| (i) |

Unless specifically otherwise provided, a bank that adopted the foundation IRB approach for the measurement of the bank's exposure to credit risk in respect of positions held in the bank's banking book— |

| (A) |

shall apply the comprehensive approach specified in subregulation (9)(b) above in order to calculate the bank’s relevant required risk components or adjusted exposure; |

[Regulation 23(12)(b)(i)(A) substituted by section 2(ooooo) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (B) |

shall at all times comply with the relevant minimum requirements— |

| (i) |

specified in subregulation (7)(b)(iii) above in respect of eligible financial collateral; |

| (ii) |

specified in subparagraph (ii)(B) below in respect of the further categories of collateral qualifying as eligible collateral in terms of the foundation IRB approach. |

[Regulation 23(12)(b)(i)(B) substituted by section 2(ppppp) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (A) |

Instruments qualifying as eligible financial collateral in terms of the standardised approach shall qualify as eligible collateral in terms of the foundation IRB approach, provided that a bank that adopted the foundation IRB approach— |

| (i) |

shall at all times comply with the relevant minimum requirements specified in subregulation (7)(b)(iii) above; or |

| (ii) |

shall be able to calculate and comply with the relevant minimum requirements relating to its own estimates of LGD and EAD specified in subregulations (13)(b)(v)(C) and (13)(b)(v)(D) below. |

Provided that, irrespective of its credit rating, a resecuritisation instrument shall in no case constitute an eligible instrument for risk mitigation purposes in terms of these Regulations

| (B) |

In addition to eligible financial collateral recognised in terms of the standardised approach, specified in subregulation (7)(b), the collateral instruments specified below shall be recognised as eligible collateral in terms of the foundation IRB approach in respect of a bank’s exposures to corporate institutions, sovereigns or banks, provided that the bank shall comply with the relevant requirements specified below: |

[Regulation 23(12)(b)(ii)(B) substituted by section 2(qqqqq) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (i) |

Financial receivables, excluding receivables arising from securitisation schemes, sub-participations or credit-derivative instruments. |

When a bank obtains as collateral in respect of its exposure to a corporate institution, sovereign or bank financial receivables other than receivables arising from securitisation schemes, sub-participations or credit-derivative instruments, such collateral shall be recognised as eligible collateral, provided that—

| (aa) |

the said financial receivables— |

| (i) |

shall consist of claims with an original maturity of less than or equal to one year, the repayment of which claim shall be dependent upon the commercial or financial flows related to the underlying assets of the obligor; |

| (ii) |

may include self-liquidating debt arising from the sale of goods or services linked to a commercial transaction or general amounts owed by buyers, suppliers, renters, national and local government authorities, or other non-affiliated persons not related to the sale of goods or services linked to a commercial transaction; |

| (bb) |

the legal mechanism in terms of which the collateral was obtained shall be robust and shall ensure that the bank has clear rights over the proceeds from the collateral. |

The bank shall take all steps necessary to fulfil requirements relating to the enforceability of the bank's security interest, such as the registration of a security interest with a registrar.

| (cc) |

the collateralised transaction shall be duly documented, which documentation— |

| (i) |

shall be binding on all relevant parties; |

| (ii) |

shall be legally enforceable in all relevant jurisdictions; |

| (iii) |

shall be legally well founded; |

| (iv) |

shall be reviewed on a regular basis in order to ensure the transaction's continued enforceability; |

| (v) |

shall provide the bank with legal authority to sell or assign the receivables to other parties without the consent of the receivables' obligors; |

| (vi) |

shall comprehensively deal with the collection of receivable amounts in distressed situations; |

| (dd) |

the bank shall have in place clear and robust procedures, adequate— |

| (i) |

to timely collect the proceeds of the relevant collateral; |

| (ii) |

to observe any legal conditions required to identify any default event of the obligor; |

| (iii) |

to identify any event of financial distress of the relevant obligor; |

| (a) |

reports relating to ageing; |

| (b) |

control over trade documents; |

| (c) |

the frequency of audits relating to collateral; |

| (d) |

the confirmation of accounts; |

| (e) |

the control over the proceeds of accounts paid; |

| (f) |

the analyses in respect of dilution; |

| (ee) |

the bank shall have in place sound and robust riskmanagement processes, which risk-management processes— |

| (i) |

shall be adequate to determine the credit risk inherent in the receivables, including concentration risk. |

When the bank relies on the obligor to determine the credit risk relating to its customers, the bank shall review the credit policy of the obligor to determine the policy's soundness and credibility.

| (ii) |

shall include an analysis of the borrower's business and industry type; |

| (iii) |

shall be adequate to identify any correlation between the obligor and the receivables pledged as security, provided that no receivables relating to affiliates of a particular obligor, including subsidiaries and employees, shall be recognised as eligible collateral; |

| (ff) |

the bank shall ensure that the margin between the amount of the exposure and the value of the receivables takes into account all relevant factors, including the cost of collection, correlations, concentration within the receivables pool pledged as security and potential concentration risk within the bank's total exposures. |

| (ii) |

Commercial real estate and residential real estate, excluding income producing real estate that meets the requirements relating to specialised lending specified in subregulation (11)(c)(i)(D) above. |

When a bank obtains as collateral in respect of its exposure to a corporate institution, sovereign or bank commercial real estate or residential real estate, such collateral shall be recognised as eligible collateral, provided that—

| (aa) |

the risk relating to the obligor shall not be materially dependent upon the performance of the underlying property or project but rather on the underlying capacity of the obligor to repay the debt due from other sources, that is, the repayment of the facility shall not be materially dependent upon any cash flow generated by the underlying commercial real estate or residential real estate serving as collateral; |

[Regulation 23(12)(b)(ii)(B)(ii)(aa) substituted by section 2(rrrrr) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (bb) |

the value of the said collateral shall not be materially dependent upon the performance of the obligor; |

[Regulation 23(12)(b)(ii)(B)(ii)(bb) substituted by section 2(sssss) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

(cc) the bank's claim in respect of the said collateral—

| (i) |

shall be legally enforceable in all relevant jurisdictions; |

| (ii) |

shall reflect a perfected lien, that is, all legal requirements shall be fulfilled in order to enforce the bank's claim; |

| (iii) |

shall be realisable within a reasonable timeframe; |

| (i) |

shall determine and apply the fair value of the collateral, that is, the value at which the property may be sold under private contract between a willing seller and a willing buyer on an armslength basis, or less than the said fair value; |

| (ii) |

shall monitor the value of the collateral on a regular basis but not less frequently than once every year; |

| (iii) |

may use statistical methods such as reference to house price indices or sampling in order to update the bank's estimates of fair value or identify collateral that may have declined in value; |

| (iv) |

shall make use of the services of a qualified professional person to value a particular property when information indicates that the value of the said property may have materially declined relative to general market prices, or when a credit event such as a default has occurred; |

| (a) |

the types of commercial real estate and residential real estate that the bank is willing to accept as collateral; |

| (b) |

the bank's lending policies, including the advance rates, in respect of commercial real estate or residential real estate as collateral; |

| (vi) |

shall ensure that the property is adequately insured against damage or deterioration; |

| (vii) |

shall monitor on an ongoing basis— |

| (a) |

the extent of any permissible preferred claims such as tax in respect of the property; |

| (b) |

the risk of environmental liability arising in respect of the collateral such as the presence of toxic material on the property. |

| (ee) |

when the bank wishes to recognise any junior lien, the bank shall— |

| (i) |

firstly reduce the value of the collateral with any relevant haircut that applies to the relevant collateral; and |

| (ii) |

thereafter reduce the value of the collateral with the sum of all loans with liens that rank higher than the junior lien, |

to determine the value of the collateral that supports the loan with the junior lien;

[Regulation 23(12)(b)(ii)(B)(ii)(ee) inserted by section 2(ttttt) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (ff) |

when liens are held by a third party that rank pari passu with the lien of the bank, the bank shall only recognise the proportion of the collateral that is attributable to the bank, after the application of— |

| (i) |

any relevant haircut(s); and |

| (ii) |

any reductions due to the value of loans with liens that rank higher than the lien of the bank, |

as envisaged hereinbefore;

[Regulation 23(12)(b)(ii)(B)(ii)(ff) inserted by section 2(uuuuu) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (iii) |

Leases other than leases that expose the bank to residual risk |

When a bank obtains collateral in the form of a lease agreement in respect of instruments/ assets that qualify as eligible collateral in terms of the foundation IRB approach, such a lease agreement shall be recognised as eligible collateral, provided that the bank shall in addition to the relevant minimum requirements relating to the relevant type of instrument/asset ensure that—

| (aa) |

the lessor has in place a robust risk-management process, which risk management process shall comprehensively address matters relating to— |

| (i) |

the location of the asset; |

| (ii) |

the use of the asset; |

| (iii) |

the age and condition of the asset; |

| (iv) |

the asset's planned obsolescence; |

| (bb) |

the lessor has in place a robust legal framework, which legal framework shall ensure that— |

| (i) |

the legal ownership of the lessor in respect of the asset is well established; |

| (ii) |

the lessor is able to exercise its rights as owner in a timely manner; |

| (cc) |

the difference between the rate of depreciation of a physical asset and the rate of amortisation of the lease payments is not material, causing the risk mitigation effect of the leased asset to be overstated; |

| (iv) |

Leases that expose the bank to residual risk |

When a bank obtains collateral in the form of a lease agreement in respect of instruments/ assets that qualify as eligible collateral in terms of the foundation IRB approach, which lease agreement exposes the bank to residual risk, that is, the bank is exposed to a potential loss due to, for example, a decline in the fair value of the equipment below the residual estimate at the inception of the lease agreement, the bank shall risk weight the relevant exposure in accordance with the relevant requirements specified in subparagraph (iii)(C) below.

| (v) |

Physical collateral other than the types of collateral specified hereinbefore, excluding any physical assets acquired by the reporting bank due to the default by an obligor in respect of an underlying exposure, specified in writing by the Authority, provided that— |

| (aa) |

the bank shall demonstrate to the satisfaction of the Authority that a sufficiently liquid market exists in respect of the said collateral in order to ensure that the collateral can be liquidated in an expeditious and economically efficient manner; |

| (bb) |

the bank shall have in place sufficiently robust processes to periodically or whenever information indicates material changes in the market, carry out a reassessment of the existence of a sufficiently liquid market as envisaged in sub-sub-item (aa) hereinbefore; |

| (cc) |

the bank shall demonstrate to the satisfaction of the Authority that a well-established market with publicly available market prices relating to the said collateral exists and the amount ultimately received by the bank in respect of the said collateral does not substantially deviate from the said market prices; |

| (dd) |

except for preferential rights in respect of tax obligations or wages of employees, the bank shall have a priority claim in respect of the proceeds of the said collateral; |

| (ee) |

the relevant loan agreement shall include a detailed description of the said collateral and the right by the lending bank to examine and revalue the collateral whenever deemed necessary by the said lending bank ; |

| (ff) |

the bank shall have in place robust policies, processes and procedures relating to physical collateral, which policies, processes and procedures— |

| (i) |

shall in the case of inventories such as raw materials or work-in-progress, and equipment, ensure that the bank conducts regular physical inspections of the said collateral; |

| (ii) |

shall be subject to regular and appropriate independent review; |

| (i) |

shall duly document the types of physical collateral and loan-to-value or lending-to-value ratios acceptable to the bank; |

| (ii) |

shall comply with all the relevant minimum requirements relating to commercial real estate and residential real estate specified in sub-item (ii) above and such further conditions as may be specified in writing by the Authority in respect of such a further category of physical assets qualifying as eligible collateral. |

[Regulation 23(12)(b)(ii)(B)(v) substituted by section 2(vvvvv) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

When a bank that adopted the foundation IRB approach for the measurement of the bank’s exposure to credit risk—

| (A) |

obtains eligible collateral in respect of its exposures to corporate institutions, sovereigns or banks, the bank— |

| (i) |

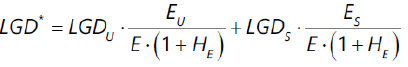

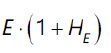

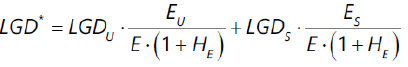

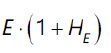

shall calculate the relevant LGD ratio applicable to the collateralised transaction, denoted by LGD*, as the exposure weighted average of the LGD applicable to the unsecured portion of the exposure, denoted by LGDU, and the LGD applicable to the collateralised portion of the exposure, denoted by LGDS, through the application of the formulae specified below, provided that, in all relevant cases or whenever required, unless specifically otherwise specified, the bank shall calculate the relevant required EAD amount without taking into account the impact of any collateral obtained: |

where:

EU and ES are only used to calculate LGD*

| E |

is the current value of the exposure, that is, for example, cash lent or securities lent or securities posted, provided that, in the case of securities lent or posted, the bank shall increase the relevant exposure value by applying the relevant specified haircuts, denoted by He or HE, in accordance with the relevant requirements specified in the comprehensive approach for financial collateral, in subregulation (9)(b)(viii) read with subregulation (9)(b)(xi) |

| ES |

is the current value of the collateral received after the application of the relevant haircut— |

| (aa) |

for the relevant type of collateral, denoted by Hc, and |

| (bb) |

for any relevant currency mismatch between the exposure and the collateral, as specified in subregulation (9)(b)(viii) read with subregulation (9)(b)(xi) and sub-item (ii) below, provided that in all relevant cases ES shall be capped at the value of— |

| LGDU |

is the relevant LGD ratio applicable to an unsecured exposure, as set out in subregulation (11)(d)(ii) |

| LGDS |

is the relevant LGD ratio applicable to exposures secured by the specified type of collateral obtained |

| (ii) |

shall in the calculation of LGD* apply the relevant LGD ratios and haircut percentages specified in table 1 below: |

|

Table 1

|

|

Type of collateral

|

LGDs

|

Haircut

|

|

Eligible financial collateral

|

0%

|

See note 1 1

|

|

Eligible receivables

|

20%

|

40%

|

|

Eligible residential real estate/ commercial real estate

|

20%

|

40%

|

|

Other eligible physical collateral

|

25%

|

40%

|

|

Ineligible collateral

|

N/A

|

100%

|

| 1. |

In accordance with the relevant requirements specified in subregulation (9)(b)(xi) read with subregulation (9)(b)(xiv). |

|

| (iii) |

shall apply the relevant haircut for currency risk specified in the comprehensive approach in subregulation (9)(b) whenever the eligible collateral obtained is denominated in a currency that differs from the exposure protected by the collateral; |

| (iv) |

may in the case of repo-style transactions recognise a reduction in the bank’s counterparty credit risk requirement arising from the effect of a master netting agreement by calculating its adjusted exposure, denoted by E*, in accordance with the formula and requirements specified in subregulation (9)(b)(ix) when the repo-style transaction complies with the relevant requirements specified in subregulation (9)(b)(xvi). Provided that, when the bank calculates the relevant required risk-weighted exposure amount and the related expected loss amount for the counterparty credit risk arising from the set of transactions covered by the relevant master netting agreement, the bank shall use E* as the EAD amount of the relevant counterparty and determine the LGD of the relevant counterparty by using the LGD related to an unsecured exposure, as set out in subregulation (11)(d)(ii); |

| (B) |

lends securities or posts collateral, the bank shall calculate a capital requirement in respect of— |

| (i) |

the credit risk or market risk related to the relevant securities, when that risk remains with the bank; and |

| (ii) |

the relevant counterparty credit risk arising from the risk that the borrower of the securities may default; |

| (C) |

obtains eligible collateral in the form of a lease agreement, which exposes the bank to residual risk, the bank shall risk weight— |

| (i) |

the discounted lease payments based on the financial strength, that is, the PD ratio, of the lessee, and the LGD ratio specified by the Authority; |

| (ii) |

the residual value at 100 per cent. |

[Regulation 23(12)(b)(iii) substituted by section 2(wwwww) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

National Credit Act, 2005 (Act No. 34 of 2005)

National Credit Act, 2005 (Act No. 34 of 2005)