Public Service Act, 1994

Public Service Act, 1994

R 385

Public Finance Management Act, 1999 (Act No. 1 of 1999)Understanding and Using this ActGuide for Accounting Officers2. Vision of the PFMA: performance budgets and accountability |

Financial planning

Financial planning is a cycle that runs from policy formulation, to the determination of priorities in the short and long run, to planning the delivery of services and reflecting these plans in financial allocations (the budget), and to the monitoring of results. The most notable reforms over the last four years include:

| • | The moves towards decentralising budgeting from national to subnational governments |

| • | The new system of equitable shares and conditional grants |

| • | The shift to multi-year budgeting through the MTEF |

| • | The deepening of the budget process, through greater political participation and oversight |

| • | The closure of the gap between policy and budgeting through joint MinMECs between the national Treasury and other line functions |

| • | The setting up of technical forums such as the ‘4x4s’ to support joint MinMECs |

| • | The introduction of the Medium-term Budget Policy Statement in October, four months before Budget day |

Government departments are currently attempting to align planning and budgeting. Future changes will seek to close the gap between service delivery and budgets, for example, through ‘service delivery improvement programmes’ and performance budgeting.

Focus on outcomes and outputs

As expenditure has been brought under control successfully, the major challenge is now for the public sector to become more efficient and effective in the use of resources – this requires a focus on outcomes and outputs. Outcomes are the results Government wants to achieve for communities, for example, reduced child mortality rates and a lower level of crime. As the articulated vision of Government, they indicate the intended impact of government activity on the community.

The definition and costing of outputs are vital for assessing the level of service delivery. Outputs are statements of the goods and services produced by departments for communities, such as access to treatment in primary health clinics, or the administration of social welfare payments. Accounting officers are accountable for achieving outputs against a range of predetermined indicators. In future, planning, budgeting, monitoring and reporting must be more closely linked and departments must be specific about what is intended to be, and has actually been, delivered.

Planning and budgeting

In the context of the broader process of budgetary reform, which reduces the policy and budgeting gap, the Regulations strengthen the coordination of planning and budgeting. Accounting officers must ensure that the strategic plans developed in accordance with the 1999 Public Service Regulations and the Regulations are sufficiently quantified to shape the budget and include appropriate service delivery indicators. Although this is not an immediate legal requirement, accounting officers should adopt this measure as soon as possible. The Forum of Directors-General (FOSAD) is considering ways of streamlining and rationalising the various regulations on planning into a single Planning Framework document.

The strategic planning process will ensure commonality of purpose between the accounting officer and the executive authority in the pursuit of government objectives and outcomes. Published plans are key instruments in the accountability process, as they provide essential information for the legislatures to assess and debate proposed government programmes. In addition, by providing performance measures and indicators (that will eventually be published in the annual report), they enable stakeholders to evaluate the department’s performance in achieving planned programmes, objectives and outcomes.

The strategic plan will form the basis for identifying the departmental programmes necessary to achieve government objectives or outcomes. It will also allocate responsibility for the delivery of specific programmes and be the foundation for performance contracts.

Operational plan

The first year of the strategic plan is known as the operational plan. It must provide a sufficiently detailed quantification of outputs and resources, together with service delivery indicators, for the legislature to understand exactly what it is ‘buying’ for the community when it approves the budget. The operational plan must not be a wish list, but must be flexible and adjustable while remaining within the MTEF allocation. The plan must contain:

| • | Descriptions of the various programmes that the department will pursue to achieve its objectives, and for each programme, the measurable objectives, total cost and intended lifespan |

| • | Information on any conditional grants to be paid or received, including the criteria to be satisfied |

| • | Information on any new programmes to be implemented, including the justification for such programmes, expected costs, staffing and new capital, as well as future implications |

| • | Information on any programmes to be scaled down or discontinued during the financial year |

| • | Where two or more departments contribute to the delivery of the same service, a concise summary of the contribution of each department (the accounting officers must ensure that the summaries included in their respective plans are consistent) |

| • | Summary information, drawn from the strategic plan, of all capital investments planned for the year, including the future impact on the operating budget (this information should be rolled forward, amended as appropriate, to the next year’s strategic plan) |

Quantifiable measures

A measurable objective might be illustrated as follows:

| • | Objective: to supply electricity to all provincial schools by 2002/03 |

| • | Service delivery indicator: the percentage of schools that have electricity |

| • | Target: to have 80 per cent of schools electrified by 31 March 2001 |

The budget for 2000/01 will then indicate the amounts required to have 80 per cent of schools electrified by 31 March 2001.

Progress towards each objective will be measured against the predetermined targets. The Office of the Auditor-General is moving to a more integrated audit approach (covering both regularity and performance audits), and will examine departments’ progress against their targets.

Matching performance contracts to operational plans

Each executive authority must ensure that these specified outputs are reflected in the terms of his or her accounting officer’s performance contract. In addition, one of the key performance indicators (KPIs) in this contract should relate to the extent to which financial management responsibilities have been effectively performed, and the plans successfully implemented by the department.

Evaluation of performance

Performance evaluation is a cyclical process that starts with strategic planning and moves through programme implementation and monitoring to performance evaluation. The findings are then reported, objectively, to accounting officers and executive authorities for use in the next strategic planning process. An appreciation of these linkages between planning, implementation, monitoring, evaluation and reporting is critical to good resource management. The Planning Framework being developed by FOSAD emphasises that the information necessary to monitor all steps in the cycle must be available within departments.

Appropriate measures

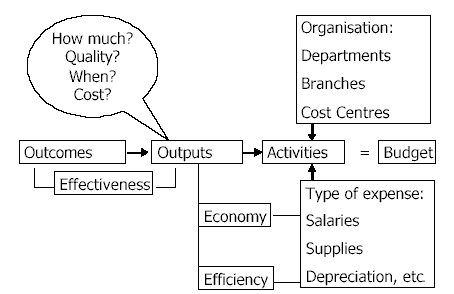

The Act differentiates between measures of efficiency and economy (typically cost, time and quantitative items that can be measured accurately) and indicators of effectiveness (often assessments of recipient satisfaction, for example through surveys). It also emphasises the need to ensure that performance measures and indicators are developed as integral parts of the planning process, and that the systems and processes can provide the relevant information.

This is illustrated in the diagram below.

Through the evaluation of performance, accounting officers, executive authorities and other stakeholders will be able to determine whether departments are achieving the objectives or outcomes identified in their strategic plans. Holding heads of department and other officials accountable for performance, i.e. the efficient, effective, economical and transparent use of the resources of their departments, may be more important than the traditional accountability for ‘compliance’ within a vote. However, the national Treasury recognises that this shift will take several years to complete.

Accountability cycle

The accountability cycle runs for at least three years, but ideally five when the multi-year budget is taken into account. It begins with the preparation of a three-year strategic plan ten months before the first year of the multi-year period, along with a more detailed plan for the first year – the operational plan. The next steps in the cycle are implementation at the beginning of the year, and in-year management, monitoring and reporting. The cycle culminates the following year with the publication of an annual report, and the hearings of the public accounts committees of the legislatures. The Act places very clear responsibilities on accounting officers at each stage of this cycle, in particular specifying a set of reporting requirements, which are detailed in Chapter 4 of this Guide.

Planning the year before the budget

As required by the 1999 Public Service Regulations, and the Regulations, departments will already have prepared strategic plans.

To be consistent with the timescale of the MTEF, the strategic plan will cover a minimum of three years and be rolled forward each year.

The operational plan will define the outputs to be delivered, so that when the legislature considers the department’s budget, it is clear what is being ‘bought’ for delivery to communities. While this form of quantification is not an immediate legal requirement of the PFMA, as this provision has been delayed to August 2002, accounting officers should ensure that outputs are sufficiently quantified and appropriate service delivery indicators developed as soon as possible. As the next major reform in the budget process, quantification will be phased in over two years, starting with the national and provincial health departments.

The operational plan will include conditional grants, transfers and capital projects. The strategic and operational plans must be submitted to the relevant treasury by 30 June, together with the MTEF submissions. The strategic plan will be tabled with the budget, having been adjusted to incorporate the new three-year allocations.

Implementation, in-year management and reporting

The executive authority should ensure that the accounting officer’s performance contract is based on the agreed plan. The KPIs must reflect the fact that implementation begins from the first day of the financial year, rather than later in the year, as is currently the case.

Good planning and in-year management and reporting are critical to successful implementation. Once the financial year begins, the accounting officer must submit regular monthly management reports to the Minister or MEC and the relevant treasury. These reports must focus on performance against budget and against service delivery improvement programmes, and alert managers when remedial actions are required. The onus for such actions is put squarely on the manager and not on the relevant treasury. Internal control measures such as internal audit will enable the accounting officer to be more proactive and to deal with problems in good time.

While the Act focuses on financial reporting, as financial data are leading indicators of performance, the accounting officer must also include non-financial indicators, which are produced quarterly. These non-financial indicators are often department or programme specific, and should be stipulated in the performance agreement between the accounting officer and executive authority, and endorsed by the portfolio committee in the relevant legislature. The monthly monitoring reports will be consolidated and published in the national Government Gazette, in line with international best practice. These reports will facilitate the compilation of the year-end financial statements and the annual report, which completes the accountability cycle.

Annual report

The annual report must review performance and achievements against the plan and budget approved by the legislature at the start of the year.

It must include the financial statements of the department, together with its achievements against the service delivery indicators agreed at the time of the budget. The report must also quote the ‘audit opinion’ of the Auditor-General, based on the external audit. In order to strengthen accountability to the legislature, a reduced time-frame has been specified for the completion of the external audit, as is the case in the private sector. Once published, the annual report will be tabled in the (relevant) legislature, and will be available for scrutiny by the relevant public accounts committee. Portfolio Committees should also consider such reports to ensure that accounting officers address any issues raised in the audit report or any recommendations of the public accounts committee.

New roles

For this process to operate effectively, all stakeholders will need to adjust their mindsets substantially. For example, accounting officers must be able to justify decisions taken during the course of the year.

The Auditor-General’s reports will need to focus the legislature on significant matters, and the emphasis of the audit will shift towards evaluating performance, rather than simply compliance with rules.

The Standing Committee on Public Accounts (SCOPA) or the relevant public accounts committee is the ultimate arbiter of the financial performance of accounting officers. Should accounting officers not implement appropriate financial management measures, or not adequately address audit queries, the relevant public accounts committee is expected to encourage executive authorities to utilise the specified sanctions.

Similarly, the role of treasuries will change and they will adopt a more strategic role in monitoring departmental progress in addressing reported weaknesses. The relevant treasury could submit regular reports to Cabinet/Exco on the extent to which accounting officers resolve audit queries.

A memorandum clarifying the respective roles of the treasury, the Office of the Auditor-General and the public accounts committees is being prepared for publication.

Accountability chain as driver

The accountability chain is the most critical driver for improving financial management in the public sector. It represents a sanction of last resort should accounting officers or their political heads fail to take corrective or appropriate action. In the past, many accounting officers failed to resolve problems raised by the Auditor-General and SCOPA, and continued to operate as though no changes were necessary. This attitude was assisted by the following negative practices:

| • | Submitting poor quality financial statements, and often requesting the Auditor-General to correct any errors and complete the work |

| • | Long delays before audited statements reached Parliament |

| • | Parliament’s expectation that treasuries or Excos would monitor the implementation of corrective actions |

Steps in the accountability chain

Closing the loop of accountability after the submission of financial statements is critical to the successful implementation of the PFMA.

The Act puts a series of steps in place:

| • | A written performance agreement between the executive authority and the head of department: One of the KPIs in this agreement ought to relate to the financial management of the department. The executive authority should monitor the agreement. |

| • | Disciplinary processes: The accounting officer is expected to ensure that incompetent or dishonest departmental officials are subjected to the prescribed disciplinary steps. Should the accounting officer fail in his or her duties, the onus is on the executive authority to act against the accounting officer. |

| • | Role of the Auditor-General: The work of this Office will shift to auditing performance, as well as compliance. It is also likely that the Office will develop a proactive relationship with audit committees, particularly in discussing the management letter. To avoid compromising its audit independence, the Office will no longer complete erroneous financial statements. |

| • | Role of SCOPA: The Constitution gives SCOPA wide-ranging powers to investigate issues, and the committee will receive reports of actions taken and not taken by accounting officers. SCOPA is likely to focus on those matters that the previous steps in the accountability chain failed to resolve. For this reason, an accounting officer appearing before the committee will be expected to answer for the failure to take appropriate corrective action earlier. SCOPA may recommend sanctions against the accounting officer to the executive authority, ranging from salary deductions, demotion to dismissal. In serious cases, it may also recommend that charges of financial misconduct be brought. |

Accounting officer’s personal liability

When investigating cases against accounting officers, the relevant public accounts committee may find that the accounting officer is personally liable unless it is convinced that he or she had:

| • | Recruited the necessary financial expertise |

| • | Implemented effective internal controls |

| • | If a particular official had been responsible for the problem, initiated the necessary disciplinary steps |

Accounting officers must therefore ensure that they put in place best practice controls, and have quality financial staff, to avoid being held personally liable in the event of any problems.

Approach of the Standing Committee on Public Accounts

In the event of a serious problem, the public accounts committee will want to determine culpability. To determine whether an accounting officer is responsible, the public accounts committee may wish to examine whether he or she had implemented the recommended best practice systems to prevent the problem. For this reason, an accounting officer should be able to answer the following questions to reduce any personal liability.

| (i) | When during the financial year did the accounting officer become aware of the potential problem? Could it have been detected earlier? |

| (ii) | Did the accounting officer appoint a suitably qualified and experienced CFO, together with qualified accounting staff, to develop a systematic monitoring and reporting system? |

| (iii) | Did the accounting officer have sufficient internal controls to prevent such a problem? Had appropriate members been appointed to the audit committee? |

| (iv) | Did the accounting officer submit monthly reports to the treasury (and executive authority)? What was the quality of the monthly reports? |

| (v) | Did the accounting officer attempt to conceal the problem or mislead the executive authority or relevant treasury (which could result in a charge of fraud)? |

| (vi) | What remedial steps were taken when the problem was first identified? |

| (vii) | If the problem was identified before the adjustment budget had been tabled, did the accounting officer seek to amend the budget during this process? |

| (viii) | Did the accounting officer take steps to address any concerns raised in previous audit reports or in any reports of the audit committee? |

| (ix) | If a particular official had been responsible for the problem, did the accounting officer take the appropriate disciplinary steps? Accounting officers who are negligent or fail to take appropriate corrective steps may be held personally liable. |

These questions aim to identify the extent to which the accounting officer can demonstrate real efforts to prevent unauthorised expenditure by adopting or adapting best practice guidelines. Such efforts would be strong grounds to suggest that he or she could not reasonably be held culpable and therefore should not face sanctions, which range from salary deductions to demotion or dismissal.

Famous excuses

Provided that accounting officers adopt a constructive and forthright approach towards accepting the responsibilities placed on them by the Act, it is unlikely that SCOPA will have to hear (and it will almost certainly not accept) the excuses for non-performance presented in the past. Some common examples are set out in the table below:

Table 2: Famous excuses

|

Excuse |

PFMA change |

|

No Treasury approval was granted |

One of the major thrusts of the Act removes the ‘micro-control’ regime previously exercised by the Treasury, in favour of frameworks of best practice for accounting officers to adapt and adopt. |

|

Tender Board procedures caused a delay |

The accounting officer must allow sufficient lead time when planning a project, and factor in such delays when preparing the budget. |

|

Inadequate systems |

No system is perfect, but the existing financial systems can provide the information managers require for monitoring departmental performance. |

|

Unfunded mandates |

The PFMA specifically requires the funding implications of any new responsibility to be clarified before a function is assigned or transferred to a province. Neither are receiving (provincial) accounting officers passive victims: they can refuse to implement a mandate for which funds have not been transferred. |

|

Capital projects take longer than expected |

Strategic and operational planning must be realistic. Planning should begin before budgetary allocations are made. |

|

Rollovers |

Rollovers imply poor budgetary capacity within departments. Departments must take projected cash flows into account when determining their budgets. |

|

Blaming a province or municipality |

National accounting officers must consider the capacity of provincial or local governments when motivating programmes or conditional grants, and not blame them for implementation failures. |

Most of these examples relate to poor planning capacity. Accounting officers who assume their full responsibilities for planning and budgeting will probably not encounter these problems.