46A1.05

(a)

| (i) |

The following documents must be submitted with the completed application for a visa: |

| (aa) |

completed bill of entry export, bill of lading, air waybill or other transport document, the commercial invoice, and the certificate of origin (where applicable) completed and signed by the exporter or the duly authorised agent as contemplated in rule 46A1.04; and |

| (bb) |

copies of such documents for retention by the Controller in addition to any copies required in terms of other export clearing procedures as the Controller may determine. |

| (ii) |

Where a certificate of origin is issued, the application for a visa must reflect the same original signature and contain the same particulars in the corresponding blocks as the certificate of origin, except that— |

| (aa) |

Block 4 must contain the numerical identifier of the certificate of origin preference grouping and the line reference on the export bill of entry; |

| (bb) |

the total quantity and unit of quantity in the shipment must be inserted in brackets below the description of the goods in Block 5, for example, 510 doz. |

| (iii) |

A visa is required and an application must be completed in respect of each preference group of textile and apparel articles contained in a shipment exported for the purposes of claiming any preferential tariff treatment under the AGOA. |

| (iv) |

Whenever a certificate of origin is issued for multiple shipments as contemplated in rule 46A1.06 the exporter must— |

| (aa) |

submit a copy of the certificate of origin with the application for a visa in respect of each shipment exported subsequently to the first shipment for which the original certificate of origin was produced; |

| (bb) |

endorse the number of the certificate of origin in the block for official use on the application form. |

| (v) |

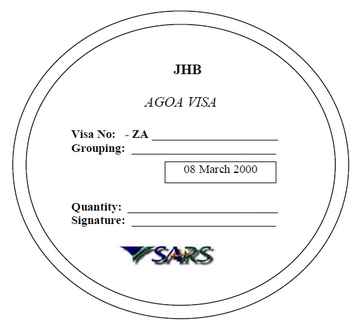

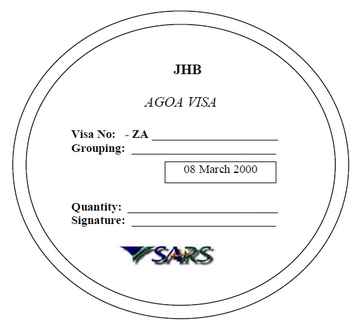

Specimen imprint of visa |

(b)

| (i) |

If the application is approved by the officer designated to perform the administration of the rules of origin function at the office of the Controller that officer shall stamp the front of the original and a copy of the commercial invoice with the visa stamp and insert within the visa stamp impression, which shall be in blue ink, the following— |

[Words preceding Rule 46A1.05(b)(i)(aa) substituted by paragraph (l) of Notice No. R. 1472 dated 22 December 2017]

| (aa) |

the visa number which will consist of one numeric digit for the applicable preference group according to the designated preference groups numbered 1 – 9 (which each sequentially corresponds with preference groups 1A – 9-I of the certificate of origin), the two-character alpha code ZA, followed by a six-digit numerical serial number identifying the shipment which is electronically allocated at the office of the Controller where the goods are entered for export; |

| (bb) |

the correct grouping, the total quantity in whole numbers and unit of quantity, for example, "grouping 5 – 510 doz". |

| (ii) |

Decimals or fractions of quantities are not acceptable. Quantities must be stated within the stamp as follows: |

| (aa) |

in groupings 1 to 8, all apparel must be stated in dozens, except for— |

| (A) |

men's, boys, women's or girls" suits which must be stated in numbers; and |

| (B) |

panty hose, tights, stockings, socks, other hosiery, gloves, mittens and mitts, all of which must be stated in dozen pairs; |

(bb)

| (A) |

where quantities are required to be stated in dozens, the number stated must be a whole number; |

| (B) |

if the quantity in the grouping is less than one half dozen, it must be rounded down (a quantity of 4 dozen and 4 pieces should therefore be stated as 4 dozen); |

| (C) |

if the quantity in the grouping is a half dozen or greater it must be rounded up (a quantity of 4 dozen and 6 pieces should therefore be stated as 5 dozen); |

| (D) |

if the quantity in the grouping is less than a half dozen, it must be stated as 1 dozen (a quantity of 3 pieces or 6 pieces should therefore be stated as 1 dozen); |

| (E) |

the methods specified in subparagraphs (A) to (D) are also applicable to quantities which must be stated in dozen pairs as required in terms of subparagraph (aa)(B). |

| (cc) |

Where items in the same grouping are mixed, such as suits (which require number) and shirts (which require dozen) or shirts and pants (which both require dozen), a separate quantity must be shown for each of the items (apparel under grouping 1 should therefore show separate quantities such as, 105 suits and 10 dozen shirts or 10 dozen shirts and 12 dozen pants). |

| (dd) |

In respect of goods of grouping 9, the quantity stated must be the usual quantity required for those goods— |

| (A) |

if rugs or handloomed fabric, it should be stated in square meters; |

| (B) |

if wall hanging, it should be stated in square meters; |

| (C) |

if apparel, it should be stated as required in grouping 1 to 8; or |

| (D) |

if household furnishings, it should be stated in kilograms. |

| (iii) |

Such officer must sign the visa in the space provided thereon. |

| (iv) |

The visa must be properly completed and no amendments are allowed, as specified in paragraph (d)(ii)(cc). |

(c)

| (i) |

The particulars entered on the visa must agree with the corresponding particulars entered on the application for a visa and on the certificate of origin whenever the certificate or a copy thereof is required to be submitted in terms of these rules. |

| (ii) |

The visa stamp must be used only to stamp the commercial invoice for goods exported for claiming preferential tariff treatment in terms of the AGOA and only such stamp shall be used for such purpose. |

(d)

| (i) |

The original visaed commercial invoice and the certificate of origin (where applicable) will be returned for submission to the importer in the US while the copy of the visaed invoice will be retained by the Controller. The original visaed invoice is required to enter the shipment in the US when claiming preferential tariff treatment as contemplated in the AGOA. |

| (ii) |

Any visa issued is subject to the following conditions and procedures prescribed by the US Customs Service: |

| (aa) |

if the quantity indicated on the visa is less than that of the shipment, only the quantity shown on the visa will be eligible for preferential tariff treatment; |

| (bb) |

if the quantity indicated on the visa is more than that of the shipment, only the quantity of the shipment will be eligible for preferential tariff treatment and the excess cannot be applied to any other shipment; |

| (cc) |

the visa will not be accepted and preferential tariff treatment will not be permitted if the visa number, date of issuance, authorised signature, preference group, quantity and the unit of measure are missing, incorrect, illegible or have been crossed out or altered in any way; |

| (dd) |

if the visa is not acceptable, then a new visa must be obtained; |

| (ee) |

if the visaed invoice is deemed invalid, the US customs service will not return it after entry, but will provide a certified copy thereof for use in obtaining a correct original visaed invoice. |

(iii)

| (aa) |

Any application for a corrected visa must be submitted together with the copy of the incorrect visa and copies of all export documents to the Officer: Origin Administration. |

| (bb) |

The officer designated to perform the administration of the rules of origin function at the office of the Controller may, after such examination as he deems necessary, issue a corrected visa unless evidence is obtained of the commission of an offence contemplated in section 46A(8) in which case the officer shall submit the application and a report on the results of the examination, to the manager responsible for the administration of the rules of origin section in Head Office for a decision. |

[Rule 46A1.05(d)(iii)(bb) substituted by paragraph (m) of Notice No. R. 1472 dated 22 December 2017]

| (iv) |

Where the officer designated to perform the administration of the rules of origin function at the office of the Controller has reasonable doubts about the correctness of the statements made on the application for a visa, such officer, may— |

[Words preceding rule 46A1.05(d)(iv)(aa) substituted by paragraph (n) of Notice No. R. 1472 dated 22 December 2017]

| (aa) |

request the exporter or manufacturer to produce documentary proof of origin; |

| (bb) |

detain and examine the goods entered for export; |

| (cc) |

investigate the books, accounts and other documents required to be kept for the purposes of the information contained in the application for a visa; and |

| (dd) |

refuse to issue a visa. |

| (v) |

The manager responsible for the administration of the rules of origin section in Head Office may, for such time as he may determine, refuse issuance of a visa if — |

[Words preceding rule 46A1.05(d)(v)(aa) substituted by paragraph (o) of Notice No. R. 1472 dated 22 December 2017]

| (aa) |

the exporter or manufacturer fails to keep or produce books, accounts and other documents as contemplated in section 46A(3)(b)(i) and rule 46A1.12; |

| (bb) |

the exporter or manufacturer refuses the investigation or assistance contemplated in section 46A(3)(b)(ii); |

| (cc) |

the application for a visa is found to be false; or |

| (dd) |

the particulars on a visaed commercial invoice are altered in any way after issuance by the officer designated to perform the administration of the rules of origin function at the office of the Controller. |

[Rule 46A1.05(d)(v)(dd) substituted by paragraph (p) of Notice No. R. 1472 dated 22 December 2017]

| (vi) |

The manager responsible for the administration of the rules origin section in Head Office shall report monthly to the US Customs Service in respect of each exportation: |

[Words preceding "name of manufacturer", Rule 46A1.05(d)(vi), substituted by paragraph (q) of Notice No. R. 1472 dated 22 December 2017]

name of manufacturer

visa number

date of issuance

grouping number

export value of goods

quantity / unit of measure

US consignee (if known)

subheading to the 6-digit level

port of loading

mode of transport

port of destination

gross weight

Mineral and Petroleum Resources Royalty (Administration) Act, 2008

Mineral and Petroleum Resources Royalty (Administration) Act, 2008