one and two. |

| (G) | The remainder of the unmatched weighted position in time zone one shall be matched with the residual of that for time zone three, after the latter's matching with time zone two, in order to determine the matched weighted position between time zones one and three. |

| (H) | The residual positions, following the three separate matching calculations described in items (E), (F) and (G) above, shall be aggregated. |

Table 5

|

Maturity band |

Weighting (in %) |

Assumed interest-rate change (in %) |

||

|

Time |

Higher than 3% coupon |

Less than 3% coupon |

|

|

|

Zone |

0 ≤ 1 month |

0 ≤ 1 month |

0,00 |

- |

|

One |

> 1 ≤ 3 months |

> 1 ≤ 3 months |

0,20 |

1,00 |

|

Maturity |

> 3 ≤ 6 months |

> 3 ≤ 6 months |

0,40 |

1,00 |

|

Band |

> 6 ≤ 12 months |

> 6 ≤ 12months |

0,70 |

1,00 |

|

Zone |

> 1 ≤ 2 years |

> 1,0 ≤ 1,9 years |

1,25 |

0,90 |

|

Two |

> 2 ≤ 3 years |

> 1,9 ≤ 2,8 years |

1,75 |

0,80 |

|

Maturity |

> 3 ≤ 4 years |

> 2,8 ≤ 3,6 years |

2,25 |

0,75 |

|

Band |

|

|

|

|

|

Zone |

> 4 ≤ 5 years |

> 3,6 ≤ 4,3 years |

2,75 |

0,75 |

|

Three |

> 5 ≤ 7 years |

> 4,3 ≤ 5,7 years |

3,25 |

0,70 |

|

Maturity |

> 7 ≤ 10 years |

> 5,7 ≤ 7,3 years |

3,75 |

0,65 |

|

band |

> 10 ≤ 15 years |

> 7,3 ≤ 9,3 years |

4,50 |

0,60 |

|

|

> 15 ≤ 20 years |

> 9,3 ≤ 10,6 years |

5,25 |

0,60 |

|

|

> 20 years |

> 10,6 ≤ 12,0 years |

6,00 |

0,60 |

|

|

|

> 12,0 ≤ 20,0 years |

800 |

0,60 |

|

|

|

> 20 years |

12,50 |

0,60 |

| (L) | A bank's capital requirement for the trading book shall be calculated as the sum of: |

| (aa) | 10 per cent of the sum of the matched weighted positions in all maturity bands; |

| (bb) | 40 per cent of the matched weighted position in the time zone one maturity band; |

| (cc) | 30 per cent of the matched weighted position in the time zone two maturity band; |

| (dd) | 30 per cent of the matched weighted position in the time zone three maturity band; |

| (ee) | 40 per cent of the matched weighted position between time zones one and two and between the time zone two and three maturity band (see item (E) above); |

| (ff) | 100 per cent of the matched weighted position between the time zone one and three maturity band; |

| (gg) | 100 per cent of the residual unmatched weighted positions. |

| (ii) | In terms of the duration-based method: |

| (A) | a bank shall ascertain the market yield to maturity of each fixed-rate loan stock, using the value implied by a loan-stock's all-in market value when trading is based on price, rather than on yield. In the case of floating-rate loan stock, the bank shall use the market value of each instrument in order to calculate its yield, on the assumption that the principal is due on the date on which the interest rate can be changed. |

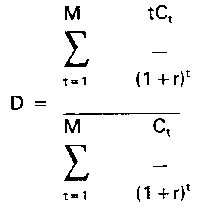

| (B) | a bank shall calculate the modified duration of each debt instrument on the basis of the following formula— |

modified duration = duration (D) / (1 + r)

where:

where:

| r | = yield to maturity (see item (A) above); |

| Ct | = cash payment in time t; |

| M | = total maturity (see item (A) above). |

| (C) | a bank shall allocate each instrument to the appropriate maturity time zone set out in Table 6, hereunder, on the basis of the modified duration of each instrument. |

Table 6

|

Time zone |

Modified duration (in years) |

Assumed interest (change in %) |

|

One |

> 0 ≤ 1 0 |

1,0 |

|

Two |

> 1,0 ≤ 3,6 |

0,85 |

|

Three |

> 3,6 |

0,7 |

| (D) | a bank shall calculate the duration-weighted position for each instrument by multiplying the market price by its modified duration and by the assumed interest-rate change for an instrument with that particular modified duration (see column 3 of Table 6 above). |

| (E) | a bank shall calculate the duration-weighted long and short positions within each time zone. The amount of the former that are matched by the latter within each time zone shall be the matched duration-weighted position for that time zone. |

| (F) | a bank's capital requirement for the trading book shall be calculated as the sum of: |

| (aa) | 2 per cent of the matched duration-weighted position for each time zone; |

| (bb) | 40 per cent of the matched duration-weighted positions between time zones one and two and between time zones two and three; |

| (cc) | 100 per cent of the matched duration-weighted position between time zones one and three; |

| (dd) | 100 per cent of the residual unmatched duration-weighted positions. |

| (2) | In the case of securities, a bank shall aggregate all its net long positions and all its net short positions in accordance with the definition of the long or the short position. The sum shall be the bank's overall gross position. The difference shall be the bank's overall net position. The bank shall calculate its capital requirement with regard to— |

| (a) | specific risk, as follows: a bank shall multiply the overall gross position by the percentage reflected in Table 7, hereunder, in order to calculate the capital requirement (for purpose of this calculation, the classification of shares are either liquid, normal or illiquid in accordance with the capital-adequacy liquidity parameters set by the Johannesburg Stock Exchange). |

Table 7

|

|

Liquid |

Normal |

Illiquid |

|

Mining shares |

5% |

10% |

20% |

|

Other shares |

5% |

10% |

20% |

and

| (b) | general risk, as follows: the capital requirement for general risk shall include the overall net position of the trading book multiplied by 20 per cent for mining shares and 10 per cent for other shares. |

| (c) | share-index futures, as follows: |

| (i) | The said futures shall be allocated into positions in each of the constituent equities, and these positions shall be treated as underlying positions in the equities in question. These positions may therefore be netted against opposite positions in the underlying equities themselves. |

| (ii) | Adequate capital shall be held in order to ensure that positions that have been netted off in one or more of the equities constituting a share-index future, against one or more positions in the share-index future itself, thereby covering the risk of loss caused by the future's values not moving fully in line with that of its constituent equities. When a bank holds opposite positions in share-index futures that are not identical in respect of either their maturity or their composition, or both, adequate capital shall be held. |

| (iii) | Notwithstanding the provisions of subparagraphs (i) and (ii) above, share-index futures that are exchange traded and that may reasonably be regarded to represent broadly diversified indices, shall attract a capital requirement against general risk and a requirement against specific risk, as set out in Table 8 hereunder: |

Table 8

|

A |

Industrial index |

10% |

|

B |

All share index |

13% |

|

C |

Gold index |

20% |

| (iv) | Share‑index futures shall be included in the calculation of the overall net position, but shall be ignored in the calculation of the overall gross position. |

| (v) | Share‑index futures that are not analysed into its underlying positions, shall be treated as though they were individual equities. The specific risk on such individual equity can, however, be ignored if the share‑index future in question is exchange traded and represents a broadly diversified index. |

| (3) | Underwriting of loan stock or securities may with the prior written approval of the Registrar be included in the calculation of a bank's net open position and capital requirements. Once the approval of the Registrar has been obtained, the following method shall be applied: |

| (a) | The net positions shall be calculated by deduction of the underwriting positions that are subscribed or sub‑underwritten by third parties on the basis of formal agreements; |

| (b) | the net positions shall be reduced by the following reduction factors, as set out in Table 9 hereunder: |

Table 9

|

Working day |

Factor |

|

0* |

100% |

|

1 |

90% |

|

2 to 3 |

75% |

|

4 |

50% |

|

5 |

25% |

|

Longer than 5 |

0% |

* (Working day zero shall be the working day on which a bank becomes unconditionally committed to accepting a known quantity of securities at an agreed price); and

| (c) | the capital requirement shall be calculated by using the reduced underwriting positions, calculated in accordance with paragraphs (a) and (b), above. The bank shall ensure that it holds sufficient capital against the risk of loss that exists between the time of the initial commitment and working day 1. |

| (4) | In the case of commodities, the trading positions in physical commodities shall be 30 per cent of the realisable value. |

| (5) | In the case of credit-derivative instruments, a bank shall classify the net positions, calculated in accordance with the definition of a long position or a short position, according to the currency in which these positions are denominated and shall calculate the capital requirement in each individual currency separately and with regard to— |

| (a) | Specific risk |

A bank shall assign its net positions to the appropriate categories set out in Table 4 of the Regulations, which table relates to interest-rate products in terms of the building block method, on the basis of the net positions' residual maturities. The specific risk- capital requirement shall be determined by multiplying the absolute values of the net positions by the respective risk weights.

When a credit-derivative contract is concluded in respect of a single reference asset or reference entity, the protection buyer has' a short position in the reference asset or reference entity, whereas the protection seller has a long position in the reference asset or reference entity.

For the specific-risk position to be reported as a qualifying debt item, the reference asset shall meet the standard conditions for a qualifying debt item relating to interest-rate products.

When the protection seller provides cash or collateral to the protection buyer, the protection seller has to create a long specific-risk position in respect of such collateral.

With respect to multiple-name structures, the level of specific risk is dependent upon the structure concerned.

In the case of a proportional structure, the reference assets or reference entities shall be risk-weighted according to the assets/entities in the basket in the same proportion as determined in the credit-derivative contract.

Netting of trading-book positions

Banks may net notional positions in reference assets created by credit-derivative contracts with positions in underlying assets or other notional positions created by other similar types of credit derivative contract if all the following conditions are met:

| (i) | The underlying asset and the reference asset are issued by the same obligor. |

| (ii) | The specific-risk positions of the underlying asset and the reference asset will have an equivalent ranking in case of liquidation. |

| (iii) | The currency of the underlying asset and the reference asset is the same. |

| (iv) | The maturity of the underlying asset and the reference asset is the same. |

The specific risk-capital requirement arising from different credit derivative contracts shall not be netted.

Offsetting positions in the trading-book

Offsetting positions encompass long and short credit-derivative positions relating to a reference asset or reference entity, which positions are matched in all respects specified in the aforementioned paragraph relating to netting of trading-book positions, except that the long and short credit-derivative positions have different maturities.

When a bank has offsetting positions in its trading book, that is, when—

| (i) | the maturity of a credit-default swap or credit-link note differs from the maturity of the reference asset; or |

| (ii) | the bank has not only provided protection but also obtained protection in respect of the same reference entity but the maturity of the contracts differs, |

a single specific risk-capital requirement shall be maintained in respect of the position with the higher capital requirement.

Reporting requirements

The manner in which credit default-swap contracts, total return-swap contracts and credit-linked note contracts shall be reported is set out in further detail below.

(i) Credit default-swap contracts

A credit default-swap contract shall be reported as a notional position in the reference asset or reference entity and shall be subject to a specific-risk charge only. For credit-default products, there will be no requirement for general market risk relating to the reference asset or reference entity.

A bank that is a protection buyer in a first-to-default product shall record a short position in a reference asset or reference entity of its choice.

A bank that is a protection seller in a first-to-default product shall record a long position in respect of each reference asset or reference entity in the basket, since the protection seller has no knowledge as to which asset or entity could default. The risk weightings shall be applied to the maximum payment in terms of the credit-derivative contract for each of the reference assets or reference entities in the basket. The total capital requirement for this type of product will be limited to an amount equal to a deduction from capital.

| (ii) | Total return-swap contracts |

A total return-swap contract shall be reported as two legs to a single transaction.

The first leg to the transaction shall be a notional position in the reference asset, to which reference asset the general-risk requirement and the specific-risk requirement shall apply.

The second leg to the transaction shall represent the interest payments in terms of the swap contract and shall be reported as a notional position in a government bond with the appropriate fixed or floating rate.

The protection buyer shall report a short position in the reference asset and a long position as a financing component.

The protection seller shall report a long position in the reference asset and a short position as a financing component.

When a total-return swap is referenced to multiple reference assets, and the return on assets is exchanged according to the proportions of the assets in the basket, the reporting bank shall record long or short positions in all the reference assets according to the proportions underlying the swap contract.

(iii) Credit linked-note contracts

A credit linked-note contract shall be reported as a position in the note itself with an embedded credit-default swap.

A bank that is a protection seller shall calculate a specific-risk requirement in respect of the issuer of the note.

The embedded credit-default swap creates a notional position in the specific risk of the reference asset with no general market-risk requirement.

(b) General risk

A bank shall calculate its capital requirement for general risk in accordance with the directives and instructions for interest-rate products set out in subregulation (1)(b).

Generally, credit default-swap instruments do not create a general market-risk position for either the protection seller or the protection buyer, since these products relate to the potential default of one counterparty only. Consequently, there is no risk exposure to market-price movements.

Periodic premium or interest payments due in terms of the credit- default swap shall be reported as a notional position in a government bond with the appropriate fixed or floating rate.

Total-return products create a long or short position in the reference asset, as well as a short or long position in the notional bond representing the interest rate leg of the contract. These positions shall be incorporated into the calculation of the general-risk requirement.

For a protection seller, a credit-linked note creates a general market-risk position in respect of the coupon or interest rate of the note.

No general market-risk requirement shall be calculated in respect of the embedded credit-default swap in a credit-linked note.

[Regulation 15(5) substituted by regulation 6(a) of Notice No. R. 1465, GG 24088, dated 22 November 2002]

(6) In the case of other investments in—

| (a) | regulated collective investment schemes, the capital requirement shall be 20 per cent of realisable value; |

| (b) | unregistered futures or options fund, the capital requirement shall be 50 per cent of realisable value; |

| (c) | with-profit life policies, the capital requirement shall be 20 per cent of surrender value; and |

| (d) | other risk-based investments (excluding cash), the capital requirement shall be 100 per cent of assets. |

[Regulation 15(6) inserted by regulation 6(b) of Notice No. R. 1465, GG 24088, dated 22 November 2002]