| (1) |

A licensed central counterparty that obtained eligible collateral must— |

| (a) |

calculate an adjusted exposure in accordance with the relevant formulae set out in subregulation (2); |

| (b) |

in the calculation of the central counterparty’s adjusted exposure— |

| (i) |

make use of the haircut percentage specified in Table 26(C) in Schedule A in order to adjust both the amount of the exposure and the value of the collateral; or |

| (ii) |

in the case of transactions subject to further commitment, that is, repurchase or resale agreements— |

| (aa) |

apply a haircut of 0%, provided that the central counterparty complies with the minimum conditions relating to a haircut of 0% specified in subregulation (9); |

| (bb) |

recognise the effects of bilateral master netting agreements, provided that the central counterparty complies with the minimum conditions relating to bilateral master netting agreements specified in subregulation (10); and |

| (c) |

calculate its risk weighted exposure by multiplying the adjusted exposure with the risk weight of the relevant counterparty. |

| (2) |

In the case of a collateralised transaction, other than a derivative instrument subject to the current exposure method, a central counterparty must calculate its adjusted exposure through the application of the formula specified below, which formula is designed to recognise the effect of the collateral and any volatility in the amount relating to the exposure or collateral. The formula is expressed as: |

E* =

where:

| E* = |

the amount of the exposure after the effect of the collateral is taken into consideration, that is, the adjusted exposure |

| E = |

the current value of the exposure before the effect of the collateral is taken into consideration |

|

He = |

the relevant haircut that relates to the exposure |

|

C = |

the current value of the collateral obtained by the central counterparty |

| Hc = |

the haircut that relates to the collateral |

|

Hfx =

|

the haircut that relates to any currency mismatch between the collateral and the exposure— |

| (i) |

The haircut that relates to currency risk shall be 8%, based on a 10 business day holding period and daily mark-to-market. |

| (ii) |

Standard haircuts in terms of the comprehensive approach shall be subject to Table 26 (C) in Schedule A. |

| (3) |

In the case of a derivative instrument subject to the current exposure method, a central counterparty must calculate its adjusted exposure in accordance with the relevant formula and requirements specified in Regulation 29. |

| (4) |

A central counterparty that wants to recognise the effects of bilateral master netting agreements, must calculate its adjusted exposure through the application of the formula specified below, provided that the central counterparty complies with the minimum requirements relating to bilateral netting agreements specified in subregulation (10). The formula is expressed as: |

E* =

where:

|

E* = |

the adjusted exposure after the effect of risk mitigation is taken into consideration |

|

E = |

the relevant current value of the exposure |

|

C = |

the value of the relevant collateral |

|

Es = |

the absolute value of the net position in a given instrument |

|

Hs = |

the relevant haircut that relates to Es, that is, the net long or short position of each instrument included in the netting agreement shall be multiplied with the appropriate haircut |

|

Efx = |

the absolute value of the net position in a currency that differs from the settlement currency |

|

Hfx = |

the haircut in respect of the currency mismatch- |

| (i) |

the haircut that relates to currency risk must be 8%, based on a 10 business day holding period and daily mark-to-market. |

| (ii) |

standard haircuts in terms of the comprehensive approach shall be subject to Table 26(C) in Schedule A. |

| (5) |

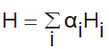

A central counterparty that obtained collateral that consists of a basket of instruments, must calculate the haircut in respect of the basket of instruments in accordance with the formula specified below, which formula is designed to weight the collateral in the basket: |

where:

|

αi = |

the relevant weight of the asset, measured in terms of the relevant currency units, in the basket |

|

Hi = |

the haircut applicable to the relevant asset |

| (6) |

The framework for collateral haircuts applied in these Regulations in respect of the comprehensive approach as summarised in Tables 26(C) to (F) in Schedule A distinguishes between— |

| (a) |

repo-style transactions, that is, transactions such as repurchase or resale agreements, and securities lending or borrowing transactions; and |

| (b) |

other capital-market-driven transactions, that is, transactions such as derivatives instruments and margin lending. |

| (7) |

In case of transactions subject to daily re-margining and mark-to-market valuation, when the central counterparty calculates its exposure or EAD amount subject to margin agreements, the central counterparty must apply a floor margin period of risk of five business days for netting sets consisting only of repo-style transactions, and a floor margin period of risk of 10 business days for all other netting sets, provided that— |

| (a) |

in respect of all netting sets where the number of trades exceeds 5 000 at any point during a quarter, the central counterparty applies a floor margin period of risk of 20 business days for the following quarter; |

| (b) |

in respect of netting sets containing one or more trades involving illiquid collateral, the central counterparty applies a floor margin period of risk of 20 business days; provided that for purposes of this Regulation,— |

| (i) |

“illiquid collateral” must be determined in the context of stressed market conditions and must be characterised by the absence of continuously active markets where a counterparty would, within two or fewer days, obtain multiple price quotations that would not move the market or represent a price reflecting a market discount in the case of collateral; and |

| (ii) |

situations where trades shall be deemed illiquid include, but are not limited to, trades that are not marked daily and trades that are subject to specific accounting treatment for valuation purposes, such as repo-style transactions referencing securities of which the fair value is determined by models with inputs that are not observed in the market. |

| (c) |

in all cases where the central counterparty considers that trades or securities held as collateral are concentrated in a particular counterparty or clearing member, and if that counterparty or clearing member suddenly exited the market, the central counterparty would be able to replace its trades; |

| (d) |

if the central counterparty experienced more than two margin call disputes on a particular netting set during the preceding two quarters, and the disputes lasted longer than the applicable margin period of risk, before consideration of this provision, the central counterparty in respect of the following two quarters applies a margin period of risk at least double the floor specified in these Regulations for that netting set; |

| (e) |

in the case of re-margining with a periodicity of N-days, the central counterparty applies a margin period of risk of at least the specified floor plus the N days minus one day, that is: |

Margin Period of Risk = F + N - 1.

where:

| F = |

the floor number of days specified before |

| N = |

he said periodicity of N-days for re-margining; |

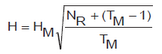

| (8) |

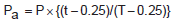

In the case of the frequency of re-margining or revaluation is longer than the minimum period specified in Table 26(D) in Schedule A, the relevant percentage in respect of the relevant specified minimum haircut must be scaled up depending on the actual number of business days between re-margining or revaluation, using the square root of time formula specified below: |

where:

|

HM = |

the relevant haircut in respect of the minimum holding period |

|

TM = |

the relevant minimum holding period for the type of transaction |

|

NR = |

the actual number of business days between re-margining for capital market transactions or revaluation in respect of secured transactions |

| (a) |

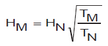

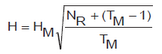

When a central counterparty calculates the volatility on a TN day holding period which is different from the specified minimum holding period TM, the central counterparty must calculate the relevant haircut HM using the square root of time formula specified below: |

where:

|

HM = |

the adjusted haircut |

|

TN = |

holding period used by the central counterparty for deriving HN

|

|

HN = |

haircut based on the holding period TN. |

|

TM = |

specified minimum holding period |

| (b) |

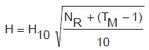

Similarly, when the frequency of re-margining or revaluation is longer than the minimum period specified in Table 26(C) in Schedule A, the relevant percentage in respect of the minimum haircut must be scaled up depending on the actual number of business days between re-margining or revaluation, using the relevant square root of time formula. |

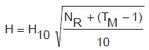

For example, based on the relevant specified square root of time formula, a central counterparty that uses the standard haircuts specified in Table 26(C) in Schedule A, must use the relevant 10 business day haircut percentages specified in the Table as a basis in scaling the haircut percentages up or down depending on the type of transaction and the frequency of re-margining or revaluation, as specified below (see Tables 26(E) and (F) in Schedule A):

Where:

|

H10 = |

the 10 business day standard haircut in respect of the instrument, specified in Table 26(C) in Schedule A |

|

NR = |

the actual number of business days between re-margining for capital market transactions or revaluation for secured transactions |

|

TM = |

the minimum holding period for the type of transaction. |

| (9) |

In the case of any repo-style transaction, a central counterparty may apply a haircut of 0%, provided that— |

| (a) |

both the exposure and the collateral consist of cash or a sovereign security or public-sector security qualifying for a 0% risk weight in terms of the standardised approach; |

| (b) |

both the exposure and the collateral are denominated in the same currency; |

| (c) |

the transaction is overnight or both the exposure and the collateral are marked to market, at a minimum, on a daily basis and subject to daily re-margining; |

| (d) |

following the failure of the counterparty to re-margin, the time that is required from the last mark-to-market adjustment, before the failure to re-margin occurred, and the liquidation of the collateral, is no more than four business days; |

| (e) |

the transaction is settled across a settlement system authorised for the type of transaction; |

| (f) |

the documentation in respect of the agreement is standard market documentation for the transactions; |

| (g) |

the transaction is governed by documentation that specifies that when the counterparty fails to satisfy an obligation to deliver cash or securities or to deliver margin, or otherwise defaults, the transaction shall be immediately terminable; |

| (h) |

upon any default event, regardless whether the counterparty is insolvent or liquidated, the central counterparty has the unfettered, legally enforceable right to immediately seize and liquidate the collateral for the central counterparty’s benefit; |

| (i) |

the agreement is concluded with— |

| (iii) |

a public-sector entity; |

| (v) |

other regulated financial institutions, including an insurance company, eligible for a risk weight of 20% in terms of the standardised approach; |

| (vi) |

a regulated collective investment scheme or money market fund determined by the Authority, provided that the collective investment scheme or money market fund must be subject to capital or leverage requirements; |

| (vii) |

a regulated pension fund determined by the Authority; |

| (viii) |

a clearing house determined by the Authority; and |

| (ix) |

another person as may be determined by the Authority, subject to such conditions as may be determined by the Authority. |

| (10) |

A central counterparty that concludes a repo-style agreement or transaction with a counterparty, which agreement or transaction is included in a bilateral master netting agreement, may recognise the effects of the bilateral master netting agreement, provided that the netting agreement must— |

| (a) |

be legally enforceable in each relevant jurisdiction upon the occurrence of an event of default, regardless whether the counterparty is insolvent or in liquidation and in cases of legal uncertainty, the central counterparty must obtain a legal opinion to the effect that its right to apply netting of gross claims is legally well founded and would be enforceable in the liquidation, default or insolvency of the counterparty or the central counterparty; |

| (b) |

provide the non-defaulting party upon an event of default, including in the event of insolvency or liquidation of the counterparty, the right to terminate and close-out, in a timely manner, all transactions included in the agreement; |

| (i) |

the netting of gains and losses relating to all transactions included in the agreement, including the value of any collateral, which transactions were terminated and closed out, resulting in a single net amount which shall be owed by the one party to the other; and |

| (ii) |

the prompt liquidation or close-out netting of collateral upon an event of default. |

(11)

| (a) |

When a central counterparty obtains protection against loss relating to an exposure or potential exposure to credit risk in the form of an eligible guarantee, the risk weight applicable to the guaranteed transaction or guaranteed exposure may be reduced to the risk weight applicable to the guarantor in accordance with these Regulations. |

| (b) |

The unprotected portion of the exposure must retain the risk weight relating to the relevant counterparty. |

| (c) |

The lower risk weight of the guarantor must apply on the outstanding amount of the exposure protected by the guarantee, provided that the requirements in subregulation (11) are met. |

Minimum general requirements

| (i) |

A reduction in the risk weight of a central counterparty's exposure to the risk weight applicable to the relevant guarantor is allowed only to the extent that such guarantee— |

| (aa) |

was not already taken into account in the calculation of the central counterparty’s risk exposure. As such, no reduction in the risk exposure of the central counterparty will be allowed in respect of an exposure for which an issue specific rating was issued, which rating already reflects the effect of the guarantee; |

| (bb) |

may be realised by the central counterparty under normal market conditions; |

Minimum specific requirements

| (ii) |

The guarantee must be an explicitly documented obligation assumed by the guarantor. |

| (iii) |

The guarantee must be legally enforceable in all relevant jurisdictions and the central counterparty’s rights in terms of the guarantee must be legally well founded; provided that legal opinions must be updated at appropriate intervals in order to ensure continued enforceability of the central counterparty’s rights in terms of the guarantee; |

| (iv) |

The guarantee must constitute a direct claim on the guarantor, provided that— |

| (aa) |

when a qualifying default or non-payment by the obligor occurs, the central counterparty pursues the guarantor for amounts outstanding under the loan, rather than having to continue to pursue the obligor; |

| (bb) |

when the guarantee provides only for the payment of principal amounts, any interest amount and other unprotected payments are regarded as unsecured amounts; |

| (cc) |

payment by the guarantor in terms of the guarantee may grant the guarantor the right to pursue the obligor for amounts outstanding under the loan. |

| (v) |

The guarantee must be linked to specific exposures, so that the extent of the cover is duly defined and incontrovertible. |

| (vi) |

Other than the central counterparty's non-payment of money due in respect of the guarantee, there may be no clause in the contract that would allow the guarantor unilaterally to cancel the guarantee or increase the effective cost of the protection as a result of deterioration in the credit quality of the protected exposure. |

| (vii) |

There may be no clause in the guarantee outside the direct control of the central counterparty that could prevent the guarantor from being obliged to pay out, in a timely manner, in the event of the original obligor failing to make the payment(s) due. |

| (viii) |

While guarantees reduce credit risk, they simultaneously increase other risks to which a central counterparty is exposed, such as legal and operational risks, therefore a central counterparty must employ robust procedures and processes, relating to guarantees, to control the risks, which must, as a minimum, include the fundamental elements specified below: |

| (aa) |

An articulated strategy for guarantees must form an intrinsic part of a central counterparty's general credit strategy and overall liquidity strategy; |

| (bb) |

A central counterparty must— |

| (AA) |

continue to assess a guaranteed exposure on the basis of the borrower's creditworthiness; |

| (BB) |

obtain and analyse sufficient financial information to determine the obligor's risk profile and its risk-management and operational capabilities; |

| (CC) |

ensure that its policies and procedures are supported by management systems capable of tracking the location and status of guarantees; |

| (DD) |

regularly review its policies and procedures in order to ensure that the policies and procedures remain appropriate and effective; |

| (EE) |

have in place a duly defined policy with respect to the amount of concentration risk that it is prepared to accept; |

| (FF) |

take guaranteed positions into account when assessing the potential concentrations in its credit portfolio; |

| (GG) |

in order to mitigate its concentration risk, monitor general trends affecting relevant guarantors; |

| (HH) |

when it obtains guarantees that differ in maturity from the underlying credit exposure, monitor and control its roll-off risks, that is, the fact that the central counterparty will be exposed to the full amount of the credit exposure when the guarantee expires. The central counterparty may be unable to obtain further guarantees or to maintain its capital adequacy when the guarantee expires. |

(12)

| (a) |

For risk mitigation purposes, credit protection obtained from guarantors that are assigned a risk weight lower than the protected exposure will be recognised as eligible guarantees, including guarantees obtained from— |

| (iii) |

guarantees as approved by the Authority. |

Materiality thresholds

| (b) |

For purposes of these Regulations, a materiality threshold below which no payment will be made in the event of a loss to the central counterparty or that reduces the amount of payment by the guarantor must be risk weighted at 1250%; or an imputed percentage that will effectively result in an amount equivalent to a deduction against capital . |

Proportional cover

| (c) |

When a central counterparty obtains a guarantee for less than the amount of the central counterparty’s exposure to credit risk, it must recognise the credit protection on a proportional basis, that is, the protected portion of the exposure shall be risk weighted in accordance with the relevant provisions of this regulation and the remainder of the credit exposure must be regarded as unsecured. |

(i)

| (aa) |

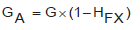

When a central counterparty obtains credit protection that is denominated in a currency that differs from the currency in which the exposure is denominated, the amount of the exposure deemed to be protected must be reduced by the application of the formula specified below, which formula is designed to recognise the effect of the currency mismatch. The formula is expressed as: |

where:

|

G = |

the relevant nominal amount of the credit protection obtained |

HFX = the haircut relating to the currency mismatch between the credit protection and the underlying obligation.

| (bb) |

The haircut shall be based on a 10 business day holding period and daily mark-to-market. |

| (ii) |

When a central counterparty applies the standard haircuts, a haircut equal to 8% shall apply. |

| (iii) |

A central counterparty must use the relevant square root of time formula specified in subregulation (8)(b) to scale up a haircut percentage when the holding period or frequency of mark-to-market adjustment is longer than the minimum period specified in Table 26(C) in Schedule A. |

| (13) |

For the protected portion of a credit exposure, a central counterparty that is a protection buyer must substitute the risk weight relating to the eligible protection provider for the risk weight of the reference asset, reference entity or underlying asset. |

| (a) |

The lower risk weight relating to the eligible protection provider shall apply to the outstanding amount of the transaction or exposure protected by the credit-derivative instrument, provided that all the relevant conditions specified in subregulation (17) are met. |

| (b) |

The unprotected portion of the exposure shall retain the risk weight relating to the relevant underlying exposure. |

| (c) |

When a central counterparty hedges the credit risk relating to an exposure, the central counterparty may only recognise the credit protection to the extent that the central counterparty transferred the relevant credit risk to an eligible third party protection provider. |

| (d) |

A central counterparty may not buy protection in the absence of an underlying exposure. |

| (i) |

A materiality threshold contained in a credit-derivative instrument that requires a given amount of loss to occur to the protection buyer before the protection seller is obliged to make payment to the protection buyer or reduces the amount of payment to the protection buyer must be risk weighted at 1250%. |

| (ii) |

The capital requirement in respect of such bought protection is limited to the capital requirement relating to the underlying asset or reference asset when no protection is recognised. |

| (14) |

For risk-mitigation, credit protection obtained from protection providers that are assigned a risk weight lower than the protected exposure must be recognised as eligible protection providers, including protection obtained from— |

| (c) |

public-sector entities; |

| (e) |

other externally rated entities that are assigned a risk weight lower than the protected exposure. |

| (15) |

A central counterparty must report all relevant foreign-currency positions created by credit-derivative instruments when the central counterparty calculates its aggregate effective net open foreign-currency position to the Authority. |

| (16) |

When a central counterparty obtains credit protection for less than the amount of the central counterparty’s exposure to credit risk, it must recognise the credit protection on a proportional basis, that is, the protected portion of the exposure must be risk weighted in accordance with these Regulations and the remainder of the credit exposure must be regarded as unsecured. |

| (17) |

A central counterparty that engages in a credit-derivative instrument as a protection buyer— |

| (a) |

that was not already taken into consideration in the calculation of the central counterparty’s required amount of capital; and the instrument can be realised by the central counterparty under normal market conditions, that is, the value at which the protection can be realised may not differ materially from its book value; and the central counterparty recognises the risk-mitigation effect of protection obtained in the form of a credit-derivative instrument in the calculation of its credit exposure; must comply with the following requirements in respect of protection from such credit-derivative instrument: |

| (i) |

The credit protection must constitute a direct claim on the protection seller. |

| (ii) |

The credit protection must be linked to specific credit exposures, so that the extent of the cover is duly defined and incontrovertible. |

| (iii) |

Other than a protection buyer's non-payment of money due in respect of the credit protection contract, there may be no clause in the contract that would allow the protection seller unilaterally to cancel the credit protection or increase the effective cost of the protection as a result of deterioration in the credit quality of the protected exposure. |

| (iv) |

There may be no clause in the contract other than clauses relating to procedural requirements that could prevent the protection seller from being obliged to make payment in a timely manner should a credit event occur in respect of an underlying asset, reference entity or reference asset. |

| (v) |

The credit protection must be legally enforceable in all relevant jurisdictions, and in cases of uncertainty, a central counterparty must obtain legal opinion confirming the enforceability of the credit protection in all relevant jurisdictions and that the central counterparty’s rights are legally well founded, which legal opinions must be updated at appropriate intervals in order to ensure continuing enforceability. |

| (vi) |

The protection seller may not have any formal recourse to the protection buyer in respect of losses incurred by the protection seller. |

| (vii) |

In the case of a funded single-name credit-derivative instrument, the protection buyer may not be obliged to repay any funds received from the protection seller in terms of the credit-derivative instrument, except at the maturity date of the contract, provided that no credit event has occurred during the period of bought protection or as a result of a defined credit event, and then in accordance with the terms of payment defined in the contract. |

| (viii) |

In order to obtain full recognition of the protection obtained, the base currency of a credit-derivative instrument must be the same currency as the currency in which the credit exposure that is protected is denominated. |

| (aa) |

When a credit-derivative instrument is denominated in a currency that differs from the currency in which the credit exposure is denominated, that is, when there is a currency mismatch, the bought protection may be less than expected owing to fluctuations in the exchange rates. |

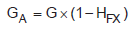

| (bb) |

When a central counterparty obtains credit protection that is denominated in a currency that differs from the currency in which the exposure is denominated, the amount of the exposure deemed to be protected shall be reduced by the application of the formula specified below, which formula is designed to recognise the effect of the currency mismatch. The formula is expressed as: |

where:

| GA = |

is the relevant adjusted value of the protection |

| G = |

is the relevant nominal amount of the credit protection obtained |

| HFX = |

is the haircut relating to the currency mismatch between the credit protection and the underlying obligation. |

| (AA) |

The haircut shall be based on a ten business day holding period and daily mark-to- market. |

| (BB) |

When a central counterparty applies the standard haircuts, a haircut equal to 8% shall apply. |

| (CC) |

A central counterparty must use the relevant square root of time formula specified in subregulation (8)(b) above to scale up a haircut percentage when the holding period or frequency of mark-to-market adjustment is longer than the minimum period specified subregulation (8)(b). |

| (ix) |

While credit derivative instruments reduce credit risk, they simultaneously increase other risks to which a central counterparty is exposed, such as legal and operational risks, therefore, a central counterparty must employ robust procedures and processes to control the risks, which as a minimum, must include the following fundamental elements: |

| (aa) |

A duly articulated strategy for credit-derivative instruments must form an intrinsic part of a central counterparty's general credit strategy and overall liquidity strategy. |

| (bb) |

A central counterparty must— |

| (AA) |

continue to assess an exposure that is hedged by a credit-derivative instrument on the basis of the borrower's creditworthiness; |

| (BB) |

obtain and analyse sufficient financial information to determine the obligor's risk profile and its risk management and operational capabilities; |

| (CC) |

ensure that its policies and procedures are supported by management systems capable of tracking the location and status of its credit-derivative instruments; |

| (DD) |

have in place a duly defined policy with respect to the amount of concentration risk that it is prepared to accept; |

| (EE) |

take into account purchased credit protection when assessing the potential concentrations in its credit portfolio; |

| (FF) |

monitor general trends affecting its credit-protection sellers, in order to mitigate its concentration risk; |

| (GG) |

when it obtains credit protection that differs in maturity from the underlying credit exposure, monitor and control its roll-off risks, that is, the fact that the central counterparty will be exposed to the full amount of the credit exposure when the credit protection expires. |

| (x) |

The risk management systems of the central counterparty must be adequate to— |

| (aa) |

capture the credit risk relating to a underlying asset acquired through a credit-derivative instrument and any counterparty risk arising from an unfunded OTC credit-derivative instrument within the normal credit approval and credit monitoring processes; |

| (bb) |

assess the probability of default correlation between the underlying asset and the protection provider; |

| (cc) |

provide valuation procedures, including assessment and monitoring of the liquidity of the credit-derivative instrument and the reference asset or underlying asset; |

| (dd) |

assess the impact on liquidity risk when the central counterparty has transferred a significant amount of credit risk through the use of funded credit-derivative instruments with a shorter maturity than the underlying credit exposure; |

| (ee) |

assess the impact on capital adequacy when the central counterparty has transferred a significant amount of credit risk through the use of unfunded credit-derivative instruments and when a replacement contract may not be available when the credit protection expires; |

| (ff) |

assess the change in the risk profile of the remaining credit exposures in terms of both the quality and the spread of the portfolio, when the central counterparty makes extensive use of credit-derivative instruments to transfer risk; |

| (gg) |

assess the basis risk between the reference asset exposure and the underlying asset exposure when these exposures are not the same; |

| (hh) |

monitor the legal and reputational risk associated with credit derivative instruments; |

| (ii) |

monitor the credit risk on an on-going basis. |

| (xi) |

The credit events relating to non-sovereign debt, specified by the contracting parties must include— |

| (aa) |

liquidation or insolvency. |

| (bb) |

any application for protection from creditors. |

| (cc) |

payment default, that is, failure to pay the principal amount or related interest amounts due. |

| (dd) |

any restructuring of the underlying obligation that results in a credit loss event such as a credit impairment or other similar debit being raised, including— |

| (AA) |

a reduction in the rate or amount of interest payable or the amount of scheduled interest accruals; |

| (BB) |

a reduction in the amount of principal, fees or premium payable at maturity or at the scheduled redemption dates; |

| (CC) |

a change in the ranking in the priority of payment of any obligation, causing the subordination of such obligation; |

| (DD) |

a postponement or other deferral of a date or dates for either the payment or accrual of interest or the payment of the principal amount or premium. |

| (xii) |

The credit events relating to sovereign debt, specified by the contracting parties must include— |

| (aa) |

any moratorium on the repayment of the principal amount or related interest amounts due; |

| (cc) |

payment default, that is, failure to pay the principal or related interest amounts due; |

| (dd) |

any restructuring of the underlying obligation that results in a credit loss event such as a credit impairment or other similar debit being raised, including— |

| (AA) |

a reduction in the rate or amount of interest payable or the amount of scheduled interest accruals; |

| (BB) |

a reduction in the amount of principal, fees or premium payable at maturity or at the scheduled redemption dates; |

| (CC) |

a change in the ranking in the priority of payment of any obligation, causing the subordination of such obligation; |

| (DD) |

a postponement or other deferral of a date or dates for either the payment or accrual of interest or the payment of the principal amount or premium. |

| (xiii) |

When the credit-derivative instrument does not include the restructuring of the underlying obligation as a credit event, it shall be deemed that the central counterparty obtained protection equal to a maximum of 60% of the amount covered in terms of the credit-derivative instrument. |

| (xiv) |

Contracts allowing for cash settlement will be recognised for risk-mitigation purposes, provided that a robust valuation process is in place in order to estimate loss reliably. |

| (xv) |

There must be a duly specified period for obtaining post credit-event valuations of the reference asset or underlying obligation, not more than 30 days. |

| (xvi) |

The grace period specified in the credit-derivative instrument may not be longer than the relevant grace period provided for failure to pay in terms of the underlying obligation. |

| (xvii) |

The protection buyer must have the right and ability to transfer the underlying obligation or reference asset to the protection seller, if such underlying obligation or reference asset is required for settlement. |

| (xviii) |

The delivery of the underlying obligation or reference asset may not contravene any term or condition relating to the underlying asset or reference asset, and consent must be obtained when necessary. |

| (xix) |

The identity of the person responsible for determining whether a credit event has occurred, and the sources to be used, must be defined. |

| (xx) |

The determination of a credit event may not be the sole responsibility of the protection seller. |

| (xxi) |

The protection buyer must have the right and ability to inform the protection seller of the occurrence of a credit event. |

| (xxii) |

When the reference asset and the underlying asset being hedged differ, the protection buyer may suffer a loss on the underlying credit exposure that will not be fully compensated by an equivalent claim against the protection seller. |

| (xxiii) |

When there is an asset mismatch between the underlying exposure and the reference asset, the protection buyer will be allowed to reduce the credit exposure, provided that— |

| (aa) |

the reference asset and the underlying exposure relate to the same obligor, that is, the same legal entity; |

| (bb) |

the reference asset ranks pari passu with or more junior than the underlying asset in the event of liquidation; |

| (cc) |

legally effective cross-default clauses, for example, cross-default or cross-acceleration clauses apply; and |

| (dd) |

the terms and conditions of the credit-derivative instrument do not contravene the terms and conditions of the underlying asset or reference asset. |

(18)

| (a) |

A maturity mismatch occurs when the residual maturity of the credit protection obtained in the form of eligible collateral, guarantees or credit-derivative instruments, or in terms of a netting agreement, is less than the residual maturity of the underlying credit exposure. |

| (b) |

A central counterparty must conservatively define the maturity of the underlying exposure and the maturity of the credit protection, taking into consideration the following: |

| (i) |

The effective maturity of the underlying exposure must be the longest possible remaining time before the obligor is scheduled to fulfil its obligation. |

| (ii) |

Embedded options that may reduce the term of the credit protection shall be taken into account when the effective maturity of the credit protection is determined so that the shortest possible effective maturity is used. |

| (c) |

In the case of maturity mismatched credit protection in respect of which the original maturity of the relevant credit protection is less than one year, such credit protection may not be recognised for credit-risk mitigation purposes in terms of these Regulations unless the credit protection has a matching maturity with the underlying credit exposure(s), that is, credit protection with an original maturity of less than one year may be recognised only when— |

| (i) |

the maturity of the protection and the maturity of the exposure is matched; or |

| (ii) |

the residual maturity of the protection is longer than the residual maturity of the exposure, |

provided that in the calculation of its minimum required amount of capital a central counterparty may in no case recognise credit protection obtained when the residual maturity of such credit protection is less than or equal to three months.

| (d) |

When a central counterparty obtained eligible protection relating to netting and collateral, guarantees or credit derivatives instruments, the central counterparty must recognise the effect of mismatches between the maturity of the central counterparty’s underlying exposure and the protection obtained through the application of the formula specified below: |

where:

| Pα = |

relevant value of the credit protection obtained, adjusted for the maturity mismatch |

| P = |

relevant amount of credit protection obtained, adjusted for any haircuts |

| t = |

min (T, residual maturity of the credit protection arrangement), expressed in years |

| T = |

min (5, residual maturity of the exposure), expressed in years |

| (19) |

If a central counterparty obtains protection that differs in maturity from the underlying credit exposure, because the central counterparty may be unable to obtain further protection or to maintain its capital adequacy when the protection expires, the central counterparty must monitor and control its roll-off risks, that is, the fact that the central counterparty will be exposed to the full amount of the credit exposure when the protection expires. |

(20)

| (a) |

When a central counterparty obtains— |

| (i) |

multiple risk mitigation instruments in order to protect a single exposure, that is, the central counterparty has obtained, for example, collateral, guarantees and credit-derivative instruments partially protecting an exposure; or |

| (ii) |

protection with differing maturities, |

the central counterparty must subdivide the exposure into portions covered by the relevant types of risk mitigation instruments.

| (b) |

A central counterparty must separately calculate its risk-weighted exposure relating to each relevant portion envisaged in paragraph (a). |

Civilian Secretariat for Police Service Act, 2011

Civilian Secretariat for Police Service Act, 2011

![]()

![]()

![]()

![]()

![]()

![]()

![]()