National Credit Act, 2005 (Act No. 34 of 2005)

National Credit Act, 2005 (Act No. 34 of 2005)

R 385

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (16) Exposure to Central Counterparties and matters related thereto |

[Subregulation (16) Heading substituted by section 3(i) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

| (16) | Exposure to Central Counterparties and matters related thereto |

| (a) | A bank shall calculate its relevant exposure to central counterparties arising from any OTC derivative instrument, exchange-traded derivative instrument, securities financing transaction or long settlement transaction, and the bank’s related required amount of capital and reserve funds, in accordance with the relevant requirements specified in this subregulation (16), provided that— |

| (i) | any relevant exposure arising from the settlement of cash transactions in respect of equities, fixed income, spot FX or spot commodities shall be calculated in accordance with the relevant requirements specified in subregulation (20) below, provided that in the case of any contributions to prepaid default funds covering settlement-risk-only products, the bank shall apply a risk weight of zero per cent; |

| (ii) | when the clearing member-to-client leg of any relevant exchange-traded derivative transaction is conducted in terms of a bilateral agreement, both the client bank and the relevant clearing member shall calculate the relevant exposure amount and the required amount of capital and reserve funds in accordance with the relevant requirements related to an OTC derivative instrument, for which purposes the provisions of paragraph (b)(ii) below shall mutatis mutandis apply; |

| (iii) | the provisions of subparagraph (ii) above shall apply mutatis mutandis to any relevant transaction between lower level clients and higher level clients in the case of any multilevel client structure; |

| (iv) | the bank shall ensure that it continuously maintains sufficient capital and reserve funds for all relevant exposures related to counterparty credit risk, including in respect of any relevant exposure to a qualifying central counterparty, that is, the bank shall, for example, consider whether it needs to maintain capital in excess of the minimum required amount of capital and reserve funds specified in terms of the provisions of these Regulations when the bank’s relevant transactions with a central counterparty give rise to more risky exposures than what is provided for or envisaged in these Regulations, or when the bank is uncertain whether or not the relevant counterparty is or may indeed be regarded as a qualifying central counterparty; |

| (v) | when the bank acts as a clearing member, the bank shall continously assess through appropriate scenario analysis and stress testing whether the level of capital and reserve funds maintained against the bank’s exposures to a central counterparty adequately addresses the risks inherent in the relevant transactions, which assessment shall, for example, include all relevant potential future exposure or contingent exposure resulting from future drawings on default fund commitments, and/or from secondary commitments to take over or replace offsetting transactions from clients of another clearing member when that clearing member defaults or becomes insolvent; |

| (vi) | the bank shall on a regular basis monitor and report to its senior management and the appropriate committee of the bank’s board of directors, all relevant exposures to central counterparties, including all relevant exposures arising from trading through a central counterparty and exposures arising from central counterparty membership obligations, such as default fund contributions; |

| (vii) | when the bank clears derivative instruments, securities financing transactions or long settlement transactions through a qualifying central counterparty, the bank shall calculate its relevant exposure amount and the related required amount of capital and reserve funds in accordance with the relevant requirements specified in paragraph (b) below, provided that— |

| (A) | subject to the prior written approval of and such conditions as may be specified in writing by the Authority, when a central counterparty no longer complies with the relevant requirements related to a qualifying central counterparty, the bank may continue to treat all relevant transactions with that counterparty in accordance with the relevant requirements specified in paragraph (b) below, for a maximum period of up to three months following the date on which that counterparty no longer complies with the said requirements, whereafter the bank shall calculate its relevant exposure amount and the related required amount of capital and reserve funds in accordance with the relevant requirements specified in paragraph (c) below; |

| (B) | when the sum of the bank’s relevant capital requirements in respect of exposures to a qualifying central counterparty related to its relevant trade exposures and default fund contributions is higher than the total capital requirement that would apply to those same exposures if the central counterparty was a non-qualifying central counterparty, the bank shall maintain the latter required amount of capital and reserve funds in respect of its relevant exposures, that is, the total capital requirement in respect of all relevant exposures to a qualifying central counterparty shall not exceed the total capital requirement for the same exposures if the central counterparty was a non-qualifying central counterparty; |

| (viii) | when the bank clears derivative instruments, securities financing transactions or long settlement transactions through a non-qualifying central counterparty, the bank shall calculate its relevant exposure amount and the related required amount of capital and reserve funds in accordance with the relevant requirements specified in paragraph (c) below. |

| (b) | Exposures to qualifying central counterparties |

| (i) | Clearing member trade exposures to qualifying central counterparties |

Subject to the provisions of subparagraph (v) below, when a bank acts as a clearing member of a qualifying central counterparty for its own purposes, the bank shall in respect of all relevant OTC derivative transactions, exchange traded derivative transactions, securities financing transactions and long-settlement transactions apply a risk weight of 2 per cent to the bank’s relevant trade exposure to the qualifying central counterparty, provided that—

| (A) | when the said bank acting as a clearing member offers clearing services to clients, the 2 per cent risk weight shall also apply to the clearing member’s trade exposure to the qualifying central counterparty that arises when the clearing member is obligated to reimburse the client for any losses suffered due to changes in the value of its transactions in the event that the qualifying central counterparty defaults, provided that the bank shall determine the risk weight to be applied to any collateral posted by the bank to the relevant qualifying central counterparty in accordance with the relevant requirements specified in subparagraph (v) below; |

| (B) | the bank shall calculate the relevant exposure amount for such trade exposure in accordance with the relevant requirements related to the standardised approach or the internal model method for exposure to counterparty credit risk, respectively specified in subregulations (18) and (19) below, as the case may be, read with the relevant requirements specified in subregulation (9) in respect of collateralised exposure, provided that— |

| (i) | in all relevant cases, when the bank wishes to calculate the relevant exposure amount for any relevant trade exposure in accordance with the internal model method, the bank shall apply to the Authority to obtain the Authority’s prior written approval to extend the scope of the internal model method to include centrally cleared products, that is, even when the bank obtained the prior written approval of the Authority to include non-centrally cleared products, the bank shall not extend the scope of the internal model method to include centrally cleared products without the explicit prior written approval of the Authority; |

| (ii) | in the case of a bank that obtained the approval of the Authority to adopt the internal model method, the relevant specified 20-day floor for the margin period of risk, related to the number of transactions, shall not apply, provided that the relevant netting set does not contain illiquid collateral or exotic trades, and there are no disputed trades; |

| (iii) | in all relevant cases the bank shall apply a minimum margin period of risk of 10 days for the calculation of trade exposures to central counterparties in respect of OTC derivative transactions or instruments; |

| (iv) | when a central counterparty retains variation margin against certain trades, such as, for example, when a central counterparty collects and holds variation margin against positions in exchange-traded or OTC forwards, and the member collateral is not protected against the insolvency of the central counterparty, the minimum time risk horizon applied to the bank’s relevant trade exposures on those trades shall be the lesser of one year and the remaining maturity of the transaction, subject to a floor of 10 business days; |

| (C) | when settlement is legally enforceable on a net basis in an event of default, regardless of whether the counterparty is insolvent or bankrupt, the bank may calculate the relevant total replacement cost of all contracts relevant to the trade exposure determination on a net replacement cost basis, provided that the relevant close-out netting sets— |

| (i) | shall in the case of all relevant repo-style transactions comply with all the relevant requirements specified in subregulation (9)(b)(xvi); |

| (ii) | shall in the case of all relevant transactions in derivative instruments comply with all the relevant requirements specified in subregulation (18); |

shall in all relevant cases related to cross-product netting comply with all the relevant requirements specified in subregulation (19)(d):

Provided that when a bank is unable to demonstrate to the satisfaction of the Authority that all relevant netting agreements duly comply with the aforesaid requirements, the bank shall regard each relevant single transaction as a netting set of its own for purposes of calculating its relevant trade exposure amount.

| (ii) | Clearing member trade exposures to clients |

Without derogating from the provisions of subparagraph (v) below, a bank that acts as a clearing member shall in all relevant cases calculate its relevant exposures, including any potential CVA risk exposure, to clients as bilateral trades, irrespective of whether the clearing member guarantees the trade or acts as an intermediary between the client and the relevant qualifying central counterparty, provided that—

| (A) | in order to recognise the shorter close-out period for cleared client transactions, a bank that acts as a clearing member and that adopted either the standardised approach or the internal model method for the measurement of the bank’s exposure to counterparty credit risk may calculate its relevant exposure amount to clients and the related required amount of capital and reserve funds by app lying a margin period of risk of no less than 5 days, provided that the bank shall also use the resultant reduced EAD amount for the calculation of any relevant capital requirement for CVA risk in terms of the standardised or advanced approach or method; |

| (B) | when a bank that acts as a clearing member collects collateral from a client in respect of client cleared trades and that collateral is passed on to the relevant central counterparty, the bank may recognise that collateral for both the central counterparty clearing member leg and the clearing member-client leg of the relevant client cleared trade. |

Therefore, the initial margin posted by clients to their clearing member mitigates the exposure the clearing member has against these clients. The same treatment shall apply in a similar manner to multi-level client structures, between a higher level client and a lower level client.

| (iii) | Client trade exposures: clearing member acting as a financial intermediary |

When a bank is a client of a clearing member, and the bank enters into a transaction with the said clearing member acting as a financial intermediary, that is, the clearing member completes an offsetting transaction with a qualifying central counterparty, the bank’s exposures to the clearing member may be calculated in accordance with the relevant requirements specified in subparagraph (i) above, provided that—

| (A) | the relevant qualifying central counterparty shall identify the relevant offsetting transactions as client transactions and the qualifying central counterparty and/or the clearing member, as the case may be, shall hold collateral to support the relevant transactions, in a manner that prevents any losses to the client due to— |

| (i) | the default or insolvency of the clearing member; |

| (ii) | the default or insolvency of the clearing member’s other clients; and |

| (iii) | the joint default or insolvency of the clearing member and any of its other clients. |

That is, upon the insolvency of the clearing member, there shall be no legal impediment, other than the need to obtain a court order to which the client is entitled, to the transfer of the collateral belonging to the clients of a defaulting clearing member to the qualifying central counterparty, to one or more other surviving clearing members or to the client or the client’s nominee.

| (B) | the relevant bank or client shall have conducted a robust legal review, and shall undertake such further review(s) as may be necessary to ensure continued enforceability, and have a well-founded legally enforceable basis to conclude that, in the event of legal challenge, the relevant courts and administrative authorities would find that the aforesaid arrangements are legal, valid, binding and enforceable in terms of all the relevant laws of all the relevant jurisdictions; |

| (C) | relevant laws, regulation, rules, contractual, or administrative arrangements shall provide that the offsetting transactions with the defaulted or insolvent clearing member are highly likely to continue to be indirectly transacted through the relevant qualifying central counterparty, or by the qualifying central counterparty, if the clearing member defaults or becomes insolvent, and in which case the client positions and collateral with the relevant qualifying central counterparty shall be transferred at market value, unless the client requests to close out the position at market value; |

| (D) | when all the relevant conditions and requirements specified in the preceding items (A) to (C) of this subparagraph (iii) are met, except that the relevant client is not protected from losses in the case that the clearing member and another client of the clearing member jointly default or become jointly insolvent, a risk weight of 4 per cent shall apply in respect of the relevant client exposure to the clearing member, or to the relevant higher level client exposure in a multi-level client structure, respectively; |

| (E) | when the bank is a client of the clearing member and the conditions and requirements envisaged in items (A) to (D) hereinbefore are not met, the bank shall calculate all relevant exposures and the related required amount of capital and reserve funds, including any relevant CVA risk exposure, to the relevant clearing member on a bilateral trade basis; |

| (F) | when all the relevant conditions and requirements specified in the preceding items (A) to (C) of this subparagraph (iii) are met in respect of all the relevant client exposures of lower level clients to higher level clients in a multi-level client structure, that is, in respect of all the relevant client levels in-between, the provisions of subparagraph (i) above may be applied to the relevant exposures of all the said client levels in-between. |

| (iv) | Client trade exposures: clearing member guaranteeing performance |

When a bank that is a client of a clearing member enters into a transaction with a qualifying central counterparty, and the clearing member guarantees the bank’s performance, the bank’s exposures to the qualifying central counterparty may be calculated in accordance with the relevant requirements specified in subparagraph (i) above, provided that—

| (A) | the relevant qualifying central counterparty shall identify the relevant offsetting transactions as client transactions and the qualifying central counterparty and/or the clearing member, as the case may be, shall hold collateral to support the relevant transactions, in a manner that prevents any losses to the client due to— |

| (i) | the default or insolvency of the clearing member; |

| (ii) | the default or insolvency of the clearing member’s other clients; and |

| (iii) | the joint default or insolvency of the clearing member and any of its other clients. |

That is, upon the insolvency of the clearing member, there shall be no legal impediment, other than the need to obtain a court order to which the client is entitled, to the transfer of the collateral belonging to the clients of a defaulting clearing member to the qualifying central counterparty, to one or more other surviving clearing members or to the client or the client’s nominee.

| (B) | the relevant bank or client shall have conducted a robust legal review, and shall undertake such further review(s) as may be necessary to ensure continued enforceability, and have a well-founded legally enforceable basis to conclude that, in the event of legal challenge, the relevant courts and administrative authorities would find that the aforesaid arrangements are legal, valid, binding and enforceable in terms of all the relevant laws of all the relevant jurisdictions; |

| (C) | relevant laws, regulation, rules, contractual, or administrative arrangements shall provide that the offsetting transactions with the defaulted or insolvent clearing member are highly likely to continue to be indirectly transacted through the relevant qualifying central counterparty, or by the qualifying central counterparty, if the clearing member defaults or becomes insolvent, and in which case the client positions and collateral with the relevant qualifying central counterparty shall be transferred at market value, unless the client requests to close out the position at market value; |

| (D) | when all the relevant conditions and requirements specified in the preceding items (A) to (C) of this subparagraph (iv) are met, except that the relevant client is not protected from losses in the case that the clearing member and another client of the clearing member jointly default or become jointly insolvent, a risk weight of 4 per cent shall apply to the relevant client exposure to the clearing member, or to the relevant higher level client exposure in a multi-level client structure, respectively; |

| (E) | when the bank is a client of the clearing member and the conditions and requirements envisaged in items (A) to (D) hereinbefore are not met, the bank shall calculate all relevant exposures and the related required amount of capital and reserve funds, including any relevant CVA risk exposure, to the relevant clearing member on a bilateral trade basis. |

| (v) | Matters related to posted collateral |

In all relevant cases, any asset or collateral posted or provided shall, from the perspective of the bank posting or providing such collateral, be assigned the relevant risk weight that otherwise applies to such asset or collateral in terms of the relevant provisions or requirements specified in these Regulations, regardless of the fact that such asset has been posted or provided as collateral, that is, all collateral posted shall be subject to the relevant requirements specified in these Regulations related to banking book or trading book positions, as the case may be, as if the collateral had not been posted to the relevant central counterparty, provided that—

| (A) | in addition, the said collateral shall be subject to the relevant requirements specified in these Regulations related to counterparty credit risk exposures, irrespective of whether such collateral is held in the bank’s banking book or trading book; |

| (B) | when an asset or collateral of a clearing member or client is posted with or provided to a qualifying central counterparty or a clearing member, and the asset or collateral so posted or provided is not held in a bankruptcy remote manner, the bank posting or providing such asset or collateral shall also recognise the related credit risk exposure, based upon the asset or collateral being exposed to a risk of loss that is based on the creditworthiness of the entity or person holding such asset or collateral, provided that— |

| (i) | when the entity or person holding such asset or collateral is the qualifying central counterparty, a risk weight of 2 per cent shall apply to collateral included in the definition of trade exposure; and |

| (ii) | the relevant risk weight of the qualifying central counterparty shall apply to assets or collateral posted or provided for any purpose other than the situation provided for in the aforesaid sub-item (i) above; |

| (C) | a bank that adopted— |

| (i) | the standardised approach for the measurement of its exposure to counterparty credit risk shall account for collateral posted not held in a bankruptcy remote manner in the relevant NICA term, in accordance with the relevant requirements specified in subregulation (18) below; |

| (ii) | the internal model method for the measurement of its exposure to counterparty credit risk shall apply the relevant specified alpha multiplier envisaged in subregulation (19) below to the relevant exposure related to the posted collateral; |

| (D) | all relevant collateral posted or provided by a clearing member, including cash, securities, other pledged assets, and excess initial or variation margin, which is often being referred to as overcollateralisation, that is held by a custodian, and is bankruptcy remote from the relevant qualifying central counterparty, shall not be subject to a capital requirement for counterparty credit risk exposure to such bankruptcy remote custodian, that is, the related risk weight or EAD shall be equal to zero, provided that for purposes of this item (D), custodian includes a trustee, agent, pledgee, secured creditor or any other person that holds property in a manner that does not give such person a beneficial interest in such property and will not result in such property being subject to legally-enforceable claims by such person’s creditors, or to a court-ordered stay of the return of such property, should such a person become insolvent or bankrupt; |

| (E) | in relation to collateral that is posted by a client and held by a custodian, and is bankruptcy remote from the relevant qualifying central counterparty, the clearing member and other clients shall not be subject to a capital requirement for counterparty credit risk, provided that when the collateral is held at the qualifying central counterparty on a client’s behalf and is not held on a bankruptcy remote basis— |

| (i) | a risk weight of 2 per cent shall apply to that collateral only when all the relevant conditions and requirements envisaged in paragraphs (b)(iii)(A) to (b)(iii)(C) above are met; |

| (ii) | a risk weight of 4 per cent shall apply to that collateral when the relevant conditions envisaged in paragraph (b)(iii)(D) apply; |

| (vi) | Matters related to default fund exposures |

When a default fund is shared between products or types of business with settlement risk only, such as, for example, equities and bonds, and products or types of business which give rise to counterparty credit risk, such as, for example, OTC derivative instruments, exchange-traded derivative instruments, securities financing transactions or long settlement transactions, the risk weight determined in accordance with the relevant formulae and methodology specified in subparagraph (vii) below shall be assigned to the relevant aggregate amount of all of the said default fund contributions, without any apportionment to the different classes or types of business or products, provided that—

| (A) | when the default fund contributions from clearing members are segregated by product types and are only accessible for specific product types, the relevant capital requirements for those default fund exposures shall be determined for each relevant product giving rise to counterparty credit risk, in accordance with the formulae and methodology specified in subparagraph (vii) below; |

| (B) | when the relevant qualifying central counterparty’s prefunded own resources are shared among product types, the qualifying central counterparty shall allocate those funds to each of the relevant calculations, in proportion to the respective product-specific exposure or EAD amount; |

| (C) | when a bank acting as a clearing member is required to calculate a required amount of capital and reserve funds related to exposures arising from default fund contributions to a qualifying central counterparty, the bank shall calculate the said required amount of capital and reserve funds in accordance with the formulae and methodology set out in subparagraph (vii) below. |

| (vii) | Formulae and methodology to be applied in respect of default fund exposures |

| (A) | Based on the risk sensitive formulae specified in items (B) and (C) below, that consider— |

| (i) | the size and quality of a qualifying central counterparty’s financial resources; |

| (ii) | the counterparty credit risk exposures of such qualifying central counterparty; and |

| (iii) | the application of such financial resources via the qualifying central counterparty’s loss bearing waterfall, in the case of one or more clearing member defaults, |

a bank that acts as a clearing member shall apply the relevant specified risk weight for its default fund contributions, provided that, in this regard, the bank’s risk sensitive capital requirement for its default fund contribution, denoted by KCMi, shall be calculated in accordance with the formulae and methodology specified in items (B) and (C) below, which calculations—

| (aa) | may also be performed by a qualifying central counterparty, supervisor or any other person with access to the relevant required data; |

| (bb) | shall be made only when the relevant conditions and requirements specified in item (D) below, are met. |

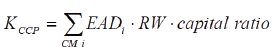

| (B) | Any relevant person that wishes to calculate the relevant required amount of capital and reserve funds and the related risk weight envisaged in this subparagraph (vii) shall firstly calculate the hypothetical capital requirement of the qualifying central counterparty due to its counterparty credit risk exposures to all of its relevant clearing members and their clients, through the application of the formula specified below, provided that— |

| (i) | the holding periods related to securities financing transactions specified in subregulation (9)(b)(xiv) and those for derivative instruments specified in subregulation (19)(e) shall apply even if more than 5000 trades are within one netting set, that is, the higher specified supervisory floor for more than 5000 trades shall not apply in this case; |

| (ii) | the netting sets that apply to regulated clearing members shall be the same as those envisaged in paragraph (b)(i)(C) above, provided that, for all other clearing members, the netting rules specified by the relevant qualifying central counterparty based upon notification of each of its clearing members, or such requirements related to netting sets as may be specified in writing by the Authority, shall apply |

where:

| KCCP | is the hypothetical capital requirement for a qualifying central counterparty, calculated for the sole purpose of determining the capitalisation of clearing member default fund contributions, that is, KCCP does not represent the actual capital requirements for a qualifying central counterparty, which may be determined separately by the relevant qualifying central counterparty and/or its relevant supervisor |

| RW | is a minimum risk weight of 20 per cent, or such a higher risk weight as may be specified in writing by the Authority, for example, when the clearing members related to a qualifying central counterparty are not highly rated |

| Capital ratio | shall be 8 per cent |

| EADi | is the relevant exposure amount of the qualifying central counterparty to clearing member 'i', including both the clearing member’s own transactions and client transactions guaranteed by the clearing member, and all relevant amounts of collateral held by the central counterparty, including the clearing member’s prefunded default fund contribution, against the relevant transactions, in respect of the valuation at the end of the relevant regulatory reporting date, before the margin called on the final margin call of that day is exchanged: |

Provided that—

| (i) | when clearing members provide client clearing services, and client transactions and collateral are held in individual or omnibus separate sub-accounts to the clearing member’s proprietary business, each such client sub-account shall be included in the sum separately, that is— |

| (aa) | in order to ensure that client collateral cannot offset the central counterparty’s exposures to clearing members’ proprietary activity in the calculation of KCCP, the member EAD in the aforesaid formula shall be the sum of the client sub-account EADs and any relevant house sub-account EAD; |

| (bb) | when any sub-account contains both derivatives and securities financing transactions, the EAD of that sub-account shall be the sum of the derivative EAD and the securities financing transactions EAD; |

| (ii) | when collateral is held against an account containing both securities financing transactions and derivative transactions, the prefunded initial margin provided by the member or client shall be allocated to the relevant securities financing transactions and derivatives exposures, in proportion to the respective product specific EADs, calculated in accordance with the relevant requirements specified in subregulations (8) and (9) for securities financing transactions and the standardised approach for the measurement of the bank’s exposure to counterparty credit risk specified in subregulation (18), without including the effect of any collateral, for derivative instruments; |

| (iii) | when the default fund contributions of the member, denoted by DFi in the relevant formulae, are not split with regard to client and house sub-accounts, the said contributions shall be allocated per sub-account according to the respective fraction the initial margin of that sub-account has in relation to the total initial margin posted by or for the account of the relevant clearing member; |

| (iv) | in the case of derivative instruments— |

| (aa) | EADi shall be calculated as the bilateral trade exposure the relevant central counterparty has against the relevant clearing member, calculated in accordance with the relevant requirements specified in subregulation (18) below, applying a margin period of risk of 10 days to calculate the central counterparty’s potential future exposure to its clearing member; |

| (bb) | all collateral held by the relevant central counterparty to which that central counterparty has a legally enforceable claim in the event of the default of the relevant member or client, including any relevant default fund contributions of that member, denoted by DFi in the relevant formulae, shall be used to offset the central counterparty’s exposure to that member or client, through inclusion in the relevant PFE multiplier, as set out in subregulation (18) below; |

| (v) | in the case of securities financing transactions, EAD shall be equal to— |

max(EBRMi – IMi – DFi; 0),

where:

| EBRMi | is the exposure value to clearing member 'i' before the application of any risk mitigation in terms of the relevant provisions of subregulation (9)(b), and where, for purposes of this calculation, variation margin that has been exchanged, before the margin called on the final margin call of that day, enters into the mark-to-market value of the relevant transactions |

| IMi | is the relevant initial margin collateral posted by the relevant clearing member with the qualifying central counterparty |

| DFi | is the relevant prefunded default fund contribution by the relevant clearing member that will be applied upon such clearing member’s default, either along with or immediately following such member’s initial margin, to reduce the qualifying central counterparty loss |

Provided that any haircuts to be applied in respect of the relevant securities financing transactions shall be the relevant standardised haircuts specified in subregulation (9)(b)(xi).

| Σ | means the relevant sum in respect of all the relevant clearing member accounts |

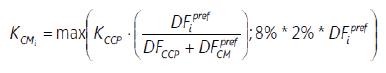

| (C) | Following the first-step calculation envisaged in item (B) above, the capital requirement for each relevant clearing member shall be calculated through the application of the formula specified below, which formula effectively imposes a floor of 2 per cent on the risk weight for the default fund exposure: |

where:

| KCMi | is the capital requirement on the default fund contribution of member i |

| DFCMpref | is the total prefunded default fund contributions from clearing members |

| DFCCP | is the central counterparty’s prefunded own resources, such as, for example, contributed capital and retained earnings, which are contributed to the default waterfall, where these rank junior to or pari passu with prefunded member contributions |

| DFipref | is the prefunded default fund contributions provided by clearing member i |

| (D) | In all cases, any relevant central counterparty, bank, supervisor or other person with access to the relevant required data shall calculate KCCP, DFCMpref and DFCCP make available sufficient information related to the said calculations— |

| (i) | to allow the Authority or any relevant supervisor of the qualifying central counterparty to appropriately oversee the said calculations; |

| (ii) | to permit each relevant clearing member to calculate its capital requirement for the default fund; and |

| (iii) | for the relevant supervisor of such clearing member to review and confirm the required calculations, |

provided that, as a minimum—

| (aa) | KCCP shall be calculated on a quarterly basis, or on such a more frequent basis as may be specified in writing by the Authority; |

| (bb) | whichever person makes the aforesaid calculations shall, whenever required or requested, make available to the relevant supervisor of any relevant bank clearing member sufficient aggregate information regarding the composition of the qualifying central counterparty’s exposures to the clearing members, and information provided to the clearing member for the purposes of the calculation of KCCP, DFCMpref and DFCCP; |

| (cc) | the aforesaid relevant required information shall be made available to the relevant supervisor on a sufficiently frequent basis to allow the supervisor to duly monitor the risks incurred by the relevant clearing member(s); |

| (dd) | KCCP and KCMi shall be recalculated at least quarterly, or whenever material changes occur in respect of, for example, the number or exposure of cleared transactions, or the financial resources of the relevant qualifying central counterparty. |

| (c) | Exposures to non-qualifying central counterparties |

| (i) | Trade exposures |

Based on the relevant type or category of counterparty credit exposure, a bank shall apply the relevant requirements specified in these Regulations related to the standardisedapproach for credit risk in respect of the bank’s trade exposure to a non-qualifying central counterparty to calculate the relevant required credit exposure amount and the related required amount of capital and reserve funds;

| (ii) | Default fund contributions |

A bank shall apply a risk weight of 1250 per cent in respect of the bank’s default fund contributions to a non-qualifying central counterparty, which default fund contributions shall for purposes of this paragraph (c) include both the funded and the unfunded contributions to be paid when required by the relevant central counterparty, provided that in respect of any liability for unfunded contributions, that is, any relevant unlimited binding commitment, the Authority shall specify in writing the relevant amount of unfunded commitment to which the bank shall apply the aforesaid risk weight of 1250 per cent.

[Regulation 23(16) substituted by section 3(j) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]