Stamp Duties Act, 1968 (Act 77 of 1968)

Stamp Duties Act, 1968 (Act 77 of 1968)

R 385

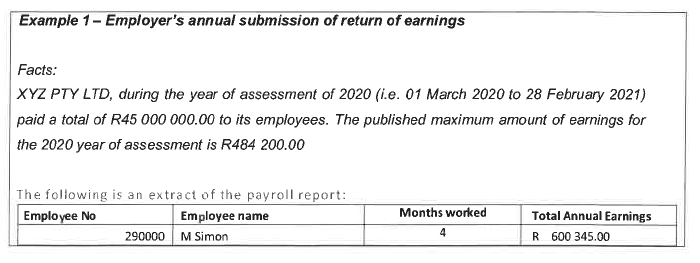

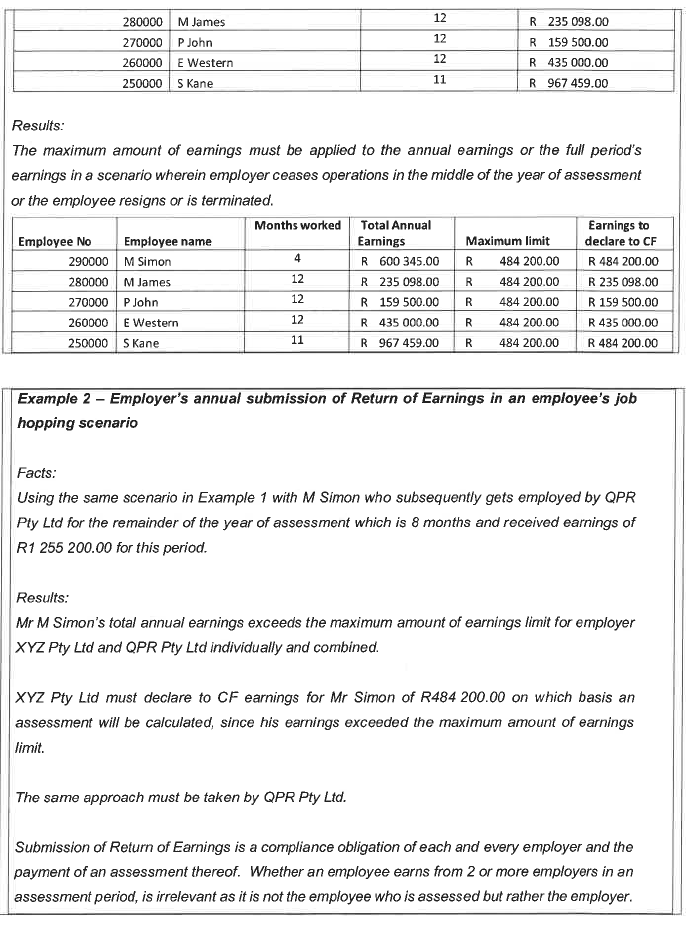

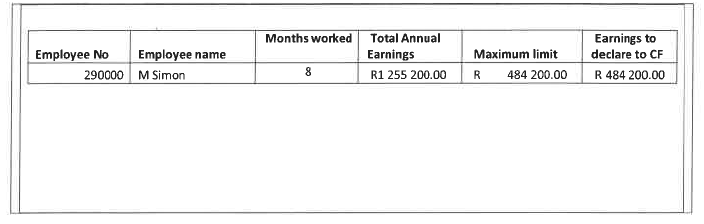

Compensation for Occupational Injuries and Diseases Act, 1993 (Act No. 130 of 1993)NoticesNotice on the Manner of Calculation of Return of Earnings and the Determination of Earnings for Inclusion/Exclusion in the Measurement of Compensation BenefitsAnnexure A - Guidance Note : on the calculation of earnings in terms of sections 82 and 83 on employers' assessments (return of earnings and maximum earnings) |

| 1. | Background |

Since the amendment of the Act in 1997, the sections dealt with in this guidance note has never changed, including their interpretation and application by the Compensation Fund (CF).

| 2. | How employers are assessed under section 83 and their obligation under section 82 |

| 2.1 | Employers are assessed based on their declaration of annual earnings of employees for the year of assessment, taking into account tariffs as per published industry classifications of their business. |

| 2.2 | Earnings of employees for the year of assessment are considered on an annual basis as opposed to monthly for purposes of applying the maximum amount of earnings. Employers are requiredto submit their Return of Earnings (ROEs) annually under the Act. |

| 2.3 | The obligation to submit a Return of Earnings rests with the employer and not employees. Thus, the maximum amount of earnings limit is applied separately to each employer's return. If the employee's total annual earnings from all employers, in a particular year, exceeds the maximum threshold, each employer is only liable for their portion of the earnings up to the threshold. |

Based on the employers' industry classification, a tariff of assessment rate as published by the Compensation Fund is used to calculate a liability amount on the earnings declared by the employer as correct, excluding earnings exceeding the maximum amount of earnings limit.

| 3. | Submission of returns online and manually |

| 3.1 | Employers must submit their Return of Earnings (ROE) online or manually by completing a manual ROE form. |

| 3.2 | The manual ROE form requires employers to declare what is referred to as "actual earnings" for the year of assessment ending on the last day of February. The form also requires employers to declare what is referred to as "provisional earnings", which represents estimated earnings for the following year of assessment ending on the last day of February. |

| 3.3 | In the "actual earnings" section, the following statement appears "Number of employees and amount of earnings (staff costs/salaries & wages) per month paid to all employees (excluding directors of a Company or members of a close corporation) up to a maximum of Rxxx xxx per person for the above period". Immediately below the above statement, a "Number" and "Earnings (Rands only)" is required per month as per the table. A "Total" for both number of employees and rand value of earnings is required after the February month row. |

| 3.4 | The statement in the "Actual Earnings" section of the manual return of earnings form requests the following information: |

| (a) | Number of employees: The total number of employees (excluding directors of a company or members of a close corporation) who received earnings (salaries, wages, or staff costs) during the specified period. (NB: Directors, etc are addressed separately in the form) |

| (b) | Amount of earnings: The total amount of earnings paid to all employees, subject to the maximum threshold principle: |

| • | Earnings up to R484 200.00 per person are included in full, since the employer is required to submit the return once a year, the earnings threshold of R484 200.00 applies to the total earnings paid to each employee over the entire assessment year (1 March to 28/29 February). |

| • | Earnings above R484 200.00 per person are excluded (or capped at R484 200.00). |

Note that the earnings amount of R484 200.00 is the published maximum threshold amount for the 2020 year of assessment and is used here for illustrative purposes.