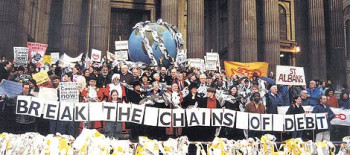

Could Jubilee debt forgiveness be reintroduced today?

As Michael Hudson and Charles Goodhart argue in this article, the Biblical concept of Jubliee debt cancellations had a stabilising effect on societies through the ages. In particular, it provided security of tenure over land for indebted farmers, which had beneficial impacts in generating future tax revenue for the rulers. Here, the authors aruge that debt cancellations could indeed be reintroduced today, albeit in a different format, to create a property-owning democracy, and to make it possible for students to attend higher level education without being crippled with debt upon graduation. Perhaps it is time to start a real discussion, backed by solid research, on the pros and cons of debt forgiveness.

As Michael Hudson and Charles Goodhart argue in this article, the Biblical concept of Jubliee debt cancellations had a stabilising effect on societies through the ages. In particular, it provided security of tenure over land for indebted farmers, which had beneficial impacts in generating future tax revenue for the rulers. Here, the authors aruge that debt cancellations could indeed be reintroduced today, albeit in a different format, to create a property-owning democracy, and to make it possible for students to attend higher level education without being crippled with debt upon graduation. Perhaps it is time to start a real discussion, backed by solid research, on the pros and cons of debt forgiveness. The idea of annulling debts nowadays seems so unthinkable that most economists and many theologians doubt whether the Jubilee Year could have been applied in practice, and indeed on a regular basis. A widespread impression is that the Mosaic debt jubilee was a utopian ideal. However, Assyriologists have traced it to a long tradition of Near Eastern proclamations. That tradition is documented as soon as written inscriptions have been found – in Sumer, starting in the mid-third millennium BC.

Instead of causing economic crises, these debt jubilees preserved stability in nearly all Near Eastern societies. Economic polarization, bondage and collapse occurred when such clean slates stopped being proclaimed.

What were Debt Jubilees?

Debt jubilees occurred on a regular basis in the ancient Near East from 2500 BC in Sumer to 1600 BC in Babylonia and its neighbors, and then in Assyria in the first millennium BC. It was normal for new rulers to proclaim these edicts upon taking the throne, in the aftermath of war, or upon the building or renovating a temple. Judaism took the practice out of the hands of kings and placed it at the center of Mosaic Law.[1]

By Babylonian times these debt amnesties contained the three elements that Judaism later adopted in its Jubilee Year of Leviticus 25. The first element was to cancel agrarian debts owed by the citizenry at large. (Mercantile debts among businessmen were left in place.)

A second element of these debt amnesties was to liberate bondservants – the debtor’s wife, daughters or sons who had been pledged to creditors. They were allowed to return freely to the debtor’s home. (Slave girls that had been pledged for debt also were returned to the debtors’ households.) Royal debt jubilees thus freed society from debt bondage, but did not liberate slaves.

A third element of these debt jubilees (subsequently adopted into Mosaic law) was to return the land or crop rights that debtors had pledged to creditors. This enabled families to resume their self-support on the land and pay taxes, serve in the military, and provide corvée labor on public works.

Commercial “silver” debts among traders and other entrepreneurs were not subject to these debt jubilees. Rulers recognized that productive business loans provide resources for the borrower to pay back with interest, in contrast to consumer debt. This was the contrast that medieval Schoolmen later would draw between interest and usury.

Most non-business debts were owed to the palace or its temples for taxes, rents and fees, along with beer to the public ale houses and other payments to these institutions. Rulers initially were cancelling debts owed mainly to themselves and their officials. This was not a utopian act, but was quite practical from the vantage point of restoring economic and military stability. Recognizing that a backlog of debts had accrued that could not be paid out of current production, rulers gave priority to preserving an economy in which citizens could provide for their basic needs on their own land while paying taxes, performing their corvée labor duties and serving in the army.

Most personal debts were not the result of actual loans, but were accruals of unpaid agrarian fees, taxes and kindred obligations to royal collectors or temple officials. Rulers were aware that these debts tended to build up beyond the system’s ability to pay. That is why they cancelled “barley” debts in times of crop failure, and typically in the aftermath of war. Even in the normal course of economic life, social balance required writing off debt arrears to the palace, temples or other creditors so as to maintain a free population of families able to provide for their own basic needs.

As interest-bearing credit became privatized throughout the Near Eastern economies, personal debts owed to local headmen, merchants and creditors also were cancelled. Failure to write down agrarian debts would have enabled officials and, in due course, private creditors, merchants or local headmen to keep debtors in bondage and their land’s crop surplus for themselves. Crops paid to creditors were not available to be paid to the palace or other civic authorities as taxes, while labor obliged to work off debts to creditors was not available to provide corvée service or serve in the army. Creditor claims thus set the wealthiest and most ambitious families on a collision course with the palace, along the lines that later occurred in classical Greece and Rome. In addition to preserving economic solvency for the population, rulers thus found debt cancellation to be a way to prevent a financial oligarchy from emerging to rival the policy aims of kings.

Cancelling debts owed to wealthy local headmen limited their ability to amass power for themselves. Private creditors therefore sought to evade these debt jubilees. But surviving legal records show that royal proclamations were, indeed, enforced. Through Hammurabi’s dynasty these “andurarum acts” became increasingly detailed so as to close loopholes and prevent ploys that creditors tried to use to gain control of labor, land and its crop surplus.

Fast-forward to today’s world. The most recent financial clean slate was the 1948 Allied Currency Reform of Germany. Basic business debts were left in place, along with employer debts to employees. The population was allowed to keep minimum working balances. But the residue of debts was cancelled, on the logic that most were owed to former Nazis. Applauded as a “free market,” Germany’s economy was freed from the postwar debt legacy that had shackled it after World War I. The aftermath in 1948 left Germany’s economy effectively debt-free, paving the way for the Economic Miracle that followed.

Social purpose of Debt Jubilees

The common policy denominator spanning Bronze Age Mesopotamia and the Byzantine Empire in the 9th and 10th centuries was the conflict between rulers acting to restore land to smallholders so as to maintain royal tax revenue and a land-tenured military force, and powerful families seeking to deny its usufruct to the palace. Rulers sought to check the economic power of wealthy creditors, military leaders or local administrators from concentrating land in their own hands and taking the crop surplus for themselves at the expense of the tax collector.

By clearing the slate of personal agrarian debts that had built up during the crop year, these royal proclamations preserved a land-tenured citizenry free from bondage. The effect was to restore balance and sustain economic growth by preventing widespread insolvency.

Babylonian scribes were taught the basic mathematical principle of compound interest, thereby increasing the volume of debt exponentially, much faster than the rural economy’s ability to pay,[2] an argument recently revived by Thomas Piketty, in Capital in the Twenty-First Century, (2014). That is the basic dynamic of debt: to accrue and intrude increasingly into the economy, absorbing the surplus and transferring land and even the personal liberty of debtors to creditors.

Debt jubilees were designed to make such losses of liberty only temporary. The Mosaic injunction (Leviticus 25), “Proclaim liberty throughout the land,” is inscribed on America’s Liberty Bell. That is a translation of Hebrew deror, the debt Jubilee, cognate to Akkadian andurarum. The liberty in question originally was from debt peonage.

To insist that all debts must be paid, regardless of whether this may bankrupt debtors and strip away their land and means of livelihood, stands at odds with the many centuries of Near Eastern clean slates. Their success stands at odds with the assumption that creditor interests should always take priority over those of the indebted economy at large.

In sum, the economic aim of debt jubilees was to restore solvency to the population as a whole. Many royal proclamations also freed businesses from various taxes and tariff duties, but the main objective was political and ideological. It was to create a fair and equitable society.

This ethic was not egalitarian as such. It merely aimed to provide citizens with the basic minimum standard needed to be self-sustaining. Wealth accumulation was permitted and even applauded, as long as it did not disrupt the normal functioning of society at large.

How well did Debt Jubilees succeed?

Creditors sought to avoid these laws, but Babylonian legal records show that the debt cancellations of Hammurabi’s dynasty and those of his neighbors were enforced. These proclamations enabled society to avert military defeat by preserving a land-tenured citizenry as the source of military fighters, corvée labor and the tax base. The Bronze Age Near East thus avoided the economic polarization between creditors and debtors to anywhere near the extent that ended up imposing bondage in classical Greece and Rome.

In the 7th-century BC, Greek populist leaders called tyrants (at that time with no original pejorative meaning) paved the way for the economic takeoff of Sparta, Corinth and Aegina by cancelling debts and redistributing the lands monopolized by their cities’ aristocracies. In Athens, Solon’s banning of debt bondage and clearing the land of debts in 594 BC avoided the land redistributions to the rich and powerful that much of the population had feared.

So popular was the demand for a debt jubilee that the 4th-century BC Greek general Aeneas Tacticus advised attackers of cities to draw the population over to their side by cancelling debts, and for defenders to hold onto the loyalty of their population by making the same offer.[3] Cities that refrained from cancelling debts were conquered, or fell into widespread bondage, slavery and serfdom.

That ultimately is what happened in Rome. Its historians describe how disenfranchising indebted citizens led to the hiring of mercenaries (often debtors expropriated from their family homestead), as wealthy creditors concentrated land in their own hands, along with law-making power and control of state religion. What, instead, threatened the security of widely-held property and ultimately led to collapse was the financial oligarchy’s ending of the power of rulers to restore liberty from bondage and to save debtors from being deprived of land tenure on a widespread scale.

Plutarch’s lives of Sparta’s kings Agis and Cleomenes shows a problem of cancelling mortgage debts other than those owed by owner-occupants. A land speculator had bought property on credit, and hoped to have his debts annulled along with those of smallholders who were supposed to be the nominal beneficiaries. One can well imagine cancelling today’s mortgage debts of investors who have bought their real estate on credit, with the loan to be paid out of the rent. Instead of the bankers or the tax collector receiving the rental value, the landlords would be by far the greatest windfall gainers. Plutarch’s narrative shows that if all property debts were cancelled, it would be necessary to adjust the tax system to collect the appropriate rental value of such properties in the tax base, in order to prevent a windfall gain. Otherwise, absentee owners would gain instead of the actual occupants and users of the economy’s debt-financed real estate.

Why did debt Jubilees fall into disuse?

Throughout history a constant political dynamic has been maneuvering by creditors to overthrow royal power capable of enforcing debt amnesties and reversing foreclosures on homes and subsistence land. The creditors’ objective is to replace the customary right of citizens to self-support by its opposite principle: the right of creditors to foreclose on the property and means of livelihood pledged as collateral (or to buy it at distress prices), and to make these transfers irreversible. The smallholders’ security of property is replaced by the sanctity of debt instead of its periodic cancellation.

Archaic restorations of order ended when the forfeiture or forced sale of self-support land no longer could be reversed. When creditors and absentee landlords gained the upper political hand, reducing the economic status for much of the population to one of debt dependency and serfdom, classical antiquity’s oligarchies used their economic gains, military power or bureaucratic position to buy up the land of smallholders, as well as public land such as Rome’s ager publicus.[4]

Violence played a major political role, almost entirely by creditors.[5] Having overthrown kings and populist tyrants, oligarchies accused advocates of debtor interests of being “tyrants” (in Greece) or seeking kingship (as the Gracchi brothers and Julius Caesar were accused of in Rome). Sparta’s kings Agis and Cleomenes were killed for trying to cancel debts and reversing the monopolization of land in the 3rd century BC. Neighboring oligarchies called on Rome to overthrow Sparta’s reformer-kings.[6]

The creditor-sponsored counter-revolution against democracy led to economic polarization, fiscal crisis, and ultimately to being conquered – first the Western Roman Empire and then Byzantium. Livy, Plutarch and other Roman historians blamed Rome’s decline on creditors using fraud, force and political assassination to impoverish and

disenfranchise the population. Barbarians had always stood at the gates, but only as societies weakened internally were their invasions successful. Today’s mainstream political and economic theories deny a positive role for government policy to constrain the large-scale concentration of wealth. Attempting to explain the history of inequality since the Stone Age, for instance, Stanford historian Walter Scheidel’s 2017 book The Great Leveler downplays the ability of State policy to reduce such inequality substantially without natural disasters wiping out wealth at the top. He recognizes that the inherent tendency of history is for the wealthy to win out and make society increasingly unequal. This argument also has been made by Thomas Piketty (op cit.) and based largely on the inheritance of great fortunes (the same argument made by his countryman Saint-Simon two centuries earlier). But the only “solutions” to inequality that Scheidel finds at work are the four “great levelers”: warfare, violent revolution, lethal pandemics or state collapse. He does not acknowledge progressive tax policy, limitations on inherited wealth, debt writeoffs or a replacement of debt with equity as means of preventing or reversing the concentration of wealth in the absence of an external crisis.

The Book of Revelation (6:12-14, 8:6-13 and 9:1-2) forecast plagues as punishment for the greed and inequity into which the Roman Empire was falling. By Late Roman times there seemed no alternative to the Dark Age that was descending. Recovery of a more equitable past seemed politically hopeless, and so was idealized as occurring only by divine intervention at the end of history. Yet for thousands of years, economic polarization was reversed by cancelling debts and restoring land tenure to smallholders who cultivated the land, fought in the army, paid taxes and/or performed corvée labor duties. That also would be Byzantine policy to avoid polarization from the 7th through 10th centuries, echoing Babylonia’s royal proclamation of clean slates.

Within Judaism, rabbinical orthodoxy attributed to Hillel developed the prosbul clause by which debtors waived their right to have their debts cancelled in the Jubilee Year. Hillel claimed that if the Jubilee Year were maintained, creditors would not lend to needy debtors – as if most debts were the result of loans, not arrears to Roman tax collectors and other unpaid bills.[7] Opposing this pro-creditor argument, Jesus announced in his inaugural sermon that he had come to proclaim the Jubilee Year of the Lord cited by Isaiah, whose scroll he unrolled. His congregation is reported to have reacted with fury. (Luke 4 tells the story). Like other populist leaders of his day, Jesus was accused of seeking kingship to enforce his program on creditors.

Subsequent Christianity gave the ideal of a debt amnesty an otherworldly eschatological meaning as debt cancellation became politically impossible under the Roman Empire’s military enforcement of creditor privileges. Falling into debt subjected Greeks and Romans to bondage without much hope of recovering their liberty. They no longer could look forward to the prospect of debt amnesties such as had annulled personal debts in Sumer, Babylonia and their neighboring realms, liberating citizens who had fallen into bondage or pledged and lost their land tenure rights to foreclosing creditors.

Continue reading here.