International Health Regulations Act, 1974

International Health Regulations Act, 1974

R 385

Financial Intelligence Centre Act, 2001 (Act No. 38 of 2001)NoticesGuidance Note 4 on Suspicious Transaction ReportingPart 6 - Process for Submitting STRs to the Centre |

What is the time period for reporting a suspicious transaction?

| 6.1 | In terms of regulation 24 of the Regulations a report under section 29 of the FIC Act must be sent to the Centre as soon as possible. In terms of the regulation this period must not be longer than fifteen days, excluding Saturdays, Sundays and Public Holidays, after a person became aware of the facts which give rise to a suspicion. |

| 6.2 | It is important to note that, in terms of regulation 24, the period for the filing of a STR does start from the point where a person forms a suspicion. The fifteen-day period starts when a person becomes aware of the facts which will eventually give rise to a suspicion. This may be, and in the majority of cases will be, before a suspicion is formed. |

| 6.3 | The fifteen-day period is to be used to consider other information at the reporter's disposal and to evaluate the circumstances to determine whether a transaction, or series of transactions, is suspicious or not. In order to comply with regulation 24, as explained in paragraph 5.1 above, this should be done as quickly as possible and once a suspicion is formed, the relevant transaction or transactions must be reported without delay. This means that reporters should not take the view that they, as a matter of routine, have a fifteen day period for the filing of reports under section 29 of the FIC Act. Reporters will be in breach of regulation 24 if they delay the reporting of a transaction or series of transactions once a suspicion is formed, and reporters should therefore avoid routinely reporting transactions 15 days after a transaction takes place. |

| 6.4 | It is only in exceptional cases that the Centre may consider condoning a STR being sent after the expiry of the fifteen-day period. If a reporter believes that they will not be able to report within the fifteen-day period, the reporter may apply for condonation for the late filing of the STR from the Centre. Application for an extension must be made before the expiry of the fifteen-day period and must be in writing. In the application for an extension the reporter must provide reasons as to why the period will not be met. Furthermore, details as to when the STR will be submitted must be provided. This application can be faxed to the Centre's Manager: Monitoring and Analysis at 012 309 9496. |

How should a STR be submitted?

| 6.5 | A report under section 29 of the FIC Act must be made by means of internet based reporting provided by the Centre at: www.fic.gov.za. A STR may not be posted. Only in exceptional cases may a STR be sent by fax or delivered by hand to the Centre at the address provided. The reporting form is available from the Centre or its website. |

|

The Centre's contact details are: Physical Address: 240 Vermeulen Street, Pretoria. 0001. Telephone: 012 309 9200 Facsimile: 0123099496 E-mail: [email protected] Website: www.fic.gov.za |

Batch reporting

Reporters also have the option of submitting STRs via batch reporting. Batch reporting issued in instances where high volumes of STRs are submitted to the Centre on a regular basis. To be able to access this facility, reporters can forward their requests to the following email address: [email protected]

Information to be provided in a STR

| 6.6 | Regulation 23 of the Regulations sets out the prescribed particulars that should be contained in a STR. A copy of the reporting form can be accessed via the Centre's website or in the Regulations. The following is the basic information that should be contained in the STR: |

| • | The person or entity making the report; |

| • | The transaction that is reported; |

| • | Any account involved in the transaction; |

| • | The person conducting the transaction or the entity on whose behalf it is conducted; |

| • | The representative, if any who is conducting the transaction on behalf of another; |

| • | General information concerning the transaction. |

What happens to a STR after being submitted to the Centre?

| 6.7 | Once the Centre receives the STR, further analytical work will be conducted on the information provided in the report. If the information provided in the report, together with the additional analysis, indicates a reasonable believe that the information may be required to investigate suspected unlawful activity, the information will be referred to the appropriate authority to carry out further investigation. In accordance with section 38(3) of the FIC Act the Centre is required to ensure that personal information of those involved in the making of an STR is protected from unauthorised disclosure. |

Completion of the STR form

| 6.8 | The following guidelines are based on electronic reporting as this is the preferred method of receiving reports. The report consists of eight parts numbered from Part A to Part H. It is important to complete all fields in each part that are applicable to the situation which is reported. It is also important that as much information as possible be included in the report as this will enable the Centre to take action in respect of a report immediately and assess whether to instruct the reporter not to proceed with the transaction under section 34 of the FIC Act. |

Example of a field:

|

* 1.Person or entity's Name : |

| 6.9 | The "Next" button will only work if ALL the mandatory fields in the Part that have been completed. |

User Name and Password

| 6.10 | Reporters who regularly submit reports electronically to the Centre as well as appointed Money Laundering Control Officers or Money Laundering Reporting Officers are advised to register their details with the Centre using the form on the website at www.fic.gov.za. This form must be printed or downloaded from the website, completed and forwarded to the Centre via fax at 012 309 9496 or via email to [email protected]. |

| 6.11 | Once a person has registered with the Centre they will receive a user name and password. In subsequent reports the person will only have to enter the user name and password and will immediately be routed to Part 2(A) of the form. If the reporter's details have changed, the reporter must forward the updated details to the Monitoring and Analysis Department via fax at 012 309 9496 or via email to [email protected]. |

| 6.12 | The reporter will then immediately be able to proceed with the completion of the rest of the form. Persons who experience any difficulty with obtaining or using their passwords should please contact the Centre's help desk at 0123099300. |

|

Username ::

Password :: |

|

|

| 6.13 | Reporters who are NOT registered users and who do not wish to register must not enter any information in these fields. Such persons must proceed directly to Part A where ALL the fields must be completed. |

|

Important to remember when completing the STR form

|

|

Examples |

||

|

Incorrect |

Correct |

|

|

Time |

2pm |

14:00 |

|

Currency |

R |

ZAR |

|

Amount |

R 2 000 000 |

2000000 |

|

Account No. |

2359-34-67 |

23593467 |

|

Tel. No. |

(012) 309 9200 |

0123099200 |

|

Date |

2008/05/30 |

20080530 |

Completing Part A: Particulars of person or entity from which STR emanates

| 6.14 | Part A of the reporting form is divided into two parts - Part A and Part A (2). Part A requires information identifying the PERSON MAKING THE STR. It is important that the reporter fill in their OWN particulars here as the Centre uses this information to send an acknowledgement of receipt and reference number for the report. The reference number should be kept and utilised at all times when dealing with the Centre in relation to a report. This is confirmation that the Centre has received a report and proof that a report was submitted to the Centre. |

Example for individual reporting:

|

* 1. Person or entity’s Full Name : |

|

||

|

* 2. Person or entity’s Identifying number |

|

||

|

* 3. Street Address: |

|

||

|

* 4. Postal Address : |

|

||

|

* 5. City : |

|

||

|

* 6. Postal Code : |

|

||

|

* 7. Surname of contact person : |

|

||

|

* 8. Initials of contact person : |

|

||

|

* 9. Title of contact person : |

|

||

|

* 10. Telephone Number of contact person |

|

||

|

* 11. Fax Number of contact person : |

|

||

|

* 12. E-mail address of contact person : |

|||

|

| 6.15 | Reporters who are reporting on behalf of their employer must fill in the employer's details (fields A1 to A6) and their own details (fields A7 to A12). Please take note of the employer's internal procedures in this regard. |

Example for company report:

|

* 1. Person or entity’s Full Name : |

|

||

|

* 2. Person or entity’s Identifying number |

|

||

|

* 3. Street Address: |

|

||

|

* 4. Postal Address : |

|

||

|

* 5. City : |

|

||

|

* 6. Postal Code : |

|

||

|

* 7. Surname of contact person : |

|

||

|

* 8. Initials of contact person : |

|

||

|

* 9. Title of contact person : |

|

||

|

* 10. Telephone Number of contact person |

|

||

|

* 11. Fax Number of contact person : |

|

||

|

* 12. E-mail address of contact person : |

|||

|

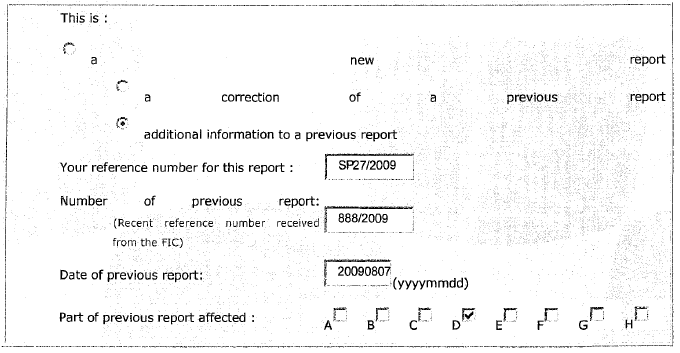

| 6.16 | Part A (2) deals with the type of report that is being made. If it is a new report, the reporter should provide their own unique internal reference number, if such a number has been allocated to the report, for ease of reference and future correspondence. |

| 6.17 | A reporter who wishes to make a correction of, or an addition to, a previous report, please remember to fill in the Centre's reference number and their own unique reference number in respect of the previous report so that the Centre can match the reports. The field requesting the date of the previous report relates to the date that the report was submitted to, and received by, the Centre. Please take note of the format for reporting the date of the transaction (YYYYMMDD). |

Example of Part A(2):

Completing Part B: Particulars of transaction reported

| 6.18 | Part B of the STR form deals with the transaction/s which are being reported to the Centre. |

| 6.19 | It is very important to provide as much information as possible concerning the specific transaction or series of transactions which are the subject of the STR, in order to enable the Centre to carry out a meaningful analysis of the reported information. All relevant fields must therefore be completed. An example of how to complete Part B is provided below. |

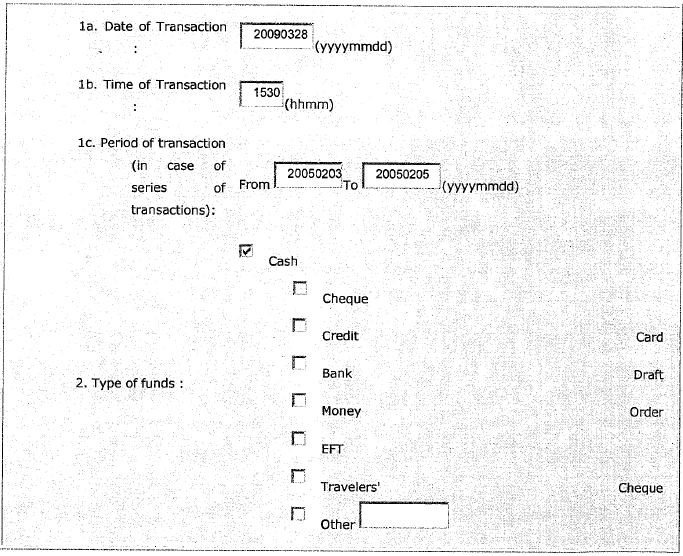

Example of Part B:

Transaction(s) (fields B1a to B1c)

| 6.20 | A report can relate either to a single transaction or a series of transactions. Fields B1a and 1b relate to a single transaction and field B1c should be completed for a series of transactions. Field B1c should be filled in where the suspicion was detected after monitoring behaviour over a period of time. |

Type of funds (field B2)

| 6.21 | This relates to the format in which the transaction was carried out when the suspicion occurred. Type of funds could include cash, cheque, credit card or other. In the case of "other", please indicate the type of funds used in the transaction in the field provided. |

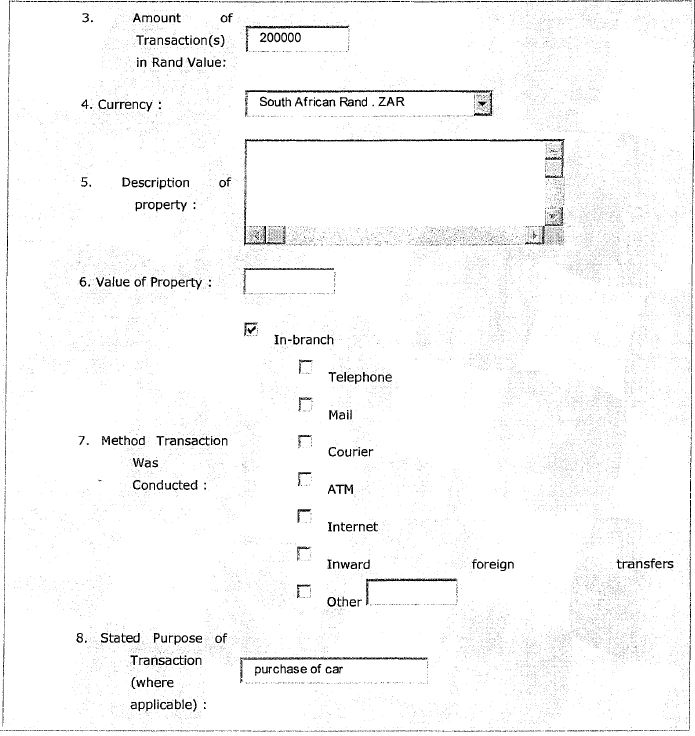

Amount of Transaction(s) in Rand Value (field B3)

| 6.22 | Amounts must be completed without any spaces or currency signs. If the transaction(s) were undertaken in a foreign currency please convert this to Rand and provide the amount in approximate Rand value, using the day of the report as a guide for the exchange rate. |

Currency (field B4)

| 6.23 | This field requires the reporter to indicate the currency in which the transaction was conducted for example, United States Dollar (USD) or Great British Pound (GBP). Please use the abbreviation ZAR for South African Rand. |

Description of the property (field B5)

| 6.24 | This field must be used if the transaction involved assets other than money, such as the purchase of fixed property or an investment policy for example. Property, other than money, can include movable (vehicle) or immovable (house), corporeal (things that are visible and tangible such as land, buildings, vehicles, jewellery) or incorporeal thing (trademarks, patents, copy right) and includes any rights, privileges, claims and securities and any interests. A description of the property must be provided in this field. Please do not use the TAB button or leave any unnecessary spaces. |

|

Example |

|

|

Incorrect |

Correct |

|

The property is: Erf 1234 Marlborough 1610 |

Erf 1234 Marlborough 1610 |

Value of property (field B6)

| 6.25 | In this field the reporter must indicate the approximate value of the property. |

Method transaction was conducted (field B7)

| 6.26 | The reporter must indicate how the transaction was conducted, for example: in a branch, by mail or via ATM which appears on the screen. If the transaction was not conducted using the listed methods of transaction then complete the "other" field and provide a description of the other method in which the transaction was conducted. |

Stated purpose of the transaction (field B8)

| 6.27 | The reporter must indicate the information which the customer may have provided as to the intended purpose of the transaction, for example that the transaction was conducted to purchase a new vehicle. |

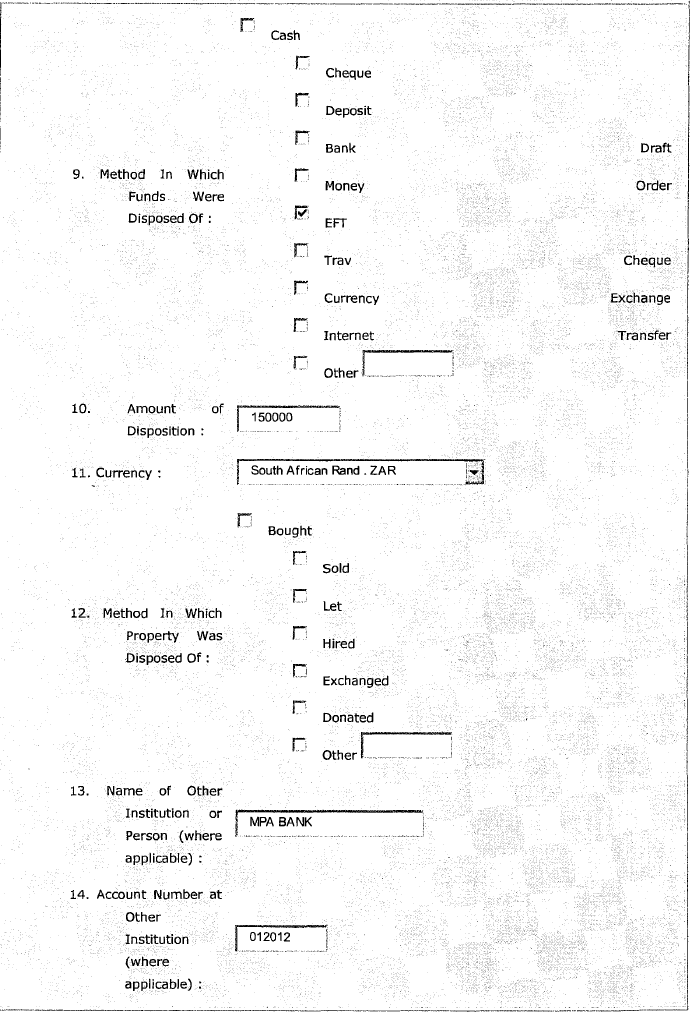

Method in which funds were disposed of (field B9)

| 6.28 | This field requires the reporter to describe how the business disposed of the funds as a result of the transaction, in other words what happened to the funds involved in the transaction. There could be more than one use for a particular transaction. For example, the customer could initiate a transaction in cash, send an electronic fund transfer ("EFT"), order a bank draft and deposit the remainder. |

Amount of disposition (field B10)

| 6.29 | In this field the reporter must indicate the amount involved in the disposition.If the amount was not in Rand, the reporter must convert the amount and also provide the currency information such as USD/GBP/ZAR. |

Currency (field B11)

| 6.30 | This field requires the reporter to provide currency in which the disposition was carried out, even if it was in Rand. For example: enter CAD for Canadian dollars or USD for United States Dollars. |

Method in which property was disposed of (field B12)

| 6.31 | If property, other than money was used in the transaction, this field must be used to indicate the manner in which the property was disposed of. |

Name of other institution or person (field B13)

| 6.32 | The reporter must indicate whether another person or institution was involved in the transaction, apart from the reporting business and the customer carrying out the transaction which is being reported. For example, if the reporter knows who the recipient of the funds were, or to which institution the funds were transferred, then those particulars must be provided. |

Account number at other institution (field B14)

| 6.33 | If the transaction which is being reported involved an account at the other institution referred to in field B13 and this number is available to the reporter, then the account number must be provided in this field. Please note that no spaces or punctuation marks should be used. |

Branch where the transaction was conducted (field B15)

| 6.34 | This field requires the reporter to indicate at which branch or office of the reporting business the transaction in question was conducted. For example, if the transaction occurred at an institution's branch or office in Cape Town, then the specific branch name, i.e. Cape Town, must be inserted. This is the case even though the transaction may have been identified as suspicious and be reported by the institution's head office in Johannesburg. It is very important that this information as to the geographical location where the transaction was carried out be provided in the report to the Centre as it contributes greatly to the Centre's ability to analyse the reported information. |

Identifying number of branch (field B16)

| 6.35 | If the branch or office where a transaction is carried out has a unique number to identify it generally or within the reporting institution, that must be provided in this field. For example: if an institution's branch in Cape Town has a branch number of 1250604 then the branch number 1250604 must be completed in the field. |

Remarks, Comments, Explanations (field B17)

| 6.36 | This field requires the reporter to provide any remarks, comments, or explanations the person conducting the transaction may have made or given in respect of the transaction. It is very important that this information be provided if it is available as it helps to contextualise the report and improves the Centre's ability to analyse the reported information. |

Completing Part C: Particulars of accounts involved in transaction

| 6.37 | Part C of the reporting form pertains to information about the account(s) involved in the reported transaction(s), if an account was involved. In other words, in every case where an account is involved in a transaction Part C must be completed. This is not limited to bank accounts, and includes accounts of any nature which a reporting business may provide to its customers in accordance with the nature of that institution. |

| 6.38 | It is possible to have more than one transaction per report, and more than one disposition per transaction. It is also possible that more than one account may have been involved in a transaction or series of transactions. |

| 6.39 | As with the-previous part, it is very important to provide as much information as possible. All relevant fields must be completed in order to provide the account information for each account that is included in the report. |

Example of Part C:

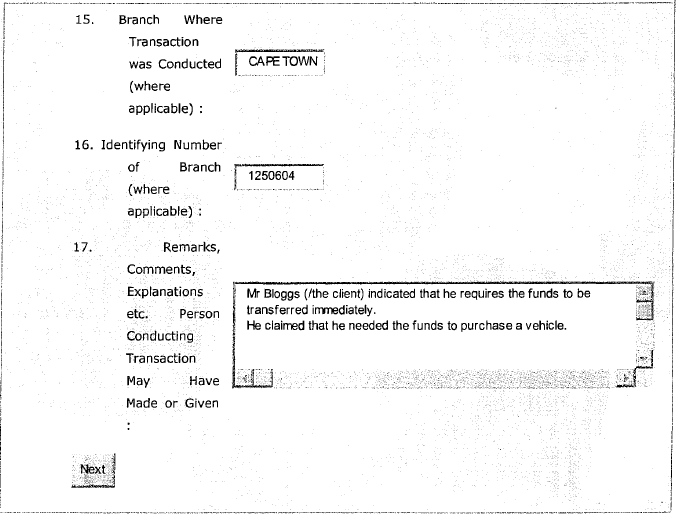

Account number (field C1)

| 6.40 | This field requires the reporter to provide the relevant account number. Please do not leave any spaces. |

Branch where account is held (field C2)

| 6.41 | This field requires the reporter to provide the branch name(s) where the account(s) are held. Please note that this is not necessarily the same as the branch referred to in the previous section where the transaction(s) were conducted. As with the previous part of the form, it is very important that this information as to the geographical location where the relevant account is held be provided in the report to the Centre as it contributes greatly to the Centre's ability to analyse the reported information. |

Identifying number of branch (field C3)

| 6.42 | If the branch where an account is held has a unique number to identify that branch generally or within the reporting institution, that must be provided in this field. For example: if the account in question is held at an institution's branch in Cape Town and that branch has a branch number of 1250604 then the branch number 1250604 must be completed in the field. |

Type of account (field C4)

| 6.43 | The type of the account must be indicated in this field. For example: a cheque, savings, credit, or business account. |

Name of each account holder (field C5)

| 6.44 | The full name of each account holder (up to three) must be provided in this field. This relates to information on each individual or entity that holds the account. For example, in the case of a joint account of a husband and wife, include the names of each spouse. The account holder might be different from the individual(s) authorised to give instructions on the account. For example, an account for a corporation will have one or more individuals authorised to give instructions on that account. In such a case, the name of the corporation that holds the account must be provided in this field. |

Date opened (field C6)

| 6.45 | This field requires the reporter to provide the date when the account was opened. |

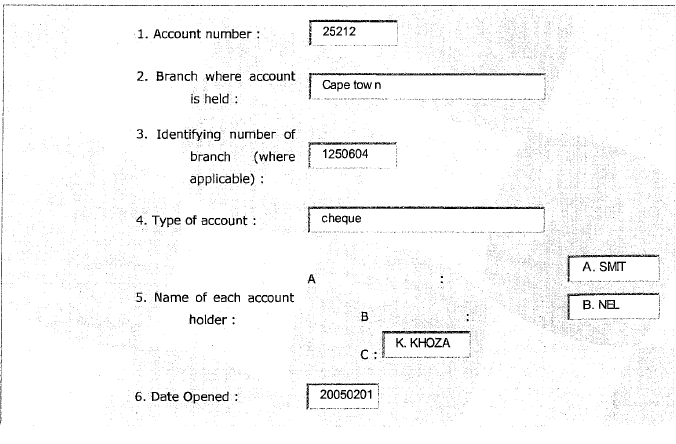

Date closed and closed by (fields C7 and C8)

| 6.46 | If the account in question had been closed before the report had been made, the date (yyyymmdd) when the account was closed must be provided here. If the account is still open at the time when the report is made this field must be completed at N/A. If the account had been closed the reporter must indicate on whose initiative this had been done by marking the relevant option in field C8. |

Status of account (field C9)

| 6.47 | In this field the reporter must indicate whether the account was active, inactive or dormant at the time the transaction or series of transactions, which is the subject of the report was initiated. |

Previous activity on the account (field C10)

| 6.48 | This field requires the reporter to indicate any activity on the account in the 180 days preceding the date of the report which had been identified and considered for reporting to the Centre (whether in fact reported or not). In other words the reporter is required to indicate past activity relating to the account which had raised attention as possibly being suspicious and in respect of which there had been some consideration given to whether the activity should be reported to the Centre. For example: three large round deposits and withdrawals shortly after deposits. |

Report number (field C11)

| 6.49 | If the activity referred to in field C10 had been reported to the Centre, the reference number of the previous report must be provided here. |

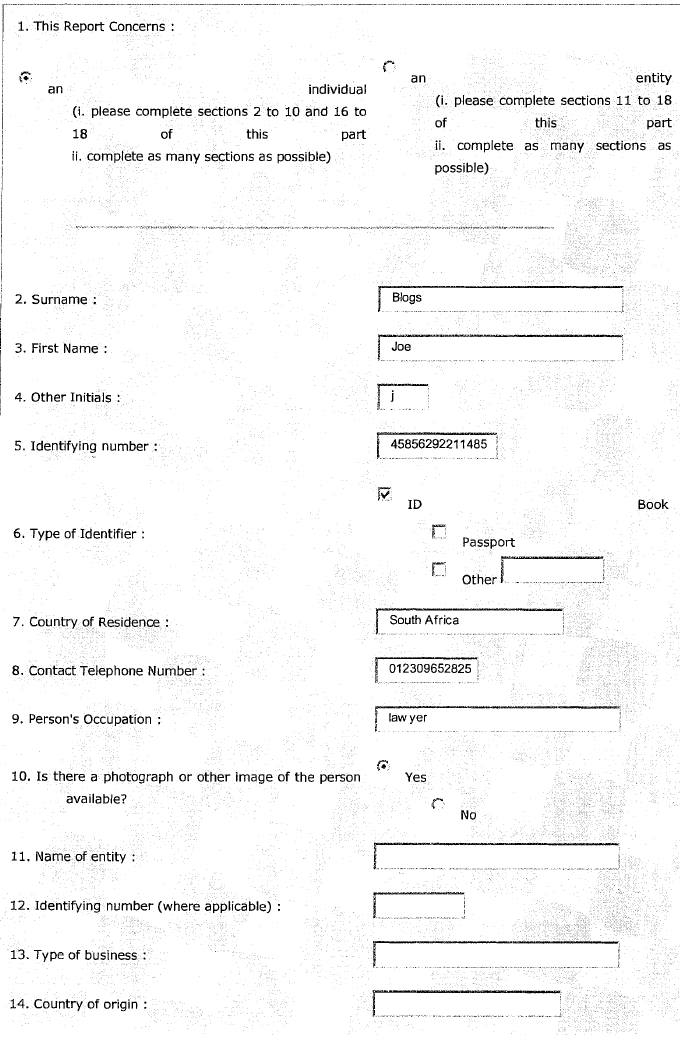

Completing Part D: Particulars of person or entity concerning whom report is made

| 6.50 | This Part of the STR form requires the reporter to provide the details of the person or entity concerning whom the report is made. In the majority of cases where the report is based on a transaction, or series of transactions, to which the business was a party, the information provided in this Part will relate to the customer of the business who carried out the transaction(s). If the report concerns more than one individual or entity, this information should be completed under this Part F, together with any other information that was not completed in the form. |

Example of Part D:

This report concerns: (field D1)

| 6.51 | If the report relates to a natural person then fields 2-10 and 16-18 of Part D must be completed. If the report concerns an entity then fields 11 to 18 of Part D must be completed. |

Surname, first names and other initials (fields D2 to D4)

| 6.52 | These fields require the reporter to provide the person's full surname, full first name and other initials, respectively. |

Identifying number (field D5)

| 6.53 | This field requires the reporter to provide the person's identity or passport number. For example: 72525652266215 (please do not leave any spaces). |

Type of identifier (field D6)

| 6.54 | In this field the reporter must indicate the type of document that had been used to confirm the person's identity. For example: indicate if a passport, green bar coded identity book or drivers licence was used. |

Country of residence (field D7)

| 6.55 | This field requires the reporter to provide the person's country of permanent residence. Please insert the full name of the country, for example, South Africa and not RSA or SA. |

Contact phone number (field D8)

| 6.56 | This field requires the reporter to list all available contact numbers with an indicator (w-work) (h-home) (c-mobile) (f-fax). For example: |

012526256226w,

0112528525h,

012 52525225f

Person's occupation (field D9)

| 6.57 | This field requires the reporter to provide person's occupation. For example: accountant, lawyer, government employee etc. |

Photograph (field D10)

| 6.58 | This field requires the reporter to indicate whether the reporting business has a photograph or other image of the person available. This may be an image obtained from video surveillance of the business' premises or from a copy or an electronic scan of a person's identity document, drivers licence or passport, for example. |

Name of entity (field D11)

| 6.59 | This field requires the reporter to provide the name of the entity to which the report relates. |

Identifier number (field D12)

| 6.60 | This field requires the reporter to provide the company or close corporation registration number or other unique identifying number that may apply to the entity in question. |

Type of business (field D13)

| 6.61 | This field requires the reporter to indicate the nature of the business activity in which the entity in question is involved, for example, the financial services industry, farming etc. |

Country of origin (field D14)

| 6.62 | This field requires the reporter to indicate the country from which the entity originates. Please insert the full name of the country, for example, South Africa and not RSA or SA. |

Person with authority to transact (field D15)

| 6.63 | In this field the reporter must provide the full name(s) and surname(s) of the person(s) who have authority to transact with the reporting business on behalf of the entity. Please do not use punctuation or tabs as separators. |

Street Address (field D16 to D18)

| 6.64 | These fields require the reporter to provide the street address (street number, name of building and suburb, for example: 12 Striven Street, Westbuild building 934, Sunnyside) as well as the city and postal code of the entity. |

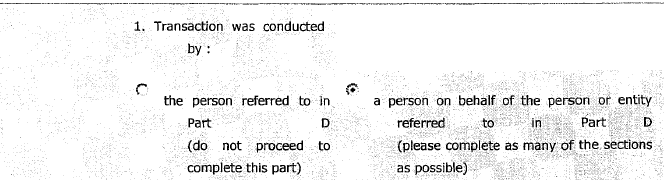

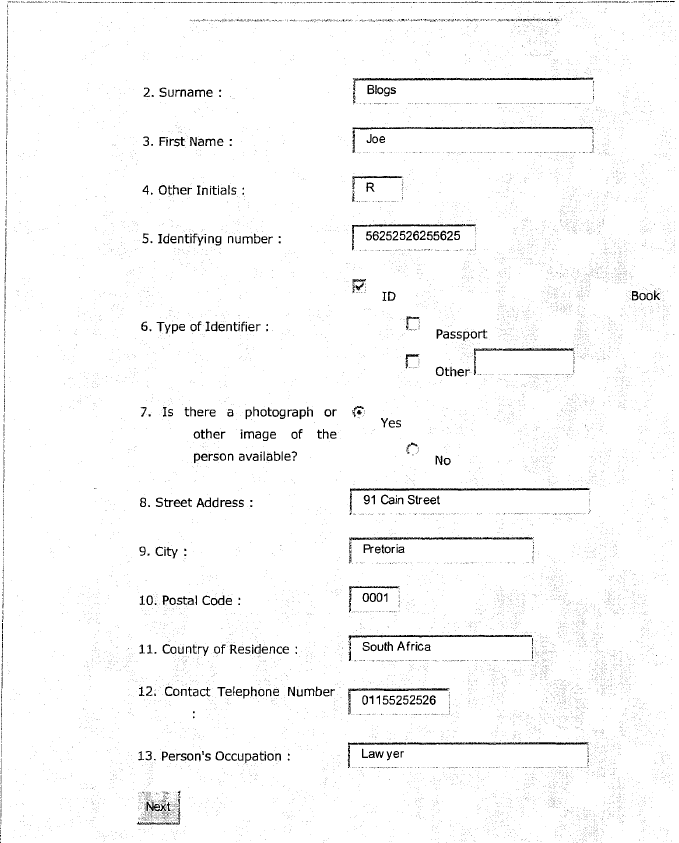

Completing Part E: Particulars of person conducting transaction

| 6.65 | Part E only applies if the transaction was conducted by a person on behalf of the person or entity referred to in Part D. The details pertaining to that individual who carried out the transaction on behalf of the person identified in Part D should be provided in full. |

Example of Part E:

Completing Part F: Particulars of suspicious activity

| 6.66 | Part F requires the reporter to explain what had led them to believe that there was something suspicious about the transaction. In this Part the reporter must describe the events which led to the forming of the conclusion that the situation which is reported is suspicious. The reporter must also provide the reasons for forming this conclusion. The more information the reporter provides to explain the basis of the suspicion, the more it will enhance the Centre's ability to analyse the reported information. The ideal response would clearly and completely describe all of the factors or unusual circumstances which led the reporter to a suspicion of proceeds of an unlawful activity, and would provide as many relevant details as possible to support this determination. |

| 6.67 | Please do not leave out information about the description of a suspicious situation or try to incorporate information by referring to any other files, documents, etc. The Centre may not be able to access that information unless the reporter provides the details in the STR. |

Completing Part G: Particulars of action taken

| 6.68 | Part G requires the reporter to indicate what action, if any, was taken resulting relation to the suspicious situation. In this part the reporter must indicate they did, apart from reporting to the Centre, concerning the suspicious situation, for example: |

| • | carrying out the transaction in accordance with the customer's instructions; |

| • | submitting a report or complaint to a law enforcement agency; |

| • | conducting an internal enquiry; |

| • | suspending a transaction pending an internal enquiry; |

| • | subjecting the account been to further monitoring; |

| • | ending the business relationship with the customer. |

Completing Part H: list of available documents

| 6.44 | Part H requires the reporter to list all available documents that the reporter used to arrive at the suspicion which is being reported. For example all account opening documentation; information required by the institution as part of it transactional obligations, account statements, and any other applicable documentation. |