National Credit Act, 2005 (Act No. 34 of 2005)

National Credit Act, 2005 (Act No. 34 of 2005)

R 385

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (15) Counterparty credit risk exposure and matters related theretoSubregulation (15)(c) Matters related to minimum required capital and reserve funds for CVA risk |

| (c) | Matters related to minimum required capital and reserve funds for CVA risk, calculated in terms of the standardised approach |

| (i) | A bank, other than a bank that obtained the approval of the Authority for the use of the internal model method for the measurement of the bank’s exposure to counterparty credit risk and the internal models approach for the measurement of specific risk as part of the bank’s exposure to market risk, shall calculate the relevant additional required amount of capital and reserve funds on a portfolio basis, in accordance with the formula specified below: |

![]()

where:

![]()

![]()

| h | is the one-year risk horizon, in units of a year, h = 1. |

| wi | is the weight applicable to counterparty 'i', provided that— |

| (i) | based on its external rating, counterparty 'i' shall be mapped to one of the seven weights specified in table 16 below: |

Table 16

|

Rating 1 |

Weight wi |

||

|

AAA |

0.7% |

||

|

AA |

0.7% |

||

|

A |

0.8% |

||

|

BBB |

1.0% |

||

|

BB |

2.0% |

||

|

B |

3.0% |

||

|

CCC |

10.0% |

||

|

|||

| (ii) | subject to the prior written approval of and such conditions as may be specified in writing by the Authority, when a counterparty does not have an external rating, the bank shall map the relevant internal rating of the counterparty to one of the relevant external ratings specified above |

| EADitotal |

| is the exposure at default of counterparty 'i', aggregated across all relevant netting sets, including the effect of any relevant collateral in accordance with the relevant requirements specified in these Regulations for the Standardised Approach for counterparty credit risk or the Internal Model Method, provided that in the case of— |

| (i) | a bank other than a bank that obtained the approval of the Authority to adopt the Internal Model Method for the measurement of the bank’s exposure to counterparty risk, the bank shall apply the following discounting factor to the exposure: |

(1 - exp(-0.05*Mi))/(0.05*Mi);

| (ii) | a bank that obtained the approval of the Authority to adopt the Internal Model Method for the measurement of the bank’s exposure to counterparty risk, the relevant discount factor is already included in Mi, and no further discount shall be applied |

| Bi | is the notional amount of purchased single name CDS hedges, which notional amounts shall be aggregated in the case of more than one position referencing counterparty 'i', and used to hedge the bank’s exposure to CVA risk, provided that the bank shall apply the following discounting factor to the relevant notional amount: |

(1 - exp(-0.05*Mihedge))/(0.05*Mihedge)

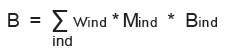

| Bind | is the full notional amount of one or more index CDS of purchased protection, used to hedge the bank’s exposure to CVA risk, provided that the bank shall apply the following discounting factor to the relevant notional amount: |

(1 - exp(-0.05*Mind))/(0.05* Mind)

| Wind | is the relevant weight applicable to index hedges, provided that the bank shall map indices to one of the seven weights (wi) specified in table 16 above, based on the average spread of index 'ind' |

| Mi | is the effective maturity of the relevant transactions with counterparty 'i', provided that— |

| (i) | in the case of a bank other than a bank that obtained the approval of the Authority to adopt the Internal Model Method for the measurement of the bank’s exposure to counterparty risk, Mi shall be the notional weighted average maturity as envisaged in regulation 23(13)(d)(ii)(B)(iii) of these Regulations, provided that Mi shall for purposes of this calculation not be capped at 5 years; |

| (ii) | a bank that obtained the approval of the Authority to adopt the Internal Model Method for the measurement of the bank’s exposure to counterparty risk shall calculate Mi in accordance with the relevant requirements specified in subregulation (19)(c) |

Mihedge

is the maturity of the hedge instrument with notional Bi, provided that in the case of several positions the bank shall aggregate the relevant quantities Mihedge.B1

| Mind | is the maturity of the index hedge 'ind', provided that in the case of more than one index hedge position, it shall be the relevant notional weighted average maturity |

Provided that, subject to the prior written approval of and such conditions as may be specified in writing by the Authority, when a counterparty is also a constituent of an index on which a CDS is used to hedge the bank’s exposure to counterparty credit risk, the notional amount attributable to that relevant single name, as per its reference entity weight, may be subtracted from the relevant index CDS notional amount and treated as a single name hedge (Bi) of the individual counterparty with maturity based on the maturity of the index.

[Regulation 23(15)(c) substituted by section 3(i) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]