Mandating Procedures of Provinces Act, 2008

Mandating Procedures of Provinces Act, 2008

R 385

Legal Practice Act, 2014 (Act No. 28 of 2014)RulesFinal Rules as per section 95(1), 95(3) and 109(2) of the Legal Practice Act 28 of 2014SchedulesSchedule 8 |

Schedule 8

(Rule 54.24.1)

AUDITOR'S REPORT

(First Part) : Illustrative Auditor’s Assurance Report (Unmodified Opinion)

|

Circumstances

|

Independent Auditor’s Reasonable Assurance Report on Legal Practitioners’ Trust Accounts

To the <Legal Practitioner/Partner(s)/Director(s)1> (insert the name of the legal practitioner’s firm)

Report on Compliance of the Legal Practitioners’2 Trust Accounts with the Act and the Rules

We have undertaken a reasonable assurance engagement on whether the legal practitioners’ trust accounts of <insert the name of the legal practitioner’s firm> were maintained, in all material respects, in compliance with Section 86, read with Section 63(1)(g),and Sections 87(1), 87(3) and 87(4) of the Legal Practice Act, No. 28 of 2014 (the Act), and Rules 54.6-54.13, 54.14.1-54.14.6, 54.14.7.2, 54.14.7.3, 54.14.8-54.14.16, 54.15, 54.16, 54.17, 54.18, 54.19, 54.31, 54.32, 54.33, 54.34, 54.35 and 55.1-55.11 of the South African Legal Practice Council Rules3 (the Rules), made under the authority of Sections 95(1), 95(3) and 109(2) of the Act, for the <period from <insert date> to <insert date>>/<year ended <insert date>>.

We clarify that we are not required to perform any procedures on records or documents relating to accounting for deceased estates, insolvent estates and trusts other than those dealt with via the legal practitioner’s trust banking account(s).

<Legal Practitioner/Partner(s)/Director(s)> responsibility for the trust accounts

The <legal practitioner/partner(s)/director(s)> is/are responsible for ensuring that legal practitioners’ trust accounts are maintained in compliance with the Act and the Rules, and for such internal control as the <legal practitioner/partner(s)/director(s)> determine(s) is necessary to maintain the integrity of the trust accounts in accordance with the relevant client mandates, including such controls as the <legal practitioner/partner(s)/director(s)> determine(s) are also necessary to prevent and detect fraud and theft. The <legal practitioner/partner(s)/director(s)> is/are also responsible for preparing the attached Legal Practitioner’s Annual Statement on Trust Accounts and for the financial information and declarations contained therein.

Auditor’s Independence and Quality Control

|

[For auditor’s assurance reports issued on or after 15 June 2019 in respect of assurance engagements for periods beginning before or on 14 June 2019]4 [Delete block if not applicable]

We have complied with the independence and other ethical requirements of Sections 290 and 291 of the Independent Regulatory Board for Auditors’ Code of Professional Conduct for Registered Auditors (Revised January 2018) and Parts 1 and 3 of the Independent Regulatory Board for Auditors’ Code of Professional Conduct for Registered Auditors (Revised November 2018) (together the IRBA Codes), which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. The IRBA Codes are consistent with the corresponding sections of the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants and the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (including International Independence Standards) respectively. |

|

[For assurance engagements for periods beginning on or after 15 June 2019] [Delete the block if it’s not applicable]

We have complied with the independence and other ethical requirements of the Code of Professional Conduct for Registered Auditors issued by the Independent Regulatory Board for Auditors (IRBA Code), which is founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. The IRBA Code is consistent with the corresponding sections of the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (including International Independence Standards). |

(Name of firm)/(The firm) applies the International Standard on Quality Control 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements and Other Assurance and Related Services Engagements and accordingly maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Auditor’s responsibility

Our responsibility is to express a reasonable assurance opinion on whether the legal practitioners’ trust accounts were maintained in compliance with the Act and the Rules, based on our assurance procedures performed; and to report, as required, on the accompanying Legal Practitioner’s Annual Statement on Trust Accounts and investment practice.

We conducted our reasonable assurance engagement in accordance with the International Standard on Assurance Engagements 3000 (Revised), Assurance Engagements Other than Audits or Reviews of Historical Financial Information (ISAE 3000 (Revised)), issued by the International Auditing and Assurance Standards Board. That standard requires that we plan and perform the engagement to obtain reasonable assurance about whether the legal practitioners’ trust accounts were maintained, in all material respects, in compliance with the Act and the Rules.

A reasonable assurance engagement in accordance with ISAE 3000 (Revised) involves performing procedures to obtain evidence about whether the legal practitioners’ trust accounts were maintained in compliance with the Act and the Rules. The nature, timing and extent of procedures selected depend on the auditor’s professional judgement, including the assessment of the risks of non-compliance with the Act and the Rules, whether due to fraud, theft and error. In making those risk assessments, we considered internal control that is relevant to the engagement in order to design procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control.

Our reasonable assurance engagement included the following summary of procedures performed:

| • | Considering, and applying when considered applicable in the engagement circumstances, the guidance in the Guide for Registered Auditors: Engagements on Legal Practitioners’ Trust Accounts (Revised March 2020) issued by the IRBA. |

| • | Making inquiries of the legal practitioner and persons within the practice. |

| • | Testing transactions for all significant service activities, with the objective of evaluating whether: |

| o | Transactions were appropriately identified as trust account transactions; |

| o | Trust account transactions were made in accordance with mandates and supported by adequate documentation and narrative to identify from whom funds were received, and for whose credit; |

| o | Deposits and withdrawals from the trust bank accounts were to, or for, a trust creditor; and |

| o | Transfers to the legal practitioner’s business bank accounts were only in respect of monies to be due to the legal practitioner. |

| • | Testing and/or scrutinising bank reconciliations, as considered appropriate in the engagement circumstances, and evaluating the records made available to us against the external confirmations from financial institutions. |

| • | Obtaining written representations from management regarding matters that are relevant to this engagement. |

We believe that the evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Opinion

In our opinion, the legal practitioners’ trust accounts of (insert the name of the legal practitioner’s firm) for the <period from <insert date> to <insert date>>/<year ended <insert date>> were maintained, in all material respects, in compliance with the Act and the Rules.

Report on Other Legal and Regulatory Requirements

Report on the Legal Practitioner’s Annual Statement on Trust Accounts5

In accordance with our responsibilities in terms of the Advisory issued by the Legal Practice Council dated 17 April 2020, we report that we have agreed the information extracted from the trust accounting records included in the accompanying Legal Practitioner’s Annual Statement on Trust Accounts for the <period from (insert date) to (insert date)>/<year ended <insert date>> to the underlying records that were the subject of our engagement. We have also read the Legal Practitioner’s Annual Statement on Trust Accounts for the purpose of identifying whether the information contained therein is inconsistent with our knowledge obtained in the course of our engagement. The Legal Practitioner’s Annual Statement on Trust Accounts is the responsibility of the legal practitioner.

Based on our reading of the legal practitioner’s representations, the disclosures and other information contained in the Legal Practitioner’s Annual Statement on Trust Accounts, we have not identified any information that is inconsistent with our knowledge obtained in the course of our engagement. Our opinion on the legal practitioner’s trust accounts does not cover the Legal Practitioner’s Annual Statement on Trust Accounts and, accordingly, we do not express an opinion thereon.

Report on the Legal Practitioner’s Investment Practice

In accordance with our responsibilities in terms of Rule 54.24.3, we report that to the best of our knowledge, the legal practitioner [has for the <period from <insert date> to <insert date>>/<year ended <insert date>> carried on the business of an investment practice and has complied with the relevant Rules6]/[has not for the <period from <insert date> to <insert date>>/<year ended <insert date>> carried on the business of an investment practice].

Other Reporting Responsibilities

<The form and content of this section of the auditor’s assurance report will vary depending on the nature of the auditor’s other reporting responsibilities.>7,8

Restriction on distribution and use

This report is for the purpose of meeting the auditor reporting requirements of the Act and the Rules and, regarding the accompanying Legal Practitioner’s Annual Statement on Trust Accounts, the additional auditor reporting requirements of the Legal Practice Council and the Legal Practitioners Fidelity Fund. Consequently, it is not suitable for any other purpose. It is intended solely for the use of the <legal practitioner/partner(s)/director(s)> of the firm, the Legal Practice Council and the Legal Practitioners Fidelity Fund, and should not be distributed to other parties.

Auditor’s Signature

Name of the individual registered auditor

IRBA registration number of the firm and/or auditor

Registered audit firm

Date of the auditor’s assurance report

Auditor’s address (if not on a firm letterhead)

_______________________________________

| 1 | Throughout the report, delete whichever “is not applicable” from the following: “legal practitioner/partner(s)/director(s)”. |

| 2 | The term legal practitioner refers to the responsibilities of both the legal practitioner and the firm. It is therefore useful to note that the Rules refer to the firm as well. |

| 3 | Rules effective 1 November 2018. |

| 4 | The wording in this section of the illustrative report is principled on the wording used in the Basis for Opinion sections of the illustrative reports in the South African Auditing Practice Statement (SAAPS) 3 (Revised May 2019), Illustrative Reports. |

| 5 | Refer to paragraphs 87-89 of the Guide for Registered Auditors: Engagements on Legal Practitioners Trust Accounts (Revised March 2020) (the Revised Guide) for guidance regarding the auditor’s reporting responsibilities. |

| 6 | Rules effective 1 November 2018: 55.1-55.11. |

| 7 | Refer to paragraph 91 of the Revised Guide for illustrative wording to insert where a reportable irregularity has been reported. |

| 8 | Refer to paragraphs 92-93 of the Revised Guide for guidance with regard to the auditor’s other reporting responsibilities. |

(Second Part) : Illustrative Auditor’s Assurance Report (Qualified Opinion)

|

Circumstances

|

Independent Auditor’s Reasonable Assurance Report on Legal Practitioners’ Trust Accounts

To the <Legal Practitioner/Partner(s)/Director(s)9> (insert the name of the legal practitioner’s firm)

Report on Compliance of the Legal Practitioners’10 Trust Accounts with the Act and the Rules

We have undertaken a reasonable assurance engagement on whether the legal practitioners’ trust accounts of <insert the name of the legal practitioner’s firm> were maintained, in all material respects, in compliance with Section 86, read with Section 63(1)(g), and Sections 87(1), 87(3) and 87(4) of the Legal Practice Act, No. 28 of 2014 (the Act), and Rules 54.6-54.13, 54.14.1-54.14.6, 54.14.7.2, 54.14.7.3, 54.14.8-54.14.16, 54.15, 54.16, 54.17, 54.18, 54.19, 54.31, 54.32, 54.33, 54.34, 54.35 and 55.1-55.11 of the South African Legal Practice Council Rules11 (the Rules), made under the authority of Sections 95(1), 95(3) and 109(2) of the Act, for the <period from <insert date> to <insert date>>/<year ended <insert date>>.

We clarify that we are not required to perform any procedures on records or documents relating to accounting for deceased estates, insolvent estates and trusts other than those dealt with via the legal practitioner’s trust banking account(s).

<Legal Practitioner’s/Partner(s)/Director(s)> responsibility for the trust accounts

The <legal practitioner/partner(s)/director(s)> is/are responsible for ensuring that legal practitioners’ trust accounts are maintained in compliance with the Act and the Rules, and for such internal control as the <practitioner/partner(s)/director(s)> determine(s) is necessary to maintain the integrity of the trust accounts in accordance with the relevant client mandates, including such controls as the <legal practitioner/partner(s)/director(s)> determine(s) are also necessary to prevent and detect fraud and theft. The <legal practitioner/partner(s)/director(s)> is/are responsible for preparing the Legal Practitioner’s Annual Statement on Trust Accounts and for the financial information and declarations contained therein.

Auditor’s Independence and Quality Control

|

[For auditor’s assurance reports issued on or after 15 June 2019 in respect of assurance engagements for periods beginning before or on 14 June 2019]12 [Delete block if not applicable]

We have complied with the independence and other ethical requirements of Sections 290 and 291 of the Independent Regulatory Board for Auditors’ Code of Professional Conduct for Registered Auditors (Revised January 2018) and Parts 1 and 3 of the Independent Regulatory Board for Auditors’ Code of Professional Conduct for Registered Auditors (Revised November 2018) (together the IRBA Codes), which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. The IRBA Codes are consistent with the corresponding sections of the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants and the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (including International Independence Standards) respectively. |

|

[For assurance engagements for periods beginning on or after 15 June 2019] [Delete the block if it’s not applicable]

We have complied with the independence and other ethical requirements of the Code of Professional Conduct for Registered Auditors issued by the Independent Regulatory Board for Auditors (IRBA Code), which is founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. The IRBA Code is consistent with the corresponding sections of the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (including International Independence Standards). |

(Name of firm)/(The firm) applies the International Standard on Quality Control 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements and Other Assurance and Related Services Engagements and accordingly maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Auditor’s responsibility

Our responsibility is to express a reasonable assurance opinion on whether legal practitioners’ trust accounts were maintained in compliance with the Act and the Rules, based on our assurance procedures performed; and to report, as required, on the accompanying Legal Practitioner’s Annual Statement on Trust Accounts and investment practice.

We conducted our reasonable assurance engagement in accordance with the International Standard on Assurance Engagements 3000 (Revised), Assurance Engagements Other than Audits or Reviews of Historical Financial Information (ISAE 3000 (Revised)), issued by the International Auditing and Assurance Standards Board. That standard requires that we plan and perform the engagement to obtain reasonable assurance about whether the legal practitioners’ trust accounts were maintained, in all material respects, in compliance with the Act and the Rules.

A reasonable assurance engagement in accordance with ISAE 3000 (Revised) involves performing procedures to obtain evidence about whether the legal practitioners’ trust accounts were maintained in compliance with the Act and the Rules. The nature, timing and extent of procedures selected depend on the auditor’s professional judgement, including the assessment of the risks of non-compliance with the Act and the Rules, whether due to fraud, theft and error. In making those risk assessments, we considered internal control that is relevant to the engagement in order to design procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control.

Our reasonable assurance engagement included the following summary of procedures performed:

| • | Considering, and applying when considered applicable in the engagement circumstances, the guidance in the Guide for Registered Auditors: Engagements on Legal Practitioners’ Trust Accounts (Revised March 2020) issued by the IRBA. |

| • | Making inquiries of the legal practitioner and persons within the practice. |

| • | Testing transactions for all significant service activities, with the objective of evaluating whether: |

| o | Transactions were appropriately identified as trust account transactions; |

| o | Trust account transactions were made in accordance with mandates and supported by adequate documentation and narrative to identify from whom funds were received, and for whose credit; |

| o | Deposits and withdrawals from the trust bank accounts were to, or for, a trust creditor; and |

| o | Transfers to the legal practitioner’s business bank accounts were only in respect of monies to be due to the legal practitioner. |

| • | Testing and/or scrutinising bank reconciliations, as considered appropriate in the engagement circumstances, and evaluating the records made available to us against the external confirmations from financial institutions. |

| • | Obtaining written representations from management regarding matters that are relevant to this engagement. |

We believe that the evidence we have obtained is sufficient and appropriate to provide a basis for our qualified opinion.

Basis for qualified opinion

The legal practitioner’s trust accounts were not maintained in compliance with the Act and the Rules, as follows13:

List …<insert instances of non-compliance identified, including those subsequently resolved>

Qualified opinion

In our opinion, except for the instances of non-compliance listed in the preceding paragraph, the legal practitioner’s trust accounts of <insert the name of the legal practitioner’s firm> for the <period from <insert date> to <insert date>>/<year ended <insert date>> were maintained, in all material respects, in compliance with the Act and the Rules.

Report on Other Legal and Regulatory Requirements

Report on the Legal Practitioner’s Annual Statement on Trust Accounts14

In accordance with our responsibilities in terms of the Advisory issued by the Legal Practice Council dated 17 April 2020, we report that we have agreed the information extracted from the trust accounting records included in the accompanying Legal Practitioner’s Annual Statement on Trust Accounts for the <period from <insert date> to <insert date>>/<year ended <insert date>> to the underlying records that were the subject of our assurance engagement. We have also read the Legal Practitioner’s Annual Statement on Trust Accounts for the purpose of identifying whether the information contained therein is inconsistent with our knowledge obtained in the course of our engagement. The Legal Practitioner’s Annual Statement on Trust Accounts is the responsibility of the legal practitioner.

Based on our reading of the legal practitioner’s representations, the disclosures and other information contained in the Legal Practitioner’s Annual Statement on Trust Accounts, we have not identified any information that is inconsistent with our knowledge obtained in the course of our engagement. Our opinion on the legal practitioner’s trust accounts does not cover the Legal Practitioner’s Annual Statement on Trust Accounts and, accordingly, we do not express an opinion thereon.15

Report on the Legal Practitioner’s Investment Practice

In accordance with our responsibilities in terms of Rule 54.24.3, we report that to the best of our knowledge, the legal practitioner [has for the <period from <insert date> to <insert date>>/<year ended <insert date>> carried on the business of an investment practice and has complied with the relevant Rules16]/[has not for the <period from <insert date> to <insert

date>>/<year ended <insert date>> carried on the business of an investment practice].

Other Reporting Responsibilities

<The form and content of this section of the auditor’s assurance report will vary depending on the nature of the auditor’s other reporting responsibilities.>17,18

Restriction on distribution and use

This report is for the purpose of meeting the auditor reporting requirements of the Act and the Rules and, regarding the accompanying Legal Practitioner’s Annual Statement on Trust Accounts, the additional auditor reporting requirements of the Legal Practice Council and the Legal Practitioners Fidelity Fund. Consequently, it is not suitable for any other purpose. It is intended solely for the use of the <legal practitioner/partner(s)/director(s)> of the firm, the Legal Practice Council and the Legal Practitioners Fidelity Fund, and should not be distributed to other parties.

Auditor’s Signature

Name of the individual registered auditor

IRBA registration number of the firm and/or auditor

Registered audit firm

Date of the auditor’s assurance report

Auditor’s address (if not on a firm letterhead)

_______________________________________

| 9 | Throughout the report - delete whichever “is not applicable” from the following: “legal practitioner/partner(s)/director(s)”. |

| 10 | The term legal practitioner refers to the responsibilities of both the legal practitioner and the firm. It is therefore useful to note that the Rules refer to the firm as well. |

| 11 | Rules effective 1 November 2018. |

| 12 | The wording in this section of the illustrative report is principled on the wording used in the Basis for Opinion sections of the illustrative reports in the South African Auditing Practice Statement (SAAPS) 3 (Revised May 2019), Illustrative Reports. |

| 13 | Any contravention of Section 86, read with Section 63(1)(g), and Sections 87(1), 87(3) and 87(4) of the Act, and any instance of contravention of the Rules listed in the Report on Compliance of the Legal Practitioners’ Trust Accounts with the Act and the Rules section of the auditor’s assurance report, identified in the course of the engagement relating to trust accounts in terms of the Rules is regarded as material and should be reported. |

| 14 | Refer to paragraphs 87-89 of the Guide for Registered Auditors: Engagements on Legal Practitioners Trust Accounts (Revised March 2020) (the Revised Guide) for guidance regarding the auditor’s reporting responsibilities. |

| 15 | Refer to paragraph 89 of the Revised Guide for matters to be considered when inconsistencies are identified. |

| 16 | Rules effective 1 November 2018: 55.1-55.11. |

| 17 | Refer to paragraph 91 of the Revised Guide for illustrative wording to insert where a reportable irregularity has been reported. |

| 18 | Refer to paragraphs 92-93 of the Revised Guide for guidance with regard to the auditor’s other reporting responsibilities. |

[Third Part]: Legal Practitioner’s Annual Statement on Trust Accounts

(On a legal practitioner’s letterhead)

The Executive Officer

Legal Practice Council

Address

Date

Legal Practitioner’s Annual Statement on Trust Accounts19

This statement is in support of the below listed member/s‟ application for a Fidelity Fund Certificate for the <year/period> commencing <insert date> and ending <insert date>.

| 1. | List of legal practitioners in firm/practice applying for an annual Fidelity Fund Certificate20 |

a)

b)

| 2. | Legal practitioner’s compliance representations |

I/we confirm that I/we have maintained the necessary accounting records21 as required in terms of Sections 86 of the Legal Practice Act, No. 28 of 2014 and the Rules for the accounting rules applicable to trust account legal practitioners for the year/period ended <insert date>, inter alia:

| a) | The firm’s trust accounts have been updated and balanced monthly. |

| b) | The firm complied/has not complied with the service fee structure (including the cash deposit fee structure where applicable) and the credit interest rates, as amended from time to time, as nationally/provincially agreed upon between the Legal Practitioners’ Fidelity Fund and the firm’s bank(s). |

| c) | The ratio as a percentage of total bank charges (excluding VAT) incurred during the year/period to the total of interest earned during the year was <insert percentage>. |

| d) | The firm’s trust accounts for the period subsequent to <insert year/period end date> have been written up to <insert date> and the trial balance was last balanced at <insert date> and in compliance with the provisions of <insert rule X> read with <insert rule X>. |

| e) | The following changes in the composition of the firm occurred during the year or period from <insert date> to <insert date>: |

|

<Insert changes>:

|

| f) | The firm was issued with a valid Fidelity Fund Certificate for the calendar year ended <insert financial period end> (i.e. the calendar year preceding the financial period/year of this report in the name of <insert the name of the firm>). |

| g) | The firm <has/has not> ensured that the trust funds were safeguarded through the design and implementation of adequate internal controls in compliance with rule 54.14.7.1.1 - 54.14.7.1.4. |

| h) | The firm <has/has not> reported to the Council any dishonesty or irregular conduct on the part of another legal practitioner in relation to the handling or accounting for trust money on the part of that other legal practitioner, as required in terms of rule 54.36. |

| i) | The firm is registered as an Accountable Institution, in accordance with Section 43B of the Financial Intelligence Centre Act, Act No. 38 of 2001 (FICA) with accountable institution registration reference number <insert number> that was issued by the Financial Intelligence Centre. |

| j) | The firm <has/has not> complied with the requirements of Section 21 of FICA “Identification of clients and other persons when establishing a business relationship or conducting a single transaction with a client”. |

| k) | The firm <has/has not> reported <insert number> cash transactions (received or paid) above the prescribed limit of the Financial Intelligence Centre for the period reported on in accordance with the requirements of Section 28 of FICA “Cash transactions above prescribed limit”. |

| l) | The firm <has/has not> reported <insert number> property associated with terrorist and related property reports to the Financial Intelligence Centre for the period in accordance with the requirements of Section 28A of FICA “Property associated with terrorist and related activities”. |

| m) | The firm <has/has not> reported <insert number> suspicious and unusual transactions to the Financial Intelligence Centre for the period in accordance with the requirements of Section 29 of FICA “Suspicious and unusual transactions”. |

| n) | The firm <has/has not> formulated and implemented internal rules in terms of Section 42 of FICA which includes the requirement to report cash threshold transactions (Section 28) and suspicious and unusual transactions (Section 29) to the Financial Intelligence Centre. |

| 3. | Places of practice |

At the date of this report, the firm’s principal place of practice is that given in the letterhead and the firm’s South African offices are situated at <insert full physical addresses22>:

|

<Insert office addresses>:

|

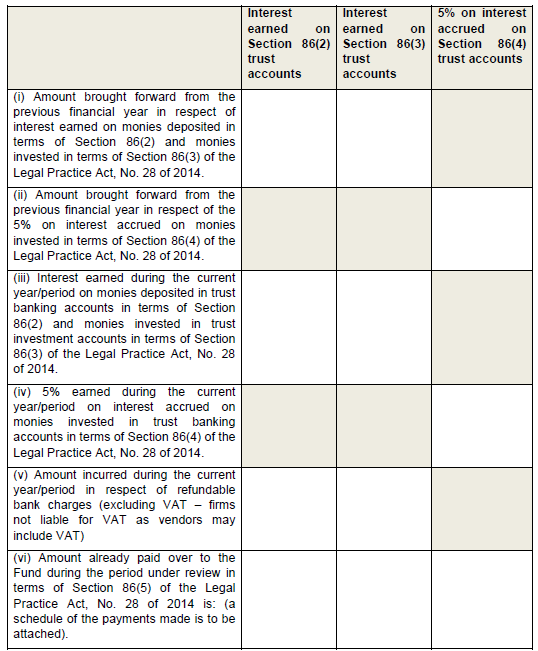

| 4. | Trust account interest |

Reconciliation of interest earned on the firm’s Section 86(2) and Section 86(3) trust accounts and 5% on interest accrued on Section 86(4) trust accounts from <insert commencement date> to <insert year/period end date>:

(ix) The amounts referred to in paragraph 4(vii) and 4(viii) agrees/does not agree23 with the balance as recorded in the books of account, which amount, less the amount of R______________ paid over to the Fund since period end, <is/ is not> held in the firm’s trust account.

If not held in the trust account, a written explanation detailing how the trust account interest has been dealt with is to be annexed to the report.

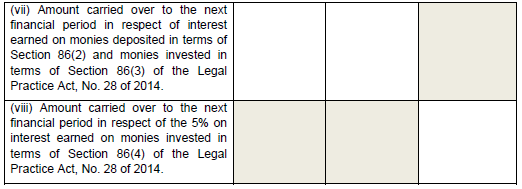

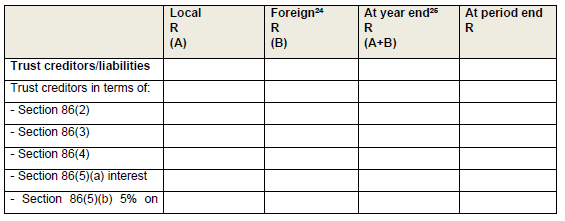

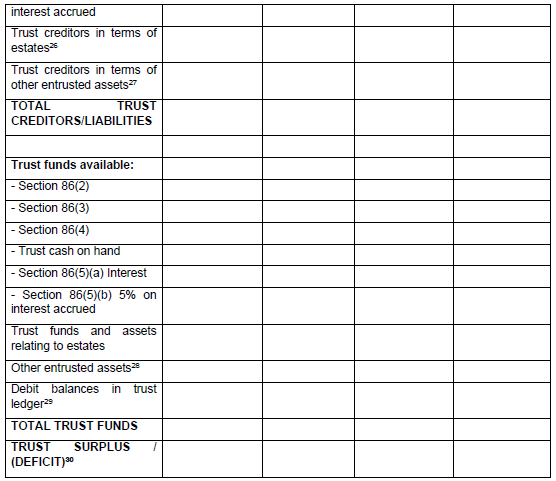

| 5. | Trust account balances |

| (I) | The following information was extracted from our trust accounting records that were the subject of our auditor’s assurance engagement in respect of trust creditors/liabilities and trust funds available at the period/year-end <insert date> and on one other date, selected by our auditor <insert date>, were as follows: |

| (ii) | The value of executor bond securities provided against the trust funds and assets relating to estate matters as reported in paragraph 5(I), at the end of the period amount to: |

Provided by the Legal Practitioners Indemnity Insurance Fund NPC - R_____________.

Provided by other security providers - R_____________.

| 6. | Investment practice |

The firm:

| (i) | <has/has not> carried on the business of an investment practice during the year under review; |

| (ii) | <has/has not> complied31 in all respects with the provisions of investment practices contained in the rules; and |

| (iii) | <is/is not> registered as a Financial Services Provider (FSP) with the FAIS Department of the Financial Sector Conduct Authority. |

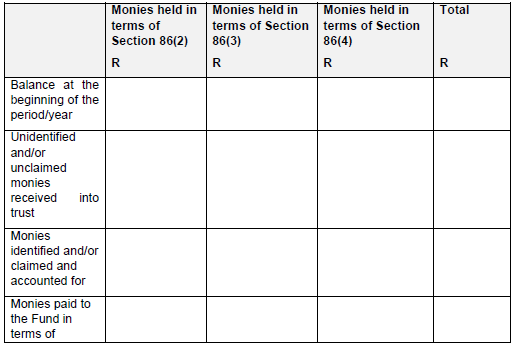

| 7. | Unknown and/or unclaimed money held in trust |

Reconciliation of any money held in the trust account of a trust account practice in respect of which the identity of the owner is unknown or which is unclaimed after one year, which must be paid over to the Fund after the second closing of the accounting records of the trust account practice following the date upon which those funds were deposited in the trust account of the trust account practice from <insert commencement date> to <insert year/period end date>:

…………………......................................………..

<Name of Trust Account Practice>

<Sole Legal Practitioner/Partner/s/Director/s>32

______________________________________

| 19 | To be attached to the auditor’s assurance report on the Legal Practitioner’s Trust Accounts to be submitted to the Legal Practice Council. |

| 20 | Attach a separate list, if there are numerous partners/directors in the firm. |

| 21 | Accounting records include those for trust liabilities in respect of which the legal practitioner is the executor, trustee or curator, or which he administers on behalf of the executor, trustee or curator. |

| 22 | Attach as a separate list, if the firm has multiple offices in South Africa. |

| 23 | If the answer to paragraph 4(ix) is “does not agree”, list all instances in which the accounting rules may not have been complied with. (If space is insufficient, this may be continued on a separate sheet and attached to this annual statement.) |

| 24 | Attach a detailed schedule of liabilities per foreign currency per category in the same format, and convert to Rand at the reporting date. |

| 25 | The date selected by the auditor must be a date, other than the financial year-end, that occurs during the financial year/period to which this assurance engagement relates. |

| 26 | This is trust liabilities in respect of which the legal practitioner is the executor, trustee or curator, or which he administers on behalf of the executor, trustee or curator and for which consent has been obtained from the Master of the High Court to deal with through the firm’s trust account. |

| 27 | This relates to the liability originating from any asset entrusted to the legal practitioner other than the items listed, and supported by a detailed schedule of the nature of such liability. |

| 28 | Assets entrusted to the legal practitioner other than the trust fund items listed. |

| 29 | Details of debit balances in the trust ledger must be provided as an attachment to the report, providing reasons for the occurrence and how it was resolved. |

| 30 | A detailed explanation is required on how the surplus/deficit originated and how it was subsequently cleared and resolved. Indicate when the deficit was reported to the Legal Practice Council. |

| 31 | If the answer to paragraph 6(ii) is “has not complied”, list all instances in which the rules may not have been complied with. (If space is insufficient, this may be continued on a separate sheet and attached to this annual statement.) |

| 32 | Delete whichever is not applicable. For practices with a large number of partners/directors, this “Legal Practitioner’s Annual Statement on Trust Accounts” should be signed by the partner/director authorised by the Partnership/Board of the Inc. |

[Schedule 8 substituted by the South African Legal Practice Council under Notice No. 634 of GG45396, dated 29 October 2021]

SUPPLEMENTARY INFORMATION REQUESTED BY THE LEGAL PRACTICE COUNCIL FIRM <INSERT FIRM NAME >

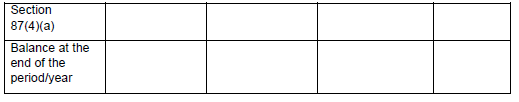

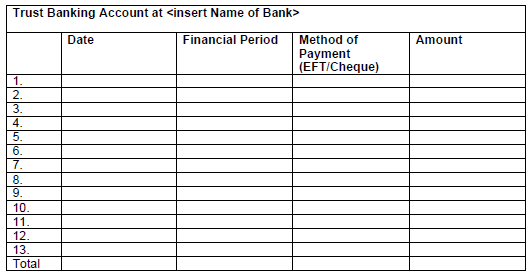

Schedule of payments on interest earned on monies deposited in terms of section 86(2) of the Legal Practice Act, No. 28 of 2014.

For the financial period from ______________ to ______________

Notes:

| 1 | The total indicated above should agree with Paragraph 4(vi) of the Practitioner’s Annual Statement on Trust Accounts |

| 2 | Kindly note that a separate schedule should be submitted for each trust bank account operated by the firm |

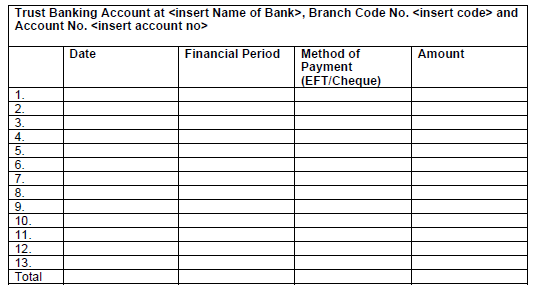

SUPPLEMENTARY INFORMATION REQUESTED BY THE LEGAL PRACTICE COUNCIL FIRM <INSERT FIRM NAME >

Schedule of payments on interest earned on monies invested in terms of section 86(3) of the Legal Practice Act, No. 28 of 2014.

For the financial period from ______________ to ______________

Notes:

| 1 | The total indicated above should agree with Paragraph 4(vi) of the Practitioner’s Annual Statement on Trust Accounts |

| 2 | Kindly note that a separate schedule should be submitted for each trust bank account operated by the firm |

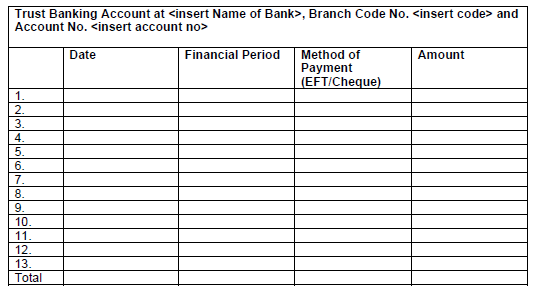

SUPPLEMENTARY INFORMATION REQUESTED BY THE LEGAL PRACTICE COUNCIL FIRM <INSERT FIRM NAME >

Schedule of payments of 5% on interest accrued on monies invested in terms of section 86(4) of the Legal Practice Act, No.28 of 2014.

For the financial period from ______________ to ______________

Notes:

| 1 | The total indicated above should agree with Paragraph 4(vi) of the Practitioner’s Annual Statement on Trust Accounts |

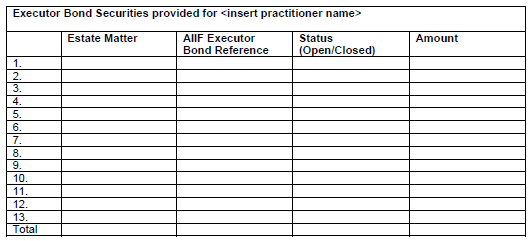

SUPPLEMENTARY INFORMATION REQUESTED BY THE LEGAL PRACTICE COUNCIL FIRM <INSERT FIRM NAME >

Schedule of Executor Bond securities obtained from the Attorneys Insurance Indemnity Fund NPC.

For the financial period from ______________ to ______________

Notes:

| 1 | The total amount indicated above should agree with Paragraph 4(xi) of the Practitioner’s Annual Statement on Trust Accounts, representing the value of all open Executor Bond Securities at the end of the reporting period. |

| 2 | A schedule is required per practitioner in the firm to whom an executor bond of security was issued by the Attorneys Insurance Indemnity Fund NPC. |