Public Service Act, 1994

Public Service Act, 1994

R 385

Public Finance Management Act, 1999 (Act No. 1 of 1999)NoticesStandards of Generally Accepted Municipal Accounting Practice (GAMAP) in terms of Section 91GAMAP 6 : Consolidated financial statements and accounting for controlled entities |

Introduction

Standards of Generally Accepted Municipal Accounting Practice (GAMAP)

The Accounting Standards Board (Board) is required in terms of the Public Finance Management Act, Act No. 1 of 1999, as amended (PFMA), to determine generally recognised accounting practice referred to as Standards of Generally Recognised Accounting Practice (GRAP).

The Board must determine GRAP for:

| (a) | departments (national and provincial); |

| (b) | public entities; |

| (c) | constitutional institutions; |

| (d) | municipalities and boards, commissions, companies, corporations, funds or other entities under the ownership control of a municipality; and |

| (e) | Parliament and the provincial legislatures. |

The above are collectively referred to as ‘entities" Standards of GRAP.

The Board considers that the Standards of GAMAP constitute GRAP for municipalities.

GAMAP is an interim solution until such time as it is replaced by a Standard of GRAP.

Any limitation of the applicability of specific Standards is made clear in those Standards.

The Standard of GAMAP on Consolidated Financial Statements and Accounting for Controlled Entities is set out in paragraphs .01 - .44. All paragraphs in this Standard have equal authority. The authority of appendices is dealt with in the preamble to each appendix. This Standard should be read in the context of its objective, the Preface to Standards of GRAP, the Preface to Standards of GAMAP and the Framework for the Preparation and Presentation of Financial Statements.

Reference may be made here to a Standards of GRAP that has not been issued at the time of issue of this Standard. This is done to avoid having to change the Standards already issued when a later Standard is subsequently issued. Paragraph .12 of the Standard of GRAP on Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.

Scope

| .01 | An entity which prepares and presents financial statements under the accrual basis of accounting shall apply this Standard in the preparation and presentation of consolidated financial statements for an economic entity. |

| .02 | This Standard shall also be applied in accounting for controlled entities in a controlling entity’s separate financial statements. |

| .03 | Consolidated financial statements are encompassed by the term "financial statements" included in the Preface to Standards of Generally Accepted Municipal Accounting Practice. Therefore, consolidated financial statements are prepared in accordance with Standards of Generally Accepted Municipal Accounting Practice. |

| .04 | This Standard does not deal with: |

| (a) | methods of accounting for entity combinations and their effects on consolidation, including goodwill arising on an entity combination (guidance on accounting for entity combinations can be found in the International Accounting Standard on Busipess Combinations), |

| (b) | accounting for investments in associates (see the of Generally Accepted Municipal Accounting Practice on Accounting for lnvestments in Associates), and |

| (c) | accounting for investments in joint ventures (see the Standard of Generally Accepted Municipal Accounting Practice on Financial Reporting of Interests in Joint Ventures). |

Definitions

| .05 | The following terms are used in this Standard with the meanings specified: |

Accounting policies are the specific principles, bases, conventions, rules and practices adopted by an entity in preparing and presenting financial statements.

Accrual basis means a basis of accounting under which transactions and other events are recognised when they occur (and not only when cash or its equivalent is received or paid). Therefore, the transactions and events are recorded in the accounting records and recognised in the financial statements of the periods to which they relate. The elements recognized under accrual accounting are assets, liabilities, net assets, revenue and expenses.

Assets are resources controlled by an entity as a result of past events and from which future economic benefits or service potential are expected to flow to the entity.

Associate is an entity in which the investor has significant influence and which is neither a subsidiary nor a joint venture of the investor.

Cash comprises cash on hand and demand deposits.

Consolidated financial statements are the financial statements of an economic entity presented as those of a single entity.

Contributions from owners is future economic benefits or service potential that have been contributed to the entity by parties external to the entity that establish a financial interest in the net assets of the entity, provided that the contributions:

(a) do not result in liabilities of the entity, and

(b) meet the following test, that they:

| (i) | convey entitlement both to distributions of future economic benefits or service potential by the entity during its life, such distributions being at the discretion of the owners or their representatives, and to distributions to any excess of assets over liabilities in the event of the entity being wound up, and/or |

| (ii) | can be sold, exchanged, transferred or redeemed. |

Control is the power to govern the financial and operating policies of another entity so as to benefit from its activities.

Controlled entity is an entity that is under the control of another entity, (known as the controlling entity).

Controlling entity is an entity that has one or more controlled entities.

Distributions to owners is future economic benefits or service potential distributed by the entity to all or some of its owners, either as a return on investment or as a return of investment.

Economic entity means a group of entities comprising a controlling entity and one or more controlled entities.

Equity method is a method of accounting whereby the investment is initially recorded at cost and adjusted thereafter for the post-acquisition change in the investor’s share of net assets of the investee. The statement of financial performance reflects the investor’s share of the results of operations of the investee.

Expenses are decreases in economic benefits or service potential during the reporting period in the form of outflows or consumption of assets or incurrences of liabilities that result in decreases in net assets, other than those relating to distributions to owners.

Investor in a joint venture is a party to a joint venture and does not have joint control over that joint venture.

Joint control is the agreed sharing of control over an activity by a binding arrangement.

Joint venture is a binding arrangement whereby two or more parties are committed to undertake an activity which is subject to joint control.

Liabilities are present obligations of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits or service potential.

Minority interest is that portion of the surplus or deficit and of net assets of a controlled entity attributable to interests that are not owned, directly or indirectly through controlled entities, by the controlling entity.

Net assets is the residual interest in the assets of the entity after deducting all its liabilities.

Surplus or deficit comprises the following components:

| (a) | surplus or deficit from ordinary activities, and |

| (b) | extraordinary items. |

Reporting date means the date of the last day of the reporting period to which the financial statements relate.

Revenue is the gross inflow of economic benefits or service potential during the reporting period when those inflows result in an increase in net assets, other than increases relating to contributions from owners.

Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control over those policies.

Economic entity

| .06 | The term "economic entity" is used in this Standard to define, for financial reporting purposes, a group of entities comprising the controlling entity and any controlled entities. |

| .07 | Other terms sometimes used to refer to an economic entity include "administrative entity", "financial entity", "consolidated entity" and "group". |

| .08 | An economic entity may include entities with both social policy and commercial objectives. |

Presentation of consolidated financial statements

| .09 | A controlling entity shall present consolidated financial statements. |

Scope of consolidated financial statements

| .10 | A controlling entity which issues consolidated financial statements shall consolidate all controlled entities, other than those referred to in paragraph .11. |

| .11 | A controlled entity shall be excluded from consolidation when: |

| (a) | control is intended to be temporary because the controlled entity is acquired and held exclusively with a view to its subsequent disposal in the near future, or |

| (b) | it operates under severe external long-term restrictions which prevent the controlling entity from benefiting from its activities. |

| .12 | Such controlled entities should be accounted for as if they are investments. The International Accounting Standard on Financial Instruments: Recognition and Measurement provides guidance on accounting for investments. |

| .13 | An example of temporary control is where a controlled entity is acquired with a firm plan to dispose of it in the short term. This may occur where an economic entity is acquired and an entity within it is to be disposed of because its activities are dissimilar to those of the acquirer. Temporary control also occurs where the controlling entity intends to cede control over a controlled entity to another entity. For this exemption to apply, the controlling entity must be demonstrably committed to a formal plan to dispose of, or no longer control, the entity that is subject to temporary control. For the exemption to apply at more than one successive reporting date, the controlling entity must demonstrate an ongoing intent to dispose of, or no longer control, the entity that is subject to temporary control. An entity is demonstrably committed to dispose of, or no longer control, another entity when it has a formal plan to do so and there is no realistic possibility of withdrawal from that plan. |

| .14 | An entity may be subject to severe restrictions outside its control that prevent the other entity from benefiting from its activities. Under the circumstances, control is unlikely to exist and the consolidation procedures in this Standard would no longer apply. |

Establishing control of another entity for financial reporting purposes

| .15 | Whether an entity controls another entity for financial reporting purposes is a matter of judgement based on the definition of control in this Standard and the particular circumstances of each case. That is, consideration needs to be given to the nature of the relationship between the two entities. In particular, the two elements of the definition of control in this Standard need to be considered. These are the power element (the power to govern the financial and operating policies of another entity) and the benefit element (which represents the ability of the controlling entity to benefit from the activities of the other entity). |

| .16 | For the purposes of establishing control, the controlling entity needs to benefit from the activities of the other entity. For example, an entity may benefit from the activities of another entity in terms of a distribution of its surpluses (such as a dividend) and is exposed to the risk of a potential loss. In other cases, an entity may not obtain any financial benefits from the other entity but may benefit from its ability to direct the other entity to work with it to achieve its objectives. It may also be possible for an entity to derive both financial and non-financial benefits from the activities of another entity. For example, an entity may provide the controlling entity with a dividend and also enable it to achieve some of its social policy objectives. |

Control for financial reporting purposes

| .17 | For the purposes of financial reporting, control stems from an entity’s power to govern the financial and operating policies of another entity and does not necessarily require an entity to hold a majority shareholding or other equity interest in the other entity. The power to control must be presently exercisable. That is, the entity must already have had this power conferred upon it by legislation or some formal agreement. The power to control is not presently exercisable if it requires changing legislation or renegotiating agreements in order to be effective. This should be distinguished from the fact that the existence of the power to control another entity is not dependent upon the probability or likelihood of that power being exercised. |

| .18 | Similarly, the existence of control does not require an entity to have responsibility for the management of (or involvement in) the day-to-day operations of the other entity. In many cases, an entity may only exercise its power to control another entity where there is a breach or revocation of an agreement between the controlled entity and its controlling entity. |

| .19 | The power of one entity to govern decision-making in relation to the financial and operating policies of another entity is insufficient, in itself, to ensure the existence of control as defined in this Standard. The controlling entity needs to be able to govern decision-making so as to be able to benefit from its activities, for example by enabling the other entity to operate with it as part of an economic entity in pursuing its objectives. This will have the effect of excluding from the definitions of a "controlling entity" and "controlled entity" relationships which do not extend beyond, for instance, that of a Municipal Financial Recovery Service and the entity being unable to meets its obligations or financial commitments, and would normally exclude a lender and borrower relationship. Similarly, a trustee whose relationship with a trust does not extend beyond the normal responsibilities of a trustee would not be considered to control the trust for the purposes of this Standard. |

Regulatory and purchase power

| .20 | Governments and their agencies have the power to regulate the behaviour of many entities by use of their sovereign or legislative powers. Regulatory and purchase powers do not constitute control for the purposes of financial reporting. To ensure that the financial statements of entities include only those resources that they control and can benefit from, the meaning of control for the purposes of this Standard does not extend to: |

| (a) | the power of the legislature to establish the regulatory framework within which entities operate and to impose conditions or sanctions on their operations. Such power does not constitute control by an entity of the assets deployed by these entities. For example, a pollution control authority may have the power to close down the operations of entities that are not complying with environmental regulations. However, this power does not constitute control because the pollution control authority only has the power to regulate, or |

| (b) | entities that are economically dependent on a public sector entity. That is, where an entity retains discretion as to whether it will take funding from, or do business with, a public sector entity, that entity has the ultimate power to govern its own financial or operating policies, and accordingly is not controlled by the public sector entity. For example, a municipality may be able to influence the financial and operating policies of a municipal entity which is dependent on it for funding or a profit-orientated entity that is economically dependent on business from it. Accordingly, the entity has some power as a purchaser but not to govern the entity’s financial and operating policies. |

Determining whether control exists for financial reporting purposes

| .21 | Entities may create other entities to achieve some of their objectives. In some cases it may be clear that an entity is controlled, and hence should be consolidated. In other cases it may not be clear. Paragraphs .22 and .23 provide guidance to help determine whether or not control exists for financial reporting purposes. |

| .22 | In examining the relationship between two entities, control is presumed to exist when at least one of the following power conditions and one of the following benefit conditions exists, unless there is clear evidence of control being held by another entity. |

Power indicators

| (a) | The entity has, directly or indirectly through controlled entities, ownership of a majority voting interest in the other entity. |

| (b) | The entity has the power, either granted by or exercised within existing legislation, to appoint or remove a majority of the members of the governing body of the other entity. |

| (c) | The entity has the power to cast, or regulate the casting of, a majority of the votes that are likely to be cast at a general meeting of the other entity. |

| (d) | The entity has the power to cast the majority of votes at meetings of the council or equivalent governing body. |

Benefit indicators

| (a) | The entity has the power to dissolve the other entity and obtain a significant level of the residual economic benefits or bear significant obligations. For example, the benefit condition may be met if an entity had responsibility for the residual liabilities of another entity. |

| (b) | The entity has the power to extract distributions of assets from the other entity, and/or may be liable for certain obligations of the other entity. |

| .23 | one or more of the circumstances listed in paragraph .22 does not exist, the following factors are likely, either individually or collectively, to be indicative of the existence of control. |

Power indicators

| (a) | The entity has the ability to veto operating and capital budgets of the other entity; |

| (b) | The entity has the ability to veto, overrule, or modify council or equivalent governing body decisions of the other entity. |

| (c) | The entity has the ability to approve the hiring, reassignment and removal of key personnel of the other entity. |

| (d) | The mandate of the other entity is established and limited by legislation. |

| (e) | The entity holds a "golden share"3 (or equivalent) in the other entity that confers rights to govern the financial and operating policies of that other entity. |

Benefit indicators

| (a) | The entity holds direct or indirect title to the net assets of the other entity with an ongoing right to access these. |

| (b) | The entity has a right to a significant level of the net assets of the other entity in the event of liquidation or in a distribution other than liquidation. |

| (c) | The entity is able to direct the other entity to co-operate with it in achieving its objectives. |

| (d) | The entity is exposed to the residual liabilities of the other entity. |

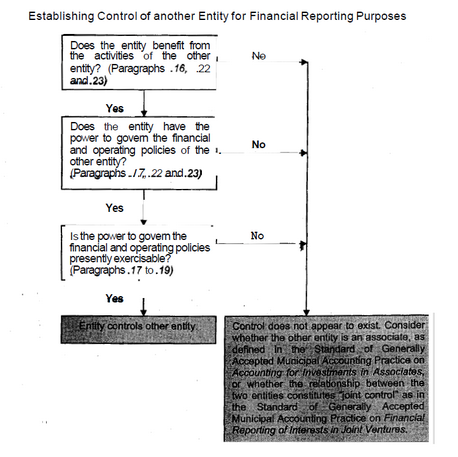

| .24 | The following diagram indicates the basic steps involved in establishing control of another entity, It should be read in conjunction with paragraphs .15 to .23. |

| .25 | Sometimes a controlled entity is excluded from consolidation when its activities are dissimilar to those of other entities within the economic entity. Exclusion on these grounds is not justified because better information would be provided by consolidating such controlled entities and disclosing additional information in the consolidated financial statements about the different activities of controlled entities. For example, disaggregated disclosures can help to explain the significance of different activities within the economic entity. |

Consolidation procedures

| .26 | In preparing consolidated financial statements, the financial statements of the controlling entity and its controlled entities are combined on a line-by-line basis by adding together like items of assets, liabilities, net assets, revenue and expenses. In order that the consolidated financial statements present financial information about the economic entity as that of a single entity, the following steps are then taken: |

| (a) | The carrying amount of the controlling entity’s investment in each controlled entity and the controlling entity’s portion of net assets of each controlled entity are eliminated (the International Accounting Standard on Business Combinations provides guidance on the treatment of any resultant goodwill); |

| (b) | Minority interests in the surplus or deficit of consolidated controlled entities for the reporting period are identified and adjusted against the surplus or deficit of the economic entity in order to arrive at the surplus or deficit attributable to the owners of the controlling entity, and |

| (c) | Minority interests in the net assets of consolidated controlled entity are identified and presented in the consolidated statement of financial position separately from liabilities and the controlling entity’s net assets. Minority interests in the net assets consist of: |

| (i) | the amount at the date of the original combination (the International Accounting Standard on Business Combinations provides guidance on calculating this amount), and |

| (ii) | the minority’s share of movements in net assets since the date of combination. |

| .27 | Balances and transactions between entities within the economic entity and resulting unrealised gains shall be eliminated in full. Unrealised losses resulting from transactions within the economic entity shall also be eliminated unless cost cannot be recovered. |

| .28 | Balances and transactions between entities within the economic entity, including sales, transfers and revenues recognised consequent to an appropriation or other budgetary authority, expenses and dividends, are eliminated in full. Unrealised surpluses resulting from transactions within the economic entity that are included in the carrying amount of assets, such as inventory and fixed assets, are eliminated in full. Unrealised deficits resulting from transactions within the economic entity that are deducted in arriving at the carrying amount of assets are also eliminated unless cost cannot be recovered. |

| .29 | When the financial statements used in the consolidation are drawn up to different reporting dates, adjustments shall be made for the effects of significant transactions or other events that occur between those dates and the date of the controlling entity’s financial statements. In any case the difference between reporting dates shall be no more than three months. |

| .30 | The financial statements of the controlling entity and its controlled entities used in the preparation of the consolidated financial statements are usually drawn up to the same date. When the reporting dates are different, the controlled entity often prepares, for consolidation purposes, statements as at the same date as the economic entity. When it is impracticable to do this, financial statements drawn up to different reporting dates may be used provided the difference is no greater than three months. The consistency principle dictates that the length of the reporting periods and any difference in the reporting dates should be the same from period to period. |

| .31 | Consolidated financial statements shall be prepared using uniform accounting policies for like transactions and other events in similar circumstances. If it is not practicable to use uniform accounting policies (other than the bases of accounting) in preparing the consolidated financial statements, that fact shall be disclosed together with the proportions of the items in the consolidated financial statements to which the different accounting policies have been applied. |

| .32 | If a member of the economic entity uses accounting policies other than those adopted in the consolidated financial statements for like transactions and events in similar circumstances, appropriate adjustments are made to its financial statements when they are used in preparing the consolidated financial statements. |

| .33 | The surplus or deficit of a controlled entity is included in the consolidated financial statements as from the date on which control becomes effective. The surplus or deficit from operating activities of a controlled entity disposed of is included in the consolidated statement of financial performance until the date of disposal, which is the date on which the controlling entity ceases to have control of the controlled entity. The difference between the proceeds from the disposal of the controlled entity and the carrying amount of its assets less liabilities as of the date of disposal is recognised in the consolidated statement of financial performance as the surplus or deficit on the disposal of the controlled entity. In order to ensure the comparability of the financial statements from one accounting period to the next, supplementary information is often provided about the effect of the acquisition and disposal of controlled entities on the financial position at the reporting date and the results for the reporting period and on the corresponding amounts for the preceding period. |

| .34 | From the date an entity ceases to fall within the definition of a controlled entity and does not become an associate as defined in the Standard of Generally Accepted Municipal Accounting Practice on Accounting for Investments in Associates, or a jointly controlled entity as defined in the Standard of Generally Accepted Municipal Accounting Practice on Financial Reporting of lnterests in Joint Ventures, it should be accounted for as an investment. The International Accounting Standard on Financial Instruments: Recognition and Measurement provides guidance on accounting for investments. |

| .35 | The carrying amount of the investment at the date that it ceases to be a controlled entity is regarded as cost thereafter. |

| .36 | Minority interests shall be presented in the statement of changes in net assets, separately from the controlling entity’s equity. Minority interests in the surplus or deficit of the economic entity shall also be separately disclosed. |

| .37 | The losses applicable to the minority in a consolidated controlled entity may exceed the minority interest in the net assets of the controlled entity. The excess, and any further losses applicable to the minority, is charged against the majority interest except to the extent that the minority has a binding obligation to, and is able to, make good the losses. If the controlled entity subsequently reports surpluses, the majority interest is allocated all such surpluses until the minority‘s share of losses previously absorbed by the majority has been recovered. |

| .38 | If a controlled entity has outstanding cumulative preferred shares which are held outside the economic entity, the controlling entity computes its share of surpluses and losses after adjusting for the controlled entity’s preferred dividends, whether or not dividends have been declared. |

Accounting for controlled entities in a controlling entity’s separate financial statements

| .39 | In a controlling entity’s separate financial statements, controlled entitjes that are included in the consolidated financial statements shall be either: |

| (a) | accounted for using the equity method as described in the Standard of Generally Accepted Municipal Accounting Practice on Accounting for lnvestments in Associates, or |

| (b) | accounted for as an investment. |

| .40 | Controlled entities that are excluded from consolidation shall be accounted for as investments in the controlling entity’s separate financial statements. |

| .41 | Guidance on accounting for investments can be found in the International Accounting Standard on Financial Instruments: Recognition and Measurement. |

| .42 | Separate financial statements are presented by a controlling entity in order to meet legal requirements. |

Disclosure

| .43 | The following disclosures shall be made: |

| (a) | In consolidated financial statements, a list of significant controlled entities including the name, the jurisdiction in which it operates (when it is different from that of the controlling entity), proportion of ownership interest and, where that interest is in the form of shares, the proportion of voting power held (only where this is different from the proportionate ownership interest), |

| (b) | In consolidated financial statements, where applicable, the reasons for not consolidating a controlled entity, |

| (c) | In the controlling entity’s separate financial statements, a description of the method used to account for controlled entities, |

| (d) | Distributions received from or accrued in respect of controlled entities, |

| (e) | Gains or losses on the sale of shares or other dilutions in controlled entities by the investor, and |

| (f) | Fees charged for administration of the controlled entity. |

Effective date

| .44 | This Standard of Generally Accepted Municipal Accounting Practice becomes effective for annual financial statements covering periods beginning on or after a date to be determined by the Minister of Finance in a regulation to be published in accordance with section 91(1)(b) of the Public Finance Management Act, Act No. 1 of 1999 as amended. |

| 3 | "golden share" refers to a class of share that entities the holder to specified powers or rights generally exceeding those normally associated with the holder's ownership interest or representation on the council or equivalent governing body. |