| (1) |

The content of the relevant return is confidential and not available for inspection by the public. |

| (2) |

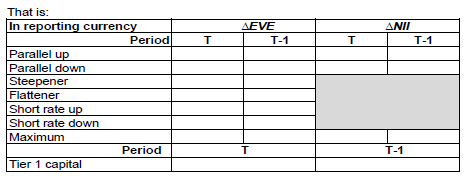

The purpose of the return is to determine, among others— |

| (a) |

the repricing gap between the reporting bank’s assets and liabilities, before and after the impact of derivative instruments are taken into consideration; |

| (b) |

the expected cumulative impact on or sensitivity of the reporting bank’s net interest income (NII) resulting from such percentage or basis points change in interest rates as may be specified in this regulation 30 or otherwise directed in writing by the Authority, in respect of the reporting bank’s current, expected or forecasted balance sheet relating to banking activities; |

| (c) |

the expected change in the net present value of the bank’s assets, liabilities and off-balance sheet items, that is, the expected changes in the bank’s economic value of equity, arising from specified interest rate shock and stress scenarios. |

Note: For the purpose of these Regulations the risk of a change in the capital value of instruments resulting from a change in interest rates shall be deemed to constitute market risk (position risk), and shall be reported in the form BA 320.

[Regulation 30(2) substituted by section 3(a) of Notice No. 2900, GG47789, dated 23 December 2022- Effective 1 January 2023]

| (3) |

Unless specifically otherwise provided in this regulation 30 or directed in writing by the Authority— |

| (a) |

the relevant required information in the form BA 330— |

| (i) |

shall be reported in Rand; and |

| (ii) |

shall in all relevant specified cases be completed on the basis of nominal or notional amounts, or fair value; |

| (b) |

subject to the provisions of paragraph (a) above, all relevant amounts shall be calculated and reported on an accrual basis; |

| (c) |

interest rate-sensitive asset means an asset as defined in subregulation (5)(c)(iii)(A); |

| (d) |

all on-balance sheet items and all off-balance sheet items relating to banking activities, which items affect the exposure of the reporting bank to interest-rate risk, shall be included in the form BA 330, including— |

| (i) |

any interest-bearing asset or liability instrument or item; |

| (ii) |

any security or instrument valued on a discounted basis; |

| (iii) |

any zero coupon bond; |

| (iv) |

any variable rate instrument that may reprice on a daily or monthly basis, such as call deposits or prime linked instruments; |

| (v) |

any adjustable-rate instrument with a known reset date, such as a 3 month JIBAR linked product, which instrument— |

| (A) |

is linked to a regular base rate; |

| (B) |

shall be reported based on its next known reset date; |

| (vi) |

any discretionary or administered rate instrument, such as a savings or current account— |

| (A) |

the relevant rate of which instrument may or may not change in line with a regular base rate; |

| (B) |

the relevant rate of which instrument may be varied at the discretion of the reporting bank; |

| (C) |

which instrument shall be reported on the basis of the earliest adjustable interest-rate date; |

| (vii) |

any fixed rate instrument, such as a 12 month fixed deposit, which instrument has a predefined fixed interest rate until maturity and shall be reported on the basis of the instrument’s relevant residual maturity; |

| (viii) |

any relevant derivative instrument, |

the relevant values of which are influenced by and sensitive to changes in interest rates, irrespective of whether or not—

| (A) |

formal interest payments are/were made in respect of the said item or instrument; |

| (B) |

the said item or instrument is denominated in Rand or a foreign currency; |

| (e) |

any instrument not sensitive to or directly impacted by changes in interest rates, that is, instruments in respect of which the relevant values are indifferent to changes in interest rates, such as capital and reserve funds, shall, when relevant, be included in the form BA 330 as non-rate sensitive items; |

| (f) |

the relevant requirements specified in this regulation 30 related to interest rate risk in the banking book shall in accordance with the respective requirements specified in regulation 7 apply to all banks and controlling companies on a solo and consolidated basis. |

[Regulation 30(3) substituted by section 3(b) of Notice No. 2900, GG47789, dated 23 December 2022- Effective 1 January 2023]

| (4) |

Matters related to a bank’s governance and risk management framework |

| (a) |

As a minimum, based upon, among others, the relevant requirements specified in regulations 39 and 43, the board of directors of a bank— |

| (i) |

shall specify and appropriately oversee, among others— |

| (A) |

the bank’s risk appetite for exposure to interest rate risk in the banking book in terms of the risk to— |

| (i) |

economic value, that is, the change in the net present value of the banking book portion of the bank’s balance sheet under appropriate interest rate stress scenarios; and |

| (ii) |

earnings, that is, the impact of changes in interest rates on the bank’s future accrued or reported earnings, and hence, the future profitability of the bank’s banking book positions; |

| (B) |

appropriate limits and sub-limits— |

| (i) |

that apply on a solo and consolidated basis for the bank’s aggregate exposure to interest rate risk in the banking book, including the definition of specific procedures and approvals required for or related to any exception, and ensure that the bank’s aggregate exposure to interest rate risk in the banking book remains consistent with the approved risk appetite and overall approach for the measurement of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

that apply in respect of all relevant individual affiliates, business units, portfolios or instrument types; |

| (iii) |

that may be associated with specific scenarios of changes in interest rates and/or term structures, such as an increase or decrease of a particular size or a change in the shape of a curve; |

| (iv) |

that duly take into consideration— |

| (aa) |

the nature, size, complexity and capital adequacy of the bank, as well as its ability to measure and manage its exposure to risk; |

| (bb) |

the bank’s vulnerability to loss under stressful market conditions, including the breakdown of key assumptions; |

| (cc) |

risks that may arise from changes to the level and structure of interest rates, in addition to the economic risks normally associated with changes to the level and structure of interest rates, such as, for example— |

| (i) |

currency mismatches, that is, when exposure to interest rate risk is in addition to normal exchange rate risks, which may potentially fall within a wider definition of basis risk; or |

| (ii) |

accounting treatment of risk positions, that is, when the bank’s interest rate hedging activity may achieve the desired economic effect, but may fail to qualify for hedge accounting treatment in terms of the relevant requirements specified in accounting standards or statements that may apply form time to time, |

Provided that the board shall also clearly specify whether limits are absolute limits in the sense that they may never be exceeded, or whether breaches of limits can be tolerated under specific circumstances for a predetermined short period of time.

| (ii) |

shall approve and appropriately oversee the bank’s— |

| (A) |

broad business strategy related to its exposure to interest rate risk in the banking book; |

| (B) |

relevant risk appetite framework and related statements, that is, the written articulation of the aggregate level and types of exposure to interest rate risk in the banking book that the bank is willing to accept, or avoid, in order to achieve its business objectives, which risk appetite framework— |

| (i) |

shall clearly delineate delegated powers, lines of responsibility and accountability in respect of management decisions related to the bank’s exposure to interest rate risk in the banking book; and |

| (ii) |

shall clearly define authorised instruments, hedging strategies and acceptable risk-taking opportunities, |

Provided that the board shall approve all relevant major hedging or risktaking initiatives prior to its implementation;

| (A) |

the bank has in place— |

| (i) |

a sufficiently robust risk management framework that complies with, among others, the respective requirements specified in subregulation (5) below; |

| (ii) |

sufficiently robust systems and internal controls— |

| (aa) |

to ensure the integrity of the bank’s risk management process in respect of its exposure to interest rate risk in the banking book; |

| (bb) |

to ensure that positions that exceed or are likely to exceed limits specified by the board receive prompt management attention and are appropriately escalated without delay; |

| (cc) |

to ensure that positions related to internal risk transfers between the bank’s banking book and its trading book are properly documented; |

| (dd) |

that promote effective and efficient operations, reliable financial and regulatory reporting, and compliance with all relevant laws, regulations, limits and bank policies, |

Provided that the board shall ensure that when revisions or enhancements to the bank’s internal controls are identified or necessary, sufficiently robust mechanisms are in place to ensure that the said revisions or enhancements are actually implemented in a timely manner.

| (iii) |

an effective validation framework that complies with, among others, the respective requirements specified in subregulation (8) below; |

| (iv) |

adequate policies, processes, systems and procedures— |

| (aa) |

relating to the person(s) to inform, how the communication will take place and the actions to be taken in response to an exception or deviation from the approved or specified business strategy, risk appetite framework or limits; |

| (bb) |

for the valuation of positions and for assessing performance, including procedures for updating interest rate shock and stress scenarios and key underlying assumptions driving the analysis of the bank’s exposure to interest rate risk in the banking book; |

| (v) |

sufficiently clear guidance regarding the acceptable level of exposure to interest rate risk in the banking book, given the bank’s approved business strategy; |

| (B) |

all relevant evaluations and reviews of the bank’s risk management framework, internal control system and processes— |

| (i) |

include ensuring that the bank’s personnel comply with established policies, limits and procedures; |

| (ii) |

appropriately address any significant changes that may affect the effectiveness of the bank’s controls, including changes in market conditions, personnel, technology and structures of compliance with exposure limits; |

| (iii) |

are conducted on a sufficiently regular basis by individuals and/or units that are independent of the function(s) being reviewed; |

| (C) |

the management of the bank’s exposure to interest rate risk in the banking book— |

| (i) |

is sufficiently integrated within the bank’s broader risk management framework and governance structures; and |

| (ii) |

is duly aligned with the bank’s business planning and budgeting activities; |

| (D) |

in relation to the bank’s use of models, and the approval of policies, all relevant and respective oversight responsibilities are appropriately integrated within the bank’s governance processes for model risk management; |

| (E) |

the bank considers capital requirements related to the bank’s exposure to interest rate risk in the banking book as an integral part of— |

| (i) |

the bank’s Internal Capital Adequacy Assessment Process (ICAAP); and |

| (ii) |

the bank’s risk appetite framework and broad business strategy; |

| (F) |

the bank complies with the relevant requirements related to the bank’s ICAAP, specified in subregulation (7) below; |

| (G) |

key or material behavioural and modelling assumptions used in the measurement of the bank’s exposure to interest rate risk in the banking book— |

| (i) |

are approved by the board; |

| (ii) |

are well understood and conceptually sound; |

| (iii) |

are duly documented; |

| (iv) |

are rigorously tested; |

| (v) |

are duly aligned to the bank’s approved business strategies; and |

| (vi) |

comply with the relevant further requirements specified in subregulation (6) below; |

| (H) |

the functions responsible for the identification, measurement, monitoring and control of the bank’s exposure to interest rate risk in the banking book— |

| (i) |

have in place clearly defined responsibilities in respect of the identification, measurement, monitoring and control of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

are sufficiently independent from any relevant risk-taking function(s) of the bank; |

| (iii) |

report the bank’s exposure to interest rate risk in the banking book directly to the board or, when relevant, the committee to which the board has delegated the relevant responsibilities; |

| (I) |

as an integral part of the bank’s processes to identify, measure, monitor and control the bank’s exposure to interest rate risk in the banking book, the bank also duly monitors and assesses any relevant credit spread risk in the bank’s banking book; |

| (J) |

the bank’s risk management framework, systems, policies, processes and procedures for identifying, measuring, monitoring and controlling its exposure to interest rate risk in the banking book are subject to appropriate and regular independent review and evaluation regarding the effectiveness of the framework and the relevant systems, policies, processes and procedures, provided that, on prior written request, the bank shall make available to the Authority any relevant review and evaluation reports by an internal or external auditor or other equivalent external person; |

| (K) |

interest rate movements used in the formulation of specified limits represent meaningful shock and stress situations, taking into account historical interest rate volatility and the time required by the senior management of the bank to appropriately mitigate the bank’s relevant exposures to interest rate risk; |

| (L) |

as an integral part of the bank’s broader risk management and governance framework and processes, the bank develops and implements an effective stress testing framework for its exposure to interest rate risk in the banking book— |

| (aa) |

clearly defined objectives; |

| (bb) |

scenarios that are relevant to the bank’s businesses and respective exposures to risk, and that are sufficiently stressful; |

| (cc) |

well documented and duly approved assumptions; and |

| (dd) |

sound methodologies; |

| (ii) |

that ensures that the bank— |

| (aa) |

undertakes rigorous, forward-looking stress testing that identifies events of severe changes in market conditions which could adversely impact the bank’s capital or earnings, possibly also through changes in the behaviour of the bank’s customer base; |

| (i) |

the nature and sources of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

the required time to take appropriate action to reduce or unwind unfavourable positions or exposures to interest rate risk in the banking book; |

| (iii) |

the bank’s ability and willingness to withstand accounting losses in order to reposition the bank’s risk profile; |

| (cc) |

selects scenarios that provide meaningful estimates of risk and include a range of shocks sufficiently wide to allow the board to duly understand the risk inherent in the bank’s products and activities; |

| (iii) |

that appropriately feeds into the bank’s relevant decision-making processes, including strategic decisions, such as, for example, business and capital planning decisions, and at the appropriate level; |

| (iv) |

that is commensurate with the bank’s— |

| (aa) |

nature, size and complexity; |

| (bb) |

business activities, products and services; and |

| (cc) |

overall risk profile; |

| (v) |

that appropriately assesses, among other things, the potential impact of the relevant scenarios on the bank’s financial condition, enabling ongoing and effective review processes for stress tests and recommends appropriate actions to be taken, based upon the respective stress test results; |

| (vi) |

that facilitates effective communication of risks to all relevant stakeholders by means of appropriate disclosures; |

| (vii) |

that complies with the relevant further requirements specified in subregulation (5)(e) below; |

| (M) |

the analysis and risk management activities related to the bank’s exposure to or potential changes in interest rate risk in the banking book are conducted by competent staff with technical knowledge and experience, consistent with the nature and scope of the bank’s activities; |

| (N) |

when the bank is exposed to significant— |

| (i) |

gap risk, that is the risk that arises, for example, when the rate of interest paid on liabilities increases before the rate of interest received on assets, or reduces on assets before liabilities, which means that the bank may be exposed to a period of reduced or negative interest margins, or may experience changes in the relative economic values of assets and liabilities; |

| (ii) |

basis risk, such as, for example, when some assets priced off Jibar are funded by liabilities priced off Treasury Bills; or |

| (iii) |

positions with explicit or embedded exposure to risk arising from optionality, the board clearly specifies appropriate risk tolerance levels for the aforementioned exposures to risk; |

| (O) |

prior to the introduction of any relevant new product, hedging or risk-taking strategy, the bank has in place sufficiently robust operational procedures and risk control systems in respect of the bank’s exposure to and potential change in interest rate risk in the banking book; |

| (P) |

as an integral part of its annual risk assessment and audit plans, the internal audit department reviews, as a minimum, the integrity and effectiveness of the bank’s— |

| (i) |

model risk management process; and |

| (ii) |

risk management system; |

| (Q) |

the bank discloses to the public, as a minimum and on a sufficiently regular basis, the relevant information specified in subregulation (9); |

| (R) |

all relevant policies, processes and procedures related to the bank’s exposure to interest rate risk in the banking book, and disclosure to the public, are reviewed at least on an annual basis, duly taking into consideration the details of all relevant reports and findings reported to the board or its delegates, and revised as needed, to ensure that the said policies, processes and procedures remain appropriate and sound; |

| (iv) |

may delegate the management and monitoring of the bank’s exposure to interest rate risk in the banking book to senior management or an asset and liability management committee (ALCO), including the duty to ensure the bank’s ongoing compliance with any relevant limits specified by the board, provided that— |

| (i) |

clearly identify the delegates responsible for the management of the bank’s exposure to interest rate risk in the banking book and, to avoid any potential conflict of interest, shall ensure that there is also adequate separation of responsibilities in key elements of the risk management process; |

| (ii) |

actively promote and encourage regular discussions between— |

| (aa) |

members of the board and the said delegates; |

| (bb) |

delegates and other relevant persons, departments or divisions in the bank involved in or affected by the bank’s interest rate risk decisions and management process; |

| (cc) |

the relevant persons, departments or divisions in the bank responsible for the interest rate risk management process and the bank’s strategic planning process, to appropriately evaluate risk that may arise from the bank’s future business; |

| (aa) |

the aforesaid delegates include persons or members with clear lines of authority over the units responsible for the establishment and management of the bank’s interest rate risk positions; |

| (bb) |

a clear communication channel is in place to convey the delegates’ directives to any relevant line unit; |

| (cc) |

the bank’s organisational structure— |

| (i) |

enables its delegates to properly discharge their respective responsibilities, and |

| (ii) |

facilitates effective decision-making and good governance. |

| (B) |

when the board delegates the task for the development of policies and practices to an ALCO, the ALCO shall meet on a sufficiently frequent basis and include appropriate representatives from each relevant major department or division contributing to or impacting the bank’s exposure to interest rate risk in the banking book; |

| (v) |

shall on a sufficiently frequent basis, but not less frequently than once every six months, receive and review sufficiently detailed information in respect of the bank’s exposure to interest rate risk in the banking book— |

| (A) |

to allow the board to understand and assess— |

| (i) |

the nature, extent and trend of the bank’s exposure to interest rate risk in the banking book; and |

| (ii) |

the bank’s compliance with all the relevant policies and limits approved by the board; |

| (B) |

which reported information, as a minimum, shall include— |

| (i) |

a summary of the bank’s aggregate exposure to interest rate risk in the banking book, and appropriate explanatory text that highlights to the board the relevant assets, liabilities, cash flows, and strategies driving the level and direction of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

confirmation of the bank’s continued compliance with all relevant approved policies and limits; |

| (iii) |

a comparison between— |

| (aa) |

the bank’s current exposure to interest rate risk in the banking book and any relevant specified and/ or approved policy limit(s) and/ or sub-limit(s); |

| (bb) |

past forecasts or risk estimates, and actual results, to inform potential modelling shortcomings; |

| (iv) |

information with an appropriate balance between aggregate information and supporting detail to enable the board to duly assess the sensitivity of the bank to changes in market conditions, with particular reference to portfolios that may potentially be subject to significant mark-to-market movements; |

| (v) |

the results of the relevant required periodic model reviews and audits; |

| (vi) |

key modelling assumptions, such as, for example, characteristics related to non-maturity deposits, prepayments on fixed rate loans and currency aggregation; |

| (vii) |

the results of all relevant stress tests, including an assessment of sensitivities to key assumptions and parameters; |

| (viii) |

a summary of the reviews of any interest rate risk policies, procedures and the adequacy of the measurement systems, including any relevant findings of internal or external auditors and/or other equivalent external persons, such as consultants, and subsequent actions taken to duly address any material shortcomings, |

Provided that, the aforesaid reports to and reviews by the board shall be carried out on a more frequent basis when the bank is significantly exposed to interest rate risk in the banking book or has material positions in complex interest rate risk products or instruments;

| (b) |

As a minimum, based upon the relevant requirements specified in regulation 39, the senior management of a bank— |

| (i) |

shall provide the bank’s board of directors with timely information that is sufficiently detailed to allow the bank’s board of directors to understand and assess the performance of all relevant committees, persons or functions responsible for— |

| (A) |

monitoring, managing, mitigating and controlling the bank’s exposure to interest rate risk in the banking book; |

| (B) |

ensuring the bank’s ongoing compliance with policies and limits approved by the board in respect of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

shall develop and implement appropriate risk limits, including any limits or sub-limits required to be approved by the bank’s board of directors— |

| (A) |

to ensure the bank’s exposure to interest rate risk in the banking book remains duly aligned to and within the bank’s approved risk appetite and broad business strategy; |

| (B) |

to monitor the evolution of the bank’s approved hedging strategies that rely on instruments such as derivatives; |

| (C) |

to control mark-to-market risks in relation to instruments accounted for at market value or fair value; |

| (iii) |

shall ensure that proposals to use new strategies or new instrument types, including strategies or instruments related to hedging, are duly assessed to ensure that— |

| (A) |

the required resources to establish sound and effective interest rate risk management in respect of the product or activity have been properly identified; |

| (B) |

the proposed activities are in line with the bank’s broad business strategy and overall risk appetite; |

| (C) |

adequate procedures to identify, measure, monitor and control the relevant risks related to or arising from the proposed product or activity have been properly established. |

| (iv) |

shall ensure that the bank maintains an adequate level of qualifying capital and reserve funds— |

| (A) |

to continuously support the nature and extent of all the bank’s relevant exposures to risk, including the bank’s exposure to interest rate risk in the banking book; |

| (B) |

to withstand the adverse impact of the interest rate shock scenarios respectively envisaged in subregulations (5)(a)(iii)(H) and (5)(a)(iii)(I), without the need for the bank to unexpectedly— |

| (i) |

increase its issued capital; |

| (ii) |

increase its allocated capital and reserve funds related to the bank’s exposure to interest rate risk in the banking book; or |

| (iii) |

curtail the bank’s dividend distributions. |

[Regulation 30(4) substituted by section 3(c) of Notice No. 2900, GG47789, dated 23 December 2022- Effective 1 January 2023]

| (5) |

Matters related to the measurement and appropriate management of exposure to interest rate risk in the banking book |

| (a) |

For the measurement and appropriate management of a bank’s exposure to interest rate risk in the banking book, in terms of the risk to both the bank’s economic value as well as earnings, a bank shall have in place a sufficiently robust risk management framework that, as a minimum— |

| (A) |

appropriate approval processes, exposure limits, reviews and other mechanisms designed to provide reasonable assurance that the bank’s risk management objectives in respect of its exposure to interest rate risk in the banking book are achieved; |

| (B) |

regular evaluations and reviews of the bank’s internal control system and risk management processes; |

| (C) |

a comprehensive reporting and review process in respect of the bank’s exposure to interest rate risk in the banking book; |

| (D) |

appropriate escalation procedures in respect of any specified limits that may be exceeded. |

| (i) |

uses an appropriate variety of methodologies to quantify the bank’s exposure to interest rate risk in the banking book, under both the economic value and earnings-based measures, ranging from simple calculations based on static simulations using current holdings to more sophisticated dynamic modelling techniques that reflect the bank’s potential future business activities; |

| (ii) |

duly documents, among others, the major data sources used in the bank’s risk management and measurement processes; |

| (B) |

portfolios that may be subject to significant mark-to-market movements are clearly identified within the bank’s management information systems, and are subject to appropriate oversight; |

| (iii) |

shall include effective management information and measurement systems— |

| (i) |

identify and quantify all material sources impacting the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

compute economic value and earnings-based measures of the bank’s exposure to interest rate risk in the banking book, based upon the relevant interest rate shock and stress scenarios respectively envisaged in items (H) and (I) below; |

| (iii) |

assess the ability of the bank to generate sufficiently stable earnings to sustain its normal business operations; |

| (iv) |

measure the bank’s vulnerability to loss under stressful market conditions, including a breakdown of key assumptions; |

| (v) |

appropriately assess and aggregate all material multicurrency exposures, since yield curves vary from currency to currency, that is, when the bank, for example, has material exposures in different currencies the bank shall develop appropriate methods to aggregate its exposure to interest rate risk in the banking book in different currencies, using appropriate assumptions about the correlation between interest rates in the relevant different currencies. |

| (i) |

interest rate risk data on all the bank’s material exposures to interest rate risk in the banking book |

| (ii) |

the impact of sufficiently severe interest rate shocks— |

| (aa) |

on the bank’s economic value; |

as well as

| (bb) |

on the bank’s earnings; |

| (i) |

the bank continuously measures its exposure to interest rate risk in the banking book, in a timely and accurate manner; |

| (ii) |

data inputs are automated, as much as possible, to reduce the risk of administrative errors; |

| (iii) |

all relevant data mapping is periodically reviewed and tested against an approved model version; |

| (iv) |

the bank duly monitors the type of data extracts, and set appropriate controls; |

| (v) |

all relevant slotting criteria remain stable over time when cash flows are slotted into different time buckets, such as, for example, for purposes of gap analyses, or assigned to different vertex points to appropriately reflect the different tenors of the interest rate curve, to ensure a meaningful comparison of the relevant risk figures over different periods; |

| (D) |

that duly take into consideration the mix of the bank’s business lines, products and the risk characteristics of its activities; |

| (E) |

that assess the effect of market changes on the scope of the bank’s activities; |

| (F) |

that are sufficiently flexible to incorporate such constraints on the bank’s internal risk parameter estimates as may be specified in writing by the Authority; |

| (G) |

that allow the board of directors and senior management to duly understand how an instrument’s actual maturity or repricing behaviour may differ from the instrument’s contractual terms, due to behavioural optionality; |

| (H) |

that are able to measure or calculate, in respect of each relevant currency in which the bank has material positions or exposure, the expected impact on the bank’s economic value of multiple scenarios, based upon— |

| (i) |

the six interest rate shock scenarios specified below: |

| (bb) |

parallel shock down; |

| (cc) |

steepener shock, that is, short rates down and long rates up; |

| (dd) |

flattener shock, that is, short rates up and long rates down; |

| (ee) |

short rates shock up; and |

| (ff) |

short rates shock down, |

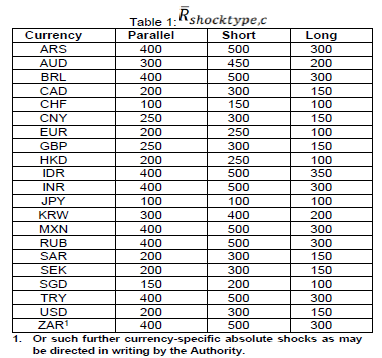

read with the currency-specific absolute shocks and the formulae respectively specified in Table 1 in sub-item (ii) and in sub-item (iii) below;

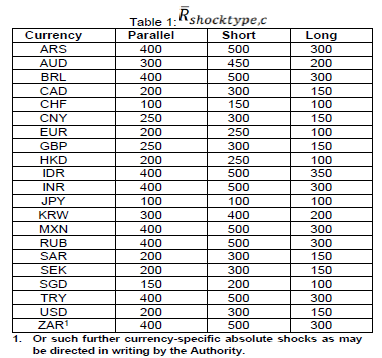

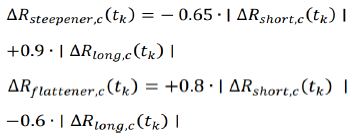

| (ii) |

the currency-specific absolute shocks specified in Table 1 below: |

| (iii) |

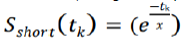

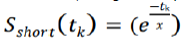

the parameterisations of the relevant instantaneous shock to the risk-free rate through the application of the formulae specified below: |

In the case of—

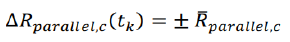

| (aa) |

a constant parallel shock up or down across all relevant time buckets, for currency c: |

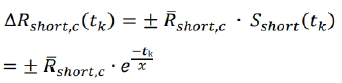

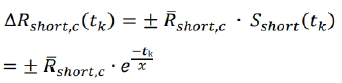

| (bb) |

a short rate shock up or down for currency c, that is greatest at the shortest tenor midpoint: |

which shock, through the shaping scalar

where x = 4, or such other variable as may be directed in writing by the Authority, diminishes towards zero at the tenor of the longest point in the term structure

and

tk is the midpoint (in time) of the kth bucket and tK is the midpoint (in time) of the last bucket K

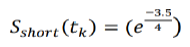

For example, assume the bank uses the standardised framework with K=19 time bands and with tK = 25 years, that is, the midpoint (in time) of the longest tenor bucket K, and where tK is the midpoint (in time) for bucket k.

If k=10 with tK = 3.5 years, the scalar adjustment for the short shock would be equal to 0.417, determined as follows:

The bank shall multiply this result with the value of the short rate shock to obtain the relevant amount to be added to or subtracted from the yield curve at that tenor point, that is, if the short rate shock was +100 bp, the increase in the yield curve at tk = 3.5 years would be 41.7 bp.

| (cc) |

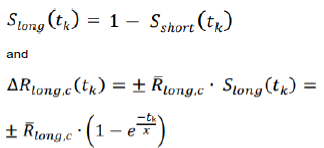

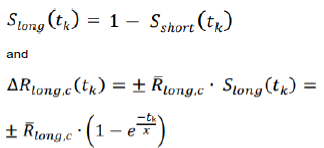

rotational long rate shocks for currency c, where the shock is greatest at the longest tenor midpoint and is related to the short scaling factor |

| (dd) |

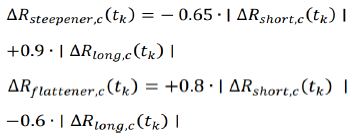

rotation shocks for currency c involving rotations to the term structure, that is, steepeners and flatteners, of the interest rates whereby both the long and short rates are shocked and the shift in interest rates at each tenor midpoint is obtained by applying the relevant formulae specified below to those shocks: |

For example, in the case of a steepener, assume the same point on the yield curve as in sub-item (bb) above, that is, where tk = 3.5 years.

If the absolute value of the short rate shock was 100 bp and the absolute value of the long rate shock was 100 bp, the change in the yield curve at tk = 3.5 years would be the sum of the effect of the short rate shock plus the effect of the long rate shock in basis points, that is, − 0.65 ∙ 100bp ∙ 0.417 + 0.9 ∙ 100bp ∙ (1 − 0.417) = +25.4bp.

In the case of a flattener, the corresponding change in the yield curve for the shocks in the aforementioned example at tk = 3.5 years would be: + 0.8 ∙ 100bp ∙ 0.417 − 0.6 ∙ 100bp ∙ (1 − 0.417) = −1.6bp.

| (iv) |

internally selected interest rate shock scenarios, duly addressing the bank’s risk profile, in accordance with the bank’s board-approved Internal Capital Adequacy Assessment Process (ICAAP); |

| (v) |

historical and hypothetical interest rate stress scenarios, which normally tend to be more severe than shock scenarios; |

| (vi) |

such additional interest rate shock and stress scenarios as may be directed in writing by the Authority; |

| (I) |

that are able to measure or calculate, in respect of each relevant currency in which the bank has material positions or exposure, the expected impact on earnings or net interest income of multiple scenarios, based upon— |

| (i) |

the two interest rate shock scenarios specified below: |

| (aa) |

parallel shock up; and |

| (bb) |

parallel shock down; |

| (ii) |

internally selected interest rate shock scenarios, duly addressing the bank’s risk profile, in accordance with the bank’s board-approved ICAAP; |

| (iii) |

historical and hypothetical interest rate stress scenarios, which normally tend to be more severe than shock scenarios; |

| (iv) |

such additional interest rate shock and stress scenarios as may be directed in writing by the Authority; |

| (b) |

Unless specifically otherwise provided in this regulation 30, whenever a bank— |

| (i) |

computes or calculates its ΔEVE, the bank— |

| (A) |

shall base the computation or calculation on the assumption of a run-off balance sheet, that is, where existing banking book positions amortise and are not replaced by any new business; |

| (B) |

shall include all cash flows from all relevant interest rate-sensitive assets, liabilities and off-balance sheet items in the banking book; |

| (C) |

shall clearly indicate whether it excluded from or included in the respective cash flow amounts commercial margins and any other relevant spread components; |

| (D) |

shall exclude its own equity from the computation of any relevant exposure value; |

| (E) |

shall discount all relevant cash flows using either— |

| (i) |

a risk-free rate, which shall be representative of a risk-free zero coupon rate, such as, for example, a rate derived from a secured interest rate swap curve; or |

| (ii) |

a risk-free rate that includes commercial margins and other spread components if the bank has included commercial margins and other spread components in its relevant cash flows, |

provided that, as stated hereinbefore, the bank shall clearly indicate or disclose whether it has discounted its cash flows using a risk-free rate or a risk-free rate that includes commercial margins and other spread components;

| (ii) |

computes or calculates its ΔNII, the bank— |

| (A) |

shall assume a constant balance sheet, that is, the bank shall assume all maturing or repricing cash flows are replaced by new cash flows with identical features with regard to the amount, repricing period and spread components; |

| (B) |

shall include all relevant expected cash flows, including any relevant commercial margins and other spread components, arising from all interest rate-sensitive assets, liabilities and off-balance sheet items in the banking book, |

| (iii) |

is required to disclose its ΔNII, the bank shall disclose the relevant ΔNII as the difference in future interest income over a rolling 12-month period; |

| (c) |

For the measurement of a bank’s exposure to interest rate risk in the banking book, based upon a change in economic value, that is, ΔEVE, a bank may choose to adopt the approach and method set out in this paragraph (c), which approach shall for purposes of these Regulations be regarded as the standardised approach for the measurement of a bank’s exposure to interest rate risk in the banking book in terms of ΔEVE, provided that— |

| (i) |

the Authority may, in the Authority’s sole discretion, direct a bank in writing to adopt the standardised approach and method set out in this paragraph (c) for the measurement of the bank’s exposure to interest rate risk in the banking book; |

| (ii) |

when the bank adopts or the Authority directs the bank in writing to adopt the standardised approach and method set out in this paragraph (c) for the measurement of the bank’s exposure to interest rate risk in the banking book, the bank shall, based upon the respective requirements specified in this paragraph (c)— |

| (A) |

in respect of each relevant currency in which the bank has material positions or exposure, that is, currencies that individually account for 5% or more of either the bank’s banking book assets or liabilities, calculate the loss in economic value of equity, that is, ΔEVEi,c under scenario i and currency c; |

| (B) |

allocate all relevant interest rate-sensitive banking book positions into one of the following three categories: |

| (i) |

positions amenable to standardisation |

Positions amenable to standardisation may include positions with embedded automatic interest rate options.

When the bank allocates the relevant notional repricing cash flows in accordance with the respective requirements specified in subparagraph (iv) below, the bank shall in the case of positions with embedded automatic interest rate options, whether sold or bought, ignore that optionality during the process of allocation, and treat the said optionality together with all other relevant automatic interest rate options, as envisaged in subparagraph (ix).

For example—

| (aa) |

a floating rate loan or debt security with a floor shall for purposes of subparagraph (iv) be treated as if there was no floor, that is, the instrument shall be treated as if it will fully reprice at the next reset date, and its full outstanding balance shall be allocated to the relevant corresponding time band in accordance with the relevant requirements specified in subparagraph (iv); |

| (bb) |

a callable bond issued by the bank at a fixed yield shall be treated as if it matured at its longest contractual term, ignoring the relevant call option. |

| (ii) |

positions less amenable to standardisation |

A common feature of positions less amenable to standardisation is optionality, which—

| (aa) |

makes the timing of notional repricing cash flows uncertain; and |

| (bb) |

introduces a non-linearity, which makes delta-equivalent approximations imprecise for large interest rate shock scenarios. |

As such, positions less amenable to standardisation shall be excluded from the requirements specified in subparagraph (iv) below related to the allocation of cash flows based on repricing maturities.

A bank shall treat positions with explicit automatic interest rate options, as well as embedded automatic interest rate options in accordance with the relevant requirements specified in subparagraphs (viii) and (ix), where the relevant options must be separated or stripped out from the bank’s relevant assets or liabilities, that is, from the relevant host contract.

An example of a product with embedded automatic interest rate options is a floating rate mortgage loan with embedded caps and/or floors. The bank shall treat the notional repricing cash flows for these loans as a fixed rate loan until the next repricing date, thereby ignoring the option, which, instead, shall be treated like a separate automatic interest rate option.

| (iii) |

positions not amenable to standardisation |

Positions not amenable to standardisation include—

| (aa) |

non-maturity deposits (NMDs); |

| (bb) |

fixed rate loans subject to prepayment risk; and |

| (cc) |

term deposits subject to early redemption risk. |

| (C) |

ensure that any relevant notional repricing cash flow amount, denoted by CF(k), includes— |

| (i) |

any repayment of the relevant principal amount, for example, at the relevant contractual maturity date; |

| (ii) |

any repricing of the relevant principal amount, which repricing shall be deemed to occur at the earliest date at which— |

| (aa) |

either the bank or its counterparty is entitled to unilaterally change the interest rate; or |

| (bb) |

the rate on a floating rate instrument changes automatically in response to a change in an external benchmark rate; |

| (iii) |

any interest payment on a tranche of principal that has not yet been repaid or repriced, that is, for purposes of this regulation 30, spread components of interest payments on a tranche of principal that has not yet been repaid and which do not reprice shall be allocated based upon their contractual maturity irrespective of whether the nonamortised principal has been repriced or not, |

Provided that for purposes of this subregulation (5)(c), the date of each of the aforementioned repayments, repricing or interest payments in respect of a particular item shall be regarded as that particular item’s repricing date.

| (iii) |

the bank shall in each relevant specified case, based upon, among others, the relevant requirements specified in subparagraphs (iv) and (v) below, in respect of each relevant currency in which the bank has material positions or exposure, project or allocate all the relevant future notional repricing cash flows arising from interest rate-sensitive— |

| (A) |

assets that are not deducted from the bank’s Common Equity Tier 1 (CET1) capital and reserve funds, excluding— |

| (i) |

any fixed asset, such as real estate; |

| (ii) |

any intangible asset; and |

| (iii) |

any equity exposure in the banking book; |

| (B) |

liabilities, including all non-remunerated deposits, other than any item that forms part of the bank’s CET1 capital and reserve funds. |

Normally term deposits lock in a fixed rate for a fixed term. However, term deposits are often subject to the risk of early withdrawal, that is, the risk of early redemption.

As such, a bank may only regard term deposits as fixed rate liabilities and allocate their relevant notional repricing cash flows into the relevant time buckets or time bucket midpoints up to their corresponding contractual maturity dates when the bank is able to demonstrate to the satisfaction of the Authority that the depositor has no legal right to withdraw the deposit at an earlier date, and the bank duly enforces that legal right, or the bank imposes a significant penalty in the case of an early withdrawal, that at least compensates the bank for the loss of interest between the date of withdrawal and the contractual maturity date and the economic cost of breaking the contract, provided that—

| (i) |

when the bank is unable to demonstrate to the satisfaction of the Authority that the aforementioned conditions are met, the bank shall regard the relevant term deposits as being subject to early redemption risk, and allocate the relevant notional repricing cash flows in accordance with the relevant requirements specified in subparagraph (v) below; |

| (ii) |

when relevant, the bank shall allocate any term deposit expected to be redeemed early into the overnight time bucket (k=1) or time bucket midpoint (t1); |

| (iii) |

when the aforementioned term deposits that do not meet the required criteria are issued to wholesale customers, the bank shall assume that the customer will always exercise the right to withdraw in a manner that is most disadvantageous to the bank, that is, the bank shall classify the relevant deposits as automatic interest rate options; |

and

| (C) |

off-balance sheet items; |

| (iv) |

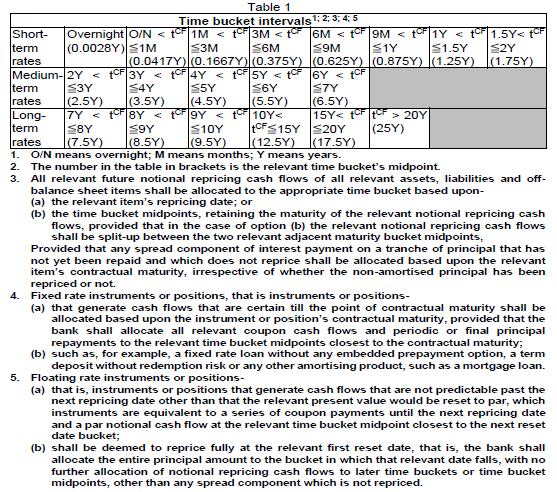

based upon the aforesaid, the bank shall, in the case of positions amenable to standardisation, based upon the respective position’s relevant repricing maturity, allocate the respective notional repricing cash flows to the appropriate time bucket specified in table 1 below, denoted by tCF, provided that the bank may choose whether or not to deduct commercial margins and other spread components from the relevant notional repricing cash flows, using a prudent and transparent methodology. |

| (v) |

based upon the aforesaid, the bank shall, in the case of positions not amenable to standardisation, duly distinguish between— |

| (A) |

non-maturity deposits (NMDs), that is, deposits that often serve as a stable and cost-effective source of funding for the bank, even when market rates change, but in respect of which the depositor is free to withdraw the funds at any time, since the deposit has no contractually agreed maturity date. |

In respect of such NMDs—

| (i) |

the bank shall duly distinguish between the respective categories or types of deposit, based upon the nature of the deposit and the depositor, that is, the bank shall distinguish between— |

| (aa) |

retail deposits, that is, deposits placed with the bank by an individual person, which shall be regarded as held in transactional accounts when regular transactions, such as, for example, salaries, are credited or carried out in that account, provided that— |

| (i) |

deposits made by small business customers and managed by the bank as retail exposures shall for purposes of this item (A) be regarded as having interest rate risk characteristics similar to retail accounts and, as such, may be treated as retail deposits, provided that the total aggregated liabilities raised from one small business customer amounts to less than such amount as may be directed in writing by the Authority from time to time; |

| (ii) |

any other retail deposits that do not comply with the requirements specified hereinbefore shall be deemed to be held in a non-transactional account. |

| (bb) |

wholesale deposits, that is, deposits from institutions, persons or entities such as legal entities, sole proprietorships or partnerships; and |

| (cc) |

non-interest bearing deposits, which, unless specifically otherwise directed in writing by the Authority, shall for purposes of this item (A) be treated in a manner similar to retail deposits. |

| (ii) |

the bank shall also, in respect of each of the aforementioned NMD categories, distinguish between the relevant stable and non-stable and the core and the non-core proportion, based upon observed volume changes during the preceding 10 years. |

For the purposes of the aforementioned required distinction—

| (aa) |

the stable NMD portion means the portion found to remain undrawn with a high degree of likelihood; |

| (bb) |

core deposits mean that proportion of stable NMDs which are unlikely to reprice even in an environment of significant changes in interest rates; |

| (cc) |

NMDs other than the aforementioned categories of NMDs shall be regarded as the non-core portion of NMDs. |

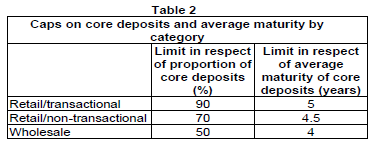

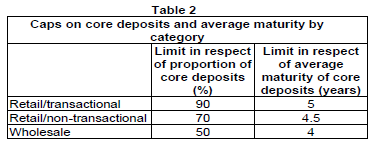

| (aa) |

aggregate the respective amounts to determine the overall volume and proportion of core deposits of each relevant NMD category, the respective proportions of which shall be limited to the respective percentages specified in Table 2 below; and |

| (bb) |

allocate the respective cash flow amounts related to each of the aforementioned categories into the appropriate time buckets or time bucket midpoints envisaged hereinbefore, for which purposes the bank shall— |

| (i) |

regard non-core deposits as overnight deposits and, as such, shall allocate the relevant amounts to the shortest/ overnight time bucket or time bucket midpoint; and |

| (ii) |

for each relevant category of core deposits allocate the relevant amounts up to the maximum average maturity specified in Table 2 below: |

| (B) |

positions with behavioural options, other than NMDs, related to retail customers |

A bank shall—

| (i) |

in respect of fixed rate loans subject to prepayment risk and term deposits subject to early redemption risk, where the bank’s retail customers have an option that, when exercised, alters the timing of the bank’s cash flows, and which option in turn may be influenced, for example, by factors such as changes in interest rate, in the case of— |

| (aa) |

fixed rate loans subject to prepayment risk, that is, cases where the customer has an option to repay the loan early, estimate the optionality in the said products by means of the two-step approach specified in item (C) below. |

| (bb) |

term deposits subject to early redemption risk, that is, cases where the customer has an option to withdraw the deposit before the scheduled date, estimate the optionality in the said products by means of the two-step approach specified in item (D) below. |

| (ii) |

in the case of any wholesale customer with a behavioural option that may change the bank’s expected pattern of notional repricing cash flows, such as, for example, a puttable fixed coupon bond issued by the bank in the wholesale market, in respect of which the owner has the right to sell the bond back to the bank at a fixed price at any time, include the relevant position and option within the category of automatic interest rate options set out in subparagraphs (viii) and (ix); |

| (C) |

fixed rate loans subject to prepayment risk |

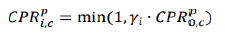

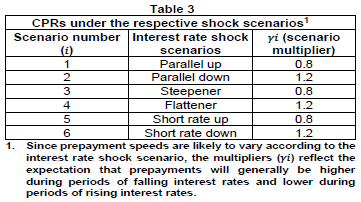

In respect of fixed rate loans subject to prepayment risk where the relevant economic cost is either not charged to the borrower, which is often being referred to as uncompensated prepayments, or charged only for prepayments above a specified threshold, the bank shall firstly calculate the relevant baseline estimates of loan prepayments based upon the current prevailing term structure of interest rates, and in accordance with such further requirements as may be directed in writing by the Authority, and then multiply the aforementioned baseline estimates with scenario-dependent scalars that reflect the likely behavioural changes in the exercise of the options, in accordance with the relevant formulae and requirements specified below:

where:

|

|

is the relevant constant baseline conditional prepayment rate (CPR) for each relevant portfolio, denoted by p, of homogeneous prepayment-exposed loans, denominated in currency c, based upon the prevailing term structure of interest rates, provided that, subject to the prior written approval of and such conditions as may be directed in writing by the Authority, a bank may vary the base CPR over the life of each relevant loan in the portfolio, denoted as:

|

|

|

for each time bucket k or time bucket midpoint tk

|

|

i

|

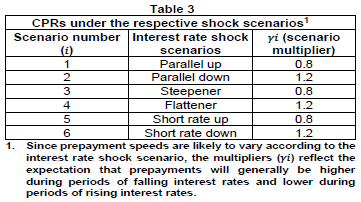

is the relevant interest rate scenario, as envisaged in table 3 below

|

|

|

is the relevant multiplier applied for scenario ����, as set out in table 3 below:

|

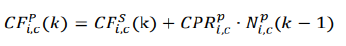

In order to ensure that all the relevant scheduled payments are appropriately adjusted for the aforementioned prepayment risk and uncompensated prepayments, the bank shall calculate the relevant cash flows related to the fixed rate loans subject to prepayment risk in accordance with the formula specified below:

where:

The base cash flows, given the current interest rate yield curve and the base CPR, are given by i = 0, while the respective interest rate shock scenarios are given for i = 1 to 6.

|

|

means the relevant scheduled interest and principal repayment

|

|

|

means the relevant notional outstanding amount at time bucket k–1

|

Provided that when an annual limit applies in respect of uncompensated prepayments, the bank shall appropriately apply that limit in the calculation of the relevant required cash flows.

| (D) |

term deposits subject to early redemption risk |

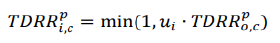

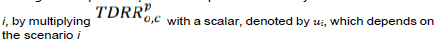

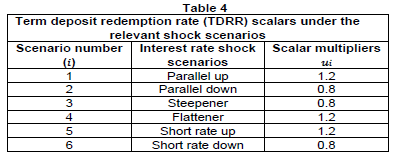

In respect of term deposits subject to early redemption risk the bank shall, in order to appropriately allocate the relevant notional repricing cash flows, firstly calculate the relevant baseline estimates of early withdrawal of fixed term deposits based upon the current prevailing term structure of interest rates, and in accordance with such further requirements as may be directed in writing by the Authority, and then multiply the aforementioned baseline estimates with scenario-dependent scalars that reflect the likely behavioural changes in the exercise of the options, in accordance with the relevant formulae and requirements specified below:

that is, the bank shall obtain the relevant term deposit redemption ratio for time bucket k or time bucket midpoint tk, applicable to each relevant homogeneous portfolio p of term deposits in currency c and under scenario

where:

|

|

means the relevant baseline term deposit redemption ratio applicable to each relevant homogeneous portfolio p of term deposits in currency c

|

|

i

|

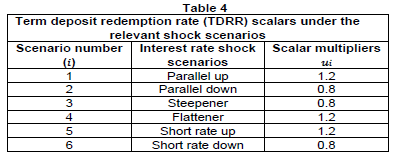

is the relevant scenario, envisaged in table 4 below

|

|

ui

|

is the relevant scalar applied for scenario as set out in table 4 below:

|

and

means the relevant notional repricing cash flows expected to be withdrawn early under interest rate shock scenario i

where:

|

|

is the relevant outstanding amount of term deposits of type p

|

| (vi) |

the bank shall then, in respect of each relevant currency in which the bank has material positions or exposure, and for all the relevant interest rate shock scenarios envisaged hereinbefore, determine the relevant ΔEVE, prior to the add-on that relates to any relevant interest rate option, envisaged in subparagraphs (viii) and (ix) below, that is, in respect of— |

| (A) |

each relevant scenario �, based upon the respective requirements specified hereinbefore, the bank shall— |

| (i) |

allocate the respective notional repricing cash flows into the respective time bucket k ε {1,2, ... ,K} or time bucket midpoint tk, k ε {1,2, ... ,K}; |

| (ii) |

within a given time bucket k or time bucket midpoint tk, net all relevant positive and negative notional repricing cash flows, to form a single long or short position; |

| (iii) |

then eventually have a set of notional repricing cash flows across all relevant time buckets or time bucket midpoints, CFi,c(k) or CFi,c(tK), k ε {1,2, … ,K}; |

| (B) |

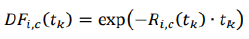

each relevant time bucket k or time bucket midpoint tK the bank shall calculate weighted net notional repricing cash flows, which may be positive or negative, that reflects the interest rate shock scenario i in currency c, by means of the application of a continuously compounded discount factor, in accordance with the formula specified below: |

where:

tK is the midpoint of time bucket k;

and

the bank shall discount the respective cash flows by using either a risk-free rate, representative of a risk-free zero coupon rate, or a risk-free rate including commercial margin and other spread components when the bank has included commercial margins and other spread components in the relevant cash flow amounts.

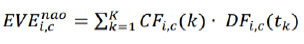

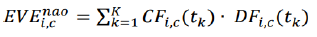

| (vii) |

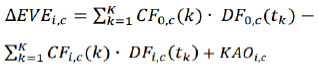

based upon the aforesaid, the bank shall then aggregate the respective risk-weighted net positions, in order to determine the EVE in currency c under scenario i, excluding automatic interest rate option positions, as follows: |

In the case of a bank that uses—

| (B) |

maturity bucket midpoints |

| (viii) |

the bank shall then, in accordance with the relevant requirements specified in subparagraph (ix) below, calculate the relevant required add-on in respect of all relevant explicit and embedded sold automatic interest rate options, such as, for example— |

| (A) |

caps and floors, which are often embedded in banking products; |

| (B) |

swaptions, such as prepayment options on non-retail products; |

| (C) |

behavioural option positions with wholesale customers that may change the pattern of notional repricing cash flows, |

Provided that—

| (i) |

all relevant interest rate options sold shall be subject to full revaluation; and |

| (ii) |

the bank may choose to also include in the relevant calculation— |

| (aa) |

all bought automatic options; or |

| (bb) |

only automatic options used to hedge sold automatic interest rate options. |

| (ix) |

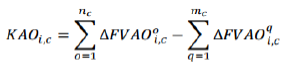

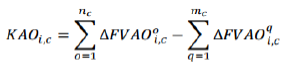

the bank shall then calculate the relevant total measure related to automatic interest rate option risk under interest rate shock scenario i in currency c, in accordance with the formulae specified below: |

where:

|

|

means the change in value for each sold automatic option o in currency c, for each relevant interest rate shock scenario i

that is, based upon the relevant methodology and any specific conditions specified in writing by the Authority, the bank shall determine the value change by:

| • |

estimating the value of the option to the option holder, given: |

| o |

a yield curve in currency c under the interest rate shock scenario i; and |

| o |

a relative increase in the implicit volatility of 25%; |

minus

| • |

the value of the sold option to the option holder, given the yield curve in currency c at the valuation date. |

|

|

nc

|

means the number of sold options in currency c

|

|

|

means, in respect of every relevant bought automatic interest rate option, denoted by q, the relevant change in the option’s value between interest rate shock scenario i and the current interest rate term structure, combined with a relative increase in the implicit volatility of 25%,

|

|

mc

|

means the number of bought options in currency c

|

Provided that, when the bank decided to include only bought automatic interest rate options used to hedge sold automatic interest rate options in the calculations up to this point, the bank shall, in respect of all the relevant remaining bought options, add to the total automatic interest rate option risk measure determined in accordance with the requirements specified hereinbefore, that is,  , any changes in the market values reflected in the bank’s respective components of capital and reserve funds, such as, for example, CET1, AT1 or total capital.

, any changes in the market values reflected in the bank’s respective components of capital and reserve funds, such as, for example, CET1, AT1 or total capital.

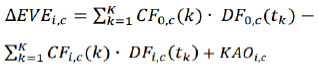

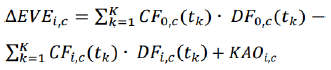

| (x) |

the bank shall then subtract  from the EVE in respect of the current interest rate term structure from the EVE in respect of the current interest rate term structure  and add the total measure for automatic interest rate option risk and add the total measure for automatic interest rate option risk  to obtain the full change in EVE in currency c associated with scenario i, as follows: to obtain the full change in EVE in currency c associated with scenario i, as follows: |

In the case of a bank that uses—

| (B) |

maturity bucket midpoints |

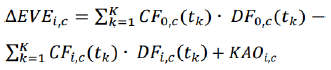

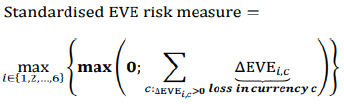

| (xi) |

the bank shall then finally calculate the amount of ΔEVE in respect of its exposure to interest rate risk in the banking book as the maximum of the worst aggregated reductions to EVE across the relevant specified six interest rate shock scenarios, that is, the bank shall aggregate the respective EVE losses ΔEVEi,c > 0 under a given interest rate shock scenario i, and the maximum loss across the respective interest rate shock scenarios shall be the bank’s relevant required EVE risk measure, which is expressed mathematically as: |

| (d) |

A bank’s risk and internal capital adequacy assessment process (ICAAP) and related measures— |

| (i) |

shall duly take into consideration the complementary nature of economic value and earnings-based measures in terms of, for example— |

| (A) |

outcomes, in respect of which— |

| (i) |

the economic value measures typically compute a change in the net present value of the bank’s assets, liabilities and off-balance sheet items subject to specific interest rate shock and stress scenarios; whilst |

| (ii) |

the earnings-based measures typically focus on changes to future profitability within a given time horizon, eventually affecting future levels of the bank’s own equity capital; |

| (B) |

assessment horizons, in respect of which— |

| (i) |

the economic value measures typically reflect changes in value over the remaining life of the bank’s assets, liabilities and off-balance sheet items, that is, until all positions have completely run off; whilst |

| (ii) |

the earnings-based measures typically cover only the short to medium term, and therefore do not completely capture risks that will continue to impact the bank’s profit and loss accounts beyond the period of estimation; |

| (C) |

future business, in respect of which— |

| (i) |

the economic value measures typically consider the net present value of repricing cash flows of instruments on the bank’s balance sheet or accounted for as an off-balance sheet item, that is, a socalled run-off view; whilst |

| (ii) |

the earnings measures may, in addition to a so-called run-off view, assume rollover of maturing items, that is, a so-called constant balance sheet view, and/or assess the scenario-consistent impact on the bank’s future earnings inclusive of future business, that is, a so-called dynamic view. |

| (ii) |

shall comply with the relevant requirements specified in subregulation (7), and such further requirements as may be directed in writing by the Authority. |

| (e) |

A bank’s stress testing framework related to its exposure to interest rate risk in the banking book— |

| (i) |

shall facilitate and actively promote ongoing effective collaboration between all relevant senior executives or functions responsible for the identification of relevant shock and stress scenarios, the application of sound modelling approaches and the appropriate use of the stress testing results, which may include, for example, the treasury department, the finance department, traders, the ALCO, the risk management and risk control departments and/or the bank’s economist(s); |

| (ii) |

shall be sufficiently robust to ensure that— |

| (A) |

the bank determines a range of potential interest rate movements, per currency in which the bank has material positions or exposure, against which the bank then measures its exposure to interest rate risk in the banking book; |

| (B) |

the bank’s risk exposure is measured under a reasonable range of potential interest rate scenarios, including some containing sufficiently severe stress elements; |

| (C) |

when the bank develops relevant scenarios, a variety of factors are considered, such as, for example— |

| (i) |

the shape and level of the current term structure of interest rates; |

| (ii) |

the historical and implied volatility of interest rates; |

| (iii) |

interest rate assumptions to measure the bank’s exposure to changes in interest rate volatilities, since the market value of options, for example, fluctuates with changes in the volatility of interest rates; |

| (iv) |

the need to also consider the possibility of negative interest rate scenarios; |

| (v) |

the possibility of asymmetrical effects of negative interest rates on the bank’s assets and liabilities; |

| (D) |

when the bank develops its interest rate shock and stress scenarios for its exposure to interest rate risk in the banking book— |

| (aa) |

are sufficiently wide-ranging to identify parallel and non-parallel gap risk, basis risk and option risk; |

| (bb) |

are both sufficiently severe and plausible, in light of the existing level of interest rates and the interest rate cycle; |

| (cc) |

include forward-looking scenarios that incorporate— |

| (i) |

changes in portfolio composition due to factors under the control of the bank, such as, for example, the bank’s acquisition and production plans, as well as external factors, such as, for example, changing competitive, legal or tax environments; |

| (ii) |

new products where only limited historical data are available; |

| (iii) |

new market information and new emerging risks that are not necessarily covered by historical stress episodes; |

| (ii) |

the bank duly considers material concentrations in instruments or markets, since it is more difficult to liquidate or offset concentrated positions in a stressful market environment; |

| (iii) |

the bank clearly specifies the term structure of interest rates that will be incorporated and the basis relationship between the relevant yield curves, rate indices, etc.; |

| (iv) |

the bank estimates how interest rates administered or managed by management, such as, for example, prime rates or retail deposit rates, as opposed to those that are purely market driven, might change; |

| (v) |

the bank duly assesses— |

| (aa) |

the possible interaction between its exposure to interest rate risk in the banking book and other related risks, as well as any other relevant risks, such as, for example, credit risk and liquidity risk; |

| (bb) |

the effect of adverse changes in the spreads of new assets or liabilities replacing assets or liabilities that mature over the horizon of the bank’s forecast of its net interest income (NII); |

| (vi) |

the bank duly documents all relevant assumptions; |

| (E) |

when the bank is exposed to significant option risk, the aforementioned scenarios include scenarios that appropriately capture the exercise of such options. |

For example, when the bank has products with sold caps or floors, the bank shall include scenarios that assess how the risk positions would change should those caps or floors move into the money.

| (F) |

the bank performs qualitative and quantitative reverse stress tests in order to, at least— |

| (i) |

identify interest rate scenarios that could severely threaten the bank’s capital and earnings; and |

| (ii) |

reveal vulnerabilities arising from the bank’s hedging strategies and the potential behavioural reactions of its customers. |

[Regulation 30(5) inserted by section 3(d) of Notice No. 2900, GG47789, dated 23 December 2022- Effective 1 January 2023]

| (6) |

Matters related to behavioural and modelling assumptions |

| (a) |

Since both the economic value and earnings-based measures of a bank’s exposure to interest rate risk in the banking book are likely to be significantly impacted by assumptions made for risk quantification purposes, the bank— |

| (i) |

shall obtain the prior written approval of its board of directors or a board-approved committee in respect of any material behavioural assumptions or adjustments made in the measurement of the bank’s exposure to interest-rate risk in the banking book; |

| (ii) |

shall ensure that its modelling assumptions are at least conceptually sound, reasonable and consistent with historical experience; |

| (iii) |

shall periodically perform sensitivity analyses in respect of both economic value and earnings-based measures for all its key assumptions to monitor their impact on the bank’s measured exposure to interest rate risk in the banking book; |

| (iv) |

shall on a sufficiently frequent basis test the appropriateness of all its key behavioural and measurement assumptions. |

Since market conditions, competitive environments and strategies change over time, the bank shall review significant measurement assumptions at least annually, or more frequently during rapidly changing market conditions.

For example, when the competitive market has changed such that consumers have lower transaction costs available to them for refinancing their residential mortgages, prepayments may become more sensitive to smaller changes in interest rates.

| (v) |

shall consider, among others, the materiality of the impact of behavioural optionalities within floating rate loans, since the behaviour of prepayments arising from embedded caps and floors may have a material impact on the bank’s economic value of equity; |

| (vi) |

shall duly document— |

| (A) |

all material assumptions made underlying the bank’s exposure to interest rate risk in the banking book; |

| (B) |

all changes made over time to the assumptions related to key parameters; |

| (C) |

how the assumptions may potentially affect the bank’s hedging strategies; |

Provided that on prior written request, the bank shall in writing provide to the Authority any relevant required information relating to the assumptions or adjustments approved by the bank’s board of directors or board-approved committee in respect of the bank’s exposure to interest-rate risk in the banking book.

| (b) |

The assumptions envisaged in paragraph (a) hereinbefore may, for example, related to— |

| (i) |

the volume and type of— |

| (A) |

new or replacement assets and liabilities expected to be originated over the time period that the bank assesses its exposure to interest rate risk in the banking book; |

| (B) |

asset and liability redemptions or reductions over the time period that the bank assesses its exposure to interest rate risk in the banking book; |

| (ii) |

the interest rate bases and margins associated— |

| (A) |

with the aforementioned new assets and liabilities; and |

| (B) |

with assets and liabilities redeemed or withdrawn; |

| (iii) |

the impact of any fees collected and/ or paid for the exercise of options; |

| (iv) |

expectations for the exercise of explicit and/ or embedded interest rate options, by both the bank and its customers, under specific interest rate shock and stress scenarios; |

| (v) |

the treatment of balances and interest flows arising from non-maturity deposits; |

| (vi) |

the treatment of the implied investment term of own equity; |

| (vii) |

the implications of accounting practices for the measurement of the bank’s exposure to interest rate risk in the banking book; |

| (x) |

how an instrument’s actual maturity or repricing behaviour may differ from the instrument’s contractual terms, as a result of behavioural optionalities, |

| (c) |

A bank shall ensure that its exposure to behavioural optionalities in its respective products and portfolios is well understood, at least by the bank’s board of directors and senior management, which products, portfolios and behavioural optionalities, for example, may include or relate to— |

| (i) |

the bank’s fixed rate loans subject to prepayment risk |

As such, the bank shall ensure that—

| (A) |

it makes reasonable and prudent estimates in respect of any expected prepayment risk; |

| (i) |

the nature of prepayment risk in relation to its respective products and portfolios; |

| (ii) |

the factors that were applied in estimating the effect of each interest rate shock and stress scenario on the average prepayment speed; |

| (C) |

it duly assesses the expected average prepayment speed under each relevant scenario; |

| (D) |

it duly documents the assumptions underlying the said estimates and where prepayment penalties or other contractual features affect the embedded optionalities. |

| (ii) |

the bank’s fixed rate loan commitments in respect of which the bank, for example, may sell options to retail customers, such as prospective mortgage buyers in terms of which, for a limited period, the customers may choose to draw down a loan at a committed rate; |

| (iii) |

the bank’s term deposits subject to early redemption risk, that is, the bank may, for example, attract deposits with a contractual maturity term or with step-up clauses that enable the relevant depositors at different time periods to modify the speed of redemption. |

As such, the bank shall duly document whether a term deposit, for example, is subject to redemption penalties or to other contractual features that preserve the cash flow profile of the instrument.

| (iv) |

non-maturity deposits in respect of which the bank’s behavioural assumptions relating to a specific repricing date may have a material impact on the bank’s exposure to interest rate risk in the banking book, under both the economic value and the earnings-based measures. |

As such, the bank must—

| (A) |

duly document, monitor and regularly update the respective key assumptions made in relation to its non-maturity deposits and the behaviour applied in the bank’s risk measurement and information systems, which assumptions may vary according to— |

| (i) |

depositor characteristics, such as, for example, retail deposits versus wholesale deposits; and |

| (ii) |

account characteristics, such as, for example, transactional versus non-transactional deposits or funding; |

| (B) |

analyse its depositor base in order to identify, among others, the relevant proportion of core deposits which are unlikely to reprice even under significant changes in the interest rate environment; |

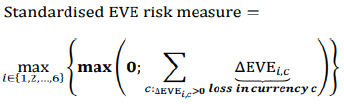

| (d) |

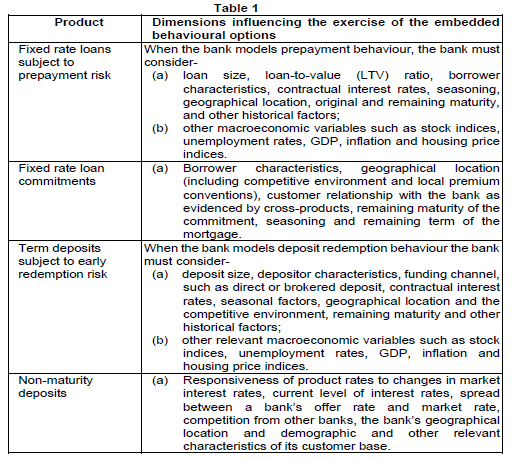

Based upon, among others, the respective requirements specified in paragraph (c) hereinbefore, the bank shall carefully consider how the exercise of behavioural optionalities may vary not only under a particular interest rate shock or stress scenario but also across other dimensions, such as, for example, in relation to the product or portfolio dimensions envisaged in table 1 below: |

| (e) |

A bank shall maintain an appropriate audit trail in respect of the data underlying the base models used for the completion of the form BA 330, which audit trail— |

| (i) |

shall include a comprehensive reconciliation between the relevant amounts of assets and liabilities included in the bank’s management and board reports and the relevant assets and liabilities relating to banking activities respectively included in the forms BA 330 and BA 100; |

| (ii) |

shall duly explain any relevant reconciliation differences; |

| (iii) |

on prior written request, shall be submitted in writing to the Authority. |

[Regulation 30(6) inserted by section 3(e) of Notice No. 2900, GG47789, dated 23 December 2022- Effective 1 January 2023]

| (7) |

Matters related to the bank’s Internal Capital Adequacy Assessment Process (ICAAP) |