Stamp Duties Act, 1968 (Act 77 of 1968)

Stamp Duties Act, 1968 (Act 77 of 1968)

R 385

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (11) Method 1 : Calculation of credit risk exposure in terms of the foundation IRB approachSubregulation (11)(o) Securitisation exposure: Calculation of risk weight |

[Regulation 23 (11)(o) heading substituted by section 2(kk) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (o) | Securitisation exposure: Calculation of risk weight |

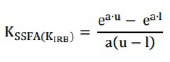

(i) The formulation of the SEC-IRBA is as follows:

Where:

KSSFA(KIRB) is the capital requirement per unit of securitisation exposure under the SEC-IRBA which is a function of three variables, labelled a, u and l. The constant e is the base of the natural logarithms (which equals 2.71828). The variables a, u and l are defined as follows:

a = –(1/(p*KIRB))

u = D – KIRB I =

max (A - KIRB; 0)

| (ii) | The risk weight assigned to a securitisation exposure when applying the SEC-IRBA is calculated as follows: |

| (A) | When (D) for a securitisation exposure is less than or equal to KIRB, the exposure must be assigned a risk weight of 1250%. |

| (B) | When (A) for a securitisation exposure is greater than or equal to KIRB, the risk weight of the exposure, expressed as a percentage, would equal K_SSFA(KIRB) times 12.5. |

| (C) | When (A) is less than KIRB and (D) is greater than KIRB, the applicable risk weight is a weighted average of 1250% and 12.5 times K_SSFA(KIRB) according to the following formula: |

![]()

| (iii) | The risk weight for market risk hedges such as currency or interest rate swaps will be inferred from a securitisation exposure that is pari passu to the swaps or, if such an exposure does not exist, from the next subordinated tranche. |

| (iv) | The resulting risk weight is subject to a floor risk weight of 15%. |

[Regulation 23 (11)(o) substituted by section 2(kk) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]