National Nuclear Regulator Act, 1999

National Nuclear Regulator Act, 1999

R 385

Public Finance Management Act, 1999 (Act No. 1 of 1999)Understanding and Using this ActGuide for Accounting Officers4. Reporting and accountability |

Information has no intrinsic value: it must be used by managers to develop plans, evaluate alternative courses of action and, where necessary, institute corrective actions. The production of information is not an end in itself, and when reports are not scrutinised and used by managers, the quality of information will remain poor. Ideally, management information should be:

| • | Accurate, for meaningful decisions and steps to be taken |

| • | Economically justified, without redundancy |

| • | Flexible and capable of rapid adjustment should needs change |

| • | Comparable, to ensure that decisions are benchmarked |

| • | Relevant to each manager’s particular area of responsibility |

Improving the quality of information

Improving the quality of information available to managers will be a crucial aspect of implementing the PFMA. While the Act stresses the need for regular monthly management reports for submission to the Minister or MEC and the relevant treasury, the primary purpose of these reports is to assist managers in discharging their responsibilities.

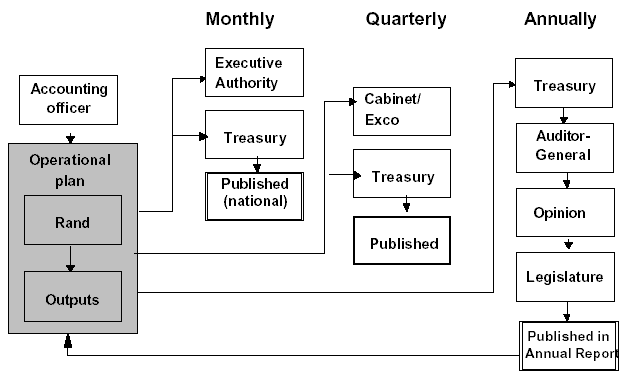

The reports will focus on performance against budget and against service delivery improvement programmes, and will alert managers where remedial action is required. In addition, these reports will be consolidated and published monthly for the National Revenue Fund (NRF) and quarterly for the provincial revenue funds in the national Government Gazette, in line with international best practice. The reports will facilitate the compilation of the year-end financial statements and annual reports, and the reduced time-frame for audit procedures will strengthen accountability to the legislatures.

The monthly reports will also enable executive authorities to monitor performance of their accounting officers, and assist Cabinet/Exco in monitoring the performance of their government.

Best practice internal reporting

Information to managers, Ministers and MECs is usually presented in internal reports, to facilitate:

| • | Controlling the current activities of the organisation |

| • | Planning its future strategies and operations |

| • | Improving objectivity in the decision-making process |

| • | Optimising the use of resources |

| • | Measuring and evaluating performance |

| • | Improving internal and external communication |

Best practice internal reporting suggests that management information should include the following:

| • | A graphical presentation of performance for the period showing KPIs (which must not be solely financial) |

| • | A focus on those KPIs essential for senior management’s attention, balancing operational and financial indicators |

| • | Written commentary on the overall performance of the department |

| • | A set of financial statements (ideally compiled on the accrual base) |

| • | A concise report from each major business unit, highlighting operating results and variances against budget |

In-year management, monitoring and reporting

The Act specifies a variety of reports, monthly, quarterly and at yearend, with different responsibilities for executive authorities and accounting officers. The requirements are illustrated in the diagram below, and detailed in the remainder of this chapter.

Monthly reports

Within 15 days of the month-end, the accounting officer must submit to the relevant treasury and executive authority, information on:

| • | Actual revenue, expenditure and transfers for that month, in the format determined by the national Treasury |

| • | Actual expenditure on any conditional grants under the DoRA |

| • | Projections of anticipated expenditure and revenue for the remainder of the current financial year, in the format determined by the national Treasury (see Annexure B) |

| • | Any material variances and a summary of actions to ensure that the projected expenditure and revenue remain within the budget |

Provincial treasury reports

The provincial treasury must also submit a statement of transactions affecting its revenue fund (in the prescribed format) to the national Treasury before the 22nd day of each month. The head of the provincial treasury must certify that the information has been verified.

Monthly reports to the executive authority should at least contain the information provided to the treasury, and be complemented by quarterly reports on:

| • | More detailed information on the state of finances |

| • | Detailed information on corrective measures taken (disciplinary action, etc.) |

| • | Progress on implementing the PFMA (internal controls, audit committee, clearing of audit queries) |

| • | Non-financial information to enable measurement of progress against service delivery indicators also as objective |

Quarterly reports (Section 32 reports)

Every quarter, the national Treasury will publish a statement in the Government Gazette detailing the revenue and expenditure of each of the ten revenue funds, with actual performance against the budget for each vote. Accounting officers should expect the press, parliamentary committees, non-governmental organisations (NGOs) and the public to monitor their department’s progress through these reports.

Information on grants made under the DoRA must be reported in terms of that Act. The accounting officer effecting the payment must report to the relevant treasury on the funds transferred to each government entity within 15 days of the end of every quarter.

Annual report

The accountability cycle is completed with the production and publication of an annual report, which reviews performance and achievement against the plan and budget approved by the legislature at the start of the year. The Act requires each department to publish an annual report that ‘fairly presents’ the state of its affairs, its financial results and position at the end of the financial year, and its performance against predetermined objectives. The annual report must include particulars of any material losses through criminal conduct, and any unauthorised, irregular, fruitless and wasteful expenditure, together with any criminal or disciplinary steps taken as a result of such losses.

Performance information

The annual report should also indicate the department’s efficiency, economy and effectiveness in delivering the outputs specified in the operational plan, as well as any other information required by the legislature, and the use of any foreign assistance or aid-in-kind. The audit committee must comment on internal control in the department.

Introduction of GRAP

In accordance with the Constitution, the financial statements will be prepared under GRAP. GRAP will be defined by the Accounting Standards Board (established under the Act) and will introduce many of the accounting practices used in the private sector. In particular, accrual accounting will be introduced: this recognises income and expenditure when the benefit is received or given, rather that simply reflecting the timing of a cash flow. It also acknowledges the consumption of assets over their useful lives, through depreciation.

Until GRAP is defined, and accrual accounting introduced over the next few years, the Regulations specify GRAP for the year ending 31 March 2001, to be a set of cash-based statements that comprise:

| • | A balance sheet |

| • | An income statement |

| • | A cash flow statement |

| • | Notes and such other statements as may be prescribed by the ASB |

The Accountant-General will issue guidelines for the production of financial statements, as well as a series of practice notes dealing with matters such as the closure of accounts. These will also be available on the national Treasury web site.

Timescale for submission

Under the Exchequer Act, accounting officers had four months to submit appropriation accounts to the Auditor-General and Treasury, and no sanctions were applied if delays occurred. The PFMA reduces this period to two months and introduces strong sanctions for delays, which are deemed financial misconduct. The accounting officer must ensure that the systems and financial staff within the department are capable of preparing high-quality financial statements within two months of the year-end. The Auditor-General will report to Parliament, the legislatures and the treasuries on the date of submission, and be asked to comment on the quality of the data: should this prove to be poor, a charge of financial misconduct may result. Should accounting officers submit incomplete financial statements, the Auditor-General will no longer finalise these.

The accounting officer must also, within five months of the year-end, submit the department’s annual report containing the audited financial statements and the Auditor-General’s report to the relevant treasury and the executive authority. The Accountant-General will consolidate the departmental information to show Government’s overall position.

Departments and the Auditor-General must cooperate to ensure that annual reports are finalised within five months of the year-end. This will include coordinating interim audits and ensuring that financial and other records are readily available for auditing at year-end. The reduced timescale will enhance accountability and will result in actual figures being available in time to influence submissions to the next budget cycle (indicated by the dotted line in the diagram).

In-year monitoring and the annual report will be the basis for evaluating achievements, and accounting officers will be responsible for delivering clearly specified outputs. The Office of the Auditor-General will focus on performance as well as compliance auditing. In addition to examining the post-audit review, legislators will play a greater role in monitoring the performance of accounting officers during the financial year.

Table 4: Reporting responsibilities of the accounting officer

|

Responsibility |

Actions required |

When? |

Reference |

||||||

|

Unauthorised and other expenditure |

Report, in writing, to the relevant treasury (and tender board in the case of irregular expenditure) particulars of unauthorised, irregular or fruitless and wasteful expenditure |

On discovery |

S 38(1)(g) |

||||||

|

Undercollection or overexpenditure |

Report to the executive authority and the relevant treasury any impending:

|

No specific time stipulated |

S 39(2)(b) |

||||||

|

Financial statements |

Submit financial statements to the Auditor-General and the relevant treasury |

Within two months of the end of the year |

S 40(1)(c) |

||||||

|

Annual reports |

Submit to the relevant treasury and executive authority:

|

Within five months of the end of a financial year |

S 40(1)(d) |

||||||

|

Breakdown per month |

Provide the relevant treasury with a monthly breakdown of the anticipated revenue and expenditure for the year |

Before the beginning of the financial year |

S 40(4)(a) |

||||||

|

Actual and anticipated figures |

Submit to the relevant treasury revenue and expenditure information for the previous month and the budget for that month |

Within 15 days of each month-end |

S 40(4)(b) |

||||||

|

Projected figures |

Submit to the relevant treasury and executive authority:

|

Within 15 days of the end of each month |

S 40(4)(c) |

||||||

|

Conditional grants |

Ensure all conditional grants and transfers are made in terms of the DoRA or an appropriation Act |

Promptly |

|

||||||

|

Inability to comply |

Report to the relevant treasury and executive authority the reasons for failure to comply with the reporting requirements |

Promptly |

S 40(5) |

||||||

|

Other information |

Supply to the relevant legislature, treasury, executive authority and the Auditor-General any information, documents or explanations, as prescribed or required |

As regulated or required |

S 40(1)(f) and 41 |

||||||

|

Inventory |

When transferring assets and liabilities to another department, file a copy of the signed inventory with the relevant treasury and the Auditor-General |

Within 14 days of the transfer |

S 42(3) |

||||||

|

Utilisation of saving |

Submit to the executive authority details of the exercise of virement |

Within seven days |

S 43(3) |

||||||

|

Directive that will lead to unauthorised expenditure |

If any directive of an executive authority will result in unauthorised expenditure, file copies of the directive with the Auditor-General, the national Treasury and, in the case of a province, with the provincial treasury |

Promptly |

S 64(3) |