Basic Conditions of Employment Act, 1997

Basic Conditions of Employment Act, 1997

R 385

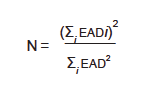

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (11) Method 1 : Calculation of credit risk exposure in terms of the foundation IRB approachSubregulation (11)(n) Securitisation exposure: matters relating to effective number of exposures, denoted by N |

| (n) |

| (i) | Securitisation exposure: matters relating to effective number of exposures, denoted by N |

The effective number of exposures shall be calculated in accordance with the formula specified below.

where:

| EADi | is the exposure-at-default amount associated with the ith instrument in the pool of exposures, provided that the bank shall consolidate multiple exposures to the same obligor, that is, the aggregate amount shall be treated as a single instrument; |

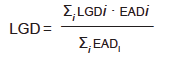

| (ii) | Calculation of exposure-weighted average LGD |

Securitisation exposure: matters relating to exposure-weighted average loss-given-default ratio, denoted by LGD

The exposure-weighted average LGD is calculated as follows:

where:

LGDi is the average LGD ratio associated with all exposures relating to the ith obligor, provided that—

| (A) | when the risk of default and the risk of dilution relating to purchased receivables are treated in an aggregate manner, that is, a single reserve or over-collateralisation was established to absorb losses relating to the risk of default and the risk of dilution within the securitisation scheme, the calculation of the relevant LGD ratio shall be based on the weighted average LGD ratio relating to default risk and a 100 per cent LGD ratio relating to dilution risk, that is, the resultant weights shall be the standalone IRB capital requirement relating to default risk and dilution risk. |

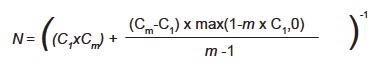

| (iii) | Simplified method for computing N and LGD |

| (A) | Under the conditions outlined below, banks may employ a simplified method for calculating the effective number of exposures and the exposure-weighted average LGD as specified in (i) and (ii) above when. |

| (i) | Let Cm in the simplified calculation denote the share of the pool corresponding to the sum of the largest m exposures, where if |

| (aa) | the share of the portfolio associated with the largest exposure, C1, is no more than 0,03, that is, 3 per cent of the underlying pool, the bank may deem the LGD ratio to be equal 50 per cent and calculate the effective number of exposures, that is, N, in accordance with the formula specified below: |

where:

| Cm | is the share of the pool that corresponds to the sum of the largest ‘m’ exposures. For example, a 15 per cent share corresponds to a value of 0.15. |

| m | is the threshold determined by the bank |

| C1 | is available and does not exceed 3 per cent of the underlying pool, the bank may deem the LGD ratio to be equal to 50 per cent and N to be equal to 1/ C1 |

[Regulation 23 (11)(n) substituted by section 2(jj) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]