| (14) |

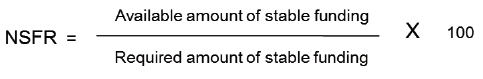

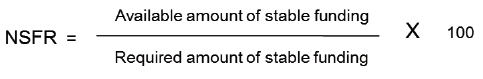

Matters related to the calculation of a bank's net stable funding ratio |

| (a) |

Specified minimum requirements |

In order to promote a bank’s funding stability and resilience over a one year time horizon and ensure that the bank continuously maintains a minimum specified amount of stable sources of funding relative to the liquidity profile of the bank’s assets and the potential for contingent liquidity needs arising from the bank’s off-balance sheet commitments, and in order to mitigate a bank’s potential over-reliance on short-term wholesale funding, a bank shall calculate and on an ongoing basis maintain a Net Stable Funding Ratio (NSFR) in accordance with, and comply with, the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, provided that—

| (i) |

the bank’s NSFR, calculated in accordance with the relevant requirements specified in this subregulation (14), and in particular, in accordance with the formula specified in paragraph (d) below, shall on an ongoing basis be equal to or higher than 100%; |

| (ii) |

in all relevant cases, the requirements specified in this subregulation (14) shall apply on a solo and consolidated basis, provided that— |

| (A) |

notwithstanding the obligation to also calculate and maintain a NSFR on a consolidated basis, the bank and controlling company shall actively monitor and control the liquidity risk exposures and funding needs at the level of each relevant individual legal entity, foreign branch and subsidiary, and any relevant sub-group or group as a whole, taking into account legal, regulatory and operational limitations in respect of the transferability of liquidity; |

| (B) |

subject to the prior written approval of and such conditions as may be specified in writing by the Authority, in the case of consolidation or solo reporting of relevant entities, a bank may apply the rules or regulations of relevant host supervisors in respect of the treatment of retail or small business deposits of relevant entities operating in those jurisdictions; |

| (iii) |

for purposes of this subregulation (14)— |

| (A) |

the relevant available amount of stable funding is deemed to be a function of, among other things, the relative stability of the bank’s funding sources, including the contractual maturity of its liabilities; |

| (B) |

stable funding means the portion of those types and amounts of equity and liabilities expected to be reliable sources of funds over a one-year time horizon; |

| (C) |

when the bank wishes to determine the maturity of any relevant equity or liability item or instrument, the bank shall assume that investors will redeem a call option at the earliest possible date; |

| (D) |

when the market expects certain liabilities to be redeemed before their legal final maturity date, the bank shall assume such behaviour when it calculates its relevant required NSFR, and include such liabilities in the corresponding available stable funding (ASF) category; |

| (E) |

in the case of long-dated liabilities, the bank shall ensure that only the portion of cash flows falling at or beyond the six-month and one-year time horizons, respectively, is treated as having an effective residual maturity of six months or more and one year or more, as the case may be; |

| (F) |

the relevant required amount of funding shall be deemed to be a function of the liquidity characteristics and residual maturities of various types of assets held by the bank, the bank’s off-balance-sheet contingent exposures and/or the activities pursued by the bank; |

| (G) |

in order not to create an environment in which banks rely on the Reserve Bank or another relevant central bank as a source of funding, any extended borrowing from central bank lending facilities, outside regular open market operations, falls outside the scope of this subregulation (14) and the calculation of the NSFR; |

| (H) |

unless specifically otherwise stated in this subregulation (14) or directed in writing by the Authority, the respective definitions applicable to the bank’s calculation of LCR in terms of the provisions of subregulation (12) shall mutatis mutandis apply to the calculation of the bank’s NSFR in terms of the provisions of this subregulation (14). |

| (b) |

Matters related to the calculation of a bank’s amount of ASF |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall continuously calculate its relevant amount of ASF, provided that—

| (i) |

in the case of items other than derivative liabilities, the bank shall calculate its relevant required ASF amount— |

| (A) |

by first assigning to the relevant category or categories of equity and liability items specified in table 1 below, or such additional category or categories of equity or liability items as may be specified in writing by the Authority, the respective carrying values of the bank’s respective equity or liability items, that is, the relevant amounts at which the respective equity or liability items or instruments are reflected in the bank’s accounting records, before the application of any regulatory deduction, filter or other adjustment; and then |

| (B) |

multiply the relevant assigned carrying amounts with the relevant ASF factors specified in table 1 below or such further ASF factor as may be specified in writing by the Authority; and then |

| (C) |

determine the bank’s relevant total ASF amount, which amount shall be equal to the relevant sum of the respective calculated weighted amounts: |

Table 1

|

Description of item

|

ASF factor

|

|

Liabilities and capital instruments assigned a ASF factor of 100%

|

|

| (a) |

Regulatory capital related to instruments that comply with all the relevant requirements specified in these Regulations, after the expiry of any relevant transitional arrangement that may apply, but before the application of any relevant capital deduction, excluding the proportion of any Tier 2 instrument with a residual maturity of less than one year |

| (b) |

Any capital instrument not included in item a) above that has an effective residual maturity of one year or more, but excluding any instruments with explicit or embedded options that, if exercised, would reduce the expected maturity to less than one year |

| (c) |

Secured and unsecured borrowings and liabilities, including the relevant amount related to any term deposit, with an effective residual maturity of one year or more1

|

|

100%

|

|

Liabilities assigned a ASF factor of 95%

|

|

| (a) |

Stable non-maturity, that is, demand deposits, and/or term deposits with a residual maturity of less than one year received from retail2 and small business3 customers |

|

95%

|

|

Liabilities assigned a ASF factor of 90%

|

|

| (a) |

Less stable non-maturity, that is, demand deposits, and/or term deposits with a residual maturity of less than one year received from retail2 and small business3 customers |

|

90%

|

|

Liabilities assigned a ASF factor of 50%

|

|

| (a) |

Secured and unsecured funding with a residual maturity of less than one year received from non-financial corporate customers |

| (b) |

Operational deposits4

|

| (c) |

Funding with a residual maturity of less than one year received from sovereigns, public sector entities (PSEs), and multilateral and national development banks |

| (d) |

Any secured or unsecured funding other than funding specified in any of the aforementioned categories, with a residual maturity between six months to less than one year, including funding received from central banks and financial institutions |

|

50%

|

|

Liabilities assigned a ASF factor specified in writing by the Authority

|

|

| (a) |

Deposits between banks within the same cooperative network— |

| (i) |

that are required by law to be placed at the relevant central organisation and are legally constrained within the cooperative bank network as minimum deposit requirements, or |

| (ii) |

when the bank that received the funds and the bank that deposited the funds participate in the same institutional network’s mutual protection scheme against illiquidity and insolvency of its members, |

and which deposits comply with such further requirements as may

be specified in writing by the Authority

| (b) |

Any secured and unsecured funding received in Rand (ZAR) from financial corporate customers, excluding banks, with a residual maturity of less than six months |

|

As may be specified in writing by the Authority

|

|

Liabilities assigned a ASF factor of 0%

|

|

| (a) |

All liabilities and equity items other than the items specified in any of the aforementioned categories, including any other funding received with a residual maturity of less than six months received from a central bank or financial institution |

| (b) |

Liabilities without a stated maturity,5; 6 such as, for example, short positions and open maturity positions |

| (c) |

Liabilities related to “trade date” payables arising from any purchase of a financial instrument, foreign currency or commodity that— |

| (i) |

is expected to settle within the standard settlement cycle or period that is customary for the relevant exchange or type of transaction, or |

| (ii) |

has failed to but is still expected to settle |

|

0%

|

| 1. |

Any cash flows falling below the one-year horizon but arising from liabilities with a final maturity greater than one year must be excluded from the 100% ASF factor category. |

|

2.

|

As defined in subregulation (12) above for the calculation of the bank’s LCR. |

|

3.

|

As defined in subregulation (12) above for the calculation of the bank’s LCR. |

|

4.

|

As defined in subregulation (12) above for the calculation of the bank’s LCR. |

|

5.

|

The bank shall treat any deferred tax liability according to the nearest possible date on which such liability could be realised, that is, the bank shall assign to the relevant amount a 100% ASF factor when the effective maturity is one year or more, or 50% when the effective maturity is between six months and less than one year. |

|

6.

|

The bank shall treat any relevant amount related to a minority interest according to the term of the relevant instrument, which is usually in perpetuity, that is, the bank shall assign to the relevant amount a 100% ASF factor when the effective maturity is one year or more, or 50% when the effective maturity is between six months and less than one year. |

| (ii) |

in the case of derivative liabilities— |

| (A) |

the bank shall firstly calculate the relevant replacement cost for all its relevant derivative contracts by marking the said derivative contract or instrument to market where the contract or instrument has a negative value, provided that— |

| (i) |

when the bank has in place an eligible bilateral netting contract that complies with the relevant requirements specified in regulation 23(17)(b), the replacement cost for the relevant set of derivative exposures covered by the contract shall be the relevant net replacement cost amount; |

| (ii) |

when the bank calculates the relevant derivative liability amount the bank shall deduct from the relevant negative replacement cost amount any relevant amount related to collateral posted in the form of variation margin in connection with the said derivative contracts, regardless of the asset type; |

| (iii) |

in order to avoid the potential risk of double-counting, when the bank reflects as an on-balance-sheet item an asset associated with collateral posted as variation margin in relation to a derivative contract that is deducted from the replacement cost amount, as envisaged herein before, the bank shall not include that asset in the calculation of the bank’s relevant amount of required stable funding (RSF); |

| (B) |

the bank shall then finally assign to the relevant derivative liability amount an ASF factor of 0%, that is: |

ASF = 0% x Max((NSFR derivative liabilities – NSFR derivative assets), 0).

| (c) |

Matters related to the calculation of a bank’s required amount of stable funding |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall continuously calculate its relevant amount of required stable funding, that is, RSF, provided that—

| (i) |

in all relevant cases, unless specifically otherwise stated in this subregulation (14)(c)— |

| (A) |

the bank shall allocate the relevant amount of an asset or item to the appropriate RSF factor based on the relevant asset or item’s residual maturity or liquidity value; |

| (B) |

when the bank wishes to determine the maturity of an asset or instrument, the bank shall assume that investors will exercise any option to extend maturity; |

| (C) |

when the bank determined that the market expects the bank to extend the maturity of an asset, the bank shall assume such behaviour, and include the asset in the relevant corresponding RSF category; |

| (i) |

shall include all relevant financial instruments, foreign currencies and commodities in respect of which a purchase order has been executed, and |

| (ii) |

shall exclude all relevant financial instruments, foreign currencies and commodities in respect of which a sales order has been executed, |

even when such transactions have not been reflected in the bank’s balance sheet in terms of a settlement-date accounting model, provided that—

| (aa) |

such transactions are not reflected as derivatives or secured financing transactions in the bank’s balance sheet, and |

| (bb) |

the effects of such transactions will be reflected in the bank’s balance sheet when settled. |

| (ii) |

in the case of any amortising loan, the bank may treat the portion of the loan that becomes due and payable within the one-year horizon in the less-than-one-year residual maturity category; |

| (iii) |

in the case of interdependent assets and liabilities specified and approved in writing by the Authority, in respect of which— |

| (A) |

the relevant contractual agreements and arrangements clearly determine that— |

| (i) |

the liability cannot fall due while the asset remains on the bank’s balance sheet; |

| (ii) |

the principal payment flows from the asset cannot be used for anything other than to repay the liability; and |

| (iii) |

the liability cannot be used to fund any other asset, |

| (B) |

the individual interdependent asset and liability items are clearly identifiable; |

| (C) |

the maturity and principal amount of both the liability and its interdependent asset are the same; |

| (D) |

the bank is acting solely as a pass-through unit to channel the funding received, that is, the interdependent liability, into the corresponding interdependent asset; and |

| (E) |

the counterparties for each pair of interdependent liabilities and assets are not the same, |

the bank may apply a RSF factor and an ASF factor of 0% respectively;

| (iv) |

in the case of items other than derivative assets, off-balance sheet exposures, potential liquidity exposures and interdependent assets and liabilities, the bank shall calculate its relevant required RSF amount— |

| (A) |

by first assigning to the relevant category or categories of asset items specified in table 1 below, or such additional category or categories of asset items as may be specified in writing by the Authority, the relevant carrying value of the bank’s relevant assets; and then |

| (B) |

multiply the relevant assigned carrying amounts with the relevant associated RSF factors specified in table 1 below or such further RSF factor as may be specified in writing by the Authority; and then |

| (C) |

determine the bank’s relevant RSF amount related to items other than derivative assets, off-balance sheet exposures and potential liquidity exposures, which amount shall be equal to the relevant sum of the respective weighted amounts: |

Table 1

|

Description of item

|

RSF factor

|

|

Assets assigned a RSF factor of 0%

|

|

| (a) |

Coins and banknotes immediately available to meet obligations |

| (b) |

Any relevant excess amount held in relation to the bank’s minimum required cash reserve balance to be held with the Reserve Bank |

| (c) |

Claims on central banks with residual maturities of less than six months |

| (d) |

Assets related to “trade date” receivables arising from any sales of financial instruments, foreign currencies and commodities that— |

| (i) |

are expected to settle within the standard settlement cycle or period that is customary for the relevant exchange or type of transaction, or |

| (ii) |

have failed to but are still expected to settle |

|

0%

|

|

Assets assigned a RSF factor specified in writing by the Authority

|

|

| (a) |

Any relevant amount related to the bank’s minimum required cash reserve balance to be held with the Reserve Bank |

|

As may be specified in writing by the Authority

|

|

Assets assigned a RSF factor of 5%

|

|

| (a) |

Unencumbered Level 1 high-quality liquid assets as defined in section 1(1) of the Act read with subregulation (12) above, other than any asset assigned a RSF factor of 0%, including: |

| (i) |

any marketable security representing a claim on or guaranteed by a sovereign, central bank, public sector entity, the Bank for International Settlements, the International Monetary Fund, the European Central Bank and the European Community, or multilateral development bank that is assigned a risk weight of 0% in terms of the standardised approach for credit risk, set out in regulation 23(8) |

| (ii) |

any debt security issued by a sovereign or central bank assigned a risk weight higher than 0%, as set out or envisaged in subregulation (12) above |

|

5%

|

|

Assets assigned a RSF factor of 10%

|

|

| (a) |

Unencumbered loans to financial institutions with residual maturities of less than six months, provided that— |

| (i) |

the loan is secured against Level 1 high-quality liquid assets as defined in section 1(1) of the Act read with subregulation (12) above, and |

| (ii) |

the bank has the ability to freely rehypothecate the received collateral for the life of the loan |

|

10%

|

|

Assets assigned a RSF factor of 15%

|

|

| (a) |

Unencumbered Level 2A high-quality liquid assets as defined in section 1(1) of the Act read with subregulation (12) above, including: |

| (i) |

any marketable security representing a claim on or guaranteed by a sovereign, central bank, public sector entity or multilateral development bank that is assigned a risk weight of 20% in terms of the standardised approach for credit risk, set out in regulation 23(8) |

| (ii) |

any corporate debt security, including commercial paper, and covered bonds with a credit rating equal or equivalent to at least AA— |

| (b) |

any unencumbered loan to a financial institution with a residual maturity of less than six months, other than an unencumbered loan qualifying for a RSF factor of 10% |

|

15%

|

|

Assets assigned a RSF factor of 50%

|

|

| (a) |

Unencumbered Level 2B high-quality liquid assets as defined in section 1(1) of the Act read with subregulation (12) above, and that comply with the relevant requirements specified in subregulations (12)(b)(ii) and (12)(b)(iii), including: |

| (i) |

residential mortgage-backed securities with a credit rating of at least AA |

| (ii) |

corporate debt securities, including commercial paper, with a credit rating of between A+ and BBB– |

| (iii) |

exchange-traded common equity shares not issued by financial institutions or their affiliates |

| (b) |

Any high-quality liquid asset as defined in section 1(1) of the Act read with subregulation (12) above that is encumbered for a period of between six months and less than one year |

| (c) |

Any loan to a financial institution or central bank with a residual maturity of between six months and less than one year |

| (d) |

Deposits held at any other financial institution for operational purposes, as envisaged in subregulation (12) above, that are subject to an ASF factor of 50% |

| (e) |

Any other non-high-quality liquid asset not included in any of the aforementioned categories, that has a residual maturity of less than one year, including loans to— |

| (i) |

non-financial corporate clients |

| (ii) |

retail customers, that is, natural persons |

| (iii) |

small business customers |

| (iv) |

sovereigns and public-sector entities |

|

50%

|

|

Assets assigned a RSF factor of 65%

|

|

| (a) |

Unencumbered residential mortgages with a residual maturity of one year or more that qualify for a risk weight of 35% or lower in terms of the standardised approach for credit risk, set out in regulation 23(8) |

| (b) |

Other unencumbered loans not included in any of the aforementioned categories, excluding loans to financial institutions, with a residual maturity of one year or more that qualify for a risk weight of 35% or lower in terms of the standardised approach for credit risk, set out in regulation 23(8) |

|

65%

|

|

Assets assigned a RSF factor of 85%

|

|

| (a) |

Cash, securities or other assets posted as initial margin for derivative contracts, and cash or any other asset provided to contribute to the default fund of a central counterparty (CCP), provided that— |

| (i) |

any initial margin posted on behalf of a customer, in respect of which the bank does not guarantee performance of the third party, is exempt from this requirement |

| (ii) |

when a higher RSF factor is otherwise assigned to a security or other asset posted as initial margin for a derivative contract, that higher factor shall apply |

| (b) |

Other unencumbered performing loans, that is, loans that are not past due for more than 90 days as envisaged in regulation 23(8)(e), that do not qualify for a risk weight of 35% or lower in terms of the standardised approach for credit risk, set out in regulation 23(8), and have residual maturities of one year or more, excluding any loan to a financial institution |

| (c) |

Unencumbered securities with a remaining maturity of one year or more and exchange-traded equities, that are not in default and do not qualify as HQLA in terms of the provisions of section 1(1) of the Act read with the relevant provisions of subregulation (12) |

| (d) |

Physical traded commodities, including gold |

|

85%

|

|

Assets assigned a RSF factor of 100%

|

|

| (a) |

Assets encumbered for a period of one year or more |

| (b) |

Any other asset not included in any of the aforementioned categories, including— |

| (i) |

any non-performing loan |

| (ii) |

any loan to a financial institution with a residual maturity of one year or more |

| (iii) |

any non-exchange-traded equity |

| (v) |

any item deducted from the bank’s capital and reserve funds |

| (vi) |

any retained interest |

| (vii) |

any insurance asset |

| (viii) |

any subsidiary interest |

| (ix) |

any defaulted security |

| (c) |

Such a percentage of derivative liabilities, that is, negative replacement cost amounts, as envisaged in subregulation (14)(b) herein before, as may be directed in writing by the Authority, before the deduction of any variation margin posted |

|

100%

|

|

Other specified encumbered assets:

|

|

| (a) |

Encumbered on-balance-sheet assets, including all relevant securities related to repos or other securities financing transactions1, must be allocated to the appropriate RSF category, as follows: |

| (i) |

Encumbered assets with less than six months remaining in the encumbrance period |

|

The same RSF factor as an equivalent asset that is unencumbered

|

| (ii) |

Assets encumbered for a period of between six months and less than one year that would, if unencumbered, be assigned an RSF factor lower than or equal to 50% |

|

50%

|

| (iii) |

Assets encumbered for a period of between six months and less than one year that would, if unencumbered, be assigned an RSF factor higher than 50% |

|

The relevant higher RSF factor

|

| 1. |

Securities financing transactions with a single counterparty may be measured on a net basis when the bank complies with the relevant requirements specified in regulation 38(15)(e) of these Regulations. |

| (v) |

in the case of derivative assets— |

| (A) |

the bank shall firstly calculate the replacement cost for all its relevant derivative contracts by marking the said derivative contract to market where the contract has a positive value, provided that— |

| (i) |

when the bank has in place an eligible bilateral netting contract that complies with the relevant requirements specified in regulation 23(17)(b), the replacement cost for the relevant set of derivative exposures covered by the contract shall be the relevant net replacement cost amount; |

| (ii) |

when the bank calculates the relevant NSFR derivative asset amount, the bank shall not offset collateral received in connection with the relevant derivative contract against the calculated positive replacement cost, unless it is received in the form of cash variation margin and complies with the relevant requirements specified in regulation 38(15)(e) of these Regulations, provided that any remaining balance sheet liability associated with— |

| (aa) |

variation margin received that does not meet the said criteria; or |

| (bb) |

initial margin received shall not offset the relevant derivative asset amount, |

and shall be assigned an ASF factor of 0%;

| (B) |

the bank shall assign to the relevant— |

| (i) |

derivative asset amount a RSF factor of 100%, that is: |

RSF = 100% x max((NSFR derivative assets – NSFR derivative liabilities), 0);

| (ii) |

derivative liability amount an ASF factor of 0%. |

| (vi) |

in the case of off-balance sheet and potential liquidity exposures, in order to ensure that the bank has sufficient stable funding in place for the relevant portion of an exposure that requires funding within a one-year horizon, the bank shall calculate its relevant RSF amount— |

| (A) |

by first assigning the relevant exposure to the relevant category specified in table 2 below, or such additional category or categories of exposure items as may be specified in writing by the Authority; and then |

| (B) |

multiply the relevant assigned exposure amount with the relevant associated RSF factor specified in table 2 below, or such further RSF factor as may be specified in writing by the Authority; and then |

| (C) |

determine the bank’s relevant RSF amount related to off-balance sheet and potential liquidity exposures, which amount shall be equal to the relevant sum of the respective weighted amounts: |

Table 2

|

Description of exposure

|

RSF factor

|

| (a) |

The currently undrawn portion of any irrevocable or conditionally revocable credit or liquidity facility to any client |

|

5%

|

| (a) |

Any other contingent funding obligation, including: |

| (i) |

unconditionally revocable credit and liquidity facilities |

| (ii) |

trade finance related obligations, including guarantees and letters of credit |

| (iii) |

guarantees and letters of credit unrelated to trade finance obligations |

| (iv) |

non-contractual obligations, such as: |

| (A) |

potential requests for debt repurchases of the bank’s own debt or that of related conduits, securities investment vehicles and other such financing facilities |

| (B) |

structured products where customers anticipate ready marketability, such as adjustable rate notes and variable rate demand notes (VRDNs) |

| (C) |

managed funds that are marketed with the objective of maintaining a stable value |

|

As may be specified in writing by the Authority

|

| (vii) |

the bank’s relevant total RSF amount shall be equal to the relevant sum of the respective amounts determined in terms of the provisions of subparagraphs (i) to (vi) specified herein before. |

| (d) |

Formula for the calculation of NSFR |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall calculate its NSFR in accordance with the formula specified below:

[Regulation 26(14) substituted by section 7(f) of Notice No. 724, GG44003, dated 18 December 2020]

National Credit Act, 2005 (Act No. 34 of 2005)

National Credit Act, 2005 (Act No. 34 of 2005)