| (1) |

In order to ensure that all banks and other relevant persons correctly classify and report all relevant required economic information related to institutional sectors and institutional units, the Reserve Bank has issued the Institutional Sector Classification Guide for South Africa— |

| (a) |

copies of which are available from the Economic Research and Statistics Department, S A Reserve Bank, P O Box 7433, Pretoria, 0001; and |

| (b) |

which guide can also be accessed on the Reserve Bank’s website address www.resbank.co.za, under statistical and economic information, other publications; and |

| (c) |

a summary of key information related to the Institutional Sector Classification Guide for South Africa is provided in subregulation (2) below. |

| (2) |

Key matters related to the Institutional Sector Classification Guide for South Africa |

The total economy essentially consists of institutional sectors, which are aggregations of institutional units, and in respect of which—

| (a) |

an institutional unit— |

| (i) |

is an economic entity that can in its own right own assets, incur liabilities and engage in economic activity and transactions with other entities; |

| (ii) |

may be a legal or social entity, or a household; |

| (iii) |

may be either a resident or non-resident unit; |

| (iv) |

is classified as a resident of the Republic of South Africa when it has a centre of economic interest in South Africa, that is, when it has premises within the economic territory of South Africa from where it engages or intends to engage indefinitely or over a finite but long period that normally exceeds one year, in significant economic activity; |

| (v) |

that is classified as a resident institutional unit is grouped into one of four mutually exclusive institutional sectors on the basis of similarity of principal economic objectives, functions and behaviour, namely— |

| (A) |

the financial corporate sector; |

| (B) |

the non-financial corporate sector; |

| (C) |

the general government sector, including social security funds; and |

| (D) |

the household sector, including non-profit institutions serving households; |

| (vi) |

that is classified as a resident institutional unit is furthermore grouped into one of two mutually exclusive institutional sectors related to ownership, namely— |

| (A) |

the private sector, consisting of all resident institutional units not controlled or owned by institutional units in the general government sector; and |

| (B) |

the public sector, consisting of all institutional units in the general government sector, and corporate sector institutional units in the financial and non-financial sectors owned or controlled by units in the general government sector, that is, the public sector consists of— |

| (i) |

the public financial corporate sector; |

| (ii) |

the public non-financial corporate sector; and |

| (iii) |

the general government sector; |

| (b) |

the main attributes of an institutional unit typically include that the institutional unit— |

| (i) |

is entitled to own goods and services, and is able to exchange those goods and services with another institutional unit; |

| (ii) |

is able to take economic decisions and engage in economic activities for its own account; |

| (iii) |

is able to incur liabilities or enter into contracts or incur future commitments on its own behalf; and |

| (iv) |

is able to compile a complete set of accounts, including a balance sheet; |

| (c) |

corporations in the financial and non-financial sectors are resident institutional units whose principal activity is the market production of goods and services at economically significant prices with the intent to generate a profit or financial gain for their shareholders; |

| (d) |

institutional units in the general government sector— |

| (i) |

are unique legal entities established by the political process with legislative, judicial or executive authority over other units within a given area; |

| (A) |

central, provincial and local government; |

| (B) |

social security funds at all levels of government; and |

| (C) |

non-market, non-profit institutions that are controlled and mainly financed by government units; |

| (A) |

public corporations, even when government units own all the equity of such corporations, and |

| (B) |

quasi-corporations owned and controlled by government units; |

| (e) |

various internationally agreed manuals have been issued to provide guidance for the correct sector classification of economic units by all relevant persons or users, which internationally agreed manuals include— |

| (i) |

the System of National Accounts (SNA); |

| (ii) |

the Government Finance Statistics Manual (GFS); |

| (iii) |

the Monetary and Financial Statistics Manual (MFSM); and |

| (iv) |

the Balance of Payments Manual (BOP), which essentially focusses on the foreign sector; |

| (f) |

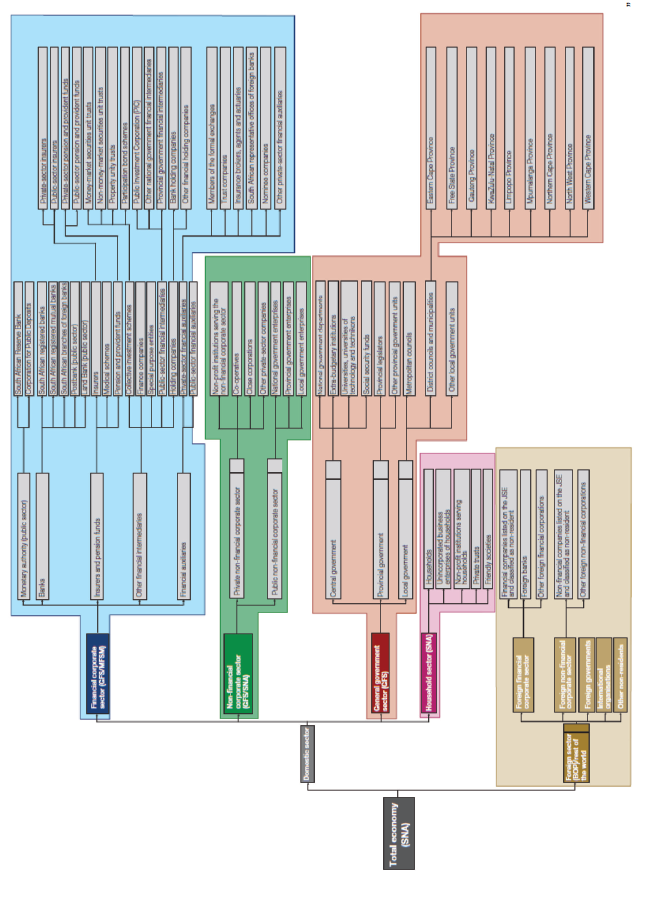

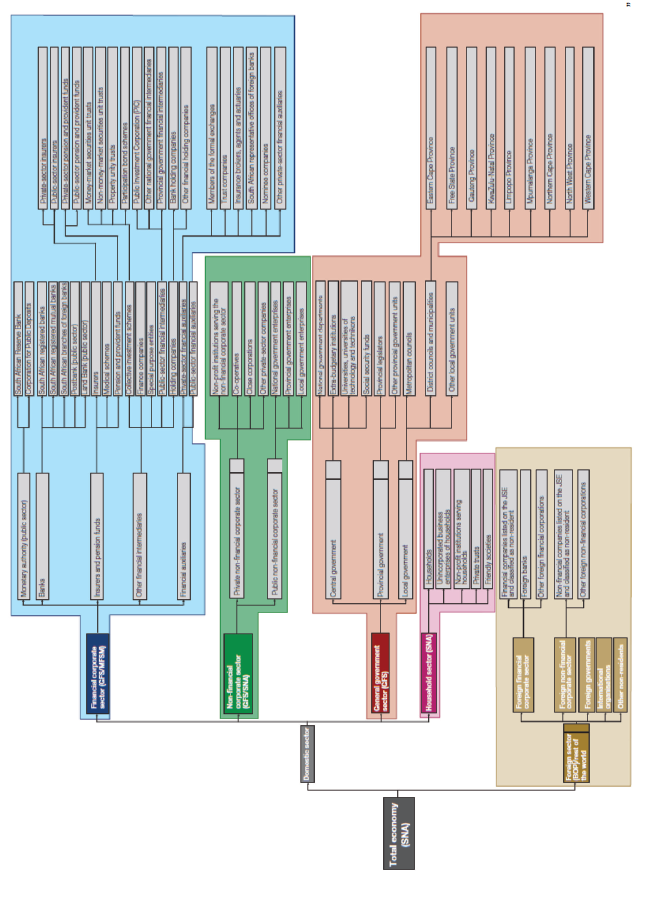

the essential composition may be depicted schematically, as follows: |

[Regulation 66 substituted by regulation 39 of Notice No. 297, GG 40002, dated 20 May 2016]

National Road Traffic Act, 1996

National Road Traffic Act, 1996